According to Jinshi Data reports, the Federal Reserve has kept the benchmark interest rate unchanged at 4.25%-4.50%, marking the fourth consecutive meeting without action, in line with market expectations.

Federal Reserve Chairman Jerome Powell added an unexpected hawkish twist to the long-anticipated rate cut narrative during the FOMC press conference on June 18. He rarely pointed directly at fiscal policy, stating that the tariffs imposed by the Trump administration have become the "elephant in the room" in the inflation narrative and could significantly drive up prices in the coming months.

This rhetoric is akin to throwing cold water on the market's enthusiasm for rate cuts. Powell reiterated that any easing is mere talk until there is "sufficient confidence" that inflation will return to 2%. This strong statement not only highlights the Federal Reserve's policy determination under political pressure but also casts a shadow of macroeconomic uncertainty over global markets, especially sensitive crypto assets.

Tariffs: The New Protagonist in the Inflation Narrative and the Federal Reserve's "Observer" Dilemma

Powell candidly stated at the press conference: "Someone has to bear the tariffs, and part of it will ultimately be passed on to consumers." He emphasized that the transmission path of tariffs to inflation is complex and lagging, and their impact will permeate both consumption and supply, thus the Federal Reserve must enter a longer "observation period."

The core of this judgment lies in the fact that the impact of tariffs is not a "one-time shock," but may evolve into more persistent inflationary pressures. This aligns with his view expressed in the May meeting that "supply shocks are becoming more frequent," but this time, he directly established tariffs as the "number one suspect" in the current inflation risk.

After the press conference, the three major U.S. stock indices fell sharply, and bond yields became more volatile, indicating that investors' concerns about "stagflation" risks are heating up.

