The U Card exit is a historical mission that should have ended. The real business opportunity lies in the next game from Crypto to TradFi.

Written by: Web3 Farmer Frank

On June 17, Infini suddenly announced the complete shutdown of all Card services.

As a star project in the current U Card craze, even after recently facing an operational crisis with approximately $50 million in funds stolen, Infini did not shut down its services but chose to exit proactively now. The explanation given by Infini co-founder @0xsexybanana is quite representative:

"Compliance costs are extremely high, profits are thin, and operations are heavy… We made a strategic adjustment and removed the to C card part of the business."

This reflects the true state of this business—heavy compliance investment, minimal profit returns, and high risk. After all, since last year, the PayFi narrative has been highly promoted, especially in the first half of this year, with a surge of U Card projects launching, creating a heated atmosphere until Infini's sudden exit.

Source: @0xsexybanana

This inevitably raises the question: Is the U Card really a good business?

"U Card" has never been a good business

To discuss the issues surrounding U Cards, the first basic premise to clarify is that the current market skepticism is not about "using cryptocurrency for consumption," but rather about the feasibility of the highly traditional financial intermediary-dependent operational model behind the "U Card."

In simple terms, since the term "U Card" has been widely accepted, it has essentially referred to a specific business operational model:

From the early Dupay to the later OneKey Card and Infini, they are essentially forms of overseas prepaid consumption cards, authorized through partnerships between Web3 projects and financial institutions with card organizations (such as Mastercard, Visa), packaged into "off-chain consumption solutions" that crypto users can utilize.

Functionally, this model alleviates the challenge for Web3 users of "spending Crypto directly" by aggregating third-party intermediaries to facilitate consumption, converting stablecoins into fiat currencies like USD and loading them onto prepaid cards. It is indeed a convenient solution in the Off-Ramp scenario and can be seen as a transitional product that integrates Crypto with existing card payments during a specific historical phase.

However, commercially, it is an extremely fragile business because the lifeblood of the entire "U Card" operational model is its extreme dependence on the permissions and stability of third-party institutions.

