Blackrock’s IBIT Keeps Bitcoin ETF Market in the Green as Ether ETFs See $11 Million Outflow

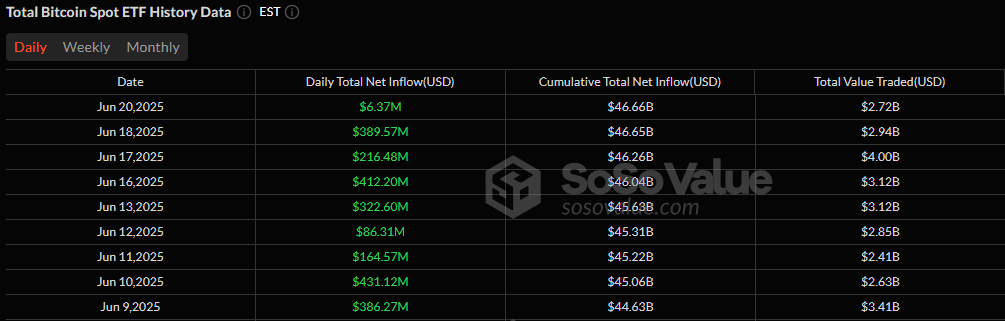

After the market pause for Juneteenth, Friday’s session returned to quiet but telling moves in the bitcoin and ether exchange-traded fund (ETF) space. Bitcoin ETFs notched their 9th straight day of net inflows, although the total was modest at $6.37 million, reflecting cautious but steady investor confidence.

Only two funds saw activity. Blackrock’s IBIT kept its grip on the market with a solid $46.91 million inflow, once again proving its dominance. A $40.55 million outflow from Fidelity’s FBTC partially offset this, resulting in the slim positive net flow. Despite the light action, trading volume stood firm at $2.72 billion, with total net assets slipping slightly to $126.54 billion.

9-day Bitcoin ETF Inflow Streak. Source: Sosovalue

Meanwhile, ether ETFs couldn’t sustain their recovery inflow streak alive, posting a net $11.34 million outflow after 3 days in the green. The drain was led by Blackrock’s ETHA, which saw $19.71 million exit the fund.

Grayscale’s Ether Mini Trust and Vaneck’s ETHV tried to stem the tide with inflows of $6.60 million and $1.77 million, respectively, but the day still closed in the red. Total ether ETF trading was brisk at $687.41 million, with net assets closing at $9.60 billion.

As the week wound down, the market signaled a brief pause in momentum, but for bitcoin ETFs, the green streak is alive and well.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。