Two weeks ago, Bitcoin.com News reported that Blackrock’s Ishares Bitcoin Trust ETF, or IBIT, had achieved the distinction of being the fastest-expanding ETF on record. At the time, it was projected that if the pace of acquisitions persisted, IBIT would be on course to hold close to 1 million BTC by Feb. 21, 2026. Back then, IBIT had amassed 662,707.41 BTC; that tally has since climbed by 3.07%.

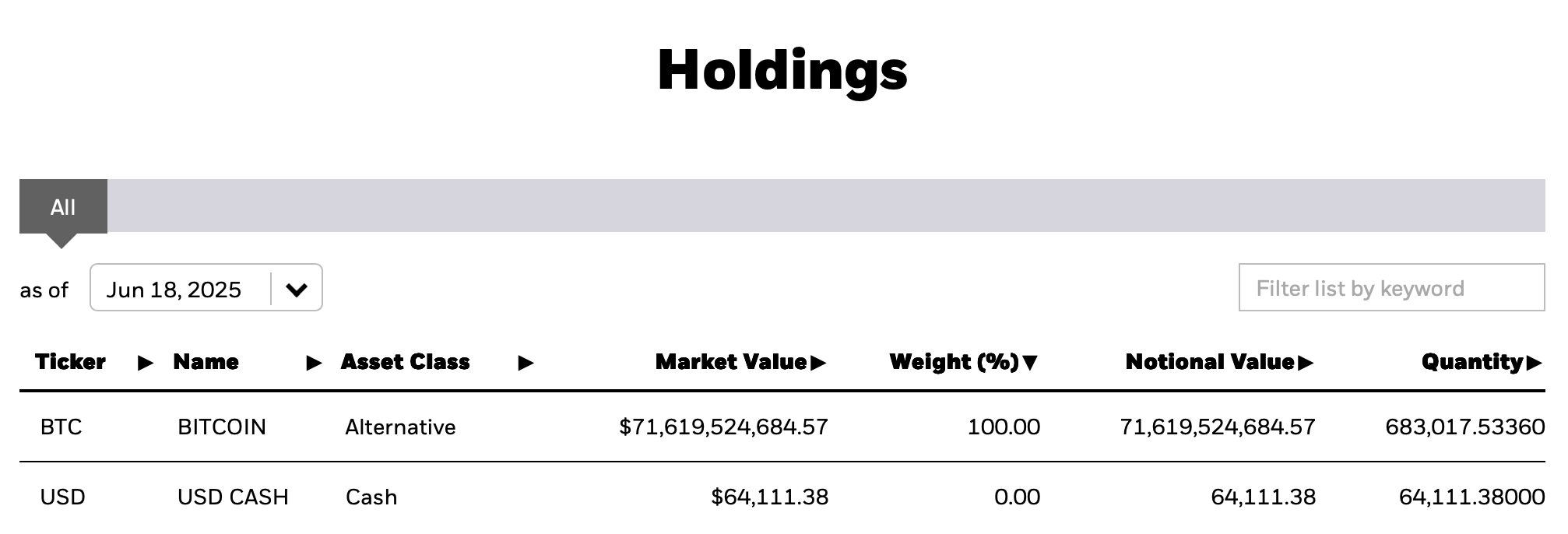

Source: Ishares Bitcoin Trust.

In less than 14 days, IBIT’s holdings swelled by 20,310.12 BTC, worth around $2.11 billion. This elevates its total to 683,017.53 BTC, translating to approximately $72.19 billion in value. Of bitcoin’s finite 21 million supply, Blackrock’s share accounts for 3.25%. Against the circulating supply of 19,881,210.21 BTC, IBIT currently commands 3.44%.

Since its debut, IBIT’s trajectory has mirrored that of bitcoin itself. On Jan. 15, 2024—four days after launch—the ETF was priced around $23.80 per share; it now trades at $59.74. IBIT investors who entered at that early stage have netted a 151% return. A parallel investment directly in bitcoin would have fared slightly better.

On that same January day, bitcoin traded at $41,560. At the time of this writing, it has reached $105,437—a gain of 153.7%. For comparison, the S&P 500 appreciated by 24.85% over the same period. Meanwhile, gold rose from $2,029 per ounce to $3,365, marking a 65.85% increase.

This trajectory places IBIT not merely as a fast-growing ETF but as a significant conduit for the institutional embrace of bitcoin. Its pace of acquisition and close tracking of bitcoin’s price point to a strengthening bond between traditional finance (TradFi) and digital scarcity. The performance gap between bitcoin and legacy assets continues to reinforce its allure as a singular financial instrument.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。