Author: Zhang Wen, BlockBeats

When some people say stablecoins are useless, take a look at the dire situation of the Iranians.

A few hours ago, Iran's largest local cryptocurrency exchange, Nobitex, was attacked by Israeli hackers, resulting in the theft of 80 million dollars, and it wasn't Bitcoin, it was 80 million in stablecoins.

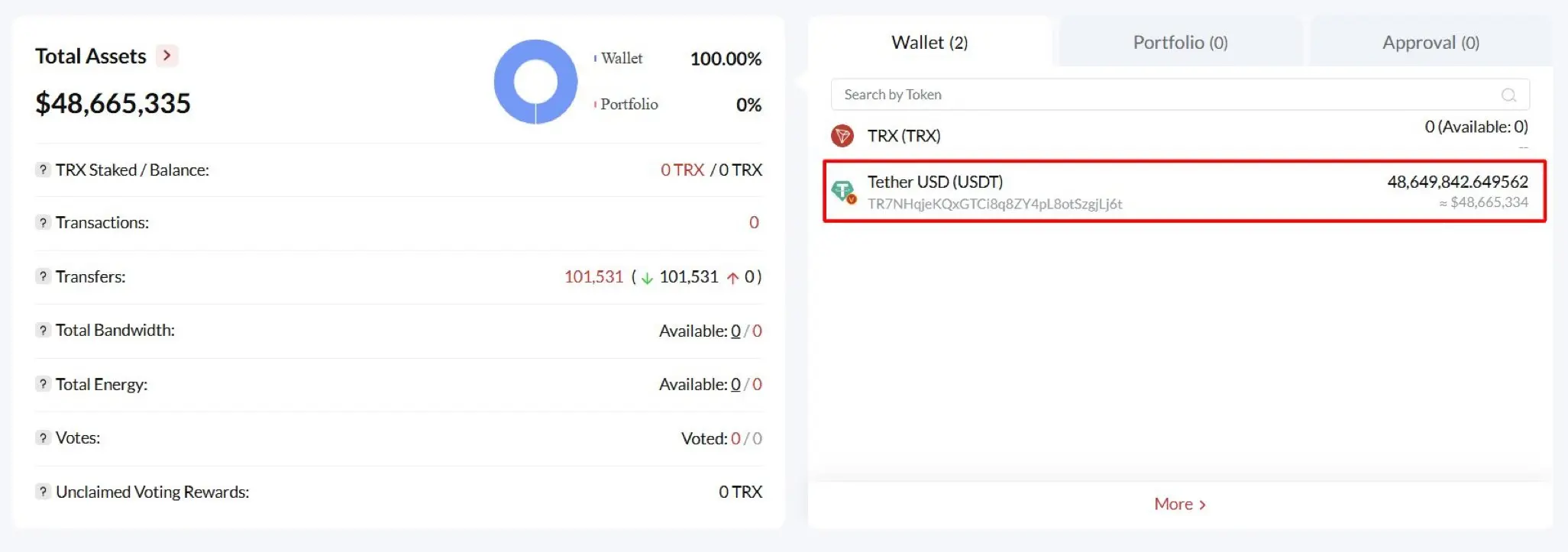

One part of the stolen funds

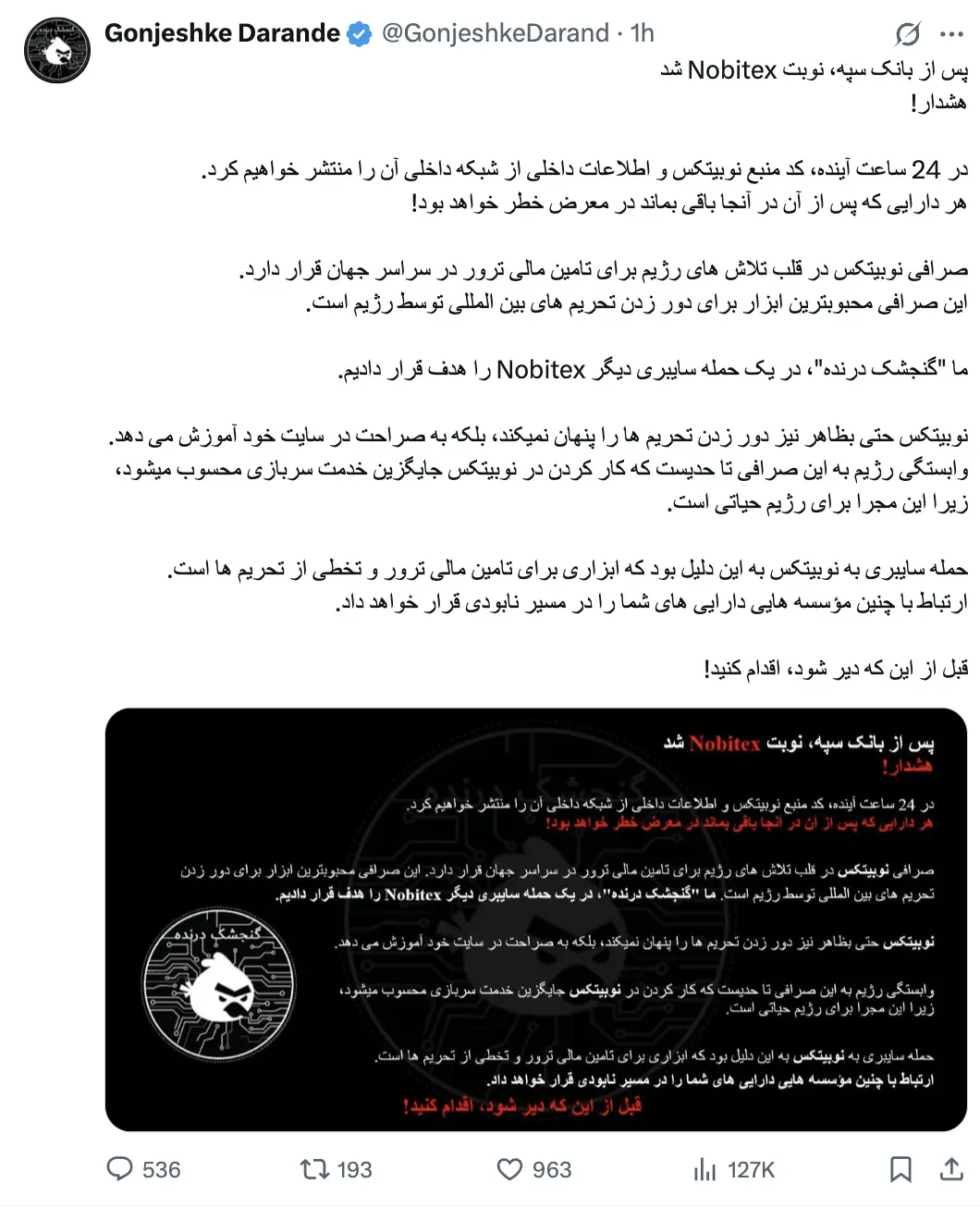

The Israeli hacker group "Gonjeshke Darande" (Predatory Sparrow) has not stopped after taking the 80 million, stating that they will release Nobitex's code, making no asset on the platform safe.

"After Sepah Bank, it's Nobitex's turn. Within the next 24 hours, we will release Nobitex's source code and internal information from its internal network. After that, any assets left there will be at risk. Nobitex Exchange is the core of this regime's funding for terrorism around the world; it is the most popular tool for this regime to evade international sanctions. We targeted 'Predatory Sparrow' in another cyber attack on Nobitex. Nobitex has not even pretended to hide its sanction-evading activities, but has explicitly taught on its website that the regime's reliance on such exchanges is so great that working at Nobitex is considered an alternative to military service, as it is an important channel for the regime. The cyber attack on Nobitex is because it is a tool for funding terrorism and violating sanctions; association with such institutions will lead your assets down a path of destruction. Act before it's too late."

This hacker group is referred to as Israeli hackers because this is not the first time they have attacked Iranian services. Over the years, they have continuously targeted Iran's gas stations, banks, ATMs, factories, and other infrastructure, and this time they chose a cryptocurrency exchange.

The theft of 80 million dollars is not a huge amount in the history of stolen funds from exchanges, but the Iranian exchange that was robbed and the Israeli hackers that initiated the attack carry more historical and political significance against the backdrop of the current Middle Eastern war.

In the Middle East, a region with the world's most complex geopolitical conflicts, Israel launched this long-planned war with a surprise airstrike on June 13, based on the game of nuclear plans.

Today's attack is also the first time in history that, during a war between the two countries, an attack was targeted at the other’s cryptocurrency exchange.

This indicates that Israel has come to view cryptocurrency exchanges as essential infrastructure for the Iranian people. More specifically, they are more interested in attacking stablecoins. When the nation falls, the people suffer. The worst off are still the local residents of Iran.

Because stablecoins have become a necessity that Iranian residents are extremely reliant on.

Iran's Extreme Demand for Stablecoins

