Original Title: Understanding the risk of Coinbase after Circle's successful IPO

Original Author: Kevin Li, Artemis

Original Translation: Odaily Planet Daily

Editor’s Note: Recently, Circle's strong performance post-IPO has left investors who missed the opportunity feeling anxious. Many who have missed out are actively seeking alternatives to Circle, with the highest calls for Coinbase, given its close business relationship with USDC. Investors widely believe that the market's future expectations for Circle and USDC could also be reflected in Coinbase's stock price.

Institutional data platform Artemis states that many investors have recently suggested going long on Coinbase while shorting Circle. However, fundamental analyst Kevin Li believes that one should not go long on Coinbase simply because they are bullish on Circle, as USDC-related revenue accounts for only a small portion of Coinbase's total revenue. Although Coinbase is a large ecosystem encompassing compliant exchanges, USDC, on-chain products, and more, all its business segments are currently under competitive pressure, and the outlook is not optimistic. Investors should price it cautiously.

Odaily Planet Daily compiles Kevin Li's comprehensive fundamental analysis of Coinbase as follows, enjoy~

Summary

· Limited upside for stablecoin revenue: Circle's IPO highlights the prospects of stablecoins, but Coinbase holds only a small share in the market economy of USDC. According to revenue-sharing agreements, Coinbase can receive about 60% of USDC's total revenue, but can only retain a small portion of that, as about 43% is distributed to users as revenue sharing. Therefore, Coinbase actually only receives 34% of the total stablecoin revenue.

· Regulatory moat gradually disappearing: Coinbase has long benefited from the uncertainty of crypto regulation, using its expensive compliance infrastructure costs as a competitive moat. However, as regulations become more friendly and transparent, and competitors gain momentum, Coinbase's advantage will gradually weaken.

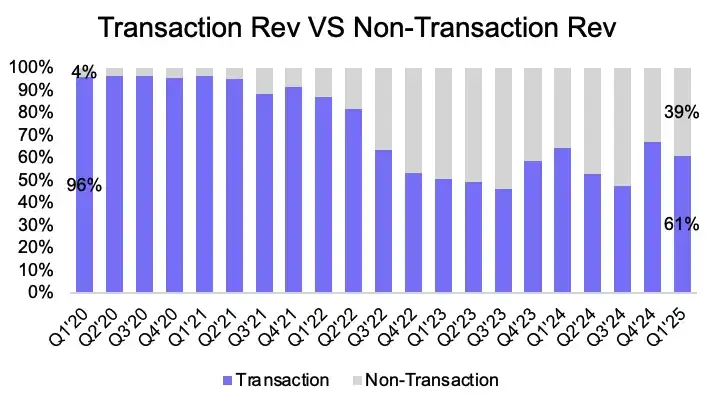

· Exchange business under pressure: Coinbase's trading fees have dropped from 2.5% to 1.4%, and its market share has fallen from over 58% to about 38%. This is mainly due to fee compression and increasing competition from ETFs, decentralized exchanges (DEX), and TradFi platforms like Robinhood. Coinbase is expanding subscription services (Coinbase One), staking, USDC interest income, and derivatives business to offset the impact of weak spot trading volume on revenue. The proportion of trading revenue to total revenue has decreased from over 90% in the previous period to about 55% in the current period.

· Strong momentum for Base: Coinbase's Ethereum Layer 2 platform, Base, is showing rapid growth in both trading volume and profitability. It currently leads all Ethereum Layer 2s in trading volume and active addresses, but still lags behind Solana in overall user activity and adoption momentum.

· Strong momentum in derivatives: Coinbase's derivatives trading volume has surged to over $300 billion per month, but its monetization and long-term growth are still constrained by aggressive liquidity incentives and fierce competition from ETF-style cryptocurrency options.

· Valuation appears attractive: Comprehensive analysis shows Coinbase's valuation is about $108.592 billion, but the market also correctly reflects the structural risks of its exchange moat and long-term profitability.

Coinbase's Path to Becoming an Ecosystem Giant

To understand the challenges Coinbase currently faces and why it cannot fully replace Circle, one must look back at its origins. Coinbase originally started as a cryptocurrency exchange at a time when it was still difficult for ordinary users to purchase Bitcoin. With its intuitive and user-friendly features, Coinbase quickly gained widespread adoption, and its proactive compliance measures in the early days provided significant advantages, allowing it to expand its business in both retail and institutional markets.

Built on trust, convenience, and legal clarity, Coinbase quickly distinguished itself in the exchange space and developed a loyal user base. Thus, Coinbase shifted its focus to expanding other profit opportunities, launching premium subscription service Coinbase One and staking products that allow users to earn returns on their assets.

The percentage of Coinbase's trading revenue to total revenue has declined over time. Source: Coinbase Quarterly Report, Artemis

As Coinbase's brand and influence grew, it jointly launched USDC with Circle—a compliant stablecoin positioned as an alternative to USDT and BUSD. Coinbase's platform integration and reputation accelerated the adoption of USDC, with USDC rates on Coinbase reaching as high as around 5%, and the interest earned from USDC reserves further boosted Coinbase's revenue.

To enhance its ecosystem, Coinbase launched Ethereum Layer 2—Base—in 2024. With this chain, Coinbase now controls a full-stack infrastructure: exchange, stablecoin, and blockchain, forming a vertically integrated crypto ecosystem.

The exchange business and the brand it has built have always been the engine behind Coinbase's vast ecosystem. The subsequent products launched are not just new features but pathways to monetize the trust established with existing core users and the exchange.

The core of Coinbase's business model follows a simple equation:

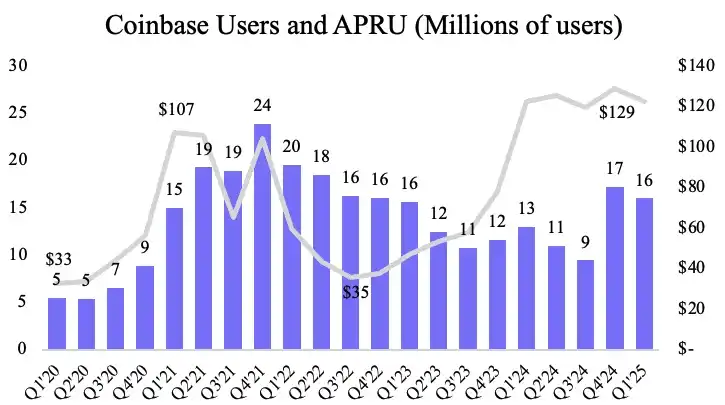

· Revenue = Number of Users × ARPU (Average Revenue Per User)

The company's strategy has always focused on expanding both sides of this equation: growing the user base through strong distribution channels and good regulatory reputation, and increasing ARPU by introducing new on-chain products with added value into its ecosystem. Therefore, its core business is to acquire users through the exchange and enhance profitability through a layered product stack.

