Is Strategy a Major Risk of Bitcoin Acquisition or a Revolutionary Model?

Author: Dio Casares

Translated by: ShenChao TechFlow

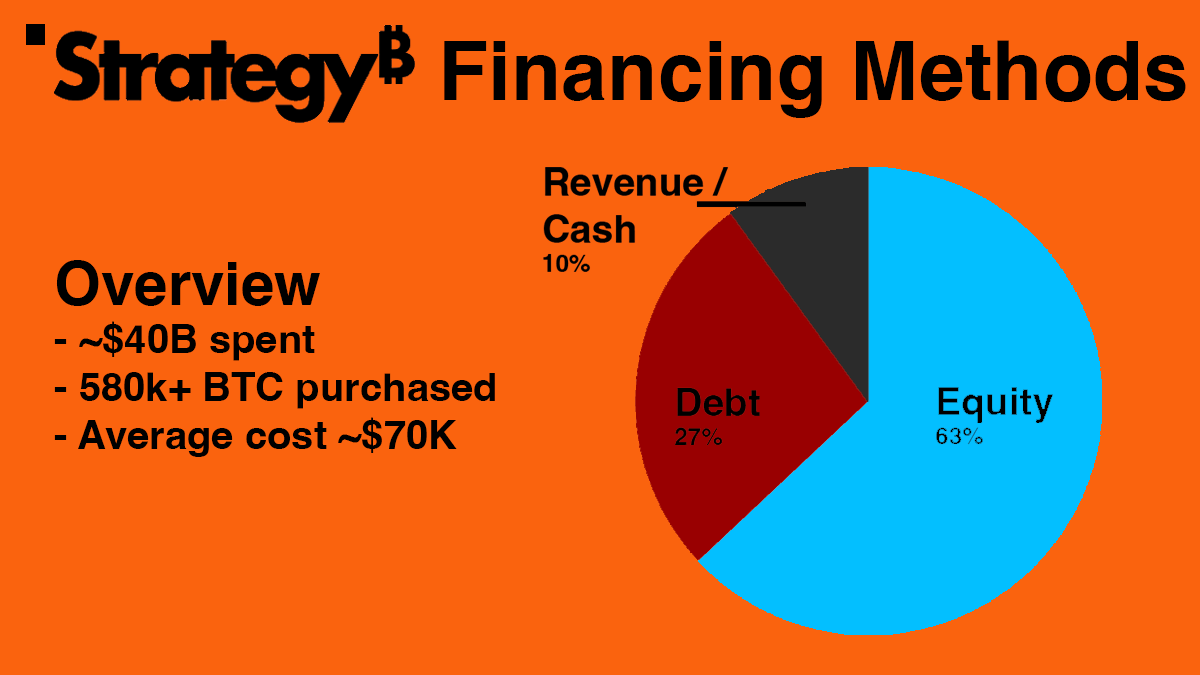

In the past five years, Strategy has spent $40.8 billion, equivalent to Iceland's GDP, acquiring over 580,000 Bitcoins. This accounts for 2.9% of the Bitcoin supply or nearly 10% of active Bitcoins (1).

Strategy's stock code $MSTR has risen 1600% over the past three years, while Bitcoin's increase during the same period was only about 420%. This significant growth has pushed Strategy's valuation over $100 billion, and it has been included in the Nasdaq 100 index.

This enormous growth has also brought skepticism. Some claim that $MSTR will become a trillion-dollar company, while others sound the alarm, questioning whether Strategy will be forced to sell its Bitcoins, potentially triggering a massive panic that could depress Bitcoin prices for years.

However, while these concerns are not entirely unfounded, most people lack a basic understanding of how Strategy operates. This article will explore in detail how Strategy works and whether it is a major risk of Bitcoin acquisition or a revolutionary model.

How Does Strategy Purchase So Many Bitcoins?

Note: Due to new financing and other reasons, the data may differ from when it was written.

Broadly speaking, Strategy primarily raises funds to purchase Bitcoins through three means: revenue from its operational business, selling stock/equity, and debt. Among these three methods, debt is undoubtedly the most scrutinized. People tend to focus heavily on debt, but in reality, the vast majority of the funds Strategy uses to purchase Bitcoins comes from equity issuance, specifically selling stock to the public and using the proceeds to buy Bitcoins.

