谁的决心更大?全景梳理主流钱包在代币化美股领域的布局路径。

撰文:Tyler

Web3 钱包们,正在加速抢登代币化美股的班车。

试想一下,当你在同一钱包内,既能掌管 ETH、USDC 等链上原生资产,又能随时买卖苹果(AAPL)、特斯拉(TSLA)等 RWA 代币时,钱包的角色便已超越 Crypto 入口,进化成了一种全新的账户体系雏形。

而推动这场质变的催化剂,正是 RWA 的规模化落地,代币化美股则是其中的先锋,主流钱包在同一时期密集切入这条赛道——有的单设「股票」板块,有的通过 DEX 协议嵌入入口等等。

优质资产与流量入口的互相渴求,正把 Web3 钱包推向一个前所未有的 RWA 战略枢纽位置。

旧时代落幕,RWA 代币化的新船

你持有的第一支美股,是哪个?

无论是像 AAPL、NVDA 这样的「科技七姐妹」,还是 HOOD、OPEN 等新锐黑马股,美股市场的增长确定性和收益性价比,普遍优于大多数高风险的 Altcoin,对投资者始终具有强烈吸引力。

但现实却是,一方面,传统券商开户流程繁琐,即便存在「盈透证券+离岸银行」的理想路径,但随着全球合规要求趋严,这条通道也在持续收紧(延伸阅读《SafePal 实用手册:转账汇款、出入金券商 /CEX,打通 Crypto 与 TradFi 的最全指南》);另一方面,高企的出入金成本、缓慢的资金到账周期,以及 T+N 的结算制度,对绝大多数中小投资者也并不友好。

正是这些根深蒂固的痛点,让股票代币化成为了 2025 年 TradFi 与 Web3 融合的最佳叙事,它的逻辑简单而强大:将传统股票通过区块链技术映射成数字代币,每个代币由真实股票 1:1 支撑,代表底层资产的所有权,以在链上自由交易。

这样不仅突破了地域与身份的限制,还把交易体验拉到了链上的「秒级结算」维度,比起传统券商的滞后流程,对加密原生用户而言显得更加自然,所以当这扇大门被推开,整个行业的巨头们都嗅到了机遇的气息。

除了 Kraken、Bybit 等 CEX 原生玩家,Robinhood 也宣布将在区块链上支持美股交易,甚至纳斯达克也抛出试探性信号,行业巨头的方向高度趋同,即试图将加密货币、股票、ETF、黄金等所有资产类别,统一纳入一个全景化的交易体系。

而对每一名用户来说,这意味着一种前所未有的投资体验:仅需一个加密钱包,持有稳定币,便能随时随地在 DEX 买入美股资产,无缝接入全球顶级资本市场。

这既是 RWA 赋予用户的自由,也是 Web3 钱包作为核心入口的价值所在,从这个角度来看,代币化美股与钱包,在上演一场优质资产与流量入口互相成全的「阳谋」:

对 RWA 而言,它迫切需要借助钱包这个天然的流量入口和流动性集散地;

对钱包来说,它同样渴望借助 RWA 优质资产来打破用户增长的瓶颈,跳脱单一的投机属性;

Web3 钱包 & RWA 布局全景一览

因此,当 RWA 代币化的可能性被验证,作为用户通往 Web3 世界核心入口的钱包,早已开始抢占这场盛宴的中心席位。

目前,除了 Mystonks 这类专门聚焦代币化美股的垂直交易平台,以及 Bybit、Bitget 等在 CEX 端上线的币股板块之外,主流钱包几乎无一缺席 RWA 赛道,从代币化美股到代币化黄金等资产,正被快速纳入核心服务版图。

本文选取 OneKey、SafePal、Bitget Wallet、imToken 这 4 家华语区覆盖面较广的主流钱包进行对比,可以发现它们在集成路径与入口策略上,展现出截然不同的战略侧重,基本上可以分为「战略型-集成型-兼容型」三档,形成了「重点突出—有但非必要—仅支持交易」泾渭分明的三个梯队。