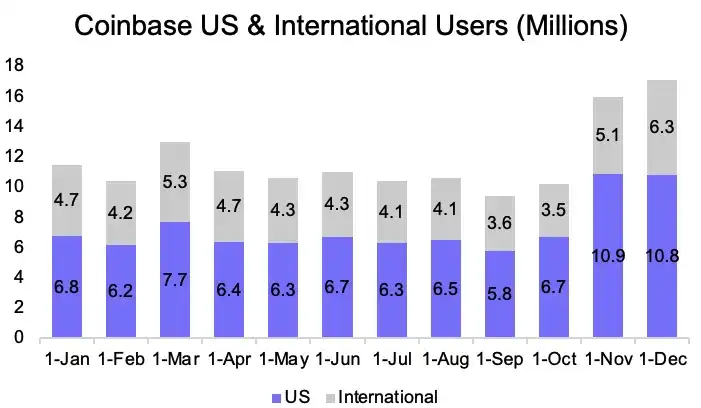

Coinbase's user growth remains relatively stable, while ARPU (driven by fee rates + product line expansion) has increased over time. Source: Coinbase Quarterly Report, Artemis, Data Ai

Coinbase is not a pure agent of Circle or USDC

While Coinbase's ecosystem strategy is quite attractive, it complicates the investment logic. Coinbase's broad business scope means it cannot be viewed as a pure agent of USDC or Circle. Currently, USDC-related revenue accounts for only 15% of Coinbase's total revenue, far less than the trading fees from its exchange business. However, due to increasing competition from ETFs, decentralized exchanges (DEX), and TradFi platforms like Robinhood, this core revenue source is facing growing pressure.

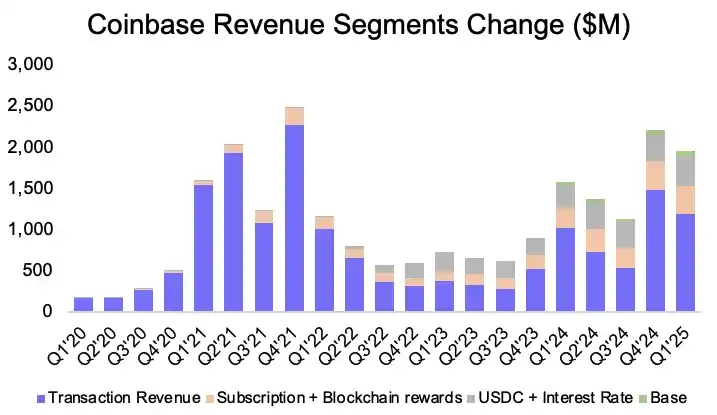

Therefore, buying Coinbase as a bullish alternative to Circle or USDC is not a wise investment choice. To cope with the fierce competition in traditional business, Coinbase is attempting to diversify its business model to build a broader and more sustainable model, freeing itself from the constraints of trading business. Currently, Coinbase's business mainly covers four major segments:

· Cryptocurrency exchange business: This is Coinbase's core business, with revenue primarily coming from trading fees.

· Subscription and blockchain rewards: Including products like Coinbase One and additional services related to institutional staking/custody.

· USDC and interest income: This revenue source includes interest income from USDC reserves and interest income generated from cash held on Coinbase's balance sheet.

· Base: Revenue from transaction fees on the Ethereum Layer 2 chain.

Breakdown of Coinbase's revenue segments over time, with contributions from new business lines increasing. Source: Coinbase Quarterly Report, Artemis

The Revival of USDC: Growing Trading Volume, but Advantages are Diminishing

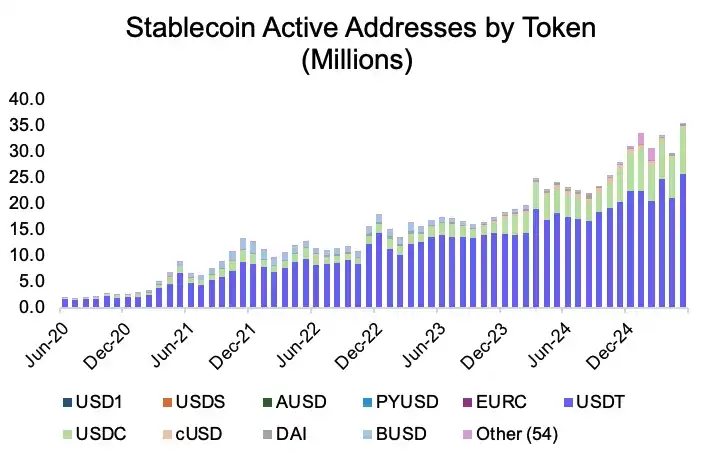

For investors focused on Circle's IPO, the rationale for being bullish on Coinbase centers around its stablecoin business. The adoption rate of USDC is increasing: among 30 million active stablecoin addresses, over 8 million use USDC, with weekly transaction counts exceeding 300 million, and this upward momentum shows no signs of slowing down.

Active addresses of stablecoins by token. Source: Artemis

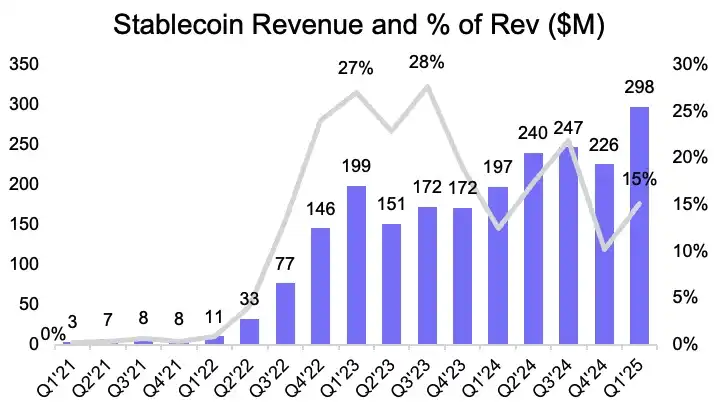

Coinbase earns revenue from US Treasury securities supporting USDC and shares it with Circle. As USDC's market capitalization continues to rise, Coinbase's stablecoin-related revenue has grown to about $1 billion annually, accounting for approximately 20% of Coinbase's total revenue.

