Maigang not only achieved success with Pop Mart but also changed Bitcoin to some extent.

Written by: Shen Chao TechFlow

Labubu has taken the world by storm, and Pop Mart's market value of HKD 340 billion has made founder Wang Ning the richest person in Henan.

A joke has been brought up again:

Before Pop Mart went public, investors described Wang Ning as: "Mediocre education, never held a proper job, speaks calmly with no charisma, and the team lacks elites." After Pop Mart went public, investors described Wang Ning as: "Wang Ning is calm, speaks little, shows no emotions, and possesses many excellent qualities of a 'consumer entrepreneur.'"

Receiving the same treatment is Pop Mart's angel investor—Maigang.

Before this trendy toy giant rose, Maigang self-deprecatingly referred to himself as an "alternative investor" who was "kicked out of the mainstream capital circle's group chat"; however, when Pop Mart's market value soared, he was invited onto the "altar," transforming into a legendary figure in the investment world.

However, Maigang's legend extends far beyond the trendy toy sector.

Little known is that Xu Mingxing, the founder of the global leading crypto trading platform OKX, is also an investor in Pop Mart, reaping thousands of times in returns, all thanks to Maigang.

Maigang was also Xu Mingxing's mentor, having invested in his earliest entrepreneurial project, Dou Ding Wang, and later co-founding OKCoin.

Moreover, Maigang was also the crypto guide for He Yi, co-founder of Binance.

In 2014, at a private gathering organized by Maigang, he introduced He Yi, who was then a TV host, to Xu Mingxing, facilitating He Yi's entry into OKCoin. Subsequently, He Yi recommended Zhao Changpeng (CZ), the current founder of Binance, to join the team, thus opening the curtain on the global crypto exchange rivalry.

His investment landscape spans two seemingly unrelated fields, yet in each sector, it has nurtured giant enterprises that have changed the industry landscape. It can be said that Maigang not only achieved success with Pop Mart but also changed Bitcoin to some extent.

Early Bitcoin Evangelist

"In 2013, I was kicked out of two mainstream VC WeChat groups for discussing Bitcoin. The members of the groups were all well-educated individuals, and I thought my teaching method was professional, but some still believed I was selling something. At that time, I felt very lost; after all, as social animals, everyone hopes to gain recognition.

This was the first time I felt 'abandoned' by the VC circle, and it made me realize the existence of mainstream and non-mainstream circles, as well as individual cognitive differences."

In 2021, Maigang expressed this during an interview with "Family Office New Intelligence."

By 2025, an article titled "Maigang: The Years I Was 'Abandoned' by the VC Circle" went viral again on social media.

At this moment, Pop Mart's market value exceeded HKD 340 billion, rising more than 20,000 times from Maigang's angel investment valuation (RMB 10 million).

At this moment, Bitcoin's price surpassed USD 100,000, increasing more than 5,000 times from the price of USD 20 at the beginning of 2013.

Maigang never shies away from his identity—he is one of the earliest evangelists in China's investment community to invest in and promote Bitcoin knowledge.

In 2013, when most people were unaware of Bitcoin or still viewed it as a financial bubble, he tirelessly promoted Bitcoin knowledge and his understanding across the country.

OG of the crypto industry, Shen Tu Qingchun recalls, he met the famous angel investor Maigang in July 2013 and casually talked about Bitcoin.

"Maigang studied finance, and his views on Bitcoin were very accurate and ahead of their time. For example, he mentioned that national reserve currency is what he said back then, and it has now become a reality. I must say, Maigang is a powerful Bitcoin evangelist; he greatly reinforced my idea of working in Bitcoin. He said he invested in OKCoin and introduced me to Xu Mingxing. I immediately withdrew all my funds from the stock market and bought 800 Bitcoins from OKCoin at the price of USD 90."

In Maigang's view, Bitcoin can be explained in two sentences: "First, Bitcoin is a perfect currency property simulated by mathematicians, geeks, and network scientists using a distributed algorithm; second, this property is maintained by the computing power of powerful distributed computers."

He categorizes the forms of currency in human society into three types: the first is the currency system represented by precious metals like gold, the second is credit currency supported by government credit. The emergence of Bitcoin has ushered humanity into the third currency era. He emphasizes that these three forms of currency will coexist for a long time, just as the internet did not completely replace fax machines and telephones.