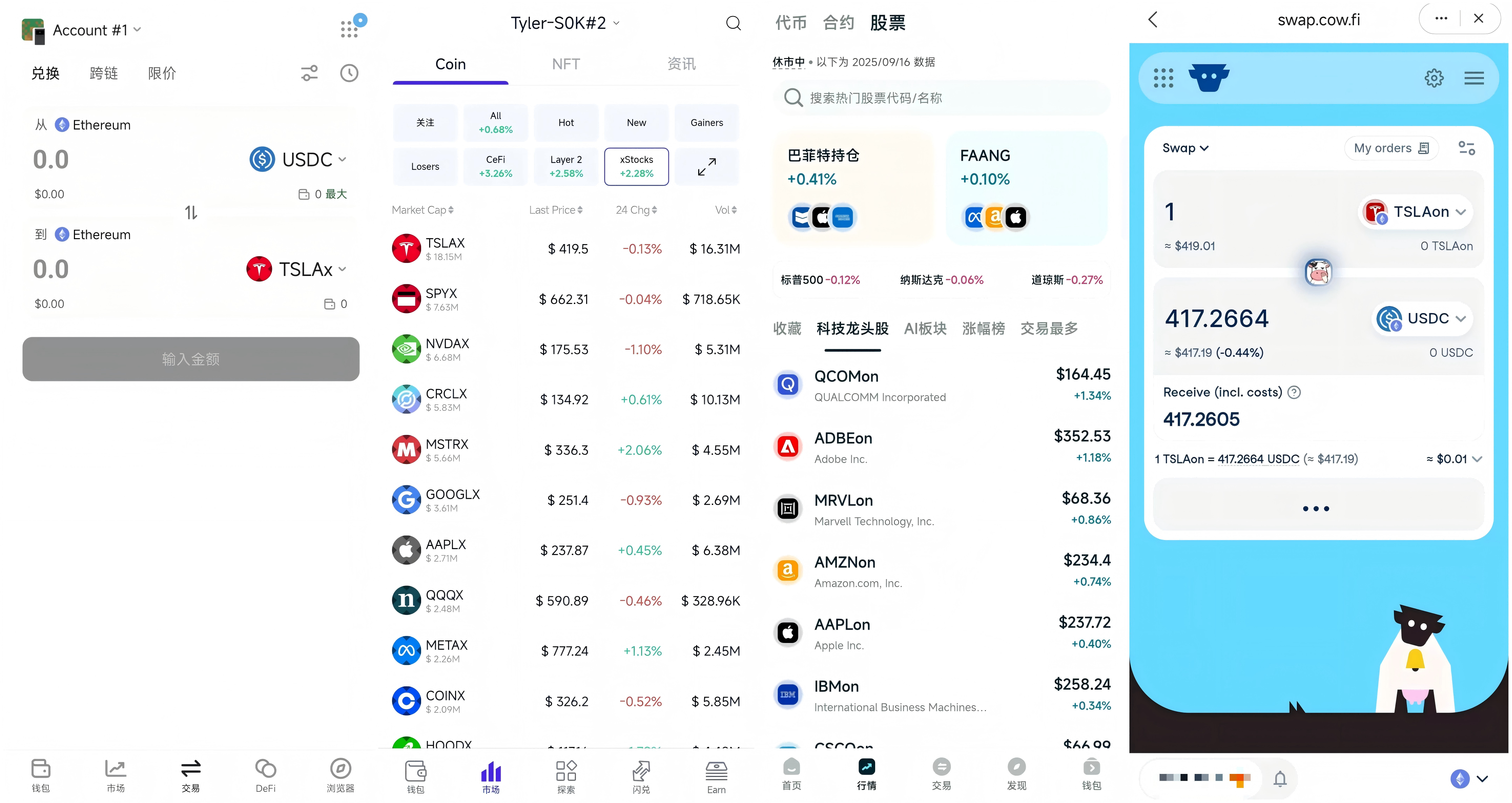

从左至右,依次为 OneKey、SafePal、Bitget Wallet、imToken 的美股代币交易页面

不过在对比之前,需要明确一个前提:钱包作为发行方的下游渠道,币股的覆盖数量并非完全由其主导,差异主要体现在集成方式与入口设计,因此横向比较数量本身并无太大意义。

首先第一档是将 RWA 交易视为核心战略方向,在产品设计上给予了最高优先级,UI 对用户而言十分直观,Bitget Wallet、SafePal 这两家钱包是其中的典型代表:

