This policy aims to alleviate the housing crisis but has also raised concerns about systemic risks, potentially replaying the path of the 2008 financial crisis.

Written by: Oliver, Mars Finance

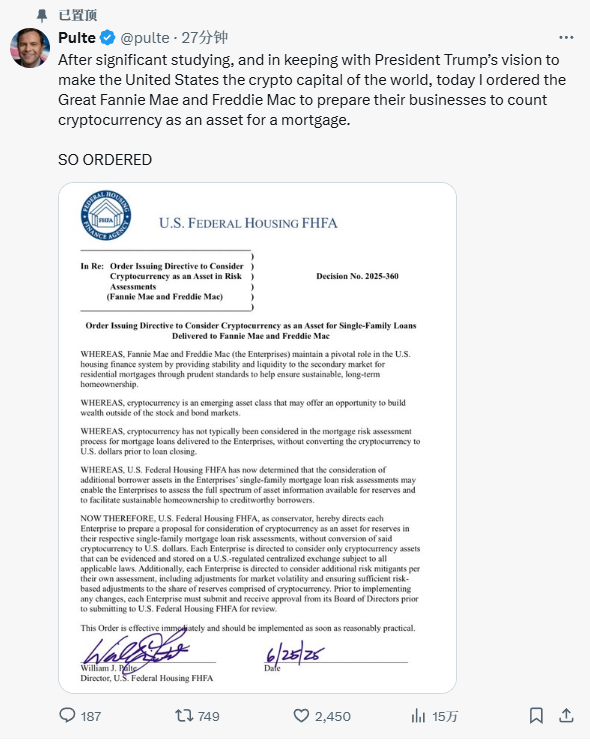

On Wednesday local time, a social media post opened a door to the unknown in the U.S. real estate finance sector. William Pulte, the director of the Federal Housing Finance Agency (FHFA), personally stepped in, instructing the two "keystones" of the U.S. housing mortgage market—Fannie Mae and Freddie Mac—to prepare for accepting cryptocurrencies as collateral. This news was not preceded by any lengthy official press release but rather burst onto the scene in a strikingly modern fashion, presenting a grand vision: to transform the U.S. into the "world capital of cryptocurrency."

This is not merely a policy adjustment; it resembles a gamble that crosses the financial Rubicon. An asset class known for its extreme volatility and high speculation is about to be grafted onto the most sensitive cornerstone of the U.S. economy—a massive market worth over $13 trillion. The market's nerves were instantly stirred, and painful memories of the 2008 financial tsunami were rekindled. Is this an innovative remedy for the housing crisis, or is it recklessly opening a new wound that could lead to systemic infection? To find the answer, we need to clear the fog and see the hidden cards of every player at the table.

Stepping Stones: A "Gentleman's Agreement" Shift in Regulation

Pulte's directive seems sudden, but it is actually the first step on a carefully cleared runway. Prior to this, the regulatory winds in Washington had already quietly shifted. A synchronized "thawing" action is paving the way for this gamble.

At the core of the transformation is the systematic dismantling of past barriers. In early 2025, the Federal Reserve, the Federal Deposit Insurance Corporation (FDIC), and the Office of the Comptroller of the Currency (OCC) joined forces to revoke several restrictive guidelines previously imposed on banks engaging in cryptocurrency activities. These documents had served as a "tightening spell" for traditional banks venturing into the crypto world. The official narrative is "supporting innovation," but the market's interpretation is more straightforward: the green light is on.

Following closely, the U.S. Securities and Exchange Commission (SEC) also dismantled another high wall by abolishing the controversial Staff Accounting Bulletin No. 121 (SAB 121). This regulation had forced banks to account for customer-held crypto assets as their own liabilities, significantly increasing the cost of providing custody services. With this stumbling block removed, the door for banks to enter the crypto custody space has been fully opened.

These seemingly independent actions connect to form a clear path: from allowing custody to encouraging participation, and now instructing the core of the financial system to accept it as collateral. The regulators have built a smooth "highway" for crypto assets to move from the margins to the center.

At the Center Stage: Giants Burdened by History

To understand the weight of this step, one must grasp the roles of Fannie Mae and Freddie Mac—along with their less-than-glorious history during the 2008 crisis. Created by Congress as government-sponsored enterprises, they inject lifeline liquidity into the entire market by purchasing and guaranteeing mortgages, with their underwriting standards serving as the "golden rule" of the industry.