Coinbase's stablecoin revenue and its proportion of total revenue. Source: Coinbase Quarterly Report, Artemis

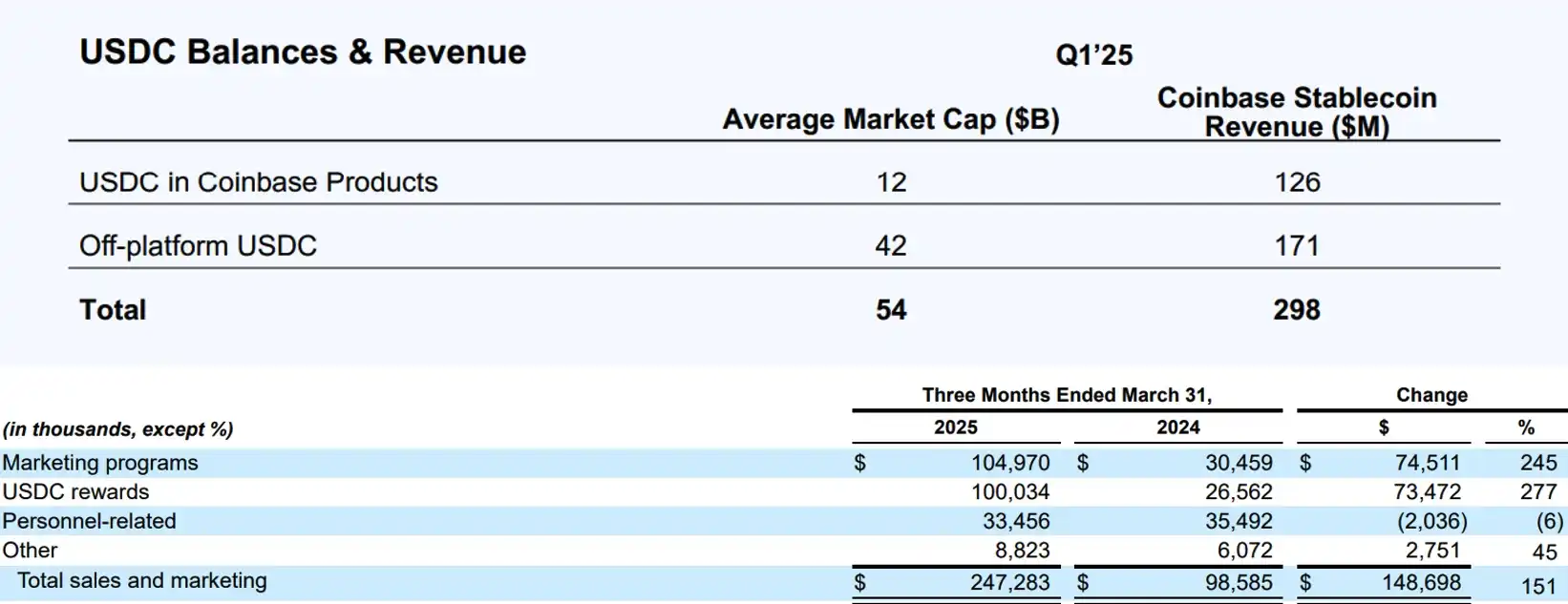

However, this figure obscures the actual profits retained by Coinbase, as about half of the stablecoin-related revenue is returned to users in the form of staking rewards. Coinbase uses this return as a user retention marketing strategy, but as competitors like Robinhood also begin to offer users funding returns, Coinbase's appeal will diminish. Therefore, Coinbase's actual net income from stablecoins is close to $171 million per quarter.

Distribution of Coinbase's stablecoin revenue and marketing cost structure. Source: Coinbase Q1 2025 Financial Report

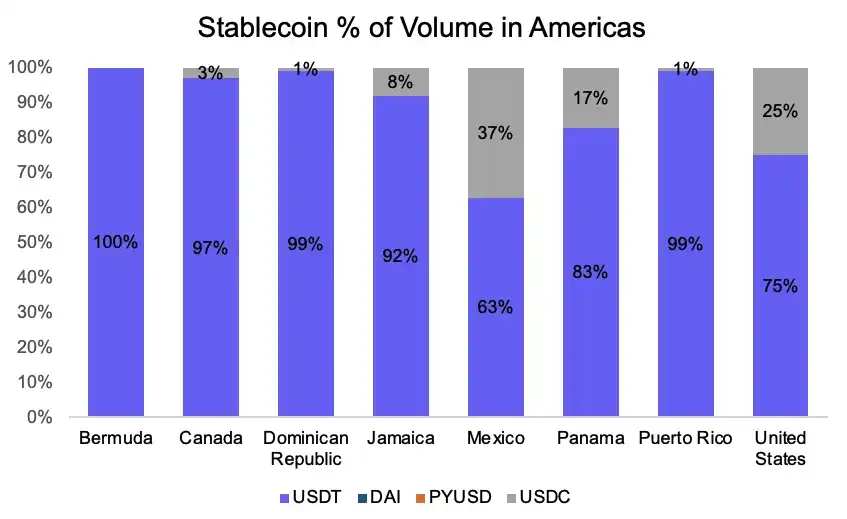

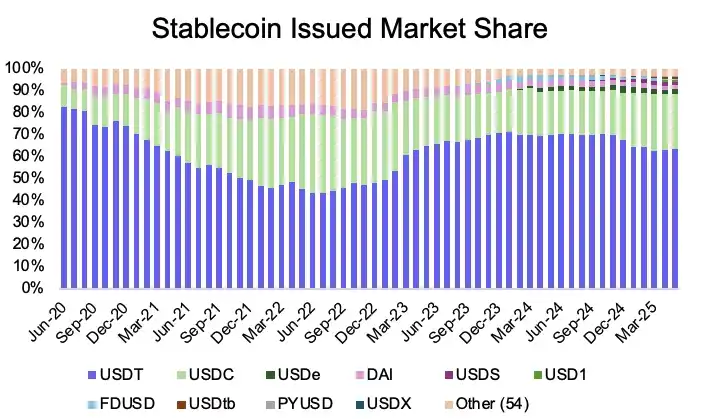

Additionally, USDC has long positioned itself as a compliant stablecoin closely tied to the US dollar ecosystem. Many believe that the US may take regulatory actions against USDT similar to those against BUSD, which would be an asymmetric benefit for USDC. Despite expectations that USDT will face regulatory pressure, it still dominates the stablecoin market, accounting for about 75% of US dollar stablecoin transactions.

USDC's recovery has been slow following the collapse of Silicon Valley Bank, with poor adoption in regions like Canada, Bermuda, and Puerto Rico. Meanwhile, Cantor Fitzgerald holds a 5% stake in Tether (Note: Cantor Fitzgerald is a large integrated financial services company in the US and one of the 24 "primary dealers" authorized by the Federal Reserve Bank, directly participating in the issuance and trading of US Treasury securities), managing its $134 billion in assets under the leadership of Howard Lutnick, indicating that the regulatory risks for USDT are also decreasing, while USDC's compliance advantages are being weakened.

Comparison of USDC and USDT trading volumes in the Americas. Source: Artemis

In summary, Coinbase shares economic benefits with Circle, but it only captures a small portion of the upside from USDC. With Tether still dominating the stablecoin market, the potential market share growth for USDC remains limited, which also constrains Coinbase's risk exposure. While Circle's stock price has shown parabolic growth, this largely reflects expectations for its future growth in the payments sector.