Bitget Wallet:在「行情」与「交易」两个一级导航栏中,均专门设置对应的「股票」板块页面,用户可以像浏览原生 Crypto 币种行情一样,直观地筛选和交易美股代币;

SafePal:同样在「市场」这个一级导航栏中,专门开辟了「xStocks」分类入口,用户既可以在此集中浏览行情、发现投资机会;对于目标明确的用户,也可以在核心的「闪兑」(Swap)功能中,直接搜索股票代码(如 TSLAx)一步完成兑换,无需跳转;

这种设计的背后,无疑是希望将用户「投资美股」的心智与自家产品深度绑定,所以会发现 Bitget Wallet 和 SafePal 的具体币股交易页面,详尽的 K 线图、市值、成交量等信息一应俱全,SafePal 甚至还额外聚合了相关新闻资讯,产品完成度较高。

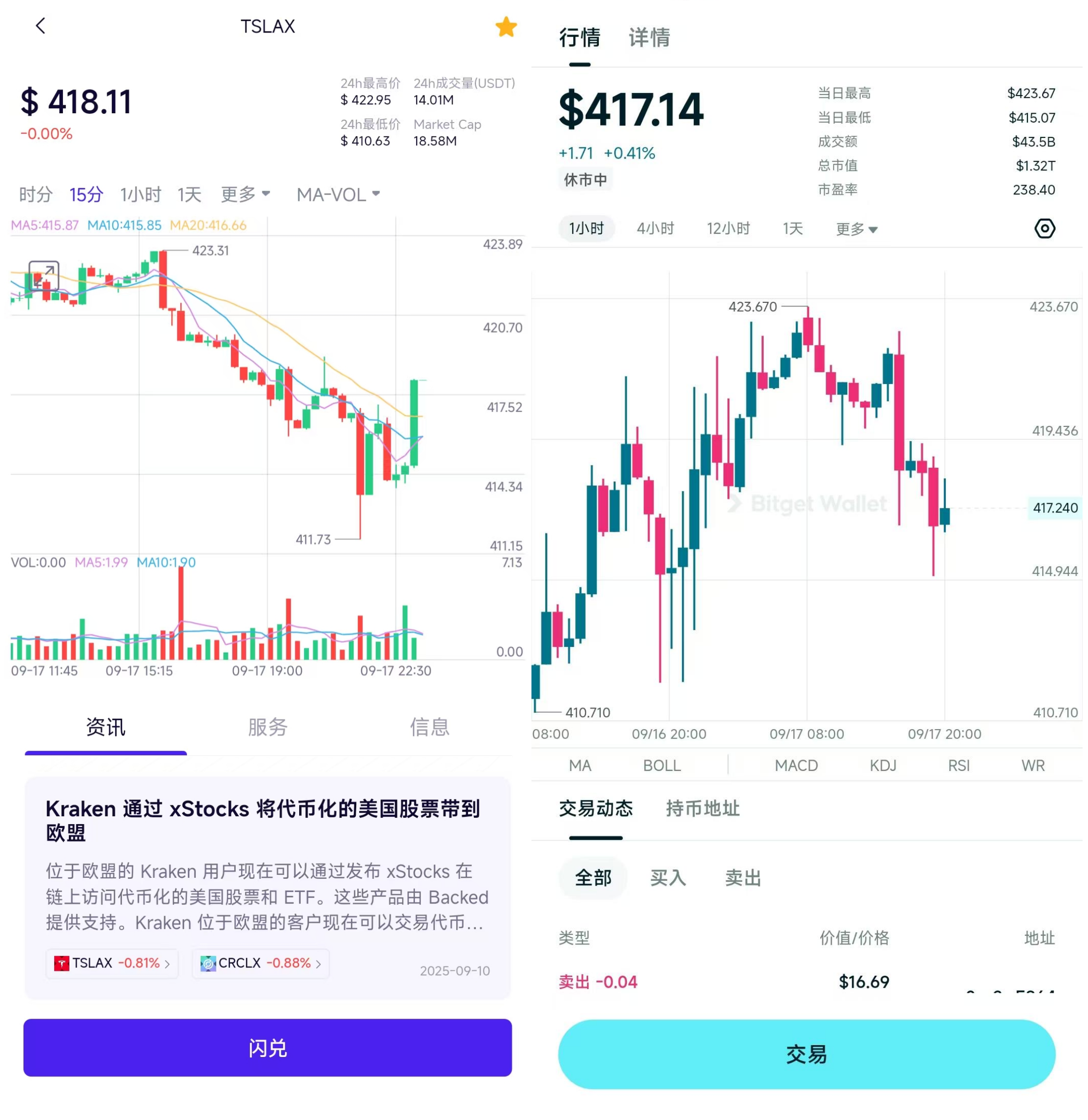

从左至右:SafePal 与 Bitget Wallet 的币股详细交易页面

其次第二档对 RWA 的态度则属于「不冷不热」的功能补充,它没有为代币化美股设计额外的专属入口,秉持「可有,但非必要」的理念,将其整合在「内置 Swap」通道中。

