From Conflict to Easing: A Market Review of the 12-Day Turmoil

The story begins on June 13, 2025. Israel's military operation, codenamed "Lion's Rise," launched the largest airstrikes against Iran in decades, instantly igniting panic in global markets. Iran's missile retaliation further escalated tensions, causing the Global Geopolitical Risk Index (GPR) to soar to 158, reaching its peak since early 2024.

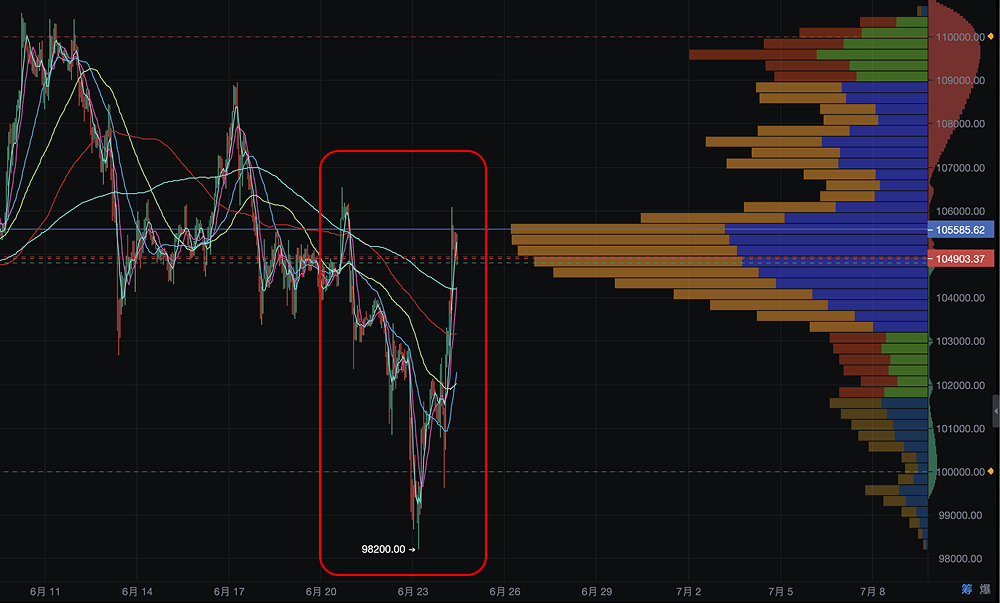

The market's reaction was a textbook "Risk-Off" mode. Capital quickly flowed into traditional safe havens—gold, the US dollar, and US Treasury bonds. Meanwhile, the cryptocurrency market, as a representative of risk assets, suffered severe blows. Bitcoin's price fell below the $100,000 mark, triggering massive leveraged liquidations. According to AiCoin data, the total liquidation amount across the network reached $1.16 billion within 24 hours, with over 250,000 investors forced to exit, leading to a brutal short squeeze.

During the conflict, former US President Trump’s tough statements, especially hints at a possible closure of the Strait of Hormuz, loomed over the market like a sword of Damocles. As a vital artery for global oil transportation (accounting for 20% of global shipments), any disruption directly threatened global inflation expectations and the Federal Reserve's monetary policy path, further suppressing the valuation of risk assets.