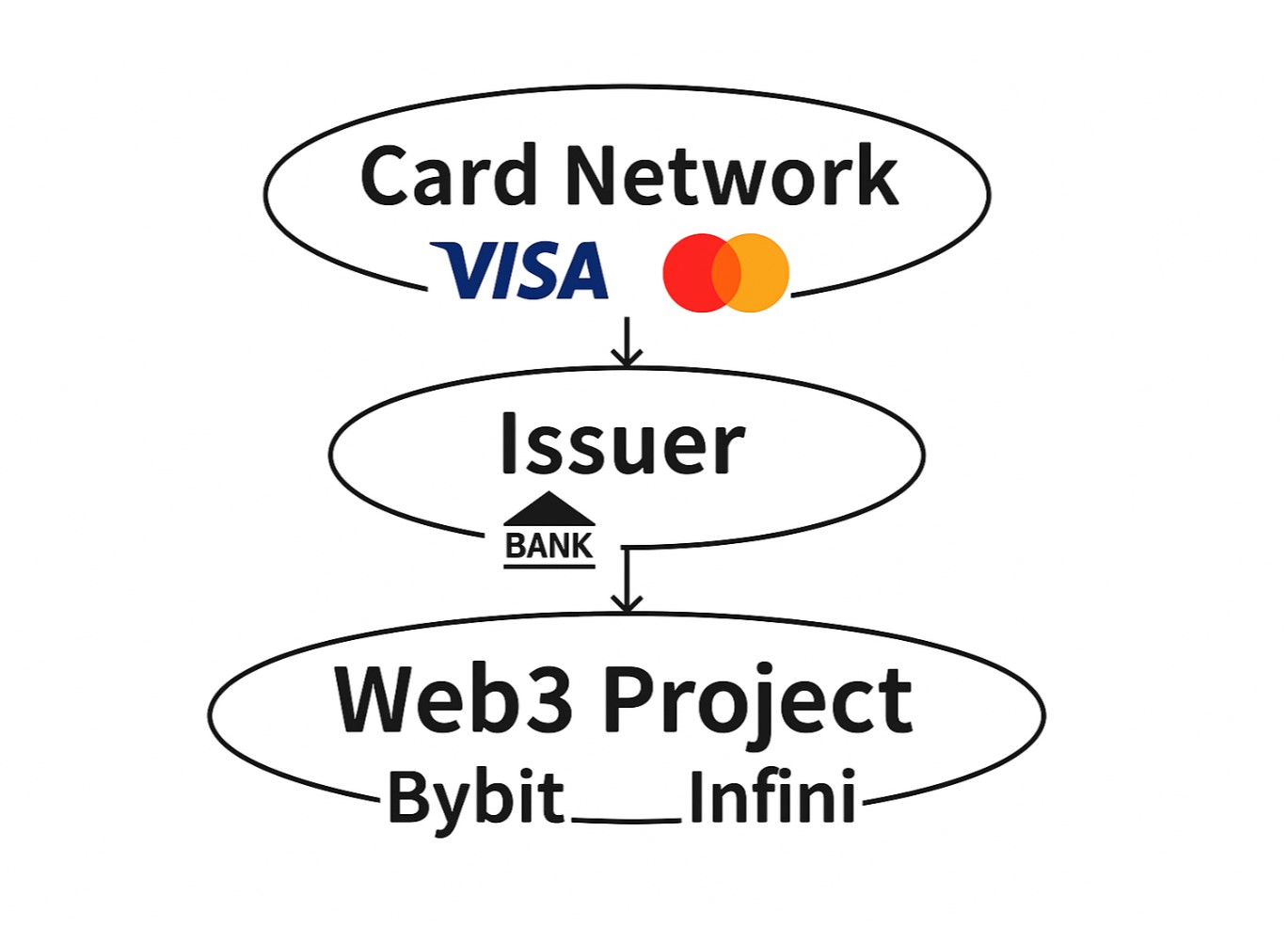

Taking the common U Card issuance logic in the market as an example, they are typically issued through collaborations between Web3 projects and traditional financial institutions (such as banks), presenting a three-tier structure of "Card Organization - Issuing Institution - Web3 Project":

Card Organization Layer (e.g., Visa, Mastercard): Holds the core card number (BIN) resources and access to the clearing system;

Primary Issuer (e.g., DCS, Fiat24, etc., licensed financial institutions): Responsible for compliance, regulatory liaison, fund custody, and risk control execution;

Web3 Project (e.g., Infini, Bybit): Responsible for front-end product packaging, user traffic, and promotional operations, but essentially just a "secondary operator" renting the license;

This three-tier structure appears to have clear divisions of labor, but the project parties are actually at the end of the ecological chain with the least authority, the greatest responsibility, and the highest risk, lacking bargaining power against card organizations and issuers. Once the source of user funds is questioned, or sensitive behaviors such as money laundering or fraud occur, even without clear violations, issuing banks or card organizations may cut cards or freeze accounts based on the "risk prudence principle."

A more realistic issue is that the U Card business inherently faces a high-risk scenario of being abused by fraud gangs, and project parties do not have "transaction fees" or other intrinsic cash flow businesses as a buffer, but instead have to directly bear potential losses and regulatory obligations from C-end users.

In this type of model, once an incident occurs at the regulatory level, card organizations and upstream banks typically shift all AML (anti-money laundering) fines to the project parties, resulting in light penalties such as the deduction of deposits, or severe consequences like direct termination of cooperation—while intermediary service providers and payment channel providers only collect service fees and tolls, never bearing substantial risks. This explains why many U Card projects cannot last more than a year and a half.

Thus, Infini's founder's statement about "99% of time and cost investment yielding 0 income" is not an exaggeration; in this chain, the bulk is indeed consumed by issuing institutions, while project parties merely struggle with minimal profits. Real profitability requires establishing a massive transaction flow + asset accumulation + high-frequency consumption scenarios, but at the same time, compliance and operational costs will grow exponentially with business expansion.

Moreover, this judgment itself implies a premise—that project parties are always at the end of the supply chain, limited by their positioning as "secondary operators," unable to intervene upstream. This also indicates that the difficulties faced by U Cards like Infini are not an industry fate but rather a matter of path selection:

Projects that truly want to break through the profitability bottleneck need to move upstream, into account systems, and into compliance layers, rather than relying solely on second-hand or even third-hand capabilities provided by BIN sponsors like Interlace.