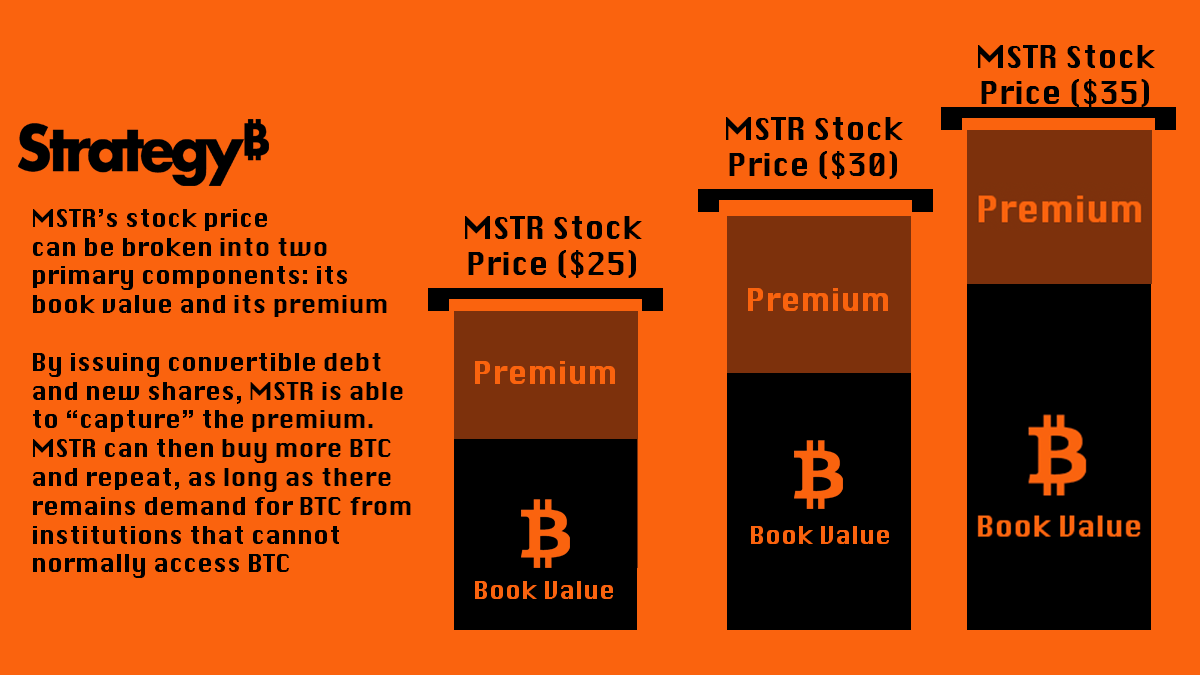

This may seem somewhat counterintuitive; why would people buy Strategy's stock instead of directly purchasing Bitcoins? The reason is quite simple, returning to the most favored business type in the cryptocurrency space: arbitrage.

Why Do People Choose to Buy $MSTR Instead of Directly Buying $BTC?

