Trump slams Powell again—Massie revives “End the Fed” bill

TRUMP vs. POWELL: It’s Getting Personal!

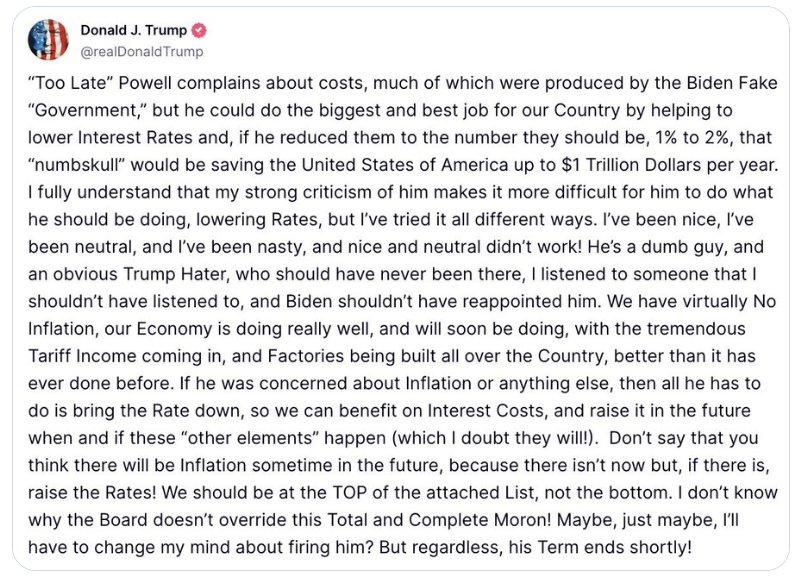

Donald Trump has publicly criticized Fed Chair Jerome Powell, calling him a "moron" and a "dumb guy." Trump has also hinted at changing his decision to fire Powell, potentially causing investor confidence to be shaken. The situation is gaining personal attention. Trump's tweet “Maybe, just maybe, I’ll have to change my mind about firing him?” suggests he could potentially fire the Central Bank chair, causing uncertainty in the U.S. dollar and treasury markets. Trump's threats to the Central Bank's independence have been interpreted as threats to the dollar's stability. Trump's attacks on Powell earlier this year spiked bond markets due to the potential chaotic relationship between the White House and the Central Bank.

Source X

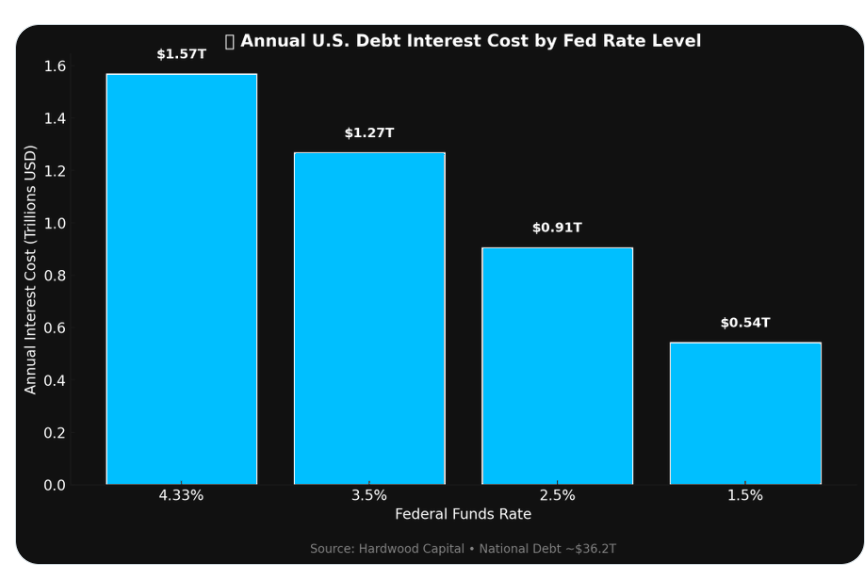

The U.S. currently pays $1.57 trillion per year to service its $37T national debt at current rates. If rates fall to 1.5%, the U.S. could save $1 trillion in yearly savings, reducing federal interest payments, opening room for tax cuts, infrastructure, and deficit reduction.

