Stablecoins are stepping out of the gray area and moving towards regulated financial norms, with the window for monetary-level dividends gradually opening.

Written by: imToken

Stablecoins, the product form in crypto finance that is closest to RWA, are facing an unprecedented regulatory upheaval.

In the early hours of June 18, 2025, the U.S. Senate passed the "GENIUS Act" (Giving Every Nation a United Stablecoin) with 68 votes in favor and 30 against, marking a milestone in crypto payment legislation. This is the first time the U.S. has established a clear compliance path for stablecoins at the federal level, signifying a critical turning point for crypto assets from technical experimentation to institutionalization.

At the same time, Hong Kong has also made forward-looking arrangements through the "Stablecoin Ordinance" and future related licensing applications, officially accepting applications for stablecoin issuance licenses starting August 1, becoming the first financial center in the world to implement a local stablecoin licensing mechanism.

As stated in "The Panorama of Traditional Institutions Entering the Market: Positions, Stablecoins, and Legislation Advancing Together, Are Giants Reshaping Web3?", the new compliance cycle represented by the U.S. and Hong Kong may profoundly reshape the position of stablecoins in the global financial system, with the underlying currents of these variables accelerating to the forefront.

01 The U.S.: The First Shot in Stablecoin Compliance

What has been the most successful crypto financial product globally in the past five years?

The answer is not hard to guess; it is neither on-chain financial innovations like Uniswap that ignited the DeFi Summer nor digital artworks like CryptoPunks that sparked the NFT craze, but rather the stablecoins that everyone has long been accustomed to.

Indeed, outside of the high-stakes games of DeFi and NFTs, stablecoins aimed at ordinary users have become one of the widely accepted use cases for both crypto and non-crypto users, gradually becoming an important bridge in on-chain payments, cross-border settlements, financial transactions, and even Web2 scenarios, significantly broadening and deepening the user base of the crypto economy.

However, objectively speaking, their widespread application has always lingered in a gray area—lacking unified regulation, opaque reserve mechanisms, and ambiguous legal attributes, which have become key issues hindering institutional entry and mainstream adoption.

As a bellwether for global financial rules, the passage of the U.S. "GENIUS Act" is undoubtedly a milestone. This act comprehensively defines stablecoins, issuance qualifications, reserve mechanisms, and user rights at the federal level for the first time. Key points include: mandatory 1:1 reserve support, requiring all issuers to maintain fiat currency reserves equivalent to the stablecoins issued, allowing users to redeem their stablecoins at a 1:1 ratio at any time.

Moreover, issuance qualifications are limited to banks, licensed non-bank financial institutions, and audit-compliant enterprises, with a wide range of applicable objects, including enterprise settlement stablecoins and consumer payment stablecoins. This means that the stablecoin business, which has long lingered in the gray area, will for the first time enter a "lawful and regulated" institutional track, especially impacting companies like Circle, PayPal, and JPMorgan that are promoting stablecoin businesses.

As a result, Circle, currently the only stablecoin issuer listed on the U.S. stock market, has seen its stock price soar since its IPO on June 5, rising from the issuance price of $31 to a peak of $263.45, an increase of over 100%, placing it among heavyweight players like Coinbase and Robinhood.

Notably, Circle's market capitalization once approached $60 billion, equivalent to the total circulating market value of its issued USDC, which undoubtedly marks a revaluation of the market's pricing logic for compliant stablecoins.

This also indicates that the imagination of "stablecoin compliance" is no longer limited to Web3 but is beginning to project into mainstream financial narratives. Regardless of how the actual trajectory unfolds, this represents a turning point for crypto assets to further enter mainstream visibility and gain a legitimate compliance framework.

02 Hong Kong: Leading the Way in Licensing and Implementation

Since the publication of the "Policy Declaration on the Development of Virtual Assets in Hong Kong" on October 31, 2022, Hong Kong has been at the forefront of crypto regulation among major global jurisdictions.

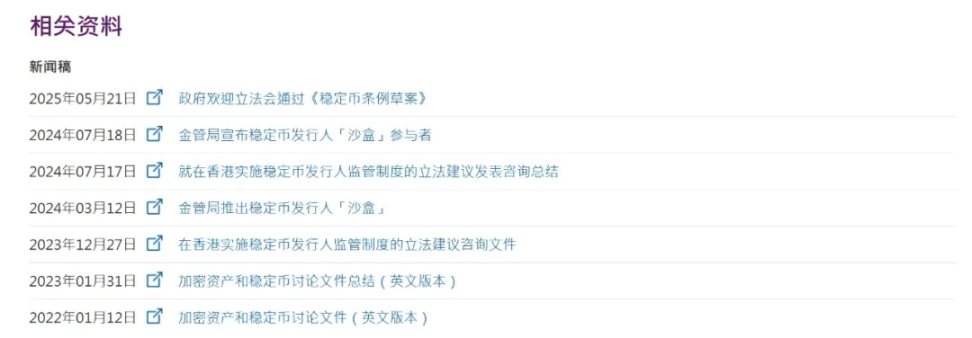

As early as January 2022, the Hong Kong Monetary Authority (HKMA) released a discussion paper on crypto assets and stablecoins, inviting stakeholders to provide feedback. Last year, it even launched a "sandbox" for stablecoin issuers to understand the business models of institutions planning to issue fiat-backed stablecoins in Hong Kong.