Regarding Bitcoin, Maigang made a prediction in 2014: "Bitcoin will become a tool for major power competition."

"I am not an anarchist, nor do I advocate that we use Bitcoin instead of RMB today. But I can tell everyone that in the future, in as short as 10 years and as long as 30 years, the United States will reconstruct a global currency system, and in this global currency system, the U.S. will likely link the dollar to a new series of assets, including virtual currencies represented by Bitcoin. To achieve this, the U.S. only needs to do one thing: gain a voice in the Bitcoin field, which could be in terms of computing power, reserves, or pricing power. Why does the U.S. have an advantage in doing this? Because the U.S. has Wall Street, which is the elite of the elite globally."

Such expressions may not seem unfamiliar now, but note that this statement came from Maigang's speech in 2014, where he actively promoted Bitcoin, hoping that Chinese entrepreneurs, Chinese companies, and ordinary Chinese people could gain a voice in the Bitcoin field.

"I hope everyone, including government agencies, should realize the greatness and complexity of the Bitcoin game, which truly concerns our descendants. Americans used the power of the dollar in the last century to gain the right to mint dollars, making the whole world work for them. If Americans gain the voice in Bitcoin over the next few decades, they will continue to make the whole world work for them."

Perhaps it is this understanding that led Maigang to choose to invest and incubate at the beginning of OKCoin's establishment in 2013.

Xu Mingxing and Maigang had known each other since 2011, when Xu Mingxing was the CTO of Dou Ding Wang, and Maigang was the angel investor of Dou Ding Wang.

Maigang and his partner, Tim Draper, founder of the American DFJ, jointly acted as Xu Mingxing's angel investors, investing RMB 5 million. Tim Draper is a well-known American investor who invested early in Baidu, Tesla, and others.

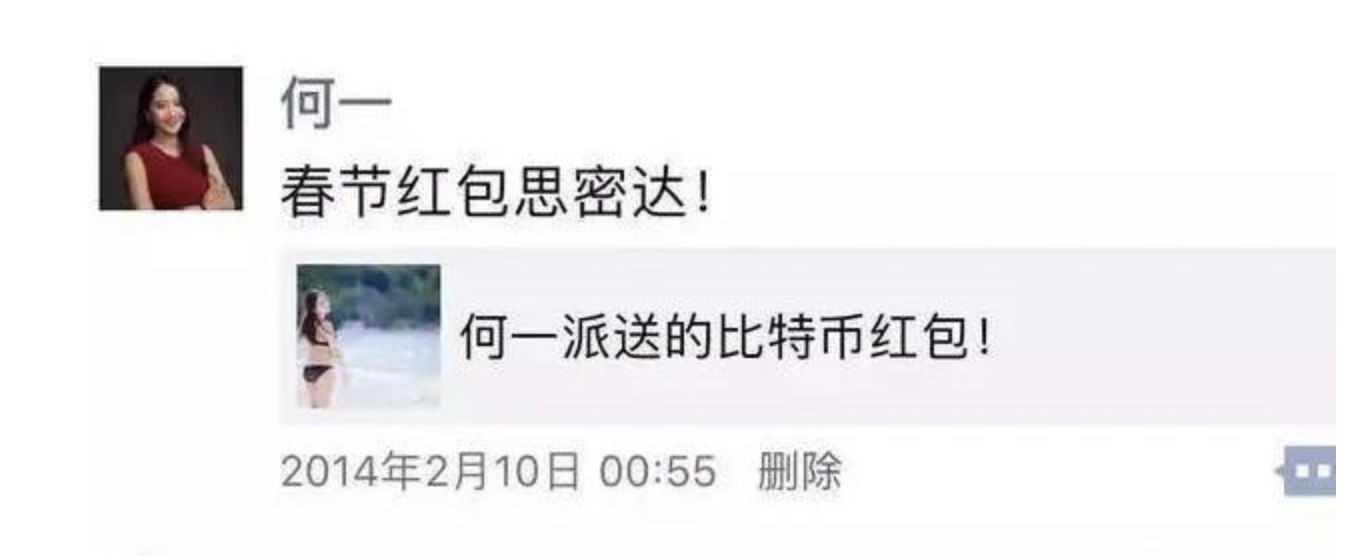

During the Spring Festival of 2014, Maigang approached He Yi, who was still a TV host at the time, and asked her to post a Bitcoin red envelope for OKCoin on her social media. He Yi gladly agreed.

