Over the past decade, data shows that Bitcoin has demonstrated significant price resilience in geopolitical conflicts, but its safe-haven properties have yet to be fully confirmed.

Written by: White55, Mars Finance

Financial market data from the past decade reveals a striking phenomenon: Bitcoin's price has consistently shown remarkable resistance in environments of war and armed conflict.

With the recent escalation of the conflict between Israel and Iran in the Middle East, Bitcoin's market price has once again exhibited stability, continuing this unique characteristic. A review of historical conflict cases shows that a multitude of factors have shaped this feature, with the global adoption of cryptocurrencies and increased institutional capital participation playing key roles.

Market observers have a consensus on the price reaction in the early stages of conflict outbreaks. André Dragosch, research director at ETC Group (part of Bitwise's ETP platform), pointed out that Bitcoin's price often bears the brunt of shocks in the short term following the outbreak of geopolitical crises. Although BTC's overall volatility has shown a downward trend in recent years, its asset characteristics are still classified as high-risk, with a high probability of panic selling triggered by sudden events. However, Mithil Thakore, co-founder and CEO of Velar (a Bitcoin L2 liquidity protocol), explained to Cointelegraph the reverse logic: "From a long-term perspective, geopolitical conflicts elevate Bitcoin's value through a triple transmission mechanism—fiscal expansion policies, a shift towards loose monetary policy, and supply chain disruptions combined with commodity price fluctuations. These factors collectively drive global inflation expectations upward, thereby creating an environment for Bitcoin's appreciation."

Historical data confirms Bitcoin's extraordinary resilience in geopolitical crises, but it is important to clarify that price stability does not equate to the confirmation of safe-haven asset properties. Bitcoin's market response exhibits a complex multi-factor coupling characteristic, where the depth of institutional participation and the level of regional adoption may become key variables. The following will conduct an empirical analysis through typical conflict cases from the past decade:  Bitcoin's price is resilient during conflicts, but it may also depend on factors such as adoption or institutional participation.

Bitcoin's price is resilient during conflicts, but it may also depend on factors such as adoption or institutional participation.

2025 Israel-Iran Full-Scale Conflict (Erupted on June 13)

In the early hours of June 13, the Israeli military carried out precise strikes on over thirty strategic targets within Iran, marking the largest scale of attack since the Iran-Iraq War in the 1980s. In the following days, these two arch-enemies in the Middle East continued to engage in strategic missile exchanges, with tensions escalating. Despite the risk of the situation spiraling out of control (especially in the context of potential U.S. intervention), financial markets exhibited unexpected calm. The Bitcoin market mirrored this trend, showing an upward curve after the outbreak of conflict.