Trump has criticized Federal Reserve Chair Powell for his interest rate policies, which have kept the benchmark rate steady this year. The committee, chaired by Powell, has opted against lowering rates earlier this week, drawing backlash from Trump. High interest rates can slow economic growth and make it more expensive for Americans to borrow money. However, lowering rates too quickly could overheat the economy and cause inflation to spike again. Trump criticized Powell, calling him a "numbskull" and suggesting other members of the Federal Open Monetary Committee "override" him. Trump also suggested Powell should lower interest rates immediately and hike them again if inflation spikes.

Will Massie’s abolition bill gain steam after Trump’s attack?

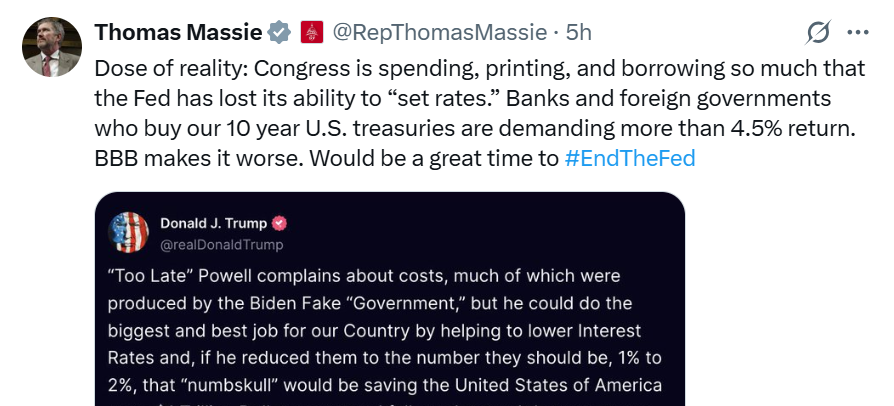

The political earthquake has triggered a financial revolution in the U.S., with Congressman Thomas Massie reintroducing a bill to dismantle the Federal Reserve. This economic policy debate, fueled by inflation and currency devaluation, has the potential to significantly alter the future of U.S. finance.

Source X

Crypto rally if Fed independence breaks

The abolition of the Federal Reserve could increase demand for decentralized alternatives like Bitcoin, Ethereum, and stablecoins, as crypto communities criticize central banking. Initial panic could lead to a surge in crypto prices , but wild swings could follow as traders process macroeconomic chaos. Regulation uncertainty regarding stablecoins, CBDCs, and banks' crypto activities could create both opportunities and confusion for crypto innovators. Trump's criticisms of Fed policy and Powell's actions are influencing the market and social media, leading to surges in crypto and equity activity. Crypto, particularly Bitcoin, is responsive to these signals, with analysts monitoring for any hint of Fed accommodation. The abolition of the Federal Reserve could cause market volatility, liquidity concerns, and transition chaos, increasing yields and borrowing costs due to perceived risk.

Are Markets Watching Trump & Massie to Reshape Crypto Community?

Trump's pro-crypto policy has sparked mixed sentiment on social media, with some predicting increased adoption and asset inflation. Others warn of potential pump-and-dump risks, volatility, and the ephemerality of narrative surges. The link between political pressure, Fed policy, and digital asset performance is evident, with some users and analysts speculating. The removal of the Federal Reserve (Fed) is expected to have a significant impact on the crypto community , with many seeing it as a validation of decentralized, transparent money systems. However, experienced traders warn that chaos could damage liquidity, cause disruption, and trigger regulatory backlash. Traditional finance leaders are also concerned, as the U.S. dollar's reserve status, bond market stability, and credit system depend on the Fed. Warnings include potential banking crises, deposits runs, and systemic risk reminiscent of pre-Fed panics.

What Influences Prices the Most? The public or the headlines?

Crypto prices are influenced by the retail crowd's reaction to Washington's decisions, rather than the news. Traders, particularly big players, constantly monitor the crowd's behavior and sentiment to predict the market's reaction. If the crowd is excited, they can ride the wave, while fear or hesitation may trigger a pullback. Therefore, monitoring behavior and sentiment is crucial for successful crypto trading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。