From that moment, the wheels of fate began to turn, which not only opened the door to the Bitcoin world for He Yi but also changed the history of the crypto world.

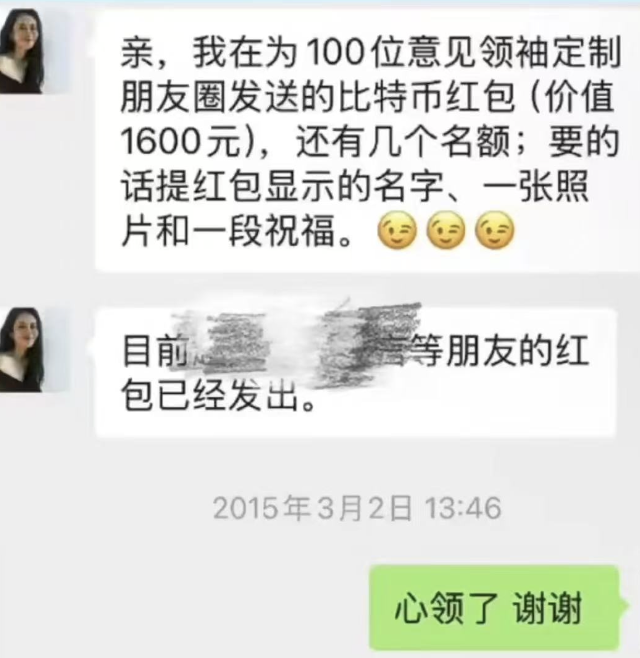

After the Spring Festival, Maigang organized a "thank you gathering" with OKCoin founder Xu Mingxing, inviting everyone who helped send red envelopes to the party, where He Yi and Xu Mingxing met.

Xu Mingxing came from a technical background, while He Yi excelled in marketing. At the gathering, Maigang suddenly said, "Hey, Mingxing, isn't your company looking for someone for marketing? This is perfect!"

The week after the gathering, He Yi joined OKCoin as Vice President, responsible for brand building and market promotion. He Yi utilized her previous media resources to promote OKCoin on the show "Non-You Can't Be Boss," and planned for OKCoin to appear in Times Square, New York. The common method of attracting KOLs for promotion is also a marketing strategy that He Yi used ten years ago.

In addition, He Yi also recruited Zhao Changpeng, who had worked at the Tokyo Stock Exchange, to join OKCoin as CTO.

Maigang's seemingly casual introductions and connections ultimately rewrote the competitive landscape of the entire cryptocurrency exchange.

Afterward, Zhao Changpeng left OKCoin to establish Binance, and He Yi soon joined, together building Binance into the world's largest cryptocurrency exchange, while OKCoin became the current leading trading platform, OKX.

Pop Mart's First Investor

In June 2020, six months before Pop Mart's listing on the Hong Kong Stock Exchange, Maigang published an article on the Entrepreneurship Factory WeChat account titled "The Story of Pop Mart: From 10 Million to 100 Billion," where 10 million was the valuation when Maigang made his angel investment in Pop Mart, and 100 billion was Maigang's expectation for Pop Mart at that time.

"100 billion is both a number and a goal. I believe that the team led by Wang Ning has the opportunity to challenge this goal and become an international company."

As a result, on the day of Pop Mart's listing, it surpassed a market value of 100 billion, and now, five years after going public, Pop Mart's market value has exceeded 300 billion, firmly ranking among the star enterprises of the Hong Kong Stock Exchange.

Looking back to 2012, Pop Mart was just a small company residing in a shabby house in Beijing. In May of that year, founder Wang Ning sent an email to Maigang, which lay quietly in the recipient's inbox for three months before being discovered.

This accidental discovery led to a precious investment opportunity.