Since Coinbase's contribution to USDC growth mainly comes from promoting its trading platform, its driving role in the next phase of USDC's rise is limited. If you are bullish on Circle, directly investing in Circle would be a better option than investing in Coinbase.

Stablecoin market share. Source: Artemis

Next, we will explore the increasing pressures faced by Coinbase's other business lines (including its core exchange and on-chain infrastructure) to analyze why investing in Coinbase now requires caution.

Coinbase Exchange Business: Intensifying Competition from ETFs and DEXs, and Erosion of Coinbase's Moat

The exchange business has always been supply-driven, meaning users will choose exchanges that list the assets they need. When compliance is no longer an issue, competitiveness depends more on which exchange can offer the latest hype or high-return tokens, rather than brand loyalty. Emerging or popular tokens (especially speculative or meme coins) often trigger spikes in user activity, and listing popular assets can significantly boost an exchange's trading volume and active users.

There are generally three different types of tokens in the market:

· Blue-chip assets: Highly liquid, trusted, and generally considered "safe" (e.g., BTC, ETH, SOL).

· VC coins: Supported by reliable teams or with a certain degree of regulatory compliance (e.g., ADA, XRP, LINK).

· MEME coins: High-risk, high-reward, often driving participation spikes (e.g., FLOKI, APE, TURBO).