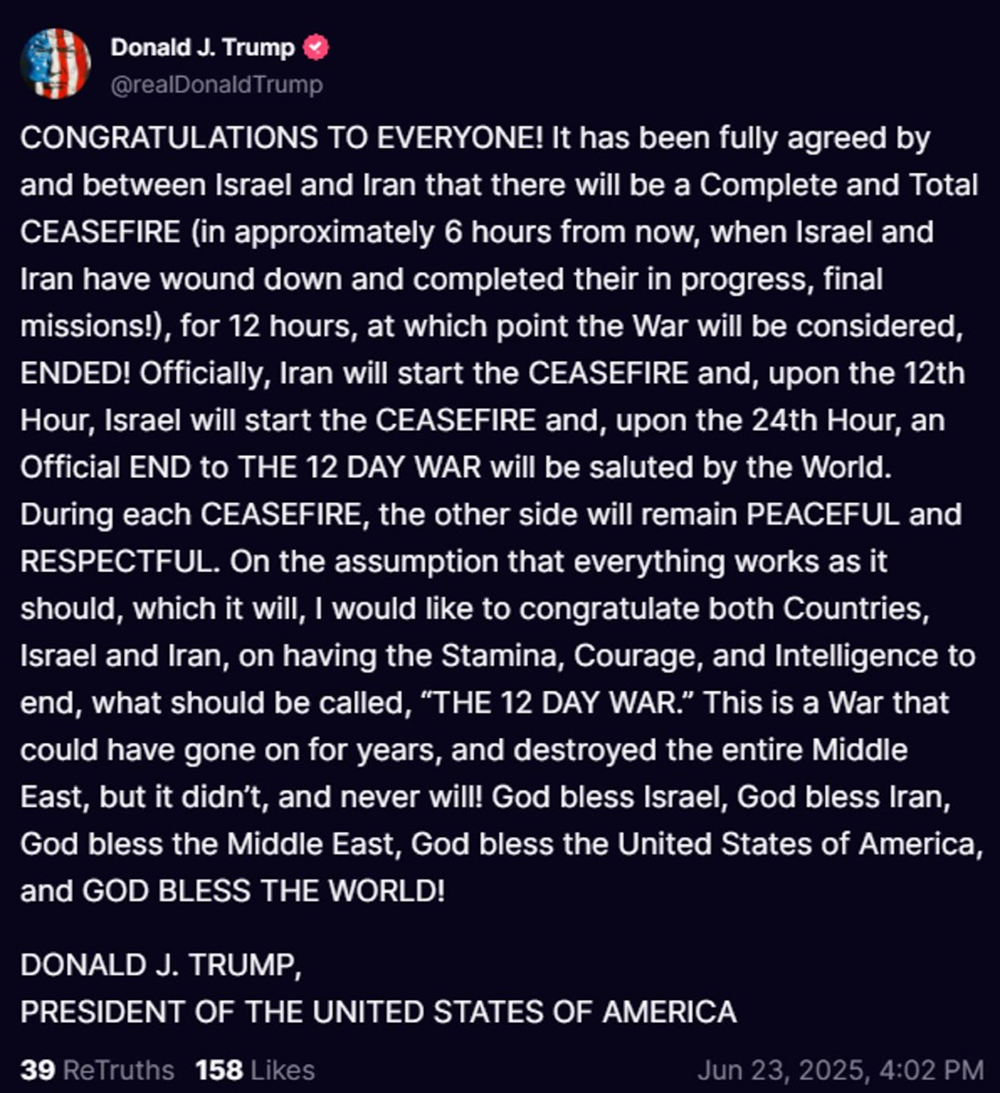

The turning point came on June 24. Trump announced via social media that, with the joint mediation of the US and Qatar, Israel and Iran had reached a "comprehensive and complete" ceasefire agreement. Upon hearing the news, the market's tense nerves instantly relaxed.

Return of Risk Appetite: Capital Shifting from Gold to Bitcoin?

The ceasefire agreement became the direct catalyst for the rebound in the cryptocurrency market.

On June 24 during the Asian trading session, market sentiment quickly shifted from panic to greed. Bitcoin led the charge, rising 4.5% within 24 hours, strongly breaking through $106,000. Major altcoins like Ethereum and Solana performed even better, recording gains of 5%-7%. The total market capitalization of the cryptocurrency market rebounded by about 3% in a single day, approaching the $3 trillion mark again. Market sentiment on social media quickly turned optimistic, with "Risk-On" becoming a high-frequency term.

The core logic of this rebound is the rapid decline of the geopolitical risk premium.