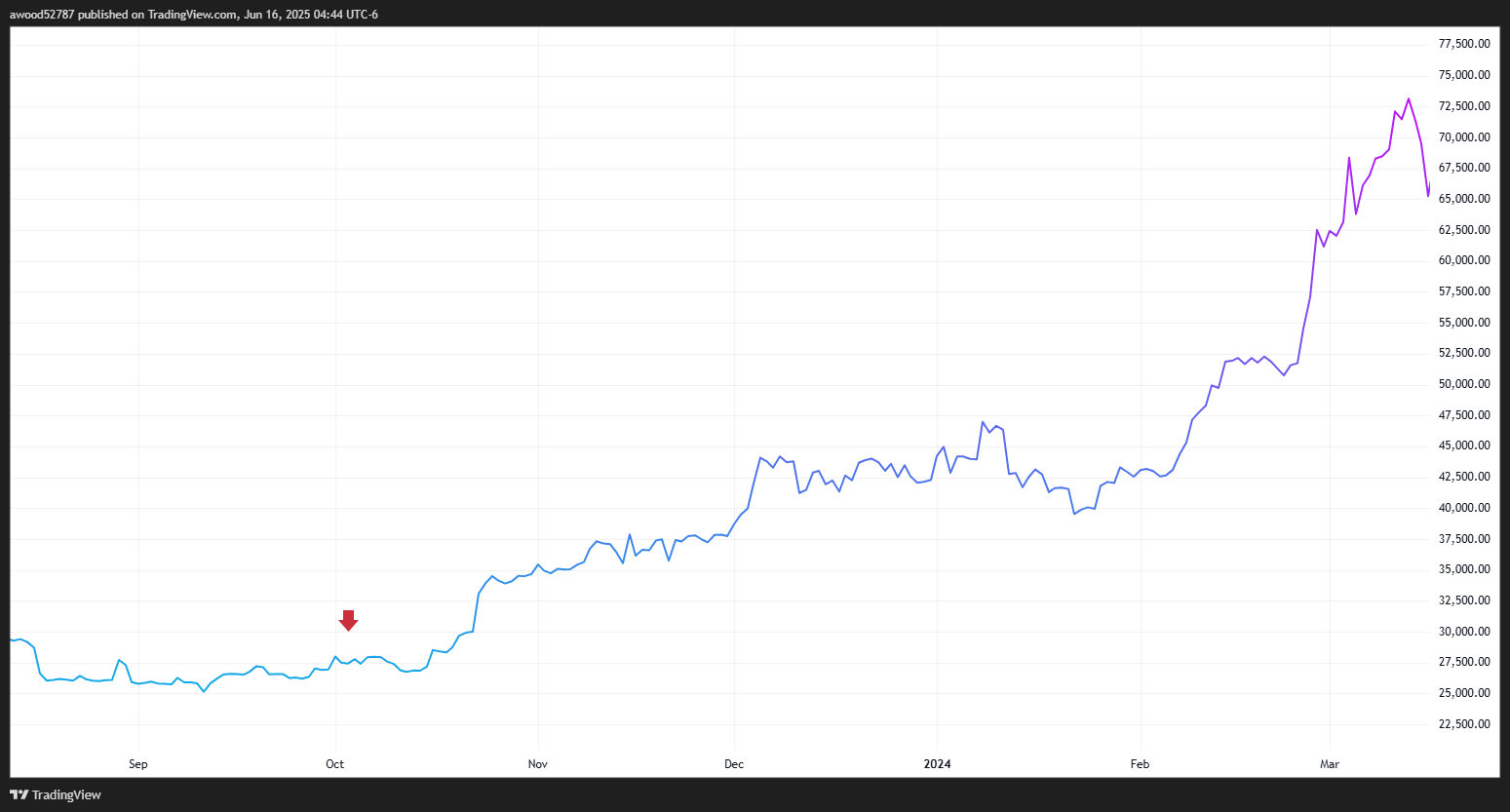

After Israel's missile attack on Iran, Bitcoin's price immediately rose. (Red arrow marks the date the conflict began.) Source: TradingView

The initial explosion triggered a brief downturn in the cryptocurrency market, but prices quickly recovered to baseline levels. Notable analyst Za emphasized on social media: "Current market sentiment shows that Bitcoin investors are significantly less concerned about the military confrontation between Israel and Iran compared to traditional asset holders." Symbolically, Bitcoin's most ardent advocate, Michael Saylor, demonstrated strategic composure during this period. His digital asset holding company, Strategy, invested $1 billion to purchase 10,001 Bitcoins on June 16, coinciding with the successful listing of the company's third Bitcoin collateralized preferred stock, STRD, on Nasdaq (trading began on June 11), showcasing institutional capital's confidence in the long-term value of cryptocurrencies.

2024 Israel-Iran Embassy Crisis (Triggered on April 1)

Looking back to April 1, 2024, Israel conducted a precision bombing of the Iranian embassy in Damascus, Syria, resulting in the deaths of several individuals, including senior military commanders. In a strong response, the Iranian Revolutionary Guard seized an Israeli "MSC series" merchant ship on April 13 and launched a large-scale missile retaliation.