US Retail and Institutional Users Flowing to ETFs

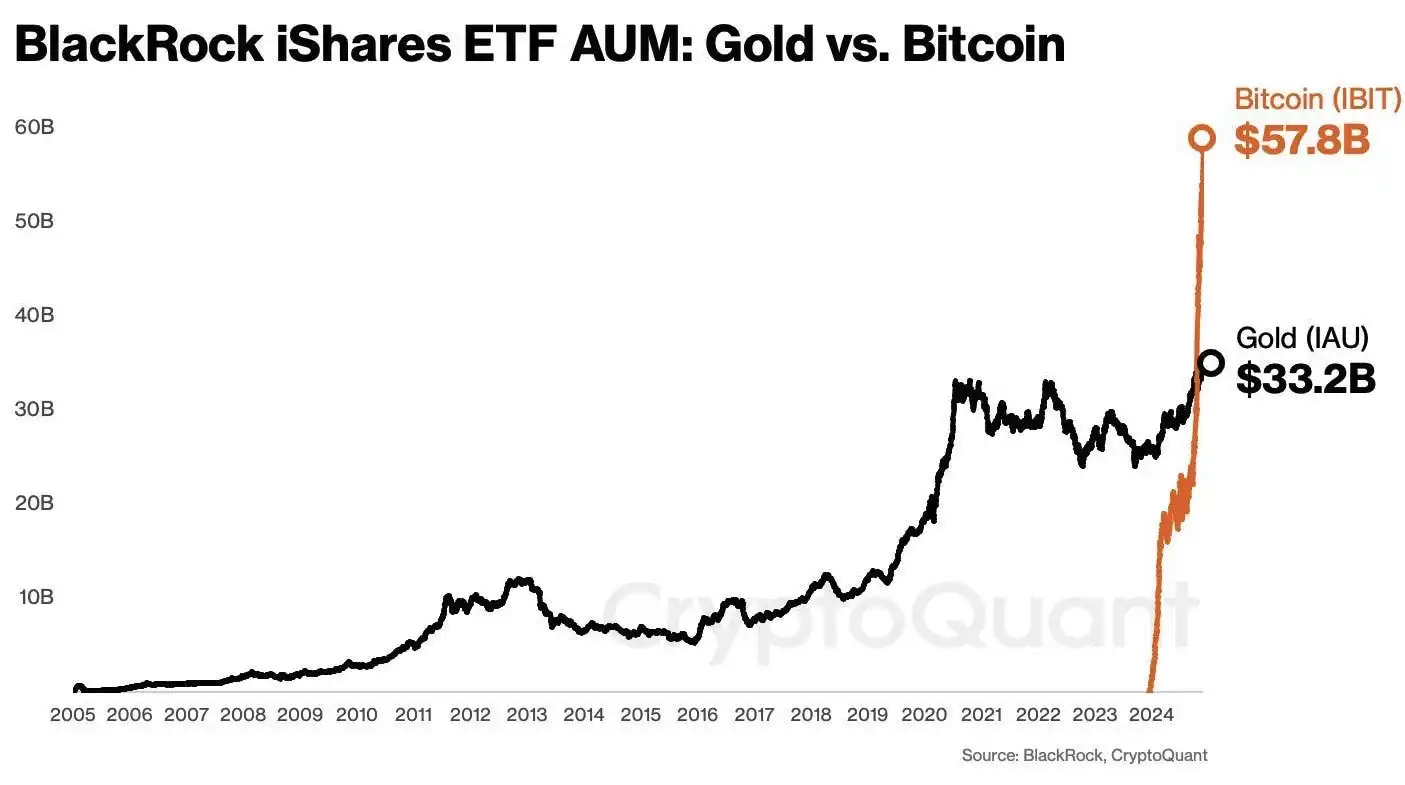

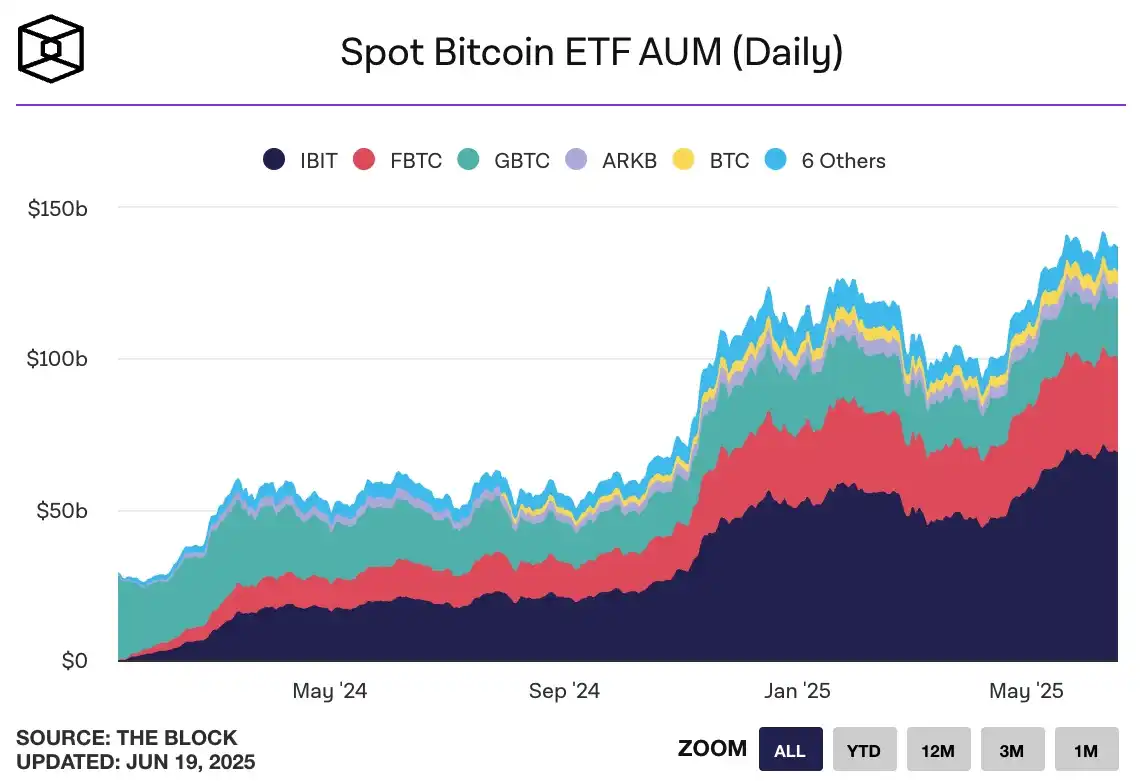

Before this cycle, Coinbase was popular in the US market due to its extensive asset list and diverse trading pairs. However, the exchange landscape has changed dramatically today. First, the rise of cryptocurrency ETFs has created a regulated and institution-friendly entry point, accelerating mainstream adoption and allowing traditional capital to enter the space without relying on platforms like Coinbase. Institutions are very fond of crypto ETFs, with the assets under management for Bitcoin ETFs exceeding $100 billion within a year. Notably, BlackRock's IBIT ETF surpassed the asset management scale of its gold ETF, which took 20 years to build, in less than 12 months.

BlackRock's Bitcoin ETF assets under management rapidly surpassed its long-held gold ETF. Source: BlackRock

ETFs have expanded investment channels for blue-chip assets like BTC and ETH while also weakening one of Coinbase's key advantages—being the primary compliant platform for cryptocurrency investment in the US. The growth opportunities that Coinbase once enjoyed are now being divided by ETF tools, and increasingly, new US investors are entering the cryptocurrency market through ETFs rather than Coinbase. Although Coinbase earns custody fees from some ETFs, this income is negligible compared to the previous high trading fees.

Growth of Bitcoin ETF assets under management over time. Source: The Block

Missing the Solana Meme Coin Wave

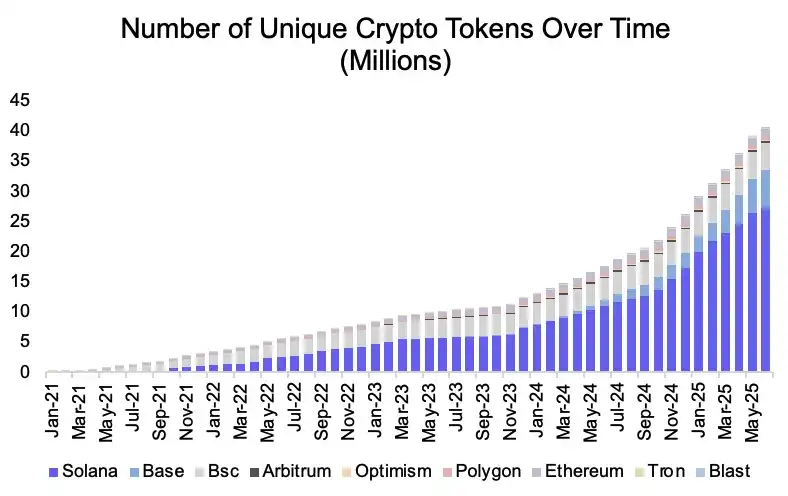

On the other hand, the explosive growth of meme coins has triggered a new wave of retail speculation, with tools like Pump.fun and Raydium making token issuance unprecedentedly simple, leading to a nearly 30-fold increase in the number of tokens since the last cycle.

The number of independent crypto tokens has increased from less than 1 million in the last cycle to over 30 million in this cycle. Source: Dune, @cgrogan

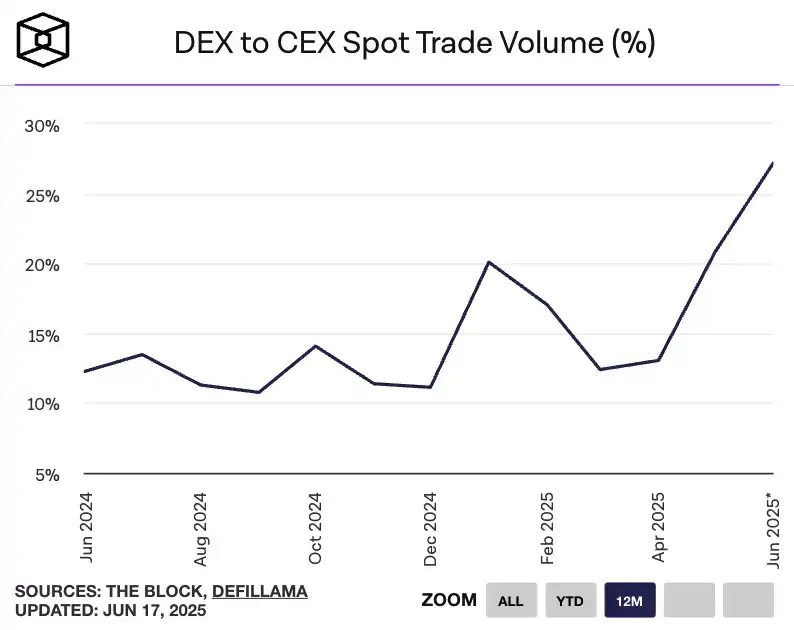

Due to strict compliance standards, Coinbase has been slow to list small tokens or meme coins, while the popularity of DEXs has surged, providing instant liquidity for almost all tokens through permissionless, AMM-based systems. This gives DEXs a clear advantage in speed and flexibility, making them often the only viable option for users seeking early, high-risk, high-reward opportunities (especially in the meme coin space).

Coinbase's disadvantage lies in its limited integration with the Solana ecosystem, which has now become the center of meme coin activity. As a result, Coinbase has largely missed the Solana meme coin craze, while DEXs like Raydium and Jupiter have captured the related trading volume and user participation.

Spot trading volume from DEX to CEX has doubled in this cycle. Source: The Block

Loss of Compliance Advantage

In addition to the rise of ETFs and meme coins, the Trump administration has also signaled a more crypto-friendly stance, aiming to increase regulatory transparency and end the heavy-handed crackdown on the industry. For example, the newly appointed SEC Chairman Paul Atkins quickly took action to rescind the harsh enforcement measures against platforms like Coinbase and Kraken that were implemented during Gary Gensler's tenure.

