Welcome to the Major Identity Crisis of Cryptocurrency in 2025.

Written by: Prathik Desai

Compiled by: Block unicorn

Preface

TRON founder Justin Sun is taking his blockchain empire public through a reverse merger with Nasdaq-listed toy company SRM Entertainment.

How did someone whose career began with the goal of disrupting traditional finance end up holding an IPO prospectus and queuing at the gates of Wall Street?

Welcome to the Major Identity Crisis of Cryptocurrency in 2025.

Rushing to Wall Street

The frenzy began with Circle. This month, the stablecoin giant went public, with its stock price soaring 168% on the first day. It was oversubscribed by 25 times: public demand was for 850 million shares, while only 34 million shares were actually issued.

Image source: TradingView

Circle currently has a market capitalization of over $33 billion, reportedly three times the $9 billion to $11 billion acquisition offer it received from Ripple before going public.

Circle's success not only rewarded early investors but also inspired a wave of crypto-native companies to consider entering Wall Street, prompting others to restart shelved IPO plans.

Three days later, Gemini filed for an IPO. Now, TRON has also announced its listing plans.

Circle provided a template, proving that traditional markets are willing to pay a high premium for regulated cryptocurrency exposure, while mainstream investors are eager for blockchain innovations packaged in familiar corporate structures.

