Is there a steering wheel and pedals? It actually isn't that important.

Author: siqi

After 10 years of Elon Musk talking about autonomous driving, Tesla's Robotaxi has finally hit the road.

On June 22 local time, Tesla's Robotaxi officially began service in Austin, Texas. The initial deployment consists of about 10-20 vehicles, with a select group of investors and social media KOLs invited to participate in the experience.

Since last year's two-door "true autonomous vehicle" Cybercab has not yet entered mass production, the first batch of Robotaxis will be serviced by the current production version of the Model Y. This means that the current Robotaxi is still equipped with a steering wheel and acceleration and brake pedals, and each vehicle also has a safety officer in the passenger seat, with some geographical restrictions on the operational area.

Musk stated on the X platform that the fixed cost for the first passengers is $4.20 per trip, but this seems more like a "trial price," with long-term costs unknown. Currently, in Austin, Waymo, a Google subsidiary, and Uber are also operating Robotaxis in the market. According to previous reports from TechCrunch, Waymo charges $3.50 per kilometer in the range of 4.3-9.3 kilometers.

Tech blogger shares Robotaxi travel experience: 16 kilometers, 22 minutes | Image source: X

Compared to the mainstream Robotaxi currently on the market, Tesla's approach has two core differences:

First, unlike the mainstream Robotaxi solutions from Waymo and others, Tesla is using "mass-produced vehicles" + FSD software for autonomous vehicle operation without needing to install complex perception hardware or redevelop new software. This is expected to significantly reduce hardware and development costs.

Second, Tesla aims to attract more "car owners" (rather than "users") through the operation of the first batch of Robotaxis. If this model proves successful, Tesla won't need to buy cars themselves before deploying them to the market, but can potentially transform directly from traditional state-owned taxi companies into a ride-hailing platform like Didi and Uber.

Therefore, although there are some "regrets" in terms of form, it does not affect the fact that Tesla's Robotaxi remains one of the most closely watched events in the entire autonomous driving and driverless vehicle industry.

Currently, Tesla's market value is $1.01 trillion, with a price-to-earnings ratio of 177, far exceeding traditional automakers. In recent years, Musk has repeatedly emphasized in various settings that Tesla "has transformed from an automotive company into an AI company," and the launch of Robotaxi into the market is an important demonstration of capability and product. A model from the renowned investment firm Morgan Stanley shows that 60-80% of Tesla's future valuation comes from expectations of Robotaxi and FSD business.

Driverless cars with steering wheels and safety officers

Most people's expectations for Tesla's Robotaxi are based on the "driverless car" Cybercab that Musk unveiled at Warner Studios in Hollywood last October. That vehicle completely eliminated the design of a steering wheel and acceleration and brake pedals, featuring a two-door, two-seat design with a screen in the front row as the core means of human-machine interaction.

Thus, many may fall into Musk's rhetorical trap, subconsciously linking Cybercab and Robotaxi. However, Cybercab has not even begun mass production. The Robotaxi launched in Austin is serviced by the 2025 Tesla Model Y. This vehicle is equipped with Tesla's HW4.0 (also known as AI4) intelligent driving hardware and software solution, utilizing pure visual perception, with 8 cameras and Tesla's self-developed chip, providing a 360° surround view.

From the currently released test ride experience videos, it can be seen that each Robotaxi is equipped with a safety officer in the passenger seat. According to U.S. media reports, Tesla has also set up an electronic fence for Robotaxi, allowing only invited passengers to book vehicles, and currently, service is only available in a small part of southern Austin.

Tesla Robotaxi's buyer showcase (top) and seller showcase (bottom) | Image source: X

Why is there such a change between the two models?

First, from a technical perspective, Cybercab still has a series of hurdles to overcome before mass production can begin.

According to Musk's previous comments during an earnings call, it is expected to officially launch by the end of 2026. Additionally, under current regulations, vehicles without steering wheels and pedals require separate exemption approval before market entry, and can only produce a maximum of 2,500 units per year.

Second, from a marketing perspective, Cybercab primarily serves a demonstration function.

Just like Xiaomi used a prototype car and the mass-produced SU7 Ultra to set the fastest lap at the Nürburgring, Xiaomi does not need the general public to understand the subtle differences between prototype and production vehicles, nor does it intend to sell its cars only to users willing to race; rather, it emphasizes the brand and product capabilities: Xiaomi's electric car has a driving feel and is faster than a Porsche.

The significance of Cybercab for Tesla is to prove that FSD software can drive itself anywhere. Moreover, the absence of a steering wheel and pedals symbolizes the metaphor of "anyone can drive."