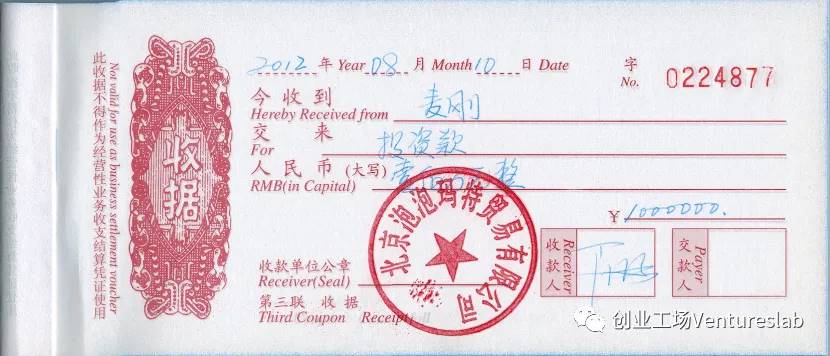

In August 2012, 25-year-old Wang Ning met Maigang for the first time. The young Wang Ning was wearing a pair of trendy shorts that had not yet been launched in China, a detail that made Maigang keenly aware of his unique sense of fashion. From the first meeting to signing the investment agreement, the entire process took only five days.

On August 10, 2012, Maigang made the first investment payment, totaling 2 million yuan, becoming Pop Mart's first angel investor.

According to 36kr reports, after signing the investment agreement, the two went to a bar in Wudaokou, and amidst the noise, the always "calm" Wang Ning suddenly raised his voice a bit: "Brother Maigang, you invested in me today; if I were Jay Chou, you would be Wu Zongxian."

Later, when discussing the reasons for the investment, Maigang stated that what truly moved him was the qualities exhibited by Wang Ning: "Composed, calm, clean, and not deceptive."

At a time when most investors and entrepreneurs were focused on e-commerce, believing that the offline retail environment was counter-trend, Maigang and Wang Ning firmly believed that there were still huge opportunities in the offline retail market, especially for trendy products that are well-designed and emotionally resonant.

For Wang Ning, this investment was of extraordinary significance. After receiving the investment, he immediately called his father: "Dad, from today on, your child is a millionaire because the shares I hold are worth 10 million."