OneKey 是这一档的典型代表,它将币股交易塞进原有的「交易/Swap」页面,而非开辟专属入口,这意味着用户需要主动在 Swap 界面搜索股票代码(Ticker),实话实说,这对不熟悉美股的用户构成了一定的使用门槛,体验上打了折扣。

最后则是 imToken 为代表的第三档,在此轮 RWA 布局中则采用相当保守的跟随策略,本质上仅提供浏览器入口,只属于「可以做到」,更偏向于「兼容」而非「集成」——根据笔者实测,用户需要在「浏览」页面中自行打开 CowSwap 等 DApp,甚至首次使用时,需要手动开启 Ondo 等发行商的代币列表才能搜索到相关资产。

坦率地说,imToken 的币股交易入口有点过于隐晦,整个流程不仅操作繁琐,还有网络设置等额外障碍(亲测部分 IP 下,其内置浏览器甚至无法搜索显示 CowSwap 协议),且这种方式几乎等同于任何一个带有 DApp 浏览器的钱包都能实现,并未体现出产品层面的设计布局。

从对比中可以清晰看到,SafePal 和 Bitget Wallet 已经将代币化美股视为核心战略,着力承接 RWA 带来的流量与交易需求;而 OneKey 与 imToken 则更像是在给现有功能库增加一个「添头」,保持生态兼容,但不主动发力。