Traditional automakers often build brand perception through speed, but supercars are not usually the most mass-produced models. Cybercab is Tesla's "supercar" in this era as a smart car brand—despite costing only $25,000, it supports over 60% of Tesla's extremely high market value.

So, if one day Musk tells everyone that Cybercab will not be mass-produced, please do not be surprised, because in Musk's plan, its role may not be about volume at all.

The side door of the Model Y prominently displays the Robotaxi label | Image source: X

Robotaxi: A business that needs a new problem-solving approach

This time, Tesla has only deployed 10-20 Robotaxis in a small part of Austin. It seems like a small scale, but why can it still become a headline news in the tech circle?

One major reason is that this may provide a new problem-solving approach for the currently cash-burning Robotaxi business.

In 2024, Waymo, the largest Robotaxi player in the U.S. market, provided over 4 million services with a fleet of about 1,500 vehicles, generating revenue of $50-70 million, but incurring a terrifying loss of $1.5 billion.

The revenue and investment are not proportional, which is the biggest pain point in the Robotaxi business.

Revenue is constrained by the current fleet size and market demand, while investment is mainly divided into hardware and software: software primarily involves the development of autonomous driving functions, while hardware includes vehicle purchases and hardware installations.

Unlike Tesla, the mainstream Robotaxi solutions currently on the market achieve functional and safety redundancy by adding perception hardware to mass-produced vehicles. This redundant hardware often consists of lidar and high-performance autonomous driving chips, and the BOM cost of just these hardware components can reach tens of thousands or even exceed 100,000 RMB.

Waymo's current vehicle, equipped with an autonomous driving safety system on top | Image source: Waymo

Additionally, current Robotaxi companies are more like traditional bus companies. They need to first spend their own money to buy vehicles, then hire "drivers" (which includes software development, safety officers, and operational personnel costs), and finally push to the market.

Clearly, this process is somewhat redundant. Using the "traditional model" for Robotaxi (which is not traditional, as this is a new technology) requires too much investment: it needs to invest in R&D like an AI company, buy equipment like a hardware company, and may even need to subsidize consumers at low prices during operations.

Musk's ideal driverless car business is not about building taxis himself but making money using car owners' vehicles.

Musk has previously stated that he hopes Tesla's fleet of autonomous taxis will reach a global scale of 1 million.

At a cost of $25,000 per vehicle, the hardware manufacturing cost alone would reach $25 billion, which is more than three times Tesla's projected net profit for the entire year of 2024. Clearly, if Cybercab were to be mass-produced and then marketed, even if regulatory approvals in various global markets were smooth, this project would still require a massive investment.

Therefore, the 10 Robotaxis this time can also be understood as "test drive vehicles." This is another round of marketing activity: last year's Cybercab was a demo, and this time the 10 vehicles aim to prove the mass production capability of Tesla's FSD software.

American netizens share Tesla Robotaxi, pure visual technology route addressing nighttime environments | Image source: X

Musk's true goal is to prove that the mass-produced Model Y and Model 3 have the capability to directly become Robotaxis. If owners of mass-produced vehicles are willing to join Tesla's Robotaxi fleet, then Tesla can transform from a "traditional bus/taxi company" that buys cars into a "Tesla-branded Didi/Uber" ride-hailing platform company. Moreover, it can earn money twice: once when selling the car and again when taking orders.

A reality check: Technology being ready is not enough.

In the valuation system of the well-known investment firm Morgan Stanley, over 60% of Tesla's future value comes from FSD and Robotaxi.