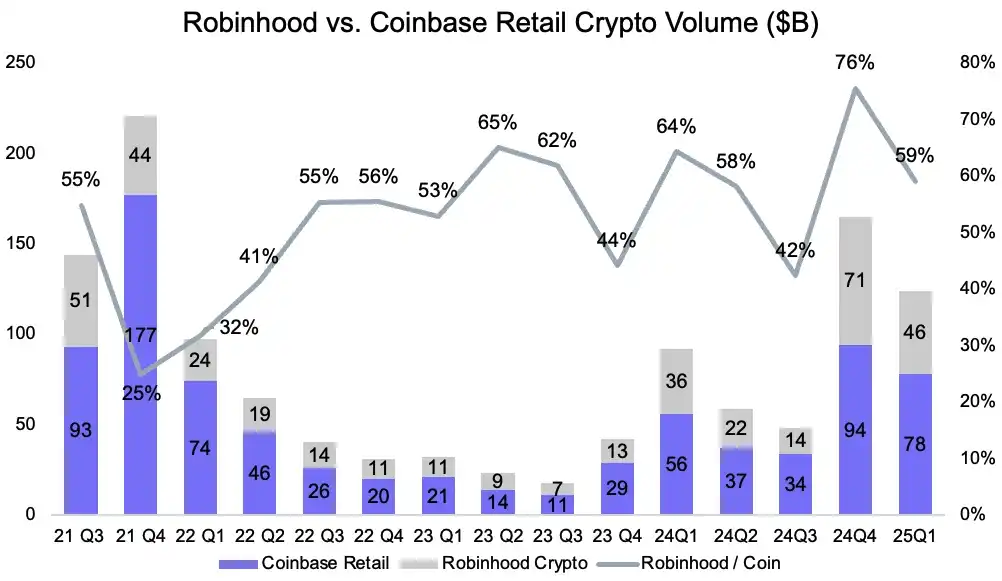

As a result, traditional financial platforms like Robinhood, which have strong retail channels, have also entered the crypto market. This shift is evident in the data: by Q4 2024, Robinhood's retail revenue share of Coinbase rose from 32% to 76%, highlighting the decline in Coinbase's market share. While clearer regulations benefit the entire crypto industry, they also lower the barriers to entry.

Previously, strict compliance policies favored resource-rich companies like Coinbase, but under the new, more lenient regulatory regime, smaller exchanges and traditional financial platforms can compete more effectively.

Robinhood's retail trading volume has significantly increased compared to Coinbase. Source: Coinbase Quarterly Report, Artemis

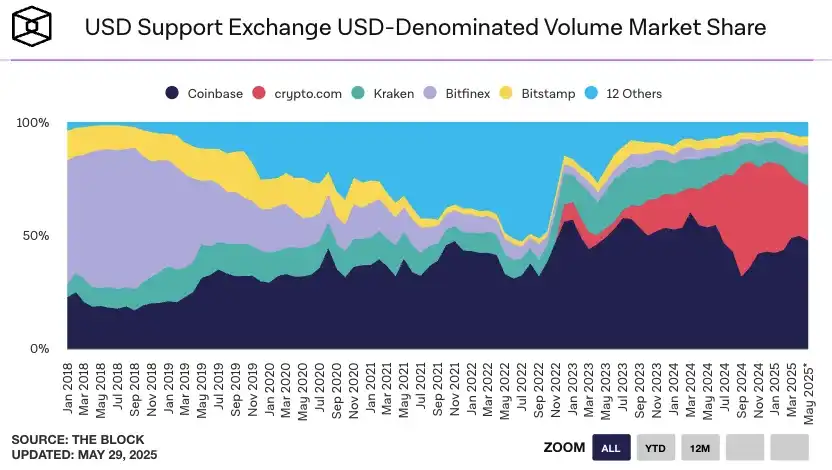

The intensifying competitiveness of the entire cryptocurrency market is likely to put greater pressure on Coinbase, forcing it to lower its high fees or risk losing market share. In fact, Coinbase's share of trading volume in dollar-backed exchanges has already declined—from a peak of 60% to around 50% today, having once dropped to a low of 32% during the meme coin craze.

With the launch of ETFs and the rise of meme coins, Coinbase's market share in dollar-backed exchanges has declined. Source: The Block

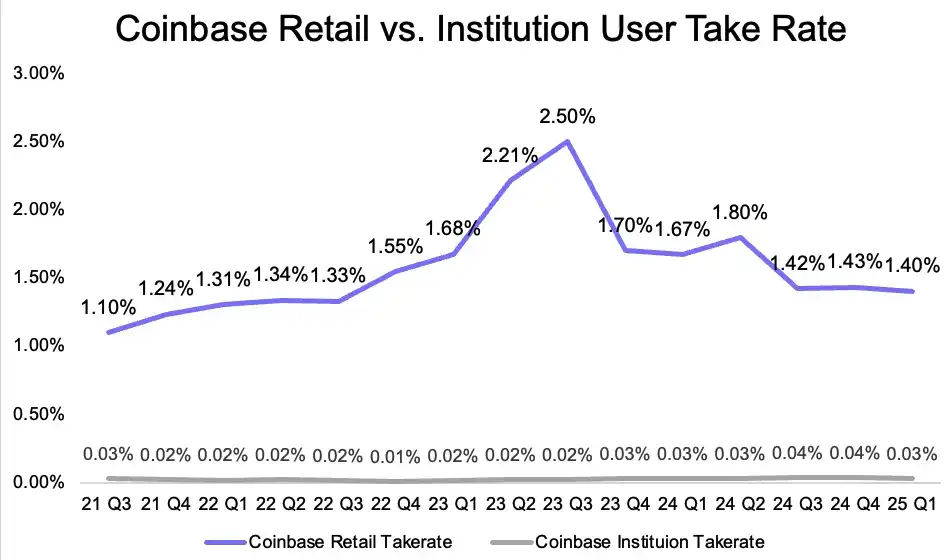

More importantly, Coinbase's trading volume commission rate has also significantly decreased, dropping from a peak of 2.5% to around 1.4%. This decline would have been even greater if not for the recent launch of derivatives. Notably, right after the collapse of FTX, Coinbase's commission rate surged at the end of 2022, when it enjoyed an almost monopolistic position in the US market. This trend peaked in Q4 2023, coinciding with the launch of Bitcoin ETFs, marking a more competitive and institutional phase for cryptocurrency trading.

Coinbase's retail commission rate dropped from a peak of 2.5% to 1.4%. Source: Coinbase Quarterly Report, Artemis

Coinbase's New Monetization Businesses: Derivatives and Base

The competitive landscape for Coinbase has changed dramatically in this cycle. The core business model of Coinbase, "from exchange to on-chain economy," is now precarious. Although Coinbase currently faces significant competition, three monetization businesses may become its core pillars: the derivatives market and Base.