Capital Rotation: As the GPR index fell, the safe-haven funds that had previously flowed into gold and the dollar began to seek higher returns, with Bitcoin becoming one of the main targets for this liquidity.

Derivatives Market: The funding rate for Bitcoin perpetual contracts turned positive, indicating that market sentiment had shifted from bearish to bullish, with long positions regaining dominance.

Institutional Confidence: According to Farside Investors data, the US spot Bitcoin ETF resumed a continuous net inflow pattern after the ceasefire news, accumulating $1.3 billion over the past five trading days. ETFs are the most direct window to observe institutional capital flows, and their performance confirms that "smart money" is re-entering the market.

Bitwise Research Director André Dragosch analyzed: "Bitcoin is highly correlated with macro liquidity and market sentiment. This event clearly demonstrates its characteristic as a 'global risk sentiment barometer.' The ceasefire agreement eliminated the greatest uncertainty in the short term, and the restoration of risk appetite is the fundamental driver of price recovery."

The Deep Game Behind the Ceasefire: Reaffirmation and Challenge of Bitcoin's Narrative

This rollercoaster market not only represents a price correction but also serves as a stress test for Bitcoin's dual narrative.

Firstly, Bitcoin's decline at the beginning of the conflict reinforced its attribute as a "risk asset." In extreme panic with liquidity drying up, investors tended to indiscriminately sell all non-dollar assets for cash, causing Bitcoin's performance to closely synchronize with the Nasdaq index.

Mithil Thakore, co-founder of Velar, pointed out: "In the moment of crisis, liquidity is king. Bitcoin's high liquidity made it one of the preferred choices for investors to cash out, which explains why it fell before the safe-haven narrative took effect."

However, the strong rebound after the ceasefire partially validated its "digital gold" and "inflation hedge" narrative logic. Thakore added: "Geopolitical conflicts will increase defense spending and disrupt supply chains, inevitably leading to higher inflation in the long run. Bitcoin, as an asset with a constant supply, has its value proposition against the over-issuance of sovereign currencies repeatedly mentioned in the context of conflict. Once market panic subsides, this narrative will attract long-term investors."

It is worth noting that the hacking incident at Iran's largest cryptocurrency exchange, Nobitex, during the conflict also revealed the vulnerability of centralized platforms in geopolitical games, which in turn highlighted the resilience of Bitcoin's decentralized network.

Market Outlook: Key Resistance Levels and Macro Variables

Although the ceasefire agreement injected a shot of adrenaline into the market, the road ahead is not smooth. Investors need to closely monitor the following key variables:

Technical Aspects: Bitcoin has regained the $105,000 level, with the next key resistance level looking towards the previous high area of $108,000. If it can effectively break through, it may open up new space towards $112,000.

Macro Aspects: The stability of the Strait of Hormuz and the trend of global oil prices will directly impact the Federal Reserve's decisions. Coin Bureau founder Nic Puckrin warned: "If oil prices continue to rise due to any subsequent friction, inflationary pressures will force the Federal Reserve to maintain a hawkish stance, which will pose headwinds for all risk assets, including cryptocurrencies." Market expectations for a Fed rate cut in September will be key in determining the liquidity environment for the second half of the year.

Geopolitical Factors: Whether the current ceasefire agreement is solid and whether the situation in the Middle East will see reversals remain the biggest X factor. Any new spark of conflict could push the market back into "Risk-Off" mode.

In Conclusion

From a crash to a surge, the 12-day conflict between Israel and Iran provided a vivid macro trading lesson for the cryptocurrency market. Bitcoin played a complex dual role: both a risk asset sold off in panic and a resilient asset that rebounded first after the easing of the crisis.

This baptism once again proves that Bitcoin's value lies not only in its code but also in how it is traded, interpreted, and endowed with narratives in the global macro chess game. With the restoration of risk sentiment, the short-term outlook for the market is optimistic, but the road ahead remains full of uncertainties. For investors, understanding and navigating Bitcoin's "dual personality" will be key to traversing the cycles.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。