Original | Odaily Planet Daily (@OdailyChina_)

_

Since June, crypto projects have faced a wave of account bans on X, with some official project accounts and related personnel's accounts being frozen en masse without warning. This includes the official account of ElizaOS and its founder Shaw's personal account, the official account of GMGN and its founder haze's personal account, and the official account of pumpfun and its founder Alon Cohen's personal account. Initially, the community speculated about the motives behind X's account bans, including project scams, regulatory pressure, and references to "Bubble Mart" memes.

Bubble Mart

However, among the various speculations, a more plausible reason is related to crypto projects' illegal use of third-party crawlers. Crypto KOL AB Kuai.Dongposted a relatively credible explanation that this wave of account bans targets data scraping activities that do not go through the official API interface. He pointed out that if a company uses X's official interface to search for 200 million tweets per month, it must pay over $200,000. Many projects like gmgn, ai16z, and eliza, in order to save costs, opted to use third-party crawlers to obtain data, leading to mass bans.

On June 18, ElizaOS founder Shaw posted on the Farcaster platformclaiming that X officials extorted him under the pretext of unfreezing his account. He stated that X officials cited his open-source code, claiming they violated certain service terms, including selling data and selling certain content by bypassing the API key. He mentioned that if Shaw was willing to pay $50,000 per month for an enterprise license, they would stop harassing him. However, Shaw already pays $1,000 monthly for "yellow label" certification and $200 for developer licensing. Therefore, Shaw believes this is unreasonable and is considering whether to use legal means.

Shaw angrily criticized Musk on the Farcaster platform

Following Shaw's revelations, the community speculated that pumpfun and GMGN's accounts were unbanned possibly due to a compromise on X's "unban conditions." After the unbanning, GMGN suspended its X monitoring and crawler tools, while Pumpfun removed its sniping/tracking features.

To get closer to the truth, Odaily Planet Daily sought confirmation from GMGN regarding the reasons for its ban and unban, but GMGN refused to publicly comment, stating, "We can't say."

Is it a deliberate escape by crypto projects or is X being unreasonable?

Since Musk officially became the owner of Twitter (now renamed X) in October 2022, X canceled the free API in 2023 and fully implemented a high-priced payment strategy. Since then, many companies have had disputes with X officials over hidden charging terms related to the API and forced upgrades to the enterprise version. However, this time, crypto companies have been collectively targeted.

In October 2024, Publer founder Ervin Kalemi publicly protested on the X platformagainst X's hidden charges. He stated that Publer originally subscribed to X's enterprise-level API ($42,000/month), but starting November 1, 2024, X officials informed him that in addition to the original monthly fee, they would also charge an additional fee of "$1 per month per connected account," meaning Publer would have to pay tens of thousands of dollars more each month.

In early 2025, a userreported that X officials began cracking down on companies that used users' own API Keys (BYOK) to batch pull X data for clients, such as Fivetran, Airbyte, and Stitch, which are commercial-grade data integration/ETL service providers. The requirement was that they must upgrade to the most expensive enterprise API, and it was reported that some companies had received legal letters from X's legal department.

According to the pricing information released by X, upgrading an X account to the enterprise gold standard costs $200 per month for the basic version, while the complete version costs $1,000 per month.

X platform API pricing standards

From the above pricing standards alone, it is evident that there may indeed be hidden charges and "extortion" of companies by the X platform. The existing pricing standards do not clearly specify what scale and nature of companies need to apply for customization, and the pricing standards for customized enterprise versions are also not publicly transparent. Is the API pricing for different companies solely at the discretion of X, which holds a monopoly? For companies, X officials control the life and death of platform accounts and can ban accounts at will. If a company does not agree to the pricing plan or delays negotiations, the ultimate victim is the company's interests, leading most companies to choose to "obediently pay."

