Today's key points are well known to everyone: two things. One is that the geopolitical conflict in the Middle East has entered a fragile pause phase, and the main reason for the rise in $BTC is the market's expectation that the Strait of Hormuz will not be blocked. This view is the same as yesterday's, but today it is compounded by the ceasefire agreement, which has made the market a bit more relaxed.

The second point is that Jerome Powell's hearing did not provide much useful information. It can be summarized in three sentences: no interest rate cuts are due to tariffs, there is almost no consideration for rate cuts in July, but September may be a suitable window. The resilience of the U.S. economy and the stability of the labor market do not require interest rate cuts to alleviate employment pressure.

Overall, this is still relatively friendly for the market. Given the current situation, it is normal for Bitcoin's price to return to and stabilize around $106,000. However, the war has not completely stopped. If the fragile ceasefire agreement is broken or if new issues arise, market volatility remains uncertain, with a continued focus on oil prices.

Looking at Bitcoin's data, as the price rises, the turnover rate has also seen a significant increase. Investors who have been bottom-fishing in the past two days are the main force behind the turnover. There is not much more to say; like with spot ETFs, investors tend to chase highs and sell lows.

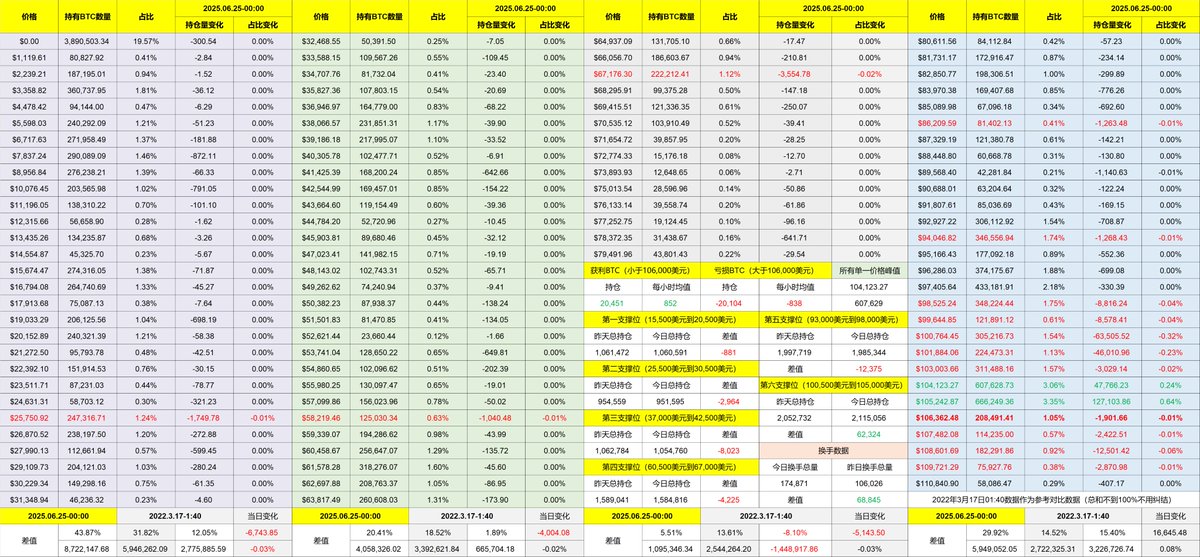

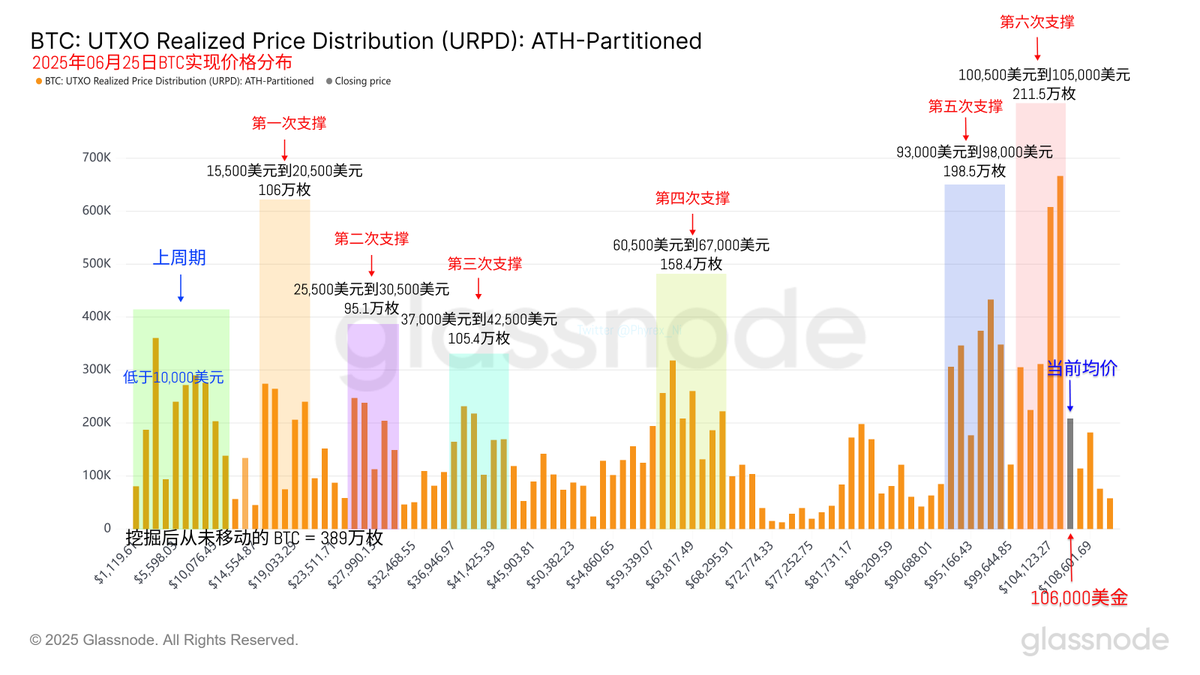

The price changes once again prove the accuracy of on-chain support. Currently, the most stable support remains between $93,000 and $98,000. This group of users has already been thoroughly tested. Unless there is a systemic risk, large-scale panic selling is unlikely, which significantly reduces the pressure on prices.

The stability between $100,500 and $105,000 is also gradually increasing, but the time frame is still relatively short, and the loyalty of this group of investors is still low. The storage volume between $104,000 and $105,000 has already exceeded 1.27 million coins, and the pressure has not yet completely eased.

Currently, from a trend perspective, the pre-war moving average price of $106,000 is still considered stable. If a breakthrough is to occur, a stable breakthrough may still require new positive stimuli.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。