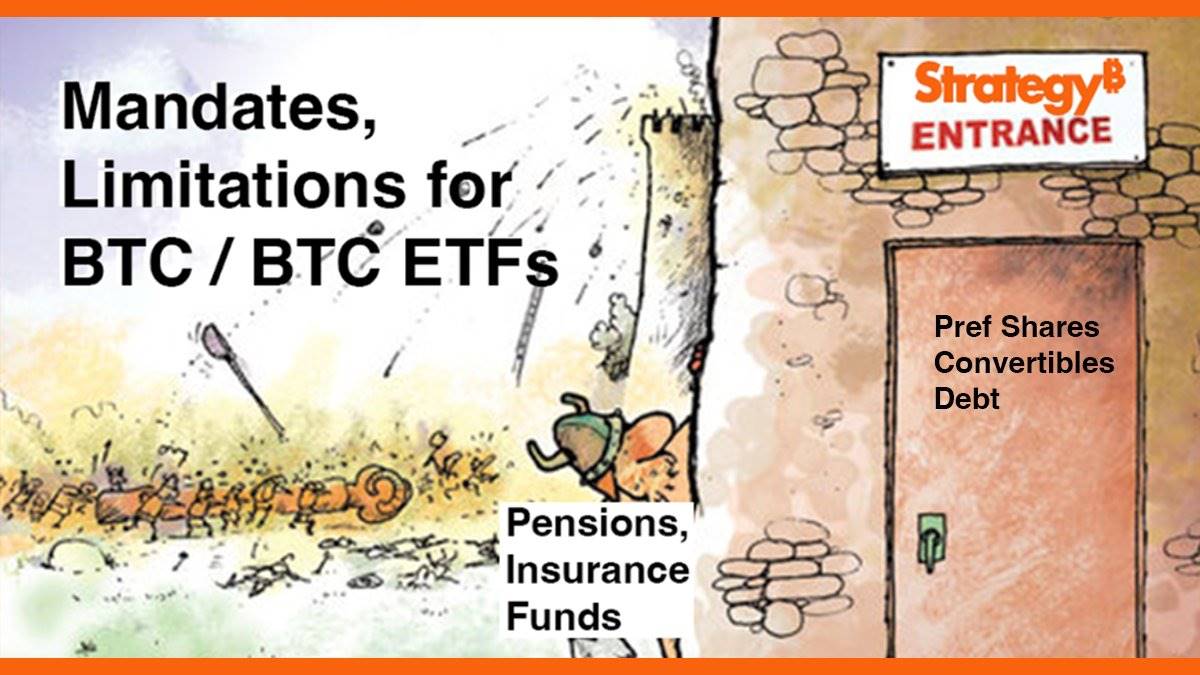

Many institutions, funds, and regulated entities are restricted by "investment mandates." These mandates specify which assets a company can and cannot purchase. For example, credit funds can only buy credit instruments, equity funds can only buy stocks, and long-only funds can never short, and so on.

These mandates allow investors to be assured that, for instance, a fund that only invests in stocks will not purchase sovereign debt, and vice versa. It forces fund managers and regulated entities (such as banks and insurance companies) to be more responsible, only taking on specific types of risks rather than being free to take on any type of risk. After all, the risk of buying Nvidia stock is entirely different from the risk of purchasing U.S. Treasury bonds or putting money into the money market.

Due to the highly conservative nature of these mandates, much of the capital that remains in funds and entities is "locked" and cannot enter emerging industries or opportunity areas, including cryptocurrencies, especially direct exposure to Bitcoin, even if the fund managers and related personnel wish to access Bitcoin in some way.

Michael Saylor, the founder and executive chairman of Strategy ( @saylor), recognized the gap between these entities' desire for asset exposure and the actual risks they could take, and capitalized on it. Before the emergence of Bitcoin ETFs, $MSTR was one of the few reliable ways for these entities, which could only purchase stocks, to gain exposure to Bitcoin. This meant that Strategy's stock often traded at a premium, as demand for $MSTR exceeded the supply of its shares. Strategy continuously leveraged this premium, the difference between the value of $MSTR stock and the value of the Bitcoins contained in each share, to purchase more Bitcoins while increasing the amount of Bitcoin per share.

In the past two years, if you held $MSTR, your "returns" in Bitcoin terms reached 134%, the highest among large-scale Bitcoin investment returns in the market. Strategy's product directly meets the needs of those entities that typically cannot access Bitcoin.

This is a classic case of "Mandate Arbitrage." Before the launch of Bitcoin ETFs, as mentioned earlier, many market participants could not purchase non-exchange-traded stocks or securities. However, as a publicly traded company, Strategy was allowed to hold and purchase Bitcoins ($BTC). Even with the recent launch of Bitcoin ETFs, it is entirely incorrect to think that this strategy is no longer effective, as many funds are still prohibited from investing in ETFs, including most mutual funds managing $25 trillion in assets.

A typical case study is Capital Group's Capital International Investors Fund (CII). This fund manages $509 billion in assets, but its investment scope is limited to equities and cannot directly hold commodities or ETFs (Bitcoin is largely considered a commodity in the U.S.). Due to these restrictions, Strategy became one of the few tools for CII to gain exposure to Bitcoin price fluctuations. In fact, CII has such high confidence in Strategy that it holds about 12% of Strategy's stock, making CII one of the largest non-insider shareholders.