The latest "Stablecoin Ordinance" in Hong Kong will take effect on August 1, at which point the HKMA will begin accepting license applications. The HKMA has already initiated market consultations on the specific guidelines for implementing the "Stablecoin Ordinance."

Source: Hong Kong Monetary Authority

According to currently disclosed information, the key institutional design adheres to the principle of "same activities, same risks, same regulation," including that issuers must apply to the HKMA for a stablecoin issuance license, must have a locally registered physical company, and the assets must be fully linked to the total issuance, with reserve assets required to be highly liquid fiat currency or short-term government bonds.

It can be said that this is largely similar to the relevant regulatory dimensions and mechanisms in the U.S. Notably, the Hong Kong regulatory system applies to stablecoins pegged to major currencies such as USD and HKD, with the core policy aimed at providing a stable clearing and settlement medium for Web3 finance while attracting more institutions to establish stablecoin businesses in Hong Kong.

As an international financial center, Hong Kong has always been actively exploring paths for financial innovation, and the stablecoin market is, to some extent, a comfort zone for Hong Kong as an international financial giant—encompassing a rich variety of financial service formats, with years of accumulation and extensive experience, a mature risk control system, complete trading infrastructure, and a large customer base.

This also makes it emphasize more on flexible implementation and international alignment compared to the U.S., attracting more institutions to use Hong Kong as a springboard to explore stablecoin clearing and issuance paths in the Asian market. Currently, local heavyweight players like HashKey and OSL are reportedly preparing or laying out applications for stablecoin licenses, becoming an important entry point to observe the integration of crypto compliance and financial infrastructure in Hong Kong.

03 The EU, South Korea, and Other Regions Flourishing

In addition, the EU's "MiCA Regulation" (Markets in Crypto-Assets), which will take effect in 2024, has comprehensively covered the compliance regulation of crypto assets, providing detailed classifications for stablecoins, including EMT (Electronic Money Tokens) and ART (Asset-Referenced Tokens).

The former refers to stablecoins pegged to a single fiat currency, such as the EURC issued by Circle, while the latter refers to stablecoins pegged to a basket of assets, like the failed Libra type. EMT stablecoins must obtain a license from the EU electronic money institutions, be regulated by central banks, disclose reserve composition and operational mechanisms, and ensure user redemption rights. Circle's EURC is one of the first products to benefit from the implementation of MiCA.

At the same time, South Korea, which has significant influence in the crypto space, has seen its new president Lee Jae-myung's ruling party propose the "Basic Law on Digital Assets," clearly stating that as long as a South Korean company has a capital of at least 500 million won (approximately $370,000) and ensures refunds through reserves, it can issue stablecoins.

Source: Cointelegraph

According to data from the Bank of Korea, trading volume of stablecoins in South Korea has surged, with the trading volume of major dollar-pegged stablecoins on five major domestic exchanges (Upbit, Bithumb, Korbit, Coinone, and Gopax) reaching 57 trillion won (approximately $42 billion) in the first quarter.

Recently, the Bank of Korea's senior vice governor Yoo Sang-don also stated that the introduction of won-denominated stablecoins should be gradual, starting with the issuance of won stablecoins by the most strictly regulated commercial banks, and then gradually opening up to non-bank institutions once they gain experience.

Additionally, several major financial centers have historically released local stablecoin frameworks or pilot projects:

- The Monetary Authority of Singapore (MAS) proposed a stablecoin regulatory draft in 2023, emphasizing 1:1 reserves, transparent disclosures, and local operational requirements;

- The Abu Dhabi Global Market (ADGM) in the UAE launched a stablecoin clearing pilot to attract cross-border businesses like PayPal and USDC;

- Japan passed a new law allowing banks and trust companies to issue stablecoins;

Overall, European regulation focuses on protecting user rights and financial stability, while South Korea tends to explore cooperation with local financial and tech giants. This not only marks a gradual unification of global stablecoin regulatory standards but also indicates that stablecoins are no longer in a gray area but are being viewed as a formal component of financial innovation, with their regulatory testing grounds becoming important capital policy tools to attract Web3 projects.

Dialectically, starting in 2025, whether it is crypto asset ETFs or stablecoins, a new regulatory cycle has become a clear watershed in the development of Web3 and the crypto industry, especially as compliance becomes the main line of stablecoin development in the next phase. The exploration of institutional frameworks by various countries not only affects market dynamics but also profoundly shapes the future infrastructure of Web3 finance.

It can be said that globally, stablecoins are undergoing a dramatic transformation from "wild expansion" to "institutional dominance," and the restructuring of this landscape is unfolding comprehensively as various national regulations come into effect.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。