Hawkish Remarks Under a "Pseudo-Dovish" Dot Plot? Powell's Art of Language

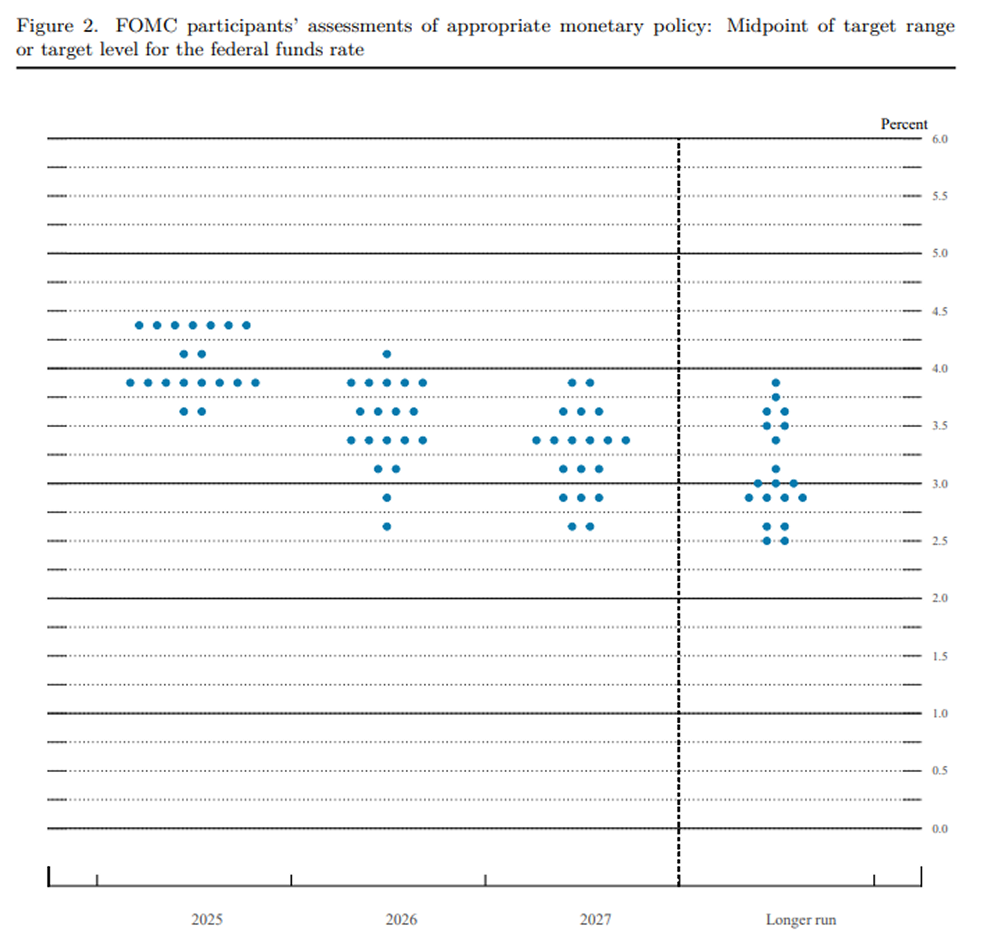

Despite the inflation risk alarm being sounded, the Federal Reserve's latest dot plot still maintains a "dovish" expectation of two rate cuts (a total of 50 basis points) by 2025. However, the market knows that the devil is in the details.

Several key statements made by Powell during his speech reveal the Federal Reserve's true intentions:

"Moderately Restrictive" Policy: He described the current policy as "moderate or moderately tight," implying that it has not yet reached a level that would stifle the economy, providing a theoretical basis for maintaining the status quo.

"Interest rates are not very high": This understated remark was interpreted by the market as the strongest hawkish signal. It suggests that, in the Federal Reserve's view, the 4.25%-4.5% interest rate range has a limited suppressive effect on the economy, and there is no urgency for rate cuts in the short term.

"Economy performing well": He emphasized that a robust job market and economic performance give the Federal Reserve sufficient strategic patience, negating the need to yield to market or political calls for rate cuts.

As SPX options data shows, the market structure has exhibited characteristics of "false easing, true warning." The dot plot's "rate cut commitment" seems more like a reassurance, while Powell's tough rhetoric serves as the real policy guidance.

The Crypto Compass Under Macro Fog: Short-Term Pressure and Long-Term Narrative Game

Although Powell did not directly name cryptocurrencies, every word he spoke tugged at the nerves of the digital asset market.

In the short term, macro headwinds are almost a foregone conclusion.

Liquidity Tightening: The "Higher for Longer" interest rate environment means that the valuation ceiling for risk assets is firmly locked, and the liquidity that the crypto market relies on is unlikely to arrive in the short term.

Strong Dollar: Tariff-driven inflation expectations may push up the Dollar Index (DXY), creating natural pressure on dollar-denominated assets like Bitcoin.

However, the long-term narrative is quietly brewing.

"Anti-Inflation" Value Rekindled: If tariffs ultimately lead the U.S. into persistent inflation, Bitcoin's narrative as "digital gold" will once again be brought to the forefront, attracting funds seeking asset preservation.

Geopolitical "X Factor": Although Powell downplayed the long-term impact of geopolitical conflicts on energy prices, the market remains skeptical. If tensions in regions like the Middle East escalate and oil prices soar, it could trigger a brief flight to safety, with some funds potentially flowing into BTC.

The policy game between the Federal Reserve and the Trump administration will be a key variable influencing the future direction of the crypto market. The actual impact of tariffs, the trajectory of inflation data, and the Federal Reserve's responses will all become core bases for market judgment.

Conclusion: Seeking Certainty Amid Uncertainty

Powell's speech on June 18 painted a complex macro picture for the market: the Federal Reserve is trying to walk a tightrope between tariff inflation, economic growth, and political pressure. Its cautious "wait-and-see" attitude is both a defense of policy independence and a sign that the market will remain in a state of high uncertainty for the coming months.

For crypto investors, this means adapting to high volatility and macro pressure in the short term. However, danger and opportunity always coexist. While closely monitoring key data such as CPI and PCE, it is also essential to deeply understand the evolving logic of the macro narrative.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。