Derivatives Market: Futures Not Meeting Expectations?

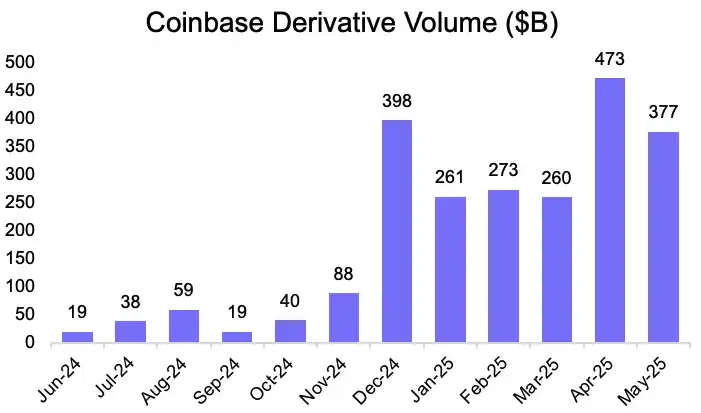

Derivatives remain the most profitable segment in cryptocurrency trading. In 2024, Coinbase launched a limited range of international derivatives, which were quickly adopted. Coinbase noted that while Q1 2025 performance showed strong trading volume growth, derivatives are still in the early stages and could be key to attracting institutional users for monetization. However, due to ongoing marketing efforts, the impact of derivatives on revenue has been limited so far, as rebates and liquidity incentives have offset institutional trading income.

Coinbase's derivatives trading volume surged after Trump's presidential election victory. Source: Coingecko

Coinbase's main goal for launching derivatives in 2024 is to better monetize existing users and attract new ones. However, aside from a brief spike in meme season users at the end of 2024, international user growth has been minimal. While derivatives have contributed higher trading revenue, they have not significantly driven user growth.

Changes in active users for Coinbase domestically and internationally over time. Source: Data AI

In 2025, Coinbase began offering derivatives services to US users to better monetize its domestic user base. However, this launch coincided with the rapid rise of Bitcoin options linked to ETFs, and since most derivatives are concentrated on blue-chip assets like BTC and ETH, Coinbase faces direct competition from ETF options, further limiting its growth potential in this area.

In summary, while the derivatives business has become an important revenue source for Coinbase in the short term, it still faces challenges in the long run unless it can break through limitations and attract new users in an increasingly crowded and fragmented exchange market.

Base: Coinbase's Bet on On-Chain Infrastructure

Base is Coinbase's Ethereum Layer 2 scaling platform, designed to bring users into the on-chain economy while diversifying Coinbase's revenue. Unlike other Layer 2 platforms, Base uses ETH as its native currency and does not have a native token. Supported by Coinbase's brand, Base quickly gained popularity due to hot applications like FriendTech and Farcaster, becoming the highest trading volume project on Ethereum Layer 2 in its first year.

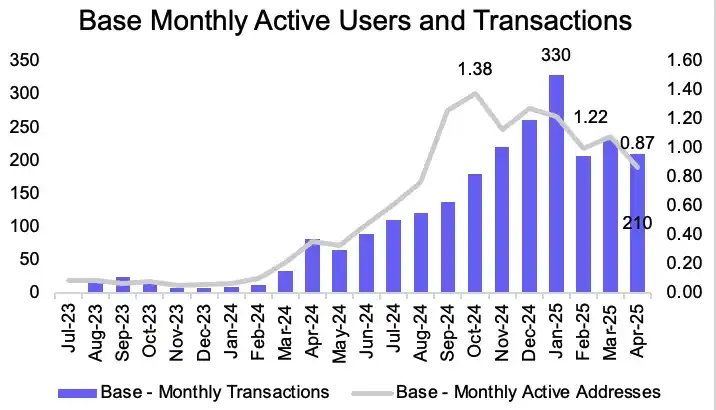

Figure 18: Monthly active addresses and monthly transaction counts for Base. Source: Artemis

Coinbase generates significant revenue by operating Base's sequencer. According to Dune data, Base's weekly gross profit is about $1 million, with a profit margin of around 90%. Additionally, Base accounts for over 75% of total profits in Ethereum Layer 2, showcasing its efficiency and market dominance. Besides sequencer fees, Base also brings users into Coinbase's ecosystem through its wallet and applications, generating revenue through cryptocurrency purchases, swaps, and Base-native applications. Base also supports Coinbase's B2B products, such as Cloud, OnchainKit, and SDK. Furthermore, through a partnership with Optimism, Coinbase expects to receive up to 118 million OP tokens over the next six years, which will be tied to Base's growth.

However, Base's core limitation lies in its positioning as a modular Ethereum L2, leading to fragmentation among liquidity, users, and developers. Bridging assets from Ethereum incurs losses, and the limited interoperability between L2s hinders seamless integration. These issues stem from differences in blockchain finality, resulting in slow, costly, and complex cross-chain liquidity transfers. Despite tools like AggLayer and cross-chain bridges, the modular structure still faces challenges.

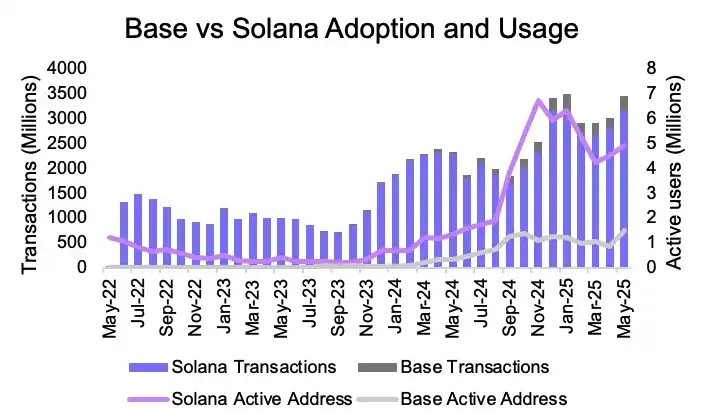

Thus, while Base is growing rapidly, its adoption rate (measured by active users and transaction volume) still lags behind more unified and scalable monolithic chains like Solana, which has three times the daily active users and seven times the daily transaction volume of Base.

Comparison of monthly active addresses and monthly transaction volume between Base and Solana. Source: Artemis

What is Coinbase Worth?

We will use a sum-of-the-parts valuation method, breaking it down into the following components:

· Exchange business: including trading revenue, subscriptions and services, and blockchain rewards

· Base revenue: income generated from Coinbase's Layer 2 network, Base

· USDC revenue: revenue share generated from Coinbase's partnership with Circle

· Interest income from cash and USDC reserves

Exchange Business Valuation: $80.7 Billion

Fundamentally, Coinbase's exchange business is both cyclical and increasingly competitive. To value it, we used the average revenue multiple of traditional brokerage firms, reflecting a more stable and mature market structure.