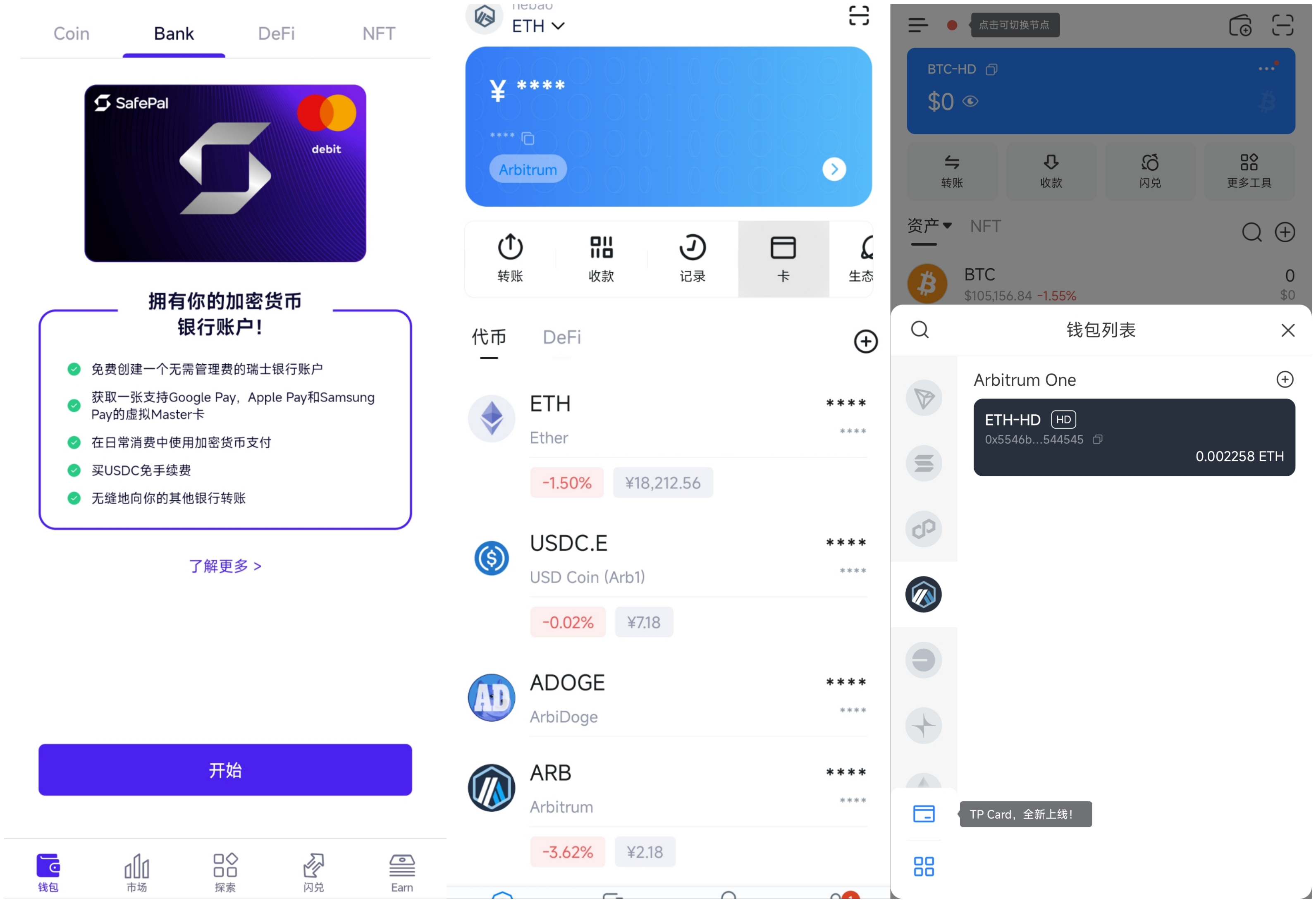

In fact, the projects currently still providing similar services are no longer pure U Card products that do "on-chain traffic + off-chain stitching." For example, SafePal, imToken, and TokenPocket are all based on the Swiss bank Fiat24, which can be said to have the same origin, differing only in integration paths and entry strategies:

SafePal combines personal bank accounts + co-branded Mastercard services, placing Bank services at the primary entry level;

imToken, as a partner of Fiat24, primarily focuses on Mastercard services, with bank account services hidden compared to SafePal, but also places "cards" at the primary entry;

TokenPocket is even more subtle, with service entry buried in a secondary entry, also primarily focusing on Mastercard services, and the Android version must be downloaded from Google Play to activate;

From left to right: SafePal "Bank" page, imToken Card entry, TP Card entry

Especially for SafePal, which directly enters the issuing and account levels through strategic investment in Fiat24, it is no longer a "secondary dealer" at the end of the chain, fundamentally reducing friction and costs in the intermediate links, allowing this advantage to be passed on to users with benefits such as no account opening fees and 0 deposit/withdrawal fees.