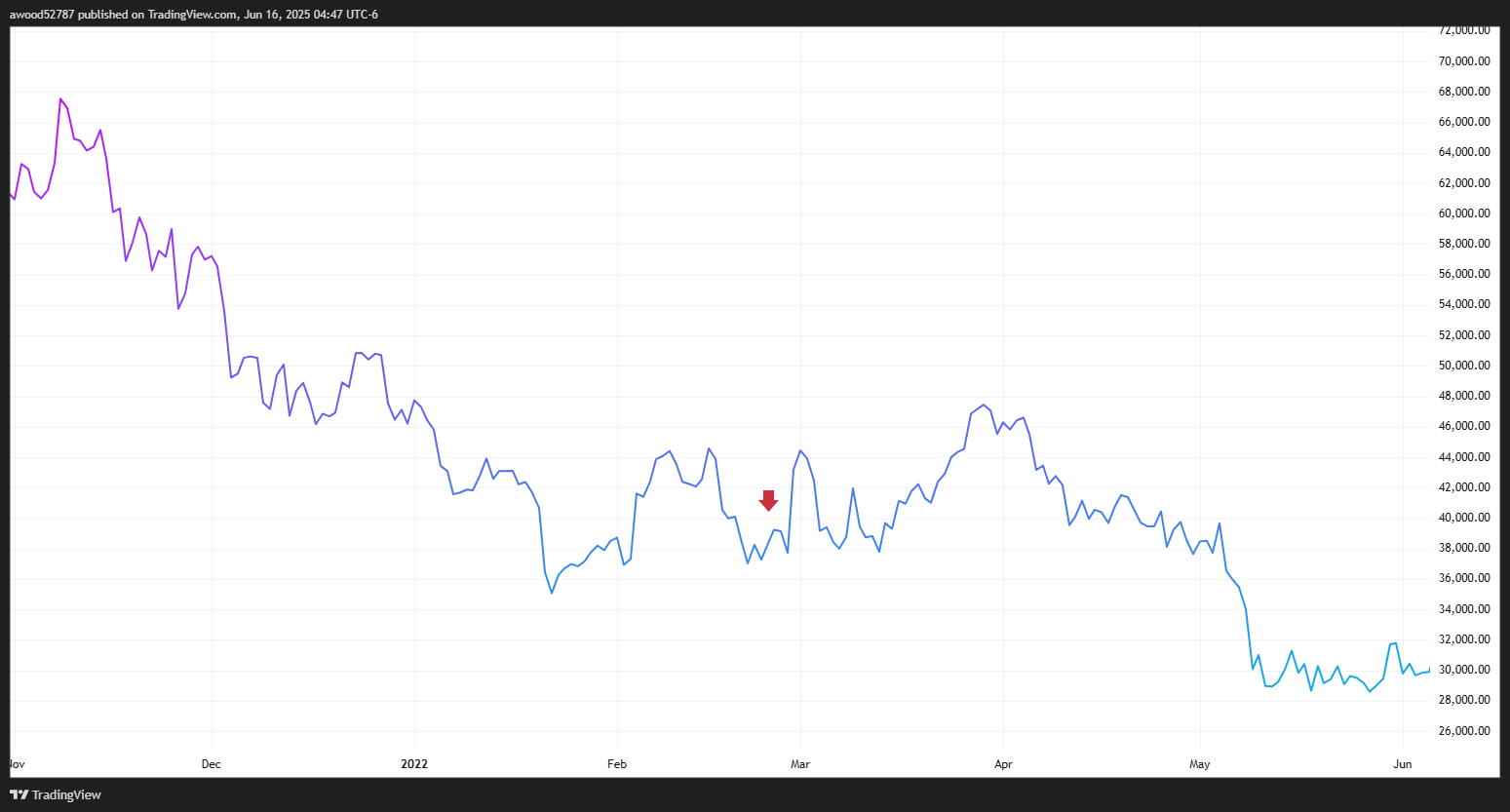

After Israel bombed the Iranian embassy, Bitcoin's price experienced significant fluctuations before recovering. (Red arrow marks the date the conflict began.) Source: TradingView

After Israel bombed the Iranian embassy, Bitcoin's price experienced significant fluctuations before recovering. (Red arrow marks the date the conflict began.) Source: TradingView

Both key events triggered short-term turbulence in the Bitcoin market, especially after the military retaliation began on April 13, when BTC's price fell by more than 8% in a single day. Notably, the market's self-adaptive mechanism quickly kicked in. As the intensity of the conflict stabilized, Bitcoin's price not only regained lost ground but also gradually entered a new upward channel, validating its resilience in responding to sudden crises.

