The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of cryptocurrency enthusiasts. I welcome everyone's attention and likes, and I refuse any market smoke screens!

A few days ago, Lao Cui's article expressed the view that the financial market is in a bear market phase, which attracted a lot of attention from friends, and I discussed it for a long time with several cryptocurrency enthusiasts. Perhaps the prosperity of the cryptocurrency circle has blinded many enthusiasts, causing everyone to fail to perceive the changes in finance and the economy. Whether it is the domestic real estate market, the tariff war initiated by the United States, or the depreciation of currencies across Asia at the beginning of the year, including the turmoil in the Middle East and Europe. Each event seems to narrate the transformation of this era. If we only look at the cryptocurrency circle, indeed, many wealth creation miracles have occurred in the past two years, but these cannot cover up the overall trend of economic decline. Even Lao Cui cannot determine where the bottom position is, and it is also difficult to estimate whether it has hit the bottom. The challenges we face are also enormous, from the root cause of commodity oversupply to overcapacity, from excess currency to excessive strategies. This is the essence of a financial crisis. For the domestic economy, we need to pay more attention to Africa's development. Currently, only Africa's infrastructure development can delay the overload explosion of industry!

The financial crisis itself should not be a concern for us; it is a natural law. The law of competition, survival of the fittest! From racial competition to institutional competition, it evolves into the upper class suppressing the middle class, and the middle class plundering the lower class. The only way to optimize is through technological advancement, which is why we have the current concepts, whether it is artificial intelligence or blockchain technology, the close binding of these two seems to point the way for everyone. This is also why cryptocurrency concept stocks are currently growing against the market trend, with a daily increase of 84.14% at one point. While the cryptocurrency circle remains in a downward state, the cryptocurrency concept benefits from the issuance of stablecoins. On June 17, Mr. Liu Qiangdong, the head of JD.com, mentioned the issuance of stablecoins. In his introduction, he also expressed the hope that stablecoin licenses could be applied for in major currency countries around the world, enabling foreign exchange between global enterprises. Ideally, this could reduce global cross-border payment costs by 90% and improve efficiency to within ten seconds. It sounds like a good idea, but implementing it will likely still be challenging.

As we all know, the cryptocurrency that occupies the stablecoin market the most is USDT, followed by USDC, and many other cryptocurrencies have emerged in between, all of which have perished in competition. As for JD.com's future, we don't need to speculate too much; we just need to understand one point: all our domestic cross-border business sectors will definitely apply for stablecoin issuance licenses. In the end, the struggle returns to the law of survival of the fittest, and there won't be too many left. Ant Group has already injected funds into the parent company of USDC. Lao Cui is not very optimistic about the issuance of domestic stablecoins. In the end, the competition has become a struggle between the United States and us, a challenge between the US dollar and CNY. Through this, we can also see that the competition in high-end technology is always dominated by these two countries. The purpose of discussing these topics is to hope that everyone has a risk awareness regarding stablecoins. Not all stablecoins can be well-known; the needs of trading companies for stablecoins are fundamentally different from what we want, and we have essential differences from them.

Currently, companies that can obtain licenses in Hong Kong are almost all backed by some countries, and they do not aspire to profit from stablecoins; they only use cryptocurrency technology to achieve asset transfer. Especially the point that stablecoins are pegged to government bonds is extremely complex. Therefore, regarding the issuance of domestic stablecoins, everyone can ignore the overall market value of the cryptocurrency circle; this part of the data does not fundamentally belong to the cryptocurrency circle. The same goes for US government bonds; buying US bonds at this stage is certainly not as profitable as before. The US dollar has become very strong compared to earlier times, and only after interest rate cuts will the returns on US bonds become considerable. With 36 trillion in government bonds, foreign capital occupies one-third, with nearly 9 trillion purchased by other countries. Currently, Japan holds the most foreign debt at nearly 1.2 trillion, and we rank third with over 870 billion. This is still the data after selling off. The US's requirements for stablecoins basically just need to meet our selling gap. At our peak, we held nearly 1.3 trillion in US bonds, with a selling gap of 400 to 500 billion, and we are still selling off, throwing out over 8 billion again, which shows that the contradictions have indeed escalated.

The US has been barely maintaining the operation of US bonds with the support of Japan and the UK. One-fourth of foreign capital is also a national policy of the US, so when stablecoins are listed, don't think that this market can absorb 36 trillion in government bonds; this is not the US's plan. The issuance of stablecoins only requires holding short-term government bonds for 93 days before they can be sold, which is just a tool for short-term stable government bonds. From the new loan data of domestic residents, we can also see some issues; the current loan data has decreased tenfold from the peak period. This leads to the inference that many things' values may continue to depreciate. Currently, the domestic economy has little impact on the cryptocurrency circle. Many friends believe that Hong Kong's opening of digital currency trading, including the introduction of stablecoins, is laying the foundation for the domestic market to open. You can dismiss this idea; the domestic market will never be opened for trading. Hong Kong's actions are only to attract foreign capital inflow, providing a channel for domestic capital to circulate, but it will not allow domestic capital to flow overseas. Domestic measures will not affect the trend of the cryptocurrency circle; a bull market can only be seen through the actions of Europe and the US.