The FHFA, which oversees these giants, was itself born from the 2008 crisis, with the core mission of preventing history from repeating itself. This creates the most dramatic contradiction of the moment: an institution born to "de-risk" is now instructing its regulatory subjects to embrace an asset known for high risk. This is akin to asking a recently recovered patient to try a potent new drug with unknown ingredients. Under the strong-willed new director Pulte, market concerns are not unfounded.

Domino Effect: How Risks Evolve from Individual Bets to Systemic Storms

Before the two giants were pushed to the table, a "niche" lending market serving cryptocurrency holders had already existed. Financial technology companies like Milo and Figure operate on a simple premise: borrowers put up crypto assets far exceeding the loan amount as collateral to obtain funds for home purchases. The biggest risk in this model lies in "margin calls"; if the market crashes and borrowers cannot top up their collateral, the assets will be liquidated. The risk is strictly confined to the narrow scope of the two parties involved.

However, once Fannie Mae and Freddie Mac enter the scene, a disturbingly familiar script begins to unfold. The path of the 2008 crisis started with the packaging and spreading of risks. Back then, banks bundled large amounts of subprime loans into seemingly safe securities (MBS), selling them globally with the backing of the two giants, ultimately obscuring the true nature of the risks until the entire structure collapsed.

Now, we can easily imagine a similar scenario: banks issuing loans backed by crypto assets, selling them to Fannie Mae and Freddie Mac, which then package them into "crypto mortgage-backed securities" (CMBS), flowing to global pension funds, insurance companies, and investors, all under the implicit government guarantee. When this risk, originally belonging to individuals, is magnified and injected into the entire financial system, the "negative feedback loop" warned of by the Federal Reserve could be triggered. The FHFA's directive attempts to connect this speculative game from a small circle to the national housing infrastructure, with stakes that are self-evident.

Cure or Poison: A Collision of Two Futures

For this policy, supporters and opponents paint starkly different futures.

On one side, it is seen as a "genius move" to solve the U.S. housing crisis. The data does not lie; nearly three-quarters of American households have been shut out by soaring home prices. Meanwhile, a large group of cryptocurrency holders, primarily young people, is forming, sitting on vast digital wealth but facing the same "difficulty in getting on board" dilemma. The core of this policy is to build a bridge connecting this "asset-rich, cash-poor" demographic with their rigid housing needs.

On the other side, it is viewed as a mere reappearance of the 2008 specter. Economists like Nouriel Roubini and other critics have long denounced cryptocurrencies as "speculative bubbles with no intrinsic value." A Housing and Urban Development (HUD) official bluntly stated, "This is akin to introducing another unregulated security into the housing market, as if 2008 never happened." They argue that this approach will only fuel the real estate market in a bull market, while in a bear market, forced liquidations will simultaneously hit both the crypto and real estate markets, creating a deadly downward spiral. Even more concerning is that, against the backdrop of already tight housing supply, a surge of new purchasing power will almost inevitably drive up overall home prices, creating a new wealth gap.

Unresolved Dilemmas

Pulte's directive is merely the starting gun; the real challenge lies in the countless details before the finish line. A series of key questions remain unresolved: Which cryptocurrencies qualify as collateral? How will real-time valuations be conducted for this 24/7 volatile asset? What will the "haircuts" set to hedge risks be?

Interestingly, amidst all the commotion, the two main characters of the story—Fannie Mae and Freddie Mac—have maintained a telling silence. This precisely confirms the top-down political driving nature of the directive. They find themselves passively drawn into a "arms race" of technology and risk management, needing to develop risk control systems that can compete with agile fintech companies in a short time. This poses a significant challenge for any large bureaucratic institution.

The FHFA's directive is undoubtedly a watershed moment. It marks the convergence of a clear political agenda, a newly relaxed regulatory environment, and the immense inertia of the U.S. housing finance system. The real estate market, one of the core sectors of the U.S. economy, has been officially designated as the next battleground for the integration of digital assets and the traditional world.

This move elevates the role of cryptocurrencies from passive speculative instruments to potential cornerstones for wealth building and achieving the American dream. Whether the future is a leap into financial inclusion or a replay of systemic instability will entirely depend on the devilish details of the execution plans that are about to be formulated. This time, the whole world will be watching to see if the U.S. learns from the lessons of 2008. The story has just begun.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。