2023 Israel-Palestine Gaza War (Erupted on October 7)

On October 7, 2023, the armed organization Hamas launched an attack on targets within Israel, resulting in over a thousand civilian casualties and igniting a humanitarian crisis in Gaza that continues to this day. In the early stages of the conflict, the Tel Aviv stock market experienced a sharp decline, while military industrial giant Lockheed Martin saw its stock price soar, highlighting a significant divergence in traditional asset performance.

After the outbreak of the Gaza War, Bitcoin's price surged. (Red arrow marks the date the conflict erupted.) Source: TradingView

After the outbreak of the Gaza War, Bitcoin's price surged. (Red arrow marks the date the conflict erupted.) Source: TradingView

Bitcoin's price demonstrated a remarkable independence during this crisis, with its value increasing significantly beyond baseline levels 50 days after the outbreak of conflict. It is noteworthy that allegations of Hamas raising funds through cryptocurrencies triggered regulatory tremors. The U.S. Treasury Department promptly imposed sanctions on cryptocurrency payment institutions in Gaza suspected of being involved, prompting global regulatory bodies to strengthen compliance requirements. However, blockchain forensic authority Elliptic released a special report clarifying: "Existing on-chain evidence does not support the conclusion that Hamas systematically utilizes cryptocurrencies for financing."

2022 Russia's Full-Scale Invasion of Ukraine (February 24)

After eight years of low-intensity conflict in the Donbas region, Russian troops launched a full-scale military operation on February 24, 2022. The shadow of war instantly loomed over global financial markets, severely impacting Eastern European economies. In contrast, the Bitcoin market saw its price rise by 16% within five days of the outbreak of hostilities, sharply contrasting with traditional assets.

After Russia invaded Ukraine, Bitcoin's price surged. (Red arrow marks the date the conflict began.) Source: TradingView

After Russia invaded Ukraine, Bitcoin's price surged. (Red arrow marks the date the conflict began.) Source: TradingView

Field research revealed a unique phenomenon in the core conflict area: significant premium trading occurred on cryptocurrency exchanges within Russia and Ukraine, as the public sought to evade currency controls through digital assets. Even more strikingly, in the first week of the war, the Ukrainian government received over $70 million in cryptocurrency donations (with Ethereum dominating). It is worth noting that Bitcoin's sharp decline at the end of that year was primarily attributed to endogenous market events such as the collapse of the Terra stablecoin system, rather than the ongoing conflict in Ukraine.

Differentiated Performance of Internal Conflicts in Emerging Markets

While cryptocurrencies exhibit safe-haven characteristics in some regional conflicts, their price response to internal armed turmoil in Africa, Asia, and Latin America has been muted. In November 2020, a full-scale civil war erupted in Ethiopia's Tigray region between the federal government and the "Tigray People's Liberation Front," which the Near East Welfare Association referred to as the "world's forgotten war," resulting in hundreds of thousands of deaths and over a million refugees.