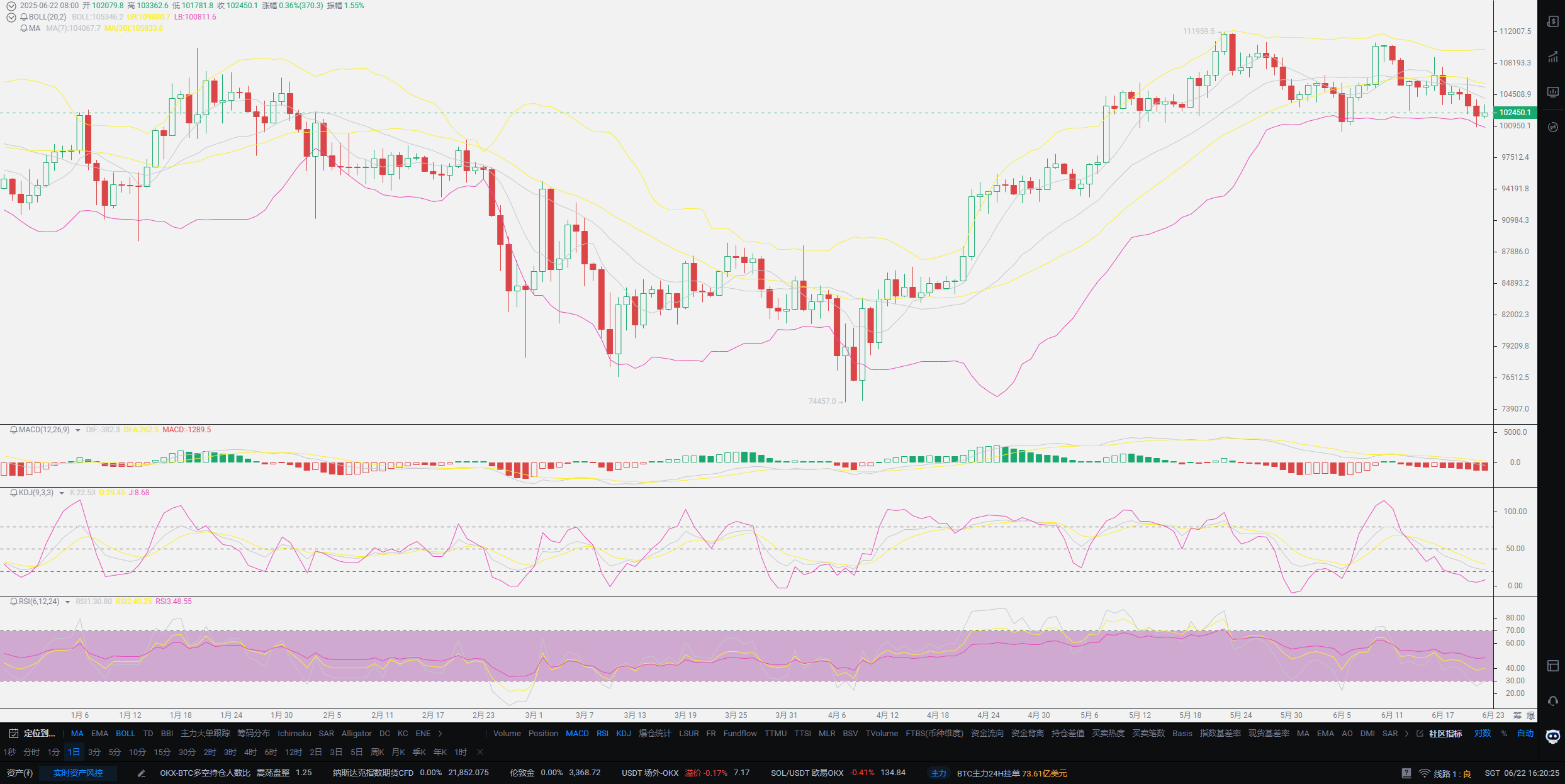

Lao Cui summarizes: Last night, with the US military actions, the cryptocurrency circle experienced a wave of decline, and many people will blame it on the war. From Lao Cui's perspective, this is all normal fluctuations; under the current conditions, it is primarily bearish. This kind of impact only accelerates the arrival of the bears and will not fundamentally affect the long-term trend. There will definitely be lower points, and these low points will not be linked to military actions; it is simply due to the insufficient capital volume in the cryptocurrency circle. Lao Cui's estimated layout is to start bottom-fishing from Bitcoin below 100,000 and Ethereum around 2,000, with batch configurations entering the market in segments. Regarding the contract aspect, the short positions have not yet exited; everyone can choose to exit, and after a recovery, re-enter. Lao Cui has not moved his own positions, largely because contracts have always been compensating for the losses in the spot market. Therefore, Lao Cui's contract form is more about cooperating with the spot market. The operation form of the spot market is to respond to changes with stability; currently, it is in a bearish range, and can only use contracts to pull a bit; if everyone's focus is on contracts, it is best to secure profits of 500 points in Ethereum and 10,000 points in Bitcoin. After the recovery, there will be opportunities for everyone to enter the market again. Do not blindly enter long positions; if the market reverses, Lao Cui will also remind everyone. If there are long positions trapped, it is best to exit as soon as possible after the recovery. Users who do not understand specific operations can directly ask Lao Cui.

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and strategizes for the big picture, not focusing on individual pieces or positions, aiming for the final victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent entrapment.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。