总之,从对入口直观度、交易便利度的综合评估来看,我们已经能够清晰感知在当前 Web3 钱包的 RWA 布局中,谁展现出更强的战略决心和产品完成度。

代币化美股的实际交易体验

然而在横向对比各家钱包的战略和入口策略之后,还必须回到一个最本质的问题——用户的实际交易体验。

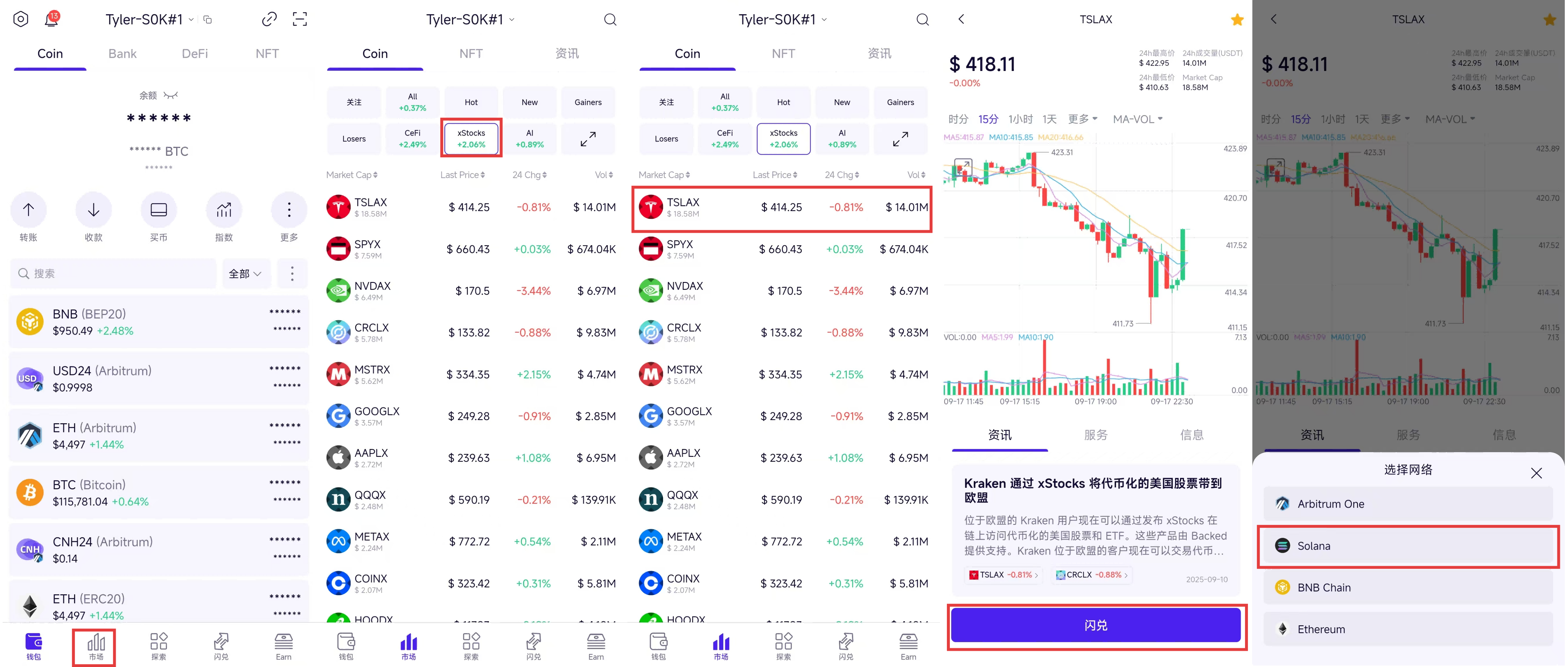

下面就以 SafePal 钱包为例,来直观感受一下如何在 Web3 钱包中自由交易代币化美股。

需要注意的是,虽然代币化股票可以 7×24 小时在链上流通,但部分发行商仍与美股交易时段联动,目前的主要交易时间是北京时间 21:30 – 04:00;此外需要确保钱包中拥有足够的稳定币(如 Solana 链上的 USDT/USDC)作为交易本金,以及少量 SOL 作为网络 Gas 费。

首先,打开 SafePal 钱包 APP,点击底部的「市场」,在顶部品类中找到并选择「xStocks」标签,此时会进入专门归类的美股代币板块,展示所有支持交易的 48 支美股代币列表;

以购买特斯拉(TSLAx) 为例,在列表中找到 TSLAx,点击进入,会看到该标的的专属页面,包含 K 线图、行情走势、交易入口;

然后点击 Swap,选择 Solana 网络,即可进入实际交易页面;

