The stablecoin issuer gained significant momentum following the Senate’s passage of the GENIUS Act. Approved on June 17, 2025, with bipartisan support in a 68-30 vote, the bill establishes the first federal regulatory framework tailored to stablecoins.

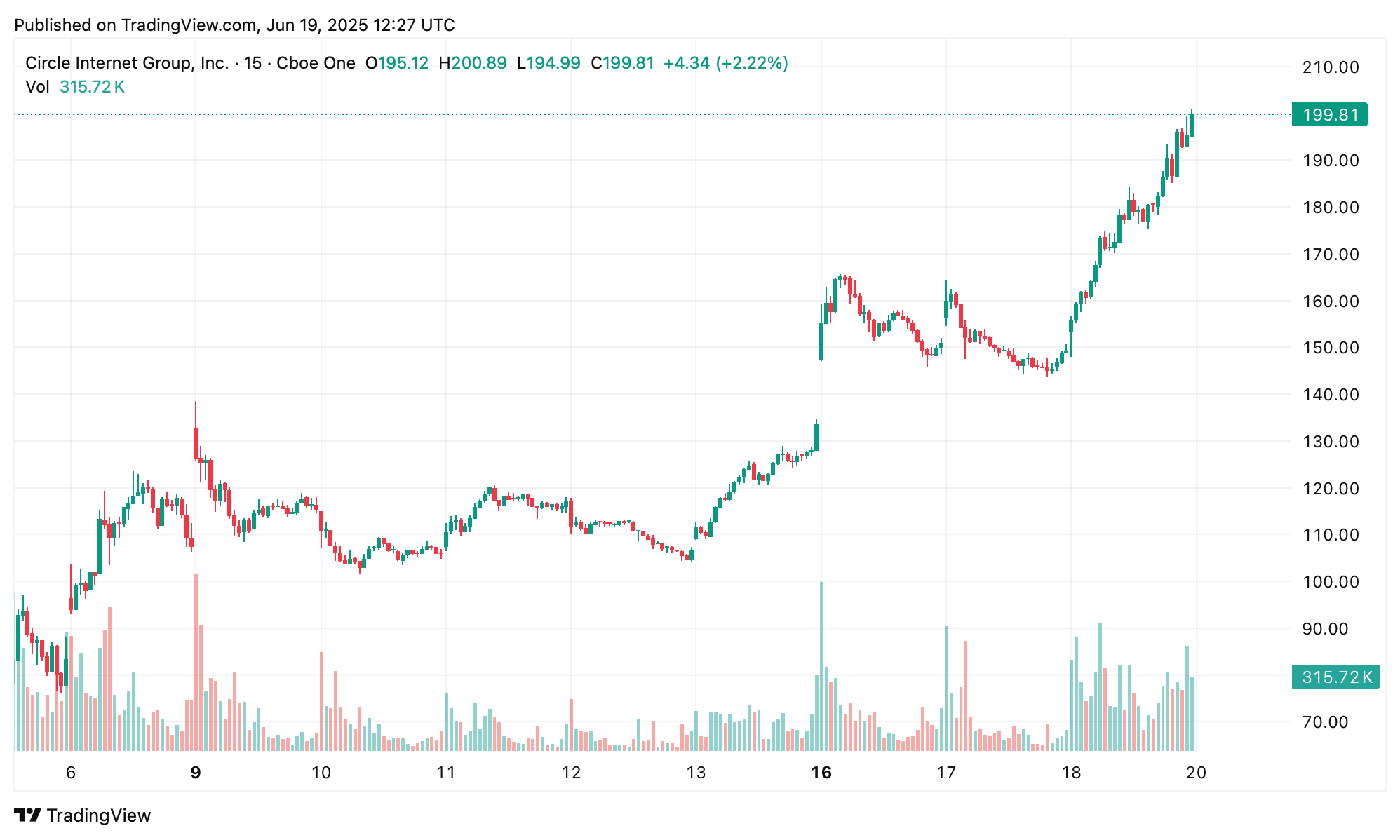

On that same day, Circle’s shares—traded under the ticker CRCL—rose from $145 to $199.59, the price logged just before Wall Street opened on Thursday, June 19. From June 17 onward, CRCL has increased in value by 37.65%.

Circle shares one hour prior to Wall Street’s opening on June 19, 2025, at 8:30 a.m. Eastern time.

When the company entered the public markets, its shares were priced at $31, meaning CRCL has now grown 543.8% from its initial valuation. Circle currently holds a market capitalization of approximately $43.90 billion.

It is also the second largest stablecoin issuer after Tether. As of now, USDC maintains a $61.19 billion market cap, with its supply expanding by 1.96%, or 1.176 billion USDC, over the past 30 days.

Circle’s dramatic equity climb appears to signal more than fleeting investor interest—it suggests deepening confidence in the integration of stablecoins within the traditional financial (TradFi) framework.

With the GENIUS Act providing regulatory clarity, Circle’s current trajectory hints that institutional capital may finally have the conditions needed to engage. As U.S. policy continues to develop, CRCL may serve as a leading indicator of how stablecoins are being positioned within mainstream financial systems.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。