Due to economic sanctions, rampant inflation, and geopolitical tensions in recent years, the Iranian currency, the rial, has been continuously devalued, with significant declines. By March 2025, the rial had fallen to 927,000 rials per dollar, a 55% drop from the previous August, compounded by outrageous inflation. The only thing Iranians need is stable currency, such as the US dollar and gold.

A few years ago, Reuters reported on the dire situation in Venezuela, known for its hyperinflation and rapid devaluation of its sovereign currency. Journalists found that locals had to go to the black market to exchange for US dollars, where prices were much higher than in the regular market, and the exchange rates were very unfavorable. But they had no choice; legitimate capital markets could not provide US dollars, so they had to resort to the black market. The situation in Iran is similar.

However, in recent years, cryptocurrencies, especially stablecoins, have become the favorites of the Iranian people. Compared to cash in US dollars, stablecoins offer clear advantages that locals cannot resist.

How much do they love it?

By the end of 2024, the Iranian government directly ordered local cryptocurrency exchanges to stop withdrawals, preventing users from taking their money out. The fundamental reason for this outrageous behavior is that Iranians were using stablecoins to move capital out of the country, with outflows soaring to 4.2 billion dollars, a 70% increase from the previous year.

In local Telegram groups, there are dedicated posts comparing black market exchange rates to publish "today's stablecoin prices." In the first half of this year, the daily trading volume of stablecoins increased by over 40% compared to the same period last year. The Iranian middle class no longer wants cash in US dollars; they want stablecoins.

Not only do residents use them daily, but the government is also using them. Due to sanctions and other circumstances, Iran cannot use the common SWIFT system, forcing them to use stablecoins. Now, Iran's import and export settlements, such as those with the UAE and Turkey, are conducted using stablecoins.

And just a few hours ago, Israel stole the stablecoins that Iran is heavily reliant on.

"We Really Need Money"

In Iranian communities, we see the helplessness of Iranians without stablecoins.

Some cannot withdraw their coins, while others lament "having nothing." Ordinary people in a war are experiencing this helpless double blow.

Whether the assets can be recovered, whether the platform will take responsibility, and how much has been lost—all remain uncertain. For Iranians living in the cracks of hyperinflation and financial blockade, those originally used for survival, cross-border payments, and resisting the devaluation of the rial are now in limbo.

We can only pray that this war ends soon, and that the Iranian people regain control over their lives.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。