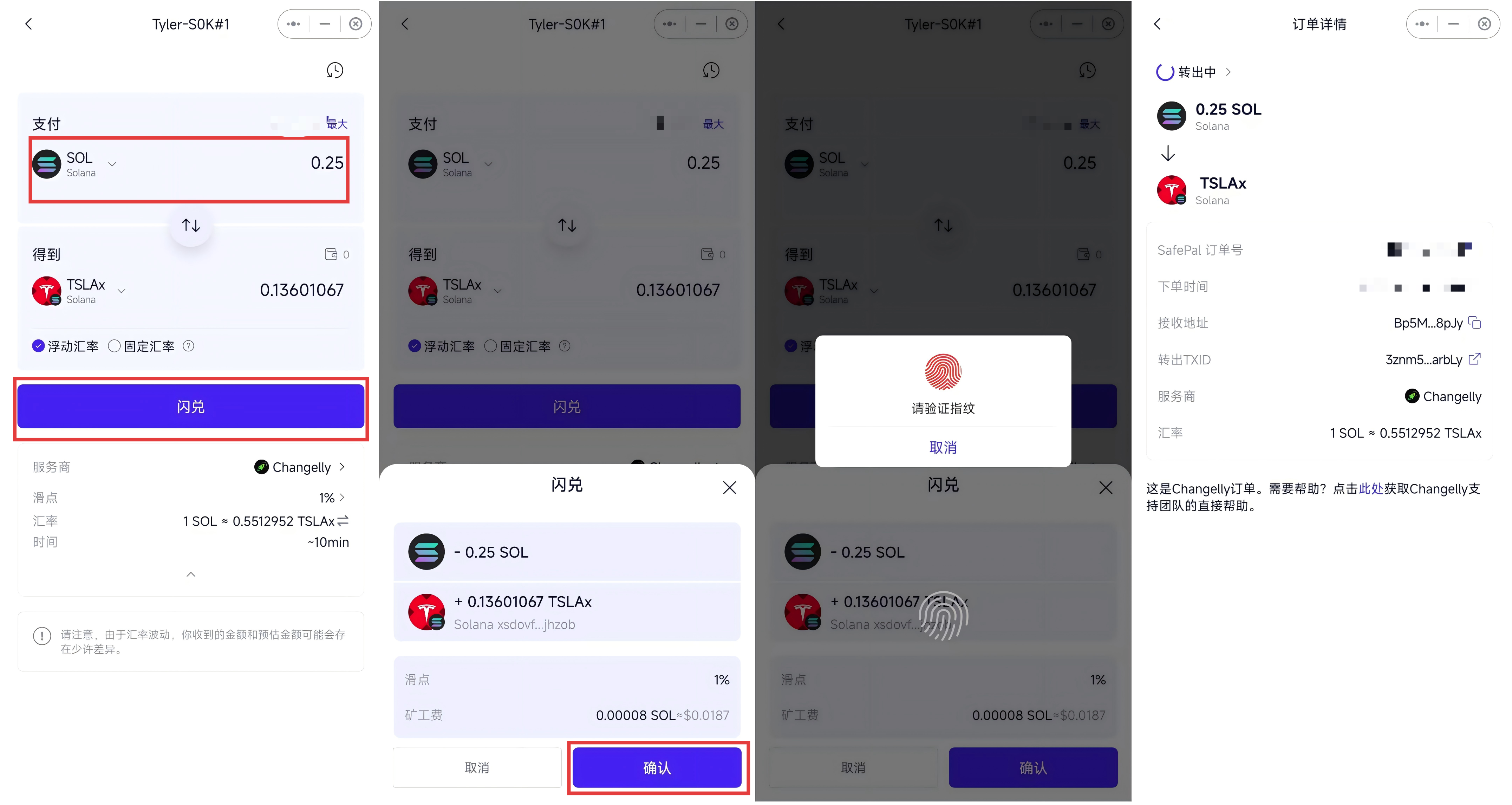

进入交易界面后,会发现操作与熟悉的 Uniswap 等 DEX 操作逻辑完全一致,对加密用户极其友好:

在「支付」一栏选择 SOL 或 USDT/USDC 等有余额的币种,输入对应金额;

在「得到」一栏,会自动换算出对应美股代币的购买数量;也可以输入想购买的 TSLAx 股数(支持小数,例如 0.1 股),系统会反算出需要支付的金额;

核对信息无误后,点击「闪兑」并确认,并在 SafePal 钱包弹出的窗口中确认交易;

输入你的安全密码或通过生物识别验证后,交易便会提交到区块链上,耐心等待片刻(通常在 1-5 分钟内),交易即可完成。

交易确认后,TSLAx 这笔代币化的股票资产就会出现在 SafePal 钱包的资产列表中,可以随时在此查看其价格波动,或者在需要时,通过同样的操作流程将其卖出换回 SOL 或 USDT/USDC 等币种。

至此,一笔无需开户、无需跨境汇款入金的真实「链上美股交易」便已完成,资产的查看、管理与买卖,皆可在钱包内一站式搞定。

写在最后

客观而言,当下所有 Web3 钱包在 RWA 交易上的探索仍处于早期阶段,尤其是在呈现和交易美股等传统资产时,与成熟的 TradFi 应用相比仍存在显著差距。

也正因如此,像 SafePal 等非托管型钱包的尝试,真正的价值并非复制旧有范式,而在于探索并塑造新规则——相比传统券商冗杂的开户与资金调度流程,直接提供一种「即插即用」的颠覆式体验。

这也意味着,即便代币化美股未必是 RWA 大规模落地的最终答案,Web3 钱包的身份进化已是既定事实,从加密资产的单一入口,走向现实资产与链上流动性交汇的关键枢纽。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。