Using this multiple, Coinbase's exchange business valuation is: $5.17 billion × 156.1 = $80.7 billion.

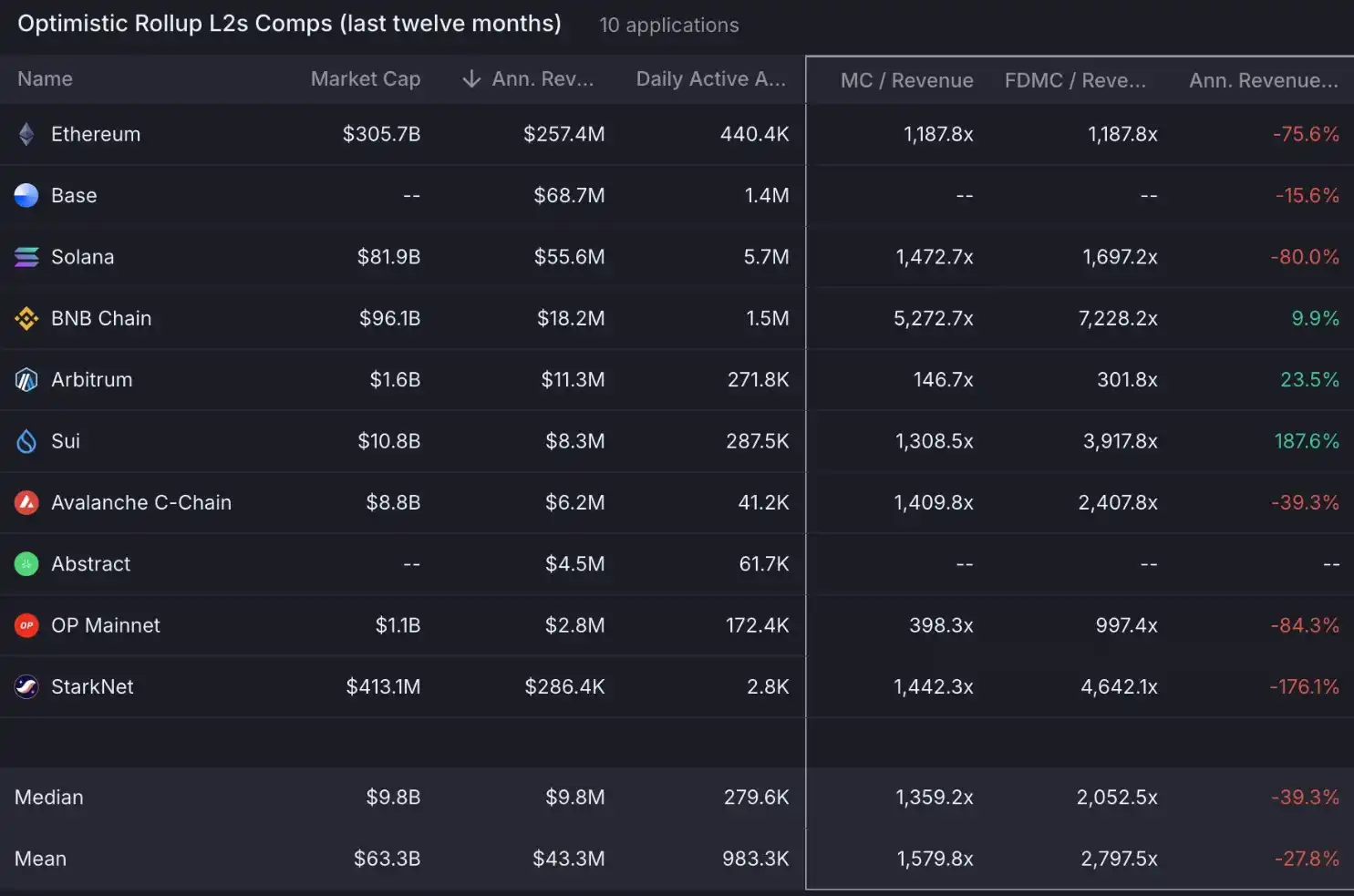

Base Business Valuation: $1.86 Billion

As part of the bullish argument for Base, we used the observed average market-to-sales ratio (MC/Revenue) between Optimism (OP) and Arbitrum (ARB), with a multiple of 270. Applying this formula to Base's annual revenue of $68.7 million yields an implied market value of: $68.7 million × 270 = $1.85 billion.

Ethereum L2 Comparison Table. Source: Artemis

However, our fundamental argument applies a traditional tech valuation framework. Using a 30x price-to-earnings ratio, assuming a gross margin of about 90%, Base's implied gross profit is approximately $61.8 million, leading to a more conservative market value estimate: $61.8 million × 30 = $1.86 billion.

This comparison highlights the significant valuation gap between token-based models and traditional financial frameworks. Given the speculative nature of current token price-to-earnings ratios, our analysis is based on a more fundamentals-focused traditional financial model.

USDC Business Valuation: $45.18 Billion

Given that Circle has completed its IPO, valuing Coinbase's USDC-related business is relatively straightforward. Circle's current valuation is approximately $52.85 billion (as of June 23, 2025), reflecting its 40% share in USDC revenue. Since Coinbase occupies the remaining 60% and retains about 57% of that as net income (after distributing earnings to users), we can estimate the value of Coinbase's USDC-related business as follows:

$52.85 billion × (6 ÷ 4) × 57% = approximately $45.18 billion

This means USDC contributes about $45.18 billion in value to Coinbase.

Coinbase earns nearly $300 million in interest income annually from its $8 billion cash reserves. We will directly account for this asset's value in the sum-of-the-parts valuation method, resulting in $8 billion.

In this view, the sum-of-the-parts valuation method suggests that Coinbase's valuation could be around $108.59 billion (sum-of-the-parts * 80%), indicating that the market may be undervaluing the company. However, this apparent discrepancy from reality also reflects real and substantial risks.

Conclusion: Comprehensive Competition Facing a Diversified Ecosystem

Coinbase's core trading business is under continuous pressure from structural factors: ETF-driven disintermediation, fee compression from DEXs, and slowing user acquisition. Meanwhile, emerging revenue pillars like Base and USDC, while strategically important, also face increasingly fierce competition in their respective markets. USDC and interest income (key drivers of recent increases) are also susceptible to pressures from declining interest rates and yield transmission, which limit further profit capture.

In short, Coinbase is evolving into a diversified crypto ecosystem, but each segment of this model now faces resistance. While Coinbase may appear undervalued from a purely financial perspective, the market's cautious attitude also reflects rational pricing regarding its shrinking moat, profit pressures, and competitive vulnerabilities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。