Financial Pressure Behind the X Platform

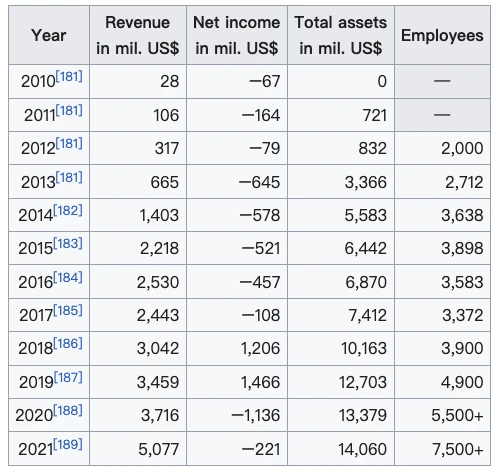

Wielding the power to ban accounts as a threat to compel companies to pay may be a "dark trick" Musk devised to save the X platform. Before Musk fully privatized Twitter, the financial situation of Twitter had been in a state of loss for years. Since its IPO in 2013, Twitter only achieved profitability in 2018 and 2019, with all other fiscal years in a loss. In the last fiscal year before Twitter was privatized by Musk—2021—the loss still reached $221 million.

Twitter's profit and loss situation from 2010 to 2021, source: Wikipedia

Years of losses also led Musk to implement the X platform API charging model starting in March 2023. In 2023, according topublic data, paid APIs contributed approximately $900 million in revenue to the X platform, accounting for 26% of total revenue; advertising revenue remains the main source of income for X, approximately $2.5 billion, accounting for 75%; the remaining revenue comes from X Premium subscriptions and enterprise gold standard certifications. Although API charging began in 2023, according toReuters, due to a 50% drop in advertising revenue and heavy debt burdens, Twitter's cash flow remained negative in 2023.

Since Musk privatized Twitter in 2022, he has not publicly disclosed financial data, but we can still infer from third-party information that its financial situation in 2024 is not optimistic. In February 2025, Musk stated in an email to employees that“Our user growth has stagnated, and revenue is disappointing; we are barely maintaining a balance between income and expenditure.” The bulk of its expenses comes from the high debt costs accumulated during Musk's acquisition of Twitter. By the end of 2024, X will have paid over1.3 billion dollars just in annual interest expenses.

Therefore, under immense financial pressure, in order to generate revenue, X officials chose to reach into the pockets of companies that rely on the platform's API.

The hegemony of the X platform has a stranglehold on the throat of crypto dissemination.

However, facing financial pressure is not a justification for X to wield the ban hammer against companies.

X has users all over the world, and its information covers various aspects such as entertainment, politics, and business, making it a very important channel for brand promotion and market updates for companies, especially for crypto companies. According to a survey by CoinGecko, 41.7% of crypto users use X as their primary social media platform, followed by Telegram and YouTube, while 73.8% of crypto users choose to obtain crypto news through social media platforms.

Due to the large number of crypto users and crypto social data accumulated on X, it has become a cornerstone of the crypto industry, just like public chains such as Ethereum. Therefore, about 90% of crypto companies and KOLs choose to publish brand promotion and product update information on the X platform. Many Web3 task platforms also choose X as their main community interaction platform. If crypto is banned, it would effectively cut off the channels for crypto companies and KOLs to promote themselves externally.

On the other hand, the emerging Meme, AI Agent, and InfoFi sectors in the crypto industry in 2024 are highly dependent on the X platform. The vast majority of Meme coins not only originate from X but also spread and ferment there, which is the main reason why monitoring tools choose to track X; most AI Agents' social training data comes from X, and Agents choose to be active on the X platform, such as AIXBT and Eliza; InfoFi platforms are even more reliant on X, with "mouth-lifting" and KOL ranking data sourced from the X platform. If X does not allow InfoFi platforms to use the official API, this sector may not exist, which is why Kaito is willing to pay $2 million per month to X to maintain its existence.

Such deep dependence makes X not only a bridge but also a shackle of power, firmly constraining the pulse of the crypto world.

The crypto industry, which advocates the ideal of decentralization, is highly dependent on a centralized platform, which is as shameful and reluctant as a freedom fighter voluntarily putting on shackles. At such times, people often think of those once-hopeful decentralized social utopias, such as Farcaster and Lens. Although they understand the needs of crypto and financialization, unfortunately, they do not understand social interaction and products, making it difficult to illuminate the main channel of crypto social interaction.

This morning, I found that ElizaOS founder Shaw has deleted his post on the Farcaster platform accusing X. Does this mean that Shaw has leaned towards "submitting" to X? If the crypto industry continues to hand over information sovereignty to X, then its hegemony may impose sanctions at any time. When crypto companies become targets again, they can only swallow their grievances—"we can't say."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。