However, for wallets/exchanges, U Card services are not their main business but rather an added value to Web3 custodial/non-custodial services—they can drive traffic, enhance user loyalty, and increase subsequent AUM, making it acceptable to not make money or even incur losses in the short term.

Thus, as an added value to enhance user loyalty and asset service stickiness, the main players are almost all wallets and exchanges, with SafePal, imToken, TokenPocket, and Bitget Wallet representing the former, while Bybit, Bitget, and other leading exchanges comprise the latter.

As previously mentioned in "The Chaotic Era of Crypto Payment Cards: A Business That Is Hard to Sustain?," Web3 wallets inherently possess the capability for crypto asset management, making them ideal carriers for PayFi services, while also being able to build a longer-term odds structure from the perspectives of traffic, AUM, and user binding, and exchanges are similarly positioned.

Ultimately, in such a highly regulated, tightly compliant, and low-profit financial application scenario, if one merely relies on assembling groups and subsidies to try to push forward, for Web3 startup teams without a primary traffic base and lacking foundational financial understanding, it is akin to a bone that is extremely difficult to chew, which is also the fundamental reason why Infini ultimately chose to abandon consumer U Cards and focus on wealth management and B-end services.

From Crypto to TradFi, it is a good business

Is the U Card itself completely worthless?

Not at all.

As mentioned earlier, the U Card did indeed fulfill a phased mission at its historical inception: helping global crypto users achieve rapid on-chain asset consumption, bypassing cumbersome fiat withdrawal processes, and allowing Crypto assets to enter the real world through the form of prepaid cards.

As an early Off-Ramp shortcut connecting crypto users' on-chain assets with daily consumption, even though the U Card heavily relies on traditional financial infrastructures like Visa and Mastercard, it is not an easy business to profit from, but the user demand it meets is genuinely present.

If we draw an analogy, it is more like the telephone ordering service before the popularization of Meituan and Ele.me; it indeed represents progress in user experience but remains a stitched product under the old system, lacking sufficient scalability and structural stability, ultimately destined to be replaced by better solutions.

Interestingly, just around the time Infini announced its shutdown, in the early hours of June 18, Beijing time, the U.S. Senate passed the "GENIUS Act," hailed as a legislative milestone for crypto payments, with 68 votes in favor and 30 against. This bill is likely to complete House review and be officially signed into effect during Trump's term.

Source: Politico

This means that stablecoins and stablecoin payments are entering a more compliant and institutionalized restructuring cycle, marking the end of the wild era, and a new window of opportunity for PayFi is opening.

Therefore, the real question is, what kind of financial entry and exit do crypto users truly need?

The answer may not be a U Card, but rather a compliant, stable, and extensible financial account system—one that not only allows users to "spend" U but also achieves true closed-loop asset flow through "on-chain–off-chain" bidirectional circulation.

In other words, the U Card is destined to be replaced by licensed banks with regulatory qualifications and risk control capabilities, as traditional financial institutions will more actively embed themselves into Web3 payment paths and usage scenarios, ensuring compliance while connecting user wallets, merchant collections, and asset inflows and outflows through bank accounts, payment channels, and clearing systems.

This is also the path currently taken by mainstream wallets like SafePal, imToken, and TokenPocket, which no longer focus on cards as the core selling point but instead collaborate with licensed banks like Fiat24 to facilitate account compliance and inflows/outflows, bridging Crypto to TradFi financial entry and exit, with card services merely serving as supporting tools.

As a Principal Member of MasterCard, Fiat24 can bypass intermediary service providers and connect directly with central banks (European Central Bank) and card organizations, allowing for lower card issuance costs and transaction fees. Its Swiss FINMA financial intermediary license also permits users to open regulated bank accounts under the same name, enabling compliant conversions between stablecoins and fiat currencies, which is a clear upstream advantage compared to players like Infini.