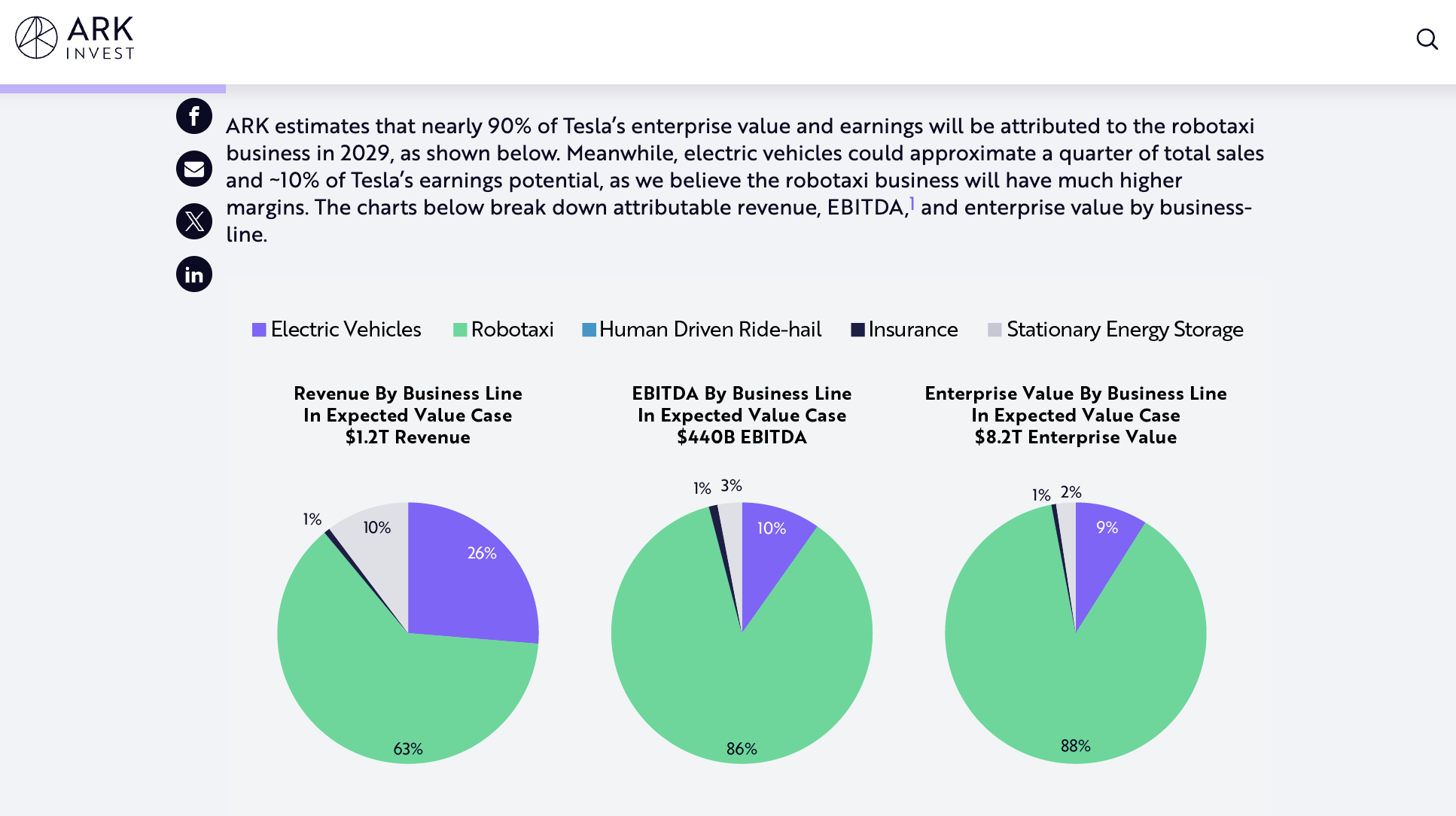

At ARK, where the famous investor "Cathie Wood" is located, the future value contribution of Robotaxi even exceeds 90% | Image source: ARK Invest

As mentioned earlier, Tesla aims to directly bridge the entire process from L2 to L4 through mass production technology, relying on both Robotaxi and FSD (software payment) models to establish two new business models beyond just selling cars.

Thanks to the current global sales and ownership of the Model Y and Model 3, theoretically, any Tesla owner with HW4.0 hardware or above can let their car serve as a "Tesla-branded Didi vehicle" during idle times. This makes Musk's long-asserted goal of a million-vehicle fleet seem feasible.

However, even if we assume that technology, operations, and approval details go smoothly, the question remains:

Will Tesla owners really do this?

For existing owners, are they willing to use their personal vehicles to provide public services?

For new owners, is anyone willing to specifically buy a Tesla to earn money as a taxi?

Taking the Chinese market as an example, a new Tesla Model Y equipped with HW4.0 starts at 263,500 yuan. According to current ride-hailing market rules, this vehicle can be put into the "dedicated vehicle" market. However, as a new product, Robotaxi will likely need to adopt pricing subsidies and other strategies to attract users, based on the competitive experience in the ride-hailing market. So, who will bear this cost?

And then there's the classic question: Musk always says that people can let their Model Y / Model 3 work when they don't need the car, but at that time, perhaps there is no demand for rides (for example, at midnight).

Therefore, from a sobering perspective, Robotaxi and autonomous driving remain a business that cannot be achieved overnight. However, from an investor's perspective, even though Tesla's pure visual mass production solution has not been fully validated, its extremely high cost advantage still makes it worth "betting" on the future.

This is also a key reason why, after experiencing a series of setbacks this year, Tesla still has a price-to-earnings ratio of 177, which is three times higher than any of the seven giants in Silicon Valley.

Before Robotaxi delivers results, Tesla and Musk's primary task remains to "sell cars," specifically cars that are not Robotaxis.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。