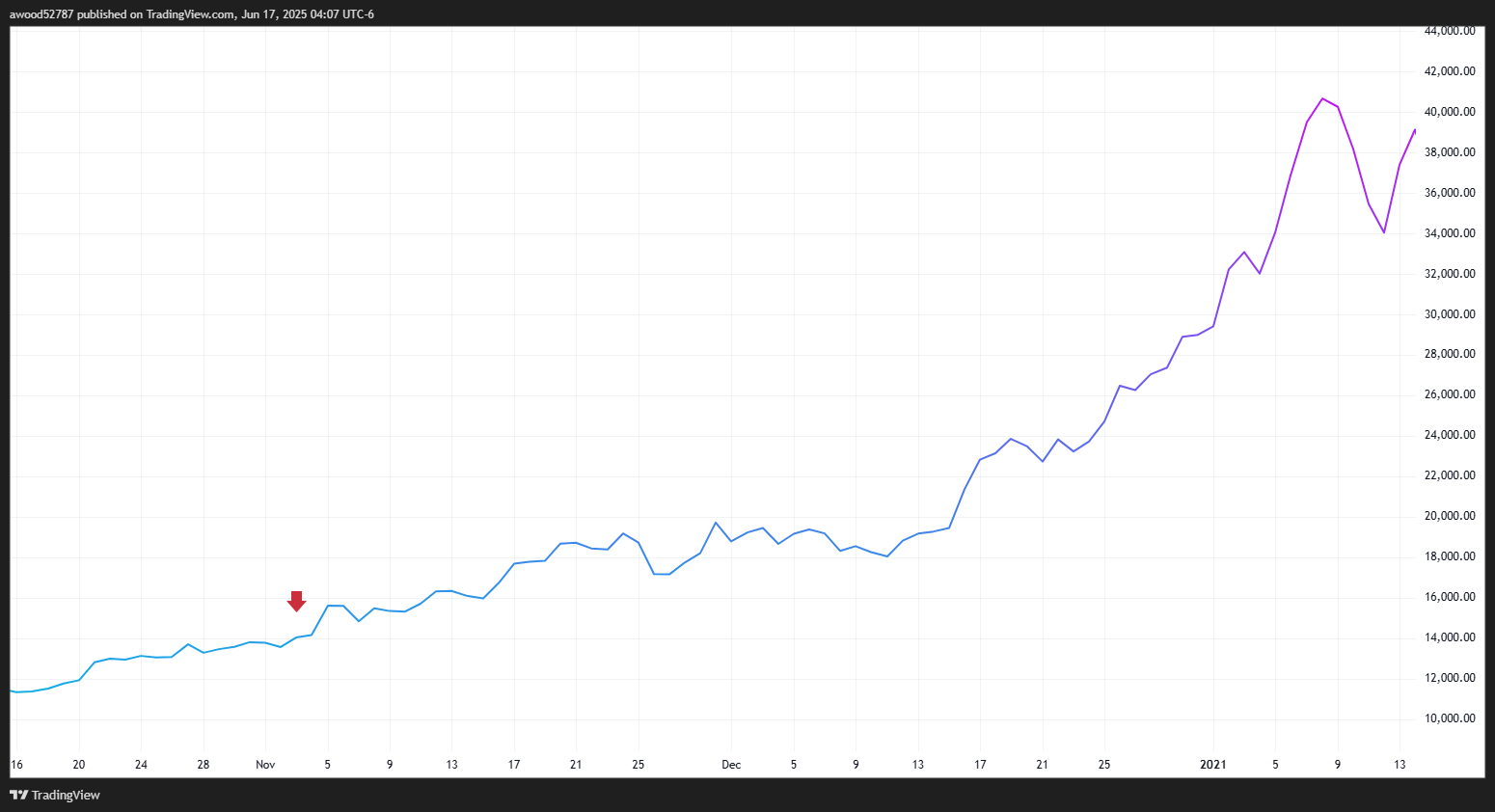

At that time, Bitcoin's price trajectory showed a significant decoupling from the progress of the civil war. The market was dominated by global inflation fears triggered by the COVID-19 pandemic, as well as the asset allocation revolution of publicly traded companies like Block (formerly Square) and Strategy (formerly MicroStrategy). A similar situation occurred during the February 1, 2021 coup in Myanmar, where the military overthrew the democratically elected government, leading to ongoing civil war. A month later, Bitcoin's price reached a historic peak of $69,000, demonstrating its low correlation with marginal geopolitical risks.

