Thoughts on Middle Eastern Trading: This is my first trading review, and I hope my friends can provide guidance.

The conflict in the Middle East seems to have reached a pause. I've been saying that analysis is meant for trading, and during this time, I also opened some positions, all of which were small, mainly to test my views. Whether I lost or made money, I plan to share my experience.

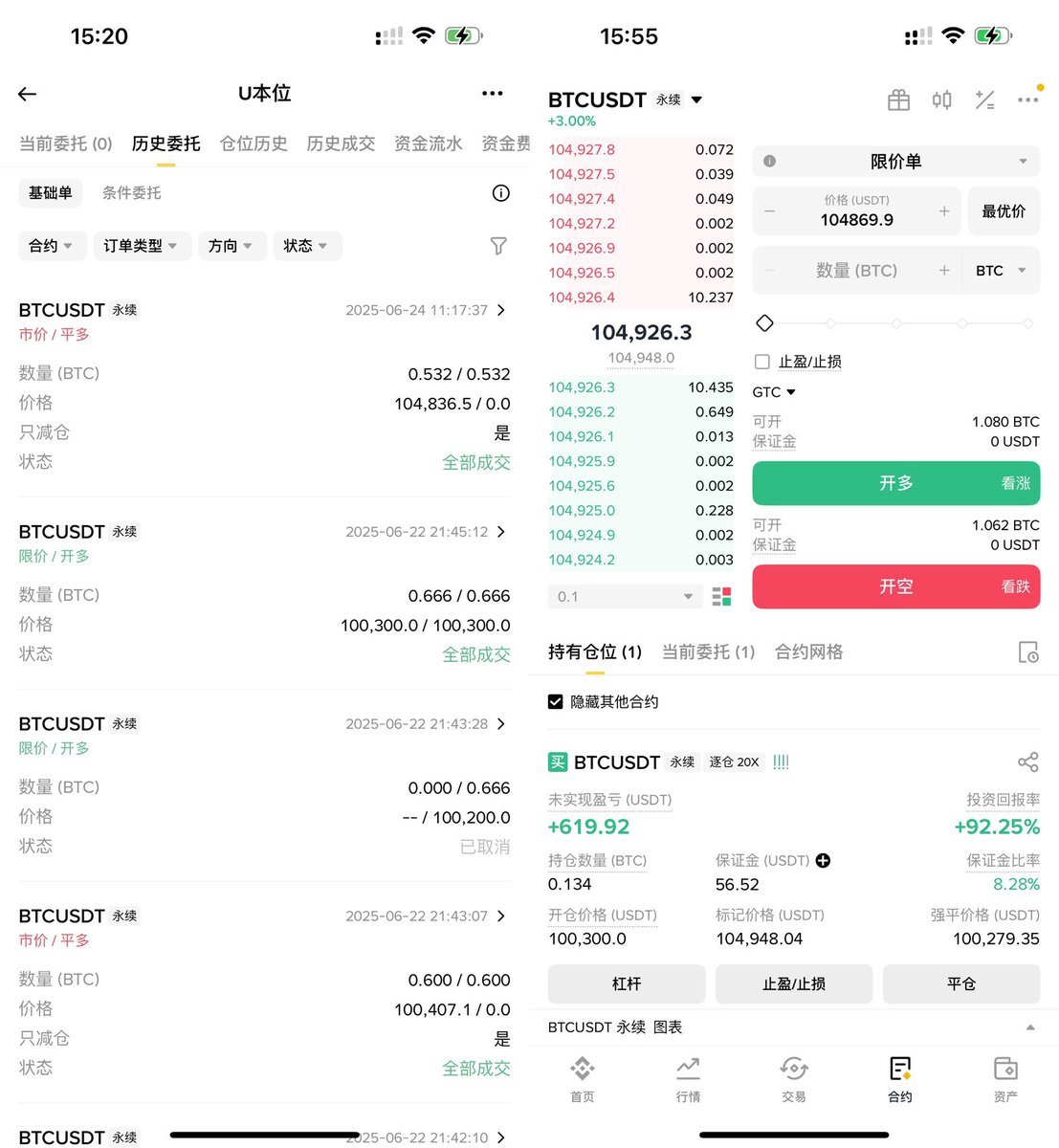

The first trade related to the geopolitical conflict started on June 17, when I placed a long order at $104,666. However, I felt uneasy about it, as the war could escalate, so I closed 85% of the position on the 19th at a price of $104,753, which allowed me to recover the funding rate and transaction fees.

The remaining 15% was left to observe. I usually do this; when I'm uncertain about the next trend, I first close the larger position and keep a smaller one to continue monitoring. That night, the price began to drop, and I placed a long order for 0.5 BTC at $103,555, which was executed.