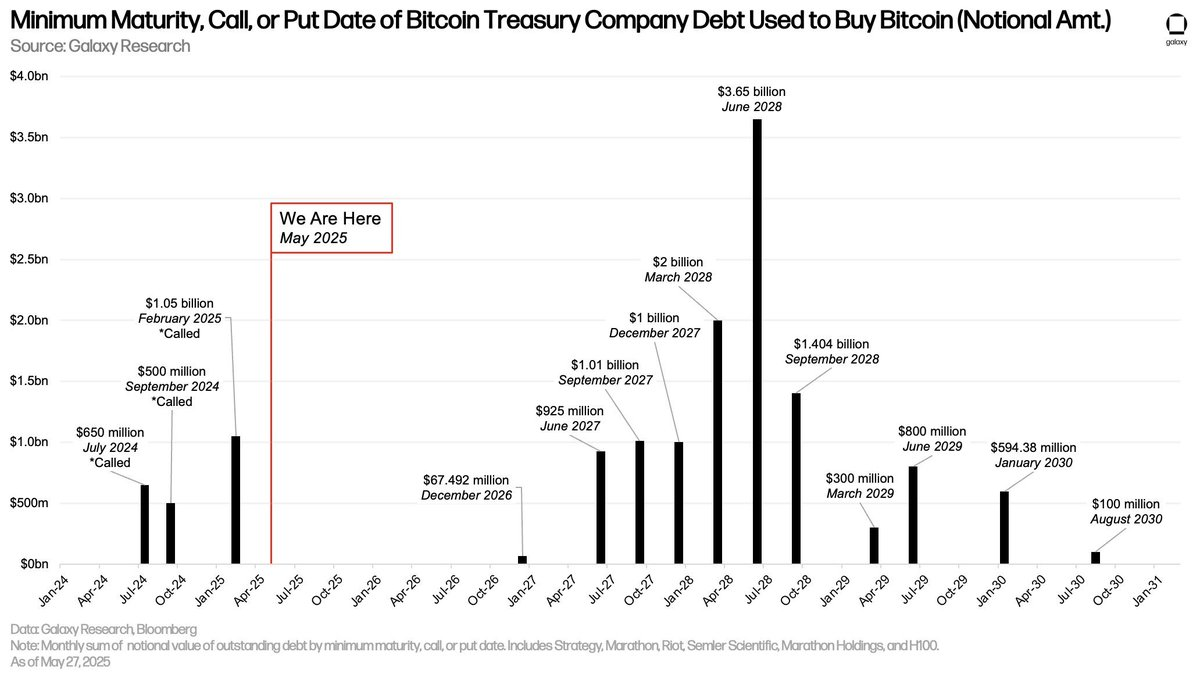

Debt Terms: A Constraint for Other Companies, but a Boost for Strategy

In addition to a favorable supply situation, Strategy also has certain advantages regarding the debt it undertakes. Not all debts are the same. Credit card debt, mortgages, margin loans—these are all distinctly different types of debt.

Credit card debt is personal debt, dependent on your salary and repayment ability rather than asset-backed, and the annual interest rate can often exceed 20%. Margin loans are typically loans secured by your existing assets (usually stocks), and if the total value of your assets approaches the amount you owe, your broker or bank may seize all your funds. Mortgages are considered the "holy grail" of debt because they allow you to purchase assets (like houses) that typically appreciate in value with a loan, while only paying monthly interest (i.e., mortgage payments).

While this is not entirely risk-free, especially in the current interest rate environment where interest can accumulate to unsustainable levels, it is still the most flexible compared to other types of loans, as the interest rates are lower, and as long as you make timely monthly payments, the asset will not be seized.

Generally, mortgages are limited to housing. However, corporate loans can sometimes operate similarly to mortgages, where interest is paid over a specified period, and the principal (the initial loan amount) only needs to be repaid at the end of that term. Although loan terms can vary significantly, typically, as long as interest is paid on time, debt holders have no right to sell the company's assets.

Chart Source: @glxyresearch

This flexibility allows corporate borrowers like Strategy to more easily navigate market fluctuations, making $MSTR a way to "harvest" the volatility of the crypto market. However, this does not mean that risks are completely eliminated.

Conclusion

Strategy is not in a leveraged business but in an arbitrage business.

While it does currently hold some debt, Bitcoin prices would need to fall to about $15,000 each within five years to pose a serious risk to Strategy. With the expansion of "vault companies" (referring to companies replicating Strategy's Bitcoin accumulation strategy), including several companies like MetaPlanet and @DavidFBailey's Nakamoto, this will become a focal point of another discussion.

However, if these vault companies stop charging premiums to compete with each other and begin to take on excessive debt, the entire situation will change and could lead to severe consequences.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。