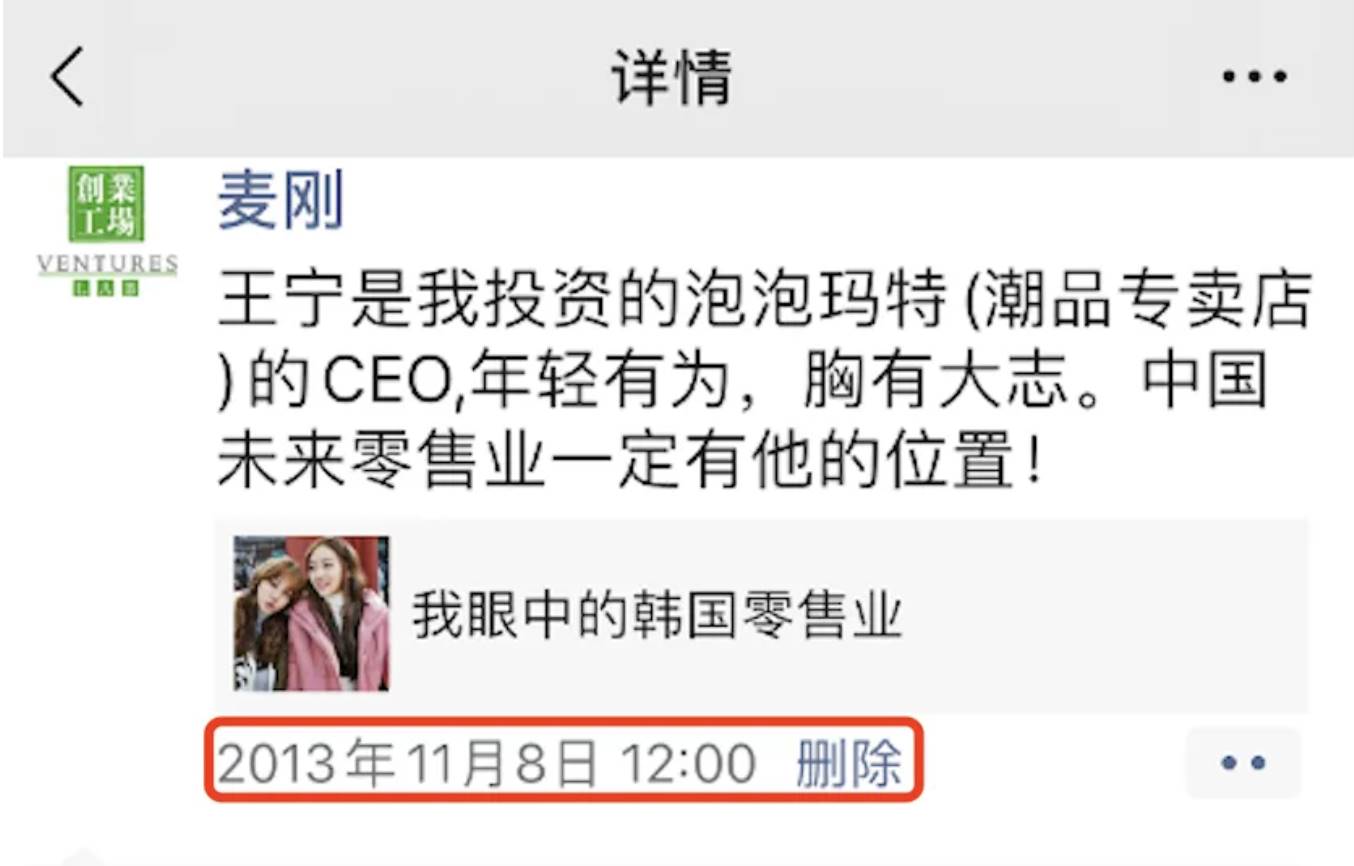

As an investor who is quite stingy with praise, Maigang gave a high evaluation of Wang Ning a year after his investment, stating, "Young and promising, with great ambitions, there is definitely a place for him in China's future retail industry."

However, apart from Maigang, there were not many people in the capital market who truly believed in Wang Ning and Pop Mart.

Wang Ning met with nearly all investors and financial advisors, visiting not only financial institutions but also industrial capital like Light Media and Aofei, yet each time he left with high hopes only to return disappointed.

A typical example is the fund under Hunan TV, which, after a long due diligence process, still did not invest. During their last meeting, they even told Wang Ning: "How could such a once-in-a-lifetime opportunity fall to you?"

The continuous setbacks in financing also led Pop Mart to be in a long-term state of financial strain, with the company once having less than 1 million yuan left in its account, making it difficult to even pay salaries.

"The financing information circulating online is inaccurate; many figures are from share transfers among shareholders after the company developed smoothly, not actual financing. The total amount of funds raised from external sources during Pop Mart's development was actually very small. In the early stages of Pop Mart's development, financing was very difficult. Basically, most well-known investment institutions had looked at this case, and I don't know why they didn't invest."

Maigang later recalled that he could empathize with the inner turmoil Wang Ning experienced during the financing setbacks, but even in difficult times, he could still feel Wang Ning's inner confidence and belief in the company's value.

On the night of Pop Mart's listing in 2020, an article by 36Kr titled "Behind Pop Mart's Market Value Exceeding 100 Billion: A Collective Misstep of China's Large Funds" went viral in the venture capital circle, serving as a release of emotions and an expression of attitude.

This scene resembled an inspirational plot from a fantasy novel—the protagonist, once regarded as a "loser," ultimately astonished everyone, making all those who once looked down on him feel ashamed.

In Maigang's view, Wang Ning's multiple financing setbacks may have been a crucial tempering process in Pop Mart's development; without this tempering, Pop Mart might not have reached its current stage.

"First, because of the lack of financing, Pop Mart was very cautious with every penny spent; second, the company was always looking for breakthroughs, forcing the founder to constantly think."

Maigang has always been someone who opposes the trend-chasing mentality; he believes that because Pop Mart did not receive large-scale financing, it had minimal media exposure and never became a trendy company, but instead became a myth that created trends (pioneering the industry).

About Maigang

At this point, you may be even more curious about what kind of person Maigang is, and how this "outlier" in the eyes of mainstream VCs managed to achieve such significant results with Pop Mart, Bitcoin, and OKCoin.

In 1996, after graduating from Renmin University of China, Maigang entered the venture capital industry, becoming one of the earliest practitioners of venture capital in China.