Bitcoin's bull market from 2020 to 2021 coincided with the Tigray civil war. (Red arrow marks the date the conflict began.) Source: TradingView

Bitcoin's bull market from 2020 to 2021 coincided with the Tigray civil war. (Red arrow marks the date the conflict began.) Source: TradingView

Structural Changes in the Geographic Proximity Effect of Conflicts

The core variable in analyzing Bitcoin's sensitivity to armed conflicts lies in "market depth correlation." Economists have observed the proximity effect in traditional markets: the closer the geographical location of the conflict to financial centers, the more severe the resulting market fluctuations. Chainalysis' 2024 Global Cryptocurrency Adoption Index reveals a contradictory reality: developing economies (led by India, Nigeria, and Indonesia) dominate in retail adoption rates. This index evaluates the trading volume of centralized service platforms, on-chain retail value transfers, and the activity of DeFi protocols.

At the outbreak of the Myanmar civil war, Bitcoin's price was at a historic high in 2021. Source: TradingView

At the outbreak of the Myanmar civil war, Bitcoin's price was at a historic high in 2021. Source: TradingView

In stark contrast is the fundamental transformation of Bitcoin's holding structure. By the end of 2024, institutional capital held over 1% of the circulating supply through financial products like ETFs (surpassing the scale of Satoshi Nakamoto's wallet), with major holders including ETF issuers like BlackRock, compliant exchanges like Coinbase, and even assets seized by the U.S. government. This qualitative change in holding structure has brought Bitcoin's coupling with the traditional financial system to an unprecedented level.

Bitcoin prices after the outbreak of the Donbas War. Source: CoinMarketCap

Bitcoin prices after the outbreak of the Donbas War. Source: CoinMarketCap

Looking back to the "wild west" of cryptocurrencies: In 2013, Bitcoin experienced its first epic bull market since its inception, with prices skyrocketing from $13 at the beginning of the year to over $1,000 by the end. During the Donbas War (including the annexation of Crimea) and the Gaza conflict in 2014, despite severe fluctuations in regional stock markets, Bitcoin, which was still a niche product at the time, received almost no attention from the mainstream market. At that time, exchanges like Coinbase and Kraken were still in their infancy, miners could use home computer graphics cards for mining, institutional investors were almost entirely absent, and public perception remained at the level of "dark web trading tools."

Bitcoin prices after the outbreak of the Gaza War in 2014. Source: CoinMarketCap

Bitcoin prices after the outbreak of the Gaza War in 2014. Source: CoinMarketCap

Paradigm Shift: Conflict Response Mechanisms in the Era of Institutionalization

The current Bitcoin market has undergone a revolutionary transformation. Three structural changes are reshaping its response patterns to geopolitical conflicts: first, the deep involvement of traditional asset management giants like BlackRock; second, the gradual clarification of the U.S. regulatory framework; and finally, the normalization of globally influential industry summits. In this context, the negative transmission effects generated by armed conflicts through traditional financial markets may strengthen the impact on Bitcoin.

It is worth pondering that most of the conflict cases mentioned earlier occurred before Bitcoin began its institutionalization process, and prices showed rapid recovery after the conflicts. This historical experience validates the rationale behind the early "digital gold" narrative. However, as the correlation coefficient between Bitcoin and traditional risk assets continues to rise, its asset characteristics have effectively shifted towards risk-seeking. Current market analysts hold a cautiously optimistic view, with QCP Capital warning in a market report on June 16 that if Iran's blockade of the Strait of Hormuz leads to a surge in oil prices or if U.S. military intervention occurs, it could trigger a chain reaction of panic selling in global risk assets.

Historical experience indicates Bitcoin's unique resilience in crisis environments, but the real test for the future lies in whether this digital currency, now included in mainstream asset categories, can continue its legendary pressure-resistant gene in an era dominated by institutional investors when traditional financial markets are shaken by war.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。