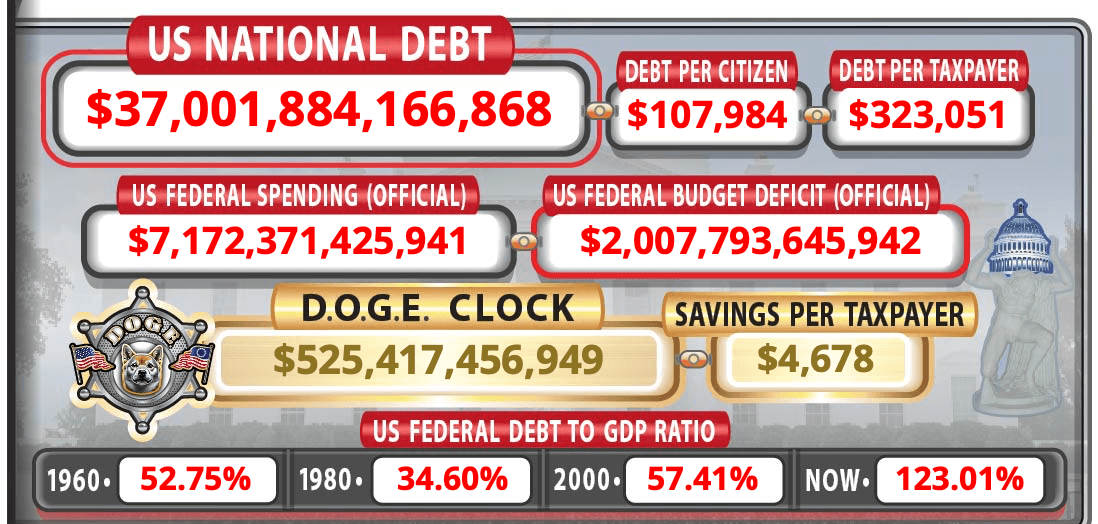

This monumental figure translates to $107,984 owed for every U.S. citizen and a crushing $323,051 for every taxpayer, highlighting the immense weight placed on working Americans. Official federal spending reached $7.17 trillion in the past year, far exceeding revenue and resulting in a $2 trillion budget deficit. These are not accidental figures. They are the logical consequence of a system that no longer values production but exalts redistribution.

Source: usdebtclock.org

The debt-to-GDP ratio, a critical measure of economic health, now stands at 123.01%, a dramatic increase from 57.41% in 2000 and 34.60% in 1980. Driving this spending are massive mandatory programs: Medicare/Medicaid costs hit $1.69 trillion, Social Security required $1.52 trillion, and net interest on the debt itself consumed $1.03 trillion – exceeding the $908 billion spent on defense.

Compounding the crisis, the total U.S. debt obligation, including unfunded liabilities, balloons to an almost incomprehensible $104.5 trillion. Interest payments alone cost taxpayers $5.47 trillion. These costs divert resources from other national priorities and investments. Debt creation has replaced wealth creation. With over $22 trillion in money supply and $1.68 trillion in “future” Treasury dollars conjured from nothing, the government trades counterfeit confidence for real capital.

Simultaneously, Americans face significant economic pressures. Median income is $43,834, while costs have skyrocketed: healthcare now averages $15,584 annually (up from $5,434 in 2000), college tuition is $27,539 (up from $10,734), and the median new home costs $411,091 (up from $164,777). Some 37.4 million Americans live in poverty.

Moreover, currency devaluation is not a symptom—it is also the cause of this downward spiral. When a government inflates its money supply, it robs every dollar of its value, punishing savers and rewarding reckless debt. This silent theft erodes purchasing power, distorts markets, and enables limitless spending without accountability. It is moral fraud disguised as economic policy, replacing real wealth with illusion.

Many widely agree the current economic trajectory is unsustainable. The ballooning debt, fueled by persistent deficits and rising interest costs, poses a severe long-term threat to the U.S. economy, potentially requiring painful fiscal adjustments or risking deeper instability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。