I always start my positions with 0.5 BTC; it's a habit. The market then behaved as everyone knows: the war intensified, and the market fell. My liquidation price was around $98,800. On June 22, news broke that the U.S. might enter the war, and the price quickly dropped. I weighed whether to hold the position or cut losses and chose the latter, closing all at $100,567.

At that time, I incurred a loss of $1,800. As shown, I placed an order at $100,200 but it wasn't filled, then placed a second order at $100,700, which was executed. The reason for this order was my belief that if the U.S. entered, the war would likely end quickly, as Trump wouldn't have much time.

The price continued to fall. I accepted the decline but felt the price was still a bit high, as my liquidation price was around $96,500, and I hoped it would be below $96,000. I closed at $100,407, incurring another loss of $200, and continued to place an order at $100,200, which again wasn't filled. The market had a slight rebound, making me a bit anxious.

I canceled that and placed a new order at $100,300, which was filled after a while. This order used all the funds in my contract account, worth 0.666 BTC. The price then continued to drop, reaching a low of $98,115 on the 22nd. By then, I was on vacation and considered whether to cut losses while waiting for a lower price.

However, I remembered it was Sunday, typically the day with the worst liquidity and highest panic. When cryptocurrencies are under pressure, the chances of a significant drop increase. So, I tweeted my thoughts, suggesting that the weekend reaction was a bit excessive and that the situation wasn't as severe as perceived.

Article: https://x.com/Phyrex_Ni/status/1936869174736986335

I decided to hold on rather than cut losses, even considering whether to transfer some funds from my spot account. I've been telling my friends for three months that analysis is meant to assist trading, and it must be linked to trading. So, I took $2,000 to start trading contracts based on my judgment.

Some friends may know that over three months, I accumulated my $2,000 to $5,000. I intended to experiment, which is why I started with 0.5 BTC, as $2,000 was exactly 0.5 Bitcoin.

My initial plan was to use a maximum of $2,000 per month for trading. If I faced liquidation, it would indicate a flaw in my judgment and analysis, requiring adjustments. I vowed not to add a single cent within a month; if I was wrong, I would take the hit.

I hesitated about transferring more funds because I believed my judgment was correct, but entering at this price might be a bit high. However, as I said, low prices are bought, not waited for. I was slightly hesitant and didn't know whether to continue averaging down to lower my cost.

That day, after leaving the bar, I stayed up until 6 AM on the 23rd. When the CME opened, the price returned above $100,000, and my long position turned profitable. I felt the situation was manageable. Then, at midnight on the 24th, news broke about a potential blockade of the Strait of Hormuz, causing oil prices to rise and risk markets to fall.

At that moment, I considered whether to take profits. However, I reviewed the U.S. stock market and revisited much information related to the Strait of Hormuz, concluding that a blockade was unlikely. Bitcoin had dropped below $100,000, and I was prepared to average down if it continued to fall, as I believed the U.S. wouldn't delay its entry for too long.

Two key reasons made me feel it was essential to hold: first, Iran had notified the U.S. before attacking Qatar, as Trump himself stated; second, Trump instructed the Energy Department to increase U.S. oil production in response to rising oil prices. After a good dinner, the price had already rebounded.

I slept until noon today and woke up to see the price exceeding $105,000, along with news of a ceasefire. I was still a bit groggy when I saw information stating that Iran launched six missiles after preparing for a ceasefire. Concerned about potential volatility, I closed 80% of my position at $104,836, covering all losses and netting a profit of $500.

I still held 20% of my long position, and while writing this tweet, the price rose to $105,200, achieving a 100% profit. I withdrew all my margin to lock in my costs. Just as I was writing this, I saw an Israeli minister state that Iran violated the ceasefire agreement, and Israel would retaliate with targeted strikes in Tehran. I closed the remaining 20% around $105,000.

Of course, as I mentioned earlier, the war isn't crucial; as long as the Strait of Hormuz isn't blocked, the impact on oil prices won't be significant. I closed my position to see if there would be better entry opportunities, but if I re-enter, it will likely be with smaller positions.

After closing all positions, my capital increased to 3.5 times, nearly $7,500. If I enter again, I will definitely consider oil prices and the trend of the war, and I will be more cautious this time.

In conclusion, I want to emphasize that the risks of contracts are very high, especially with higher leverage, the risks increase, and the gambling aspect becomes more significant. I always prepare for the possibility of losing everything when I open a position, as I started with $2,000. I don't mind how much I lose, which helps me maintain a good mindset. However, if I continue to increase my position, I don't know if I can remain so calm even when I reach a 10% position.

So, I don't expect this $2,000 to grow to $1 million like the big players. I just take it slow, opening positions of 0.5 BTC each time, focusing on market judgment to assist spot trading, as spot trading has a higher margin for error and is more stable.

Contracts can very well be a one-way street. Although I'm currently in profit, if I don't withdraw in time, I could easily lose it all back.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。