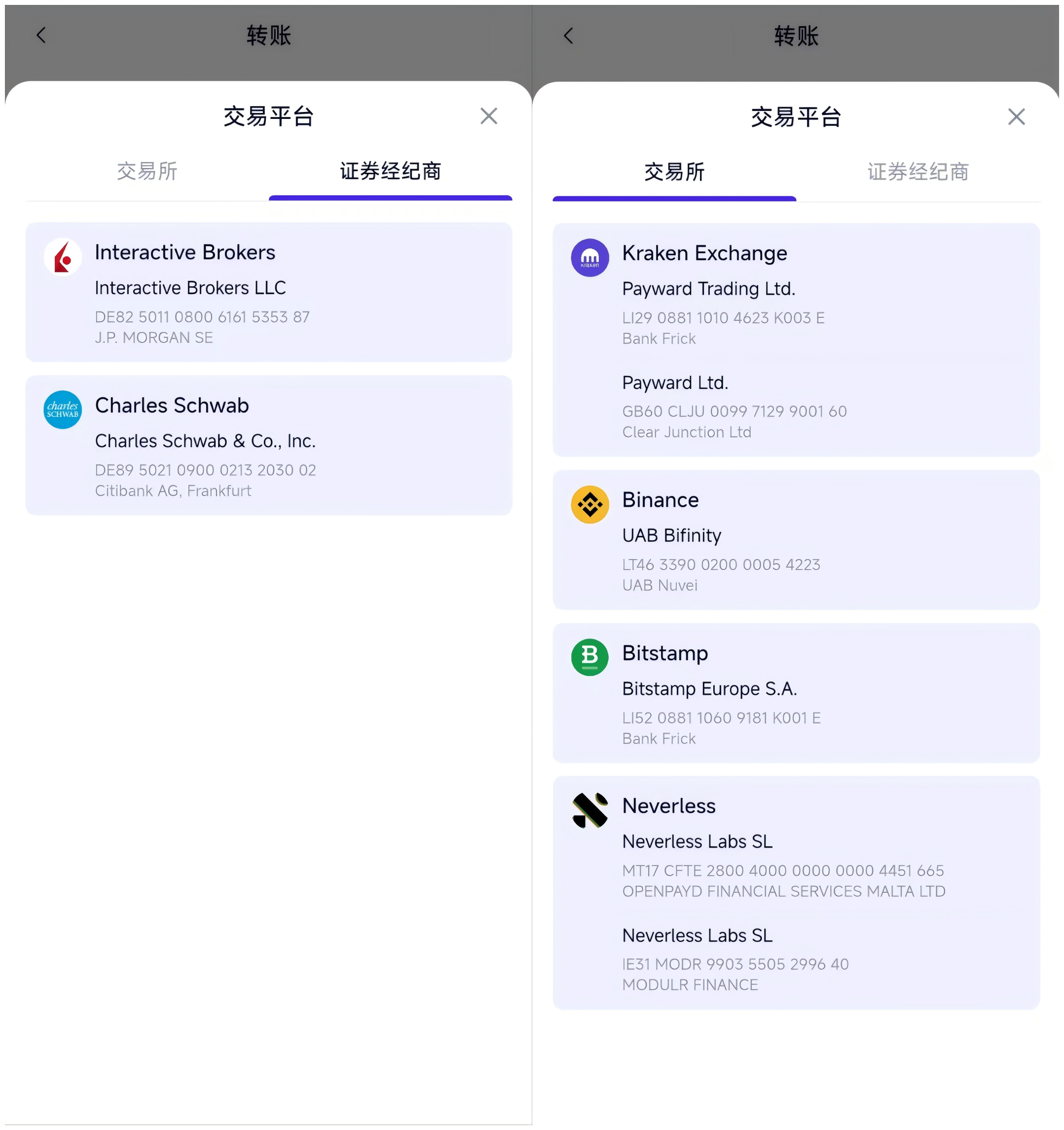

Services supported by SafePal's "Bank" service for brokerages and CEX inflows/outflows

Taking SafePal's "Bank" service as an example, it strategically invested in Fiat24 back in 2023. From a business structure perspective, it does not need to act as a "secondary dealer" renting licenses. The essential difference from pure card businesses like Infini lies in its direct control over account systems and card issuance resources, breaking through the limitations of being a "secondary operator" and achieving a better balance between cost and risk control.

For instance, the rate discounts offered by SafePal to the community, such as "free inflows/outflows and no account opening or card issuance fees," represent a structural cost advantage that most projects still stuck in the "outsourced card issuance" phase find hard to reach.