In 2001, he went to the University of California, Los Angeles (UCLA) to pursue an MBA, during which he won first place in the California University Entrepreneurship Competition and fifth place in the National College Entrepreneurship Competition. While in the U.S., he met his "Wu Zongxian," the godfather of Silicon Valley venture capital, Tim Draper, thus entering the venture capital circle in Silicon Valley.

"Tim Draper is my mentor, my former boss, and my earliest angel investor. I am very grateful to him for nurturing me and investing in my company back then."

In 2005, he co-founded VenturesLab with Tim Draper, one of the earliest entrepreneurial incubators in China.

Unlike mainstream VCs, Maigang chose an "alternative" investment path.

He has never raised funds externally and has always insisted on using his own capital for investments. In his view, the current venture capital industry suffers from a "scale curse"—many large funds adopt a "spraying money" model to improve investment hit rates, which often reduces LP returns. The best operational model in the venture capital industry is a small team "workshop" approach—led by one leader with three to five elite members, deeply cultivating and striving for three to five successful projects out of twenty.

He holds a cautious attitude towards trends. He believes that entrepreneurs and investors should focus more on the essence of opportunities rather than blindly chasing them. He has summarized three verification "formulas" to judge projects:

What problem does your company solve?

Who are your competitors?

Why will you win?

Based on his rich entrepreneurial and investment experience, Maigang categorized internet entrepreneurship and proposed the famous "Mouse and Cement Theory."

The first type is the "Mouse Model," which is a pure internet model, represented by early search engines, community websites, etc., characterized by entrepreneurs being able to conduct business primarily through computers;

The second type is the "Mouse Plus Cement Model," such as 58.com and Qunar, where these companies acquire traffic through the internet and then convert that traffic into commercial value in traditional industries;

The third type is the "Cement Plus Mouse Model," with typical representatives like Xiaomi and Huang Taiji, where these companies are essentially traditional industries but fully utilize the characteristics of the internet for innovation.

You might think that Maigang, who became a VC right after graduating from university, is more of a theorist lacking entrepreneurial experience, but he has another identity—a serial entrepreneur.

In 1999, during the Pudong Science and Technology Innovation period, Maigang invested in Yide Fangzhou, which won first place in that year's China College Student Entrepreneurship Competition. It was this project that allowed Maigang to build many connections and embark on a journey of continuous entrepreneurship with numerous entrepreneurs.

In 2003, Maigang co-founded Yiyou with one of the founders of Yide Fangzhou, Jack Ma, and served as CEO. The company received angel investments from Silicon Valley mogul Tim Draper and the chairman of Japan's KDDI, and was later acquired by the French listed company Meetic.

In 2005, Maigang made an angel investment in Chinese Online, founded by one of the founders of Yide Fangzhou, Tong Zhilei, which successfully went public on the A-share Growth Enterprise Market in January 2015.

In 2006, Maigang co-founded Tongka, which later became China's largest O2O customer relationship software company, with one of the founders of Yide Fangzhou, Lu Jun, and it was later acquired by Tencent. In 2007, Maigang also co-founded Dou Ding Wang, once the world's largest Chinese document sharing website, with Jonathan Lin, who had interned at Yiyou.

In 2010, he co-founded the largest smart TV content aggregation service provider in China, Taijie, with another founder of Tongka, Deng Yu.

In 2013, he co-invested with Dou Ding Wang's CTO Xu Mingxing to establish the Bitcoin trading platform—OKCoin.

This seemingly magical entrepreneurial experience actually has a clear thread behind it: "Treat others well and build good relationships."

"Life is a continuation of the entire relationship you have with your friends around you, so treat friends well and treat others well to achieve yourself. Of course, you need to recognize people; associating with bad people harms yourself. I believe that whether in entrepreneurship or investment, in the end, you will find that what you get back is actually your character, or the amplification effect of your character," Maigang once said.

However, what moves me the most is a detail.

Twenty years ago, when Maigang founded VenturesLab, he designed the logo himself, built the website, and wrote this passage on the company's official website: "Perhaps your lifelong goal is to start a successful business, but ultimately what is left on your tombstone is 'a kind father (mother),' 'the partner you loved most in life,' 'a generous friend,' rather than 'great CEO.' You will find that what cannot be taken away is fame and wealth; what remains is emotion and memory."

Today, this passage still remains on the homepage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。