Additionally, the bank account system based on Fiat24 not only supports daily card consumption but also facilitates key scenarios for closing the on-chain and off-chain funding loop:

Brokerage inflows/outflows: Users can convert crypto assets into euros and transfer them to mainstream brokerage accounts like Interactive Brokers (IBKR), Charles Schwab, and Tiger Brokers via SEPA remittance, achieving cross-market allocation of on-chain assets;

CEX channel inflows/outflows: Supports transfers to exchanges like Kraken and Bitstamp that accept euro deposits, or reverse withdrawals to personal bank accounts, avoiding gray OTC risks and completing the inflow and outflow paths between crypto and fiat, with a clear and compliant funding chain;

Off-chain fund backflow: Through cross-border payment service providers like Wise, users can even indirectly remit euros back to domestic bank accounts or Alipay/WeChat, achieving a closed-loop flow of assets from on-chain to local systems;

This entire pathway far exceeds the traditional U Card's "one swipe and done" usage imagination, truly possessing account attributes, compliance capabilities, and service extensibility.

From U Card to Account, and to Future "Stablecoin Payments"

From a business logic perspective, the "card + account" model is clearly more structurally resilient and growth-oriented, where compliant banks lead account and regulatory oversight, while Web3 wallets focus on on-chain asset entry and user interaction. The two form a clearly defined and mutually supportive collaborative structure, making it far more sustainable than purely card-based businesses driven by project parties alone.

I have always believed that Crypto and TradFi are not opposites but are in an accelerated process of integration and mutual leverage. After all, TradFi excels in compliance regulation, account structures, and risk control systems, while Crypto has inherent advantages in asset openness, programmability, and trustless execution.

Therefore, before a complete transformation of the payment system occurs, the most robust, realistic, and sustainable path remains led by licensed financial institutions overseeing compliant accounts and clearing systems, while Web3 projects focus on on-chain entry and asset operations, forming the optimal combination of compliance and flexibility.

This model is a solution in the present continuous tense; while it may not be highly profitable, it possesses significant structural resilience and is currently the most feasible PayFi solution, as exemplified by the paths taken by SafePal, imToken, and others: collaborating with Fiat24 to provide real, usable IBAN accounts, Mastercard payment cards, SEPA channels, and compliant inflow/outflow capabilities for brokerages and CEXs, achieving a closed loop of assets on-chain and off-chain.

If we extend the timeline further, the ultimate form of PayFi may be a completely independent on-chain payment network that bypasses Visa/Mastercard:

Merchants accept stablecoin payments without converting to fiat;

Users initiate transactions directly from their wallets, with self-custody and on-chain clearing;

The backend is supported by compliant stablecoins and a clearing network, eliminating the need for Visa/Mastercard or SWIFT channels;

In fact, this trend is already happening, from Circle's launch of Programmable Wallets and CCTP (Cross-Chain USDC Clearing) to global payment giant Stripe's $1.1 billion acquisition of stablecoin API service provider Bridge at the end of last year, all attempting to connect on-chain accounts, stablecoin assets, and merchant collection endpoints, bypassing issuing banks and card organizations in traditional payment pathways.

This also indicates that traditional payment network giants are no longer "guarding against crypto" but are actively integrating on-chain capabilities, moving towards Web3 account structures and stablecoin clearing networks. This system is expected to truly bypass the high costs and low efficiency bottlenecks of traditional payment systems, potentially even surpassing existing cross-border payment solutions like Airwallex and Wise in terms of cost and experience, becoming the next generation of global payment infrastructure.

But that is a matter for the future.

It is foreseeable that the U Card belongs to the "historical perfect tense," the current compliant bank account model of SafePal/Fiat24 is in the "present continuous tense," while the on-chain stablecoin clearing network is truly in the "future perfect tense."

Ultimately, those who can navigate the evolution path of these three layers will be the ones qualified to occupy a place in the next round of payment paradigm shifts.

In Conclusion

Thus, Infini's exit is merely the natural conclusion of a transitional product like the U Card, which is destined to be replaced.

We might view it as a tentative connection of the Web3 world to the real world while the compliance pathways remain unclear, as it has, to some extent, fulfilled the historical mission of "allowing Crypto to be spent."

However, as regulatory boundaries become increasingly clear and the status of stablecoins continues to rise, user demands are shifting from "being able to swipe" to "being able to circulate, manage assets, and close the loop," necessitating the genuine construction of underlying capabilities, especially the bidirectional synergy between Crypto and TradFi.

The next round of PayFi is no longer centered on cards.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。