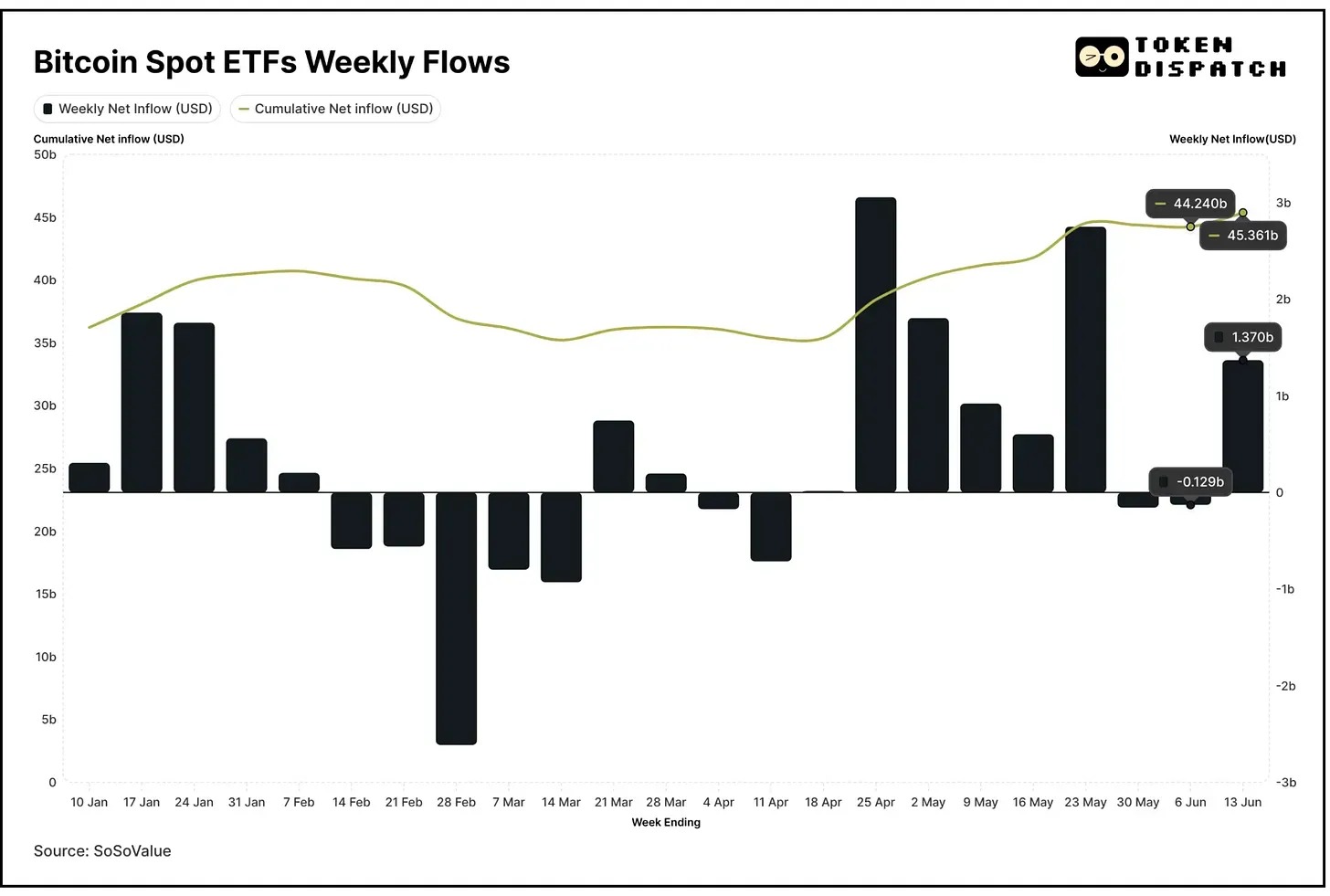

The public has readily accepted cryptocurrency products offered through traditional Wall Street channels. Since January 2024, net inflows into Bitcoin ETFs have exceeded $45 billion.

The stock price of Strategy (formerly MicroStrategy) is several times its Bitcoin holdings: it has a market cap of about $106 billion, while its Bitcoin holdings are valued at around $62 billion. Michael Saylor's Bitcoin bet has encouraged more public companies to pursue treasury investments.

These cases validate a hypothesis: the fastest path to mainstream recognition may not be to turn the world towards holding self-custodied wallets and using DeFi protocols. Instead, the path to mass adoption should go directly through traditional financial infrastructure, making cryptocurrency accessible through channels that people already trust.

Consider the mathematics of adoption. Traditional finance reaches billions, while there are only 560 million global cryptocurrency holders.

When ETFs introduced Bitcoin into 401(k) retirement plans and pension funds, their mainstream penetration in one year surpassed the results of a decade of preaching "not your keys, not your coins."

Companies that have focused on building purely crypto products for years are beginning to pay attention to relevant products that can connect the two worlds. Circle is leveraging stablecoins to create digital payment channels and corporate treasury services. Coinbase has transcended its image as a crypto exchange by building institutional custody and wholesale brokerage services that rival traditional banks.

The IPO path provides what the crypto ecosystem has been lacking: the ability to leverage public market capital to fund these relevant product lines. Need to build enterprise-grade custody solutions? Issue stock. Want to acquire a traditional fintech company? Use stock as currency. Planning to expand into regulated lending or investment management? The credibility of the public market opens doors that crypto-native qualifications cannot.

Why Trust Trumps Ideology

The overtures from traditional finance also address one of the trickiest issues in cryptocurrency: institutional trust. For years, crypto companies have struggled to bridge the credibility gap that technological innovation cannot cross.

When Coinbase went public in 2021, institutions viewed it as a risky bet on an emerging asset class. Today, Coinbase is included in the S&P 500, managing billions in institutional assets, symbolizing the integration of cryptocurrency into the mainstream financial system.

This trust-building mechanism operates through various channels.

The SEC's regulation provides compliance assurances that purely crypto investments cannot match. Quarterly earnings calls and audited financial statements offer transparency that community governance forums cannot reach. When pension fund managers can cite S&P ratings and decades of corporate law precedents, cryptocurrency is no longer a blind faith but an asset allocation decision.

This validation is bidirectional.

Wall Street's acceptance of crypto companies lends legitimacy to the entire industry. When BlackRock actively builds crypto infrastructure and Fidelity offers Bitcoin services for millions of retirement accounts, it becomes difficult to dismiss blockchain technology as a speculative bubble.

Beyond philosophical evolution, there is practical necessity.

After the FTX collapse in 2023, crypto venture funding plummeted by 65%. When the second-largest exchange was revealed to be a house of cards built on customer deposits, investors became cautious about writing checks.

Traditional venture capital, once generous to any business plan with the word "blockchain," quickly dried up. Companies accustomed to investing $50 million in Series A rounds found themselves explaining basic concepts to uninterested investors.

The public market remains open.

Institutional investors who are reluctant to invest in crypto startups are eager to buy shares of crypto companies that are regulated, SEC-compliant, have audited financial statements, and clear business models.

This shift in financing has accelerated the strategic pivot towards relevant products.

Our Perspective

The emerging strategy is to build products that solve real problems, showcase product-market fit through crypto-native channels, and then scale through traditional financial infrastructure.

There may be ideological conflicts, but they do not necessarily lead to problems.

Companies that can navigate this transformation will be able to offer DeFi innovations that combine the reliability of traditional finance. They will provide decentralized advantages to mainstream users who will never manage private keys or understand gas fees, including faster settlements, global accessibility, and programmable money.

The early promise of the crypto industry was to eliminate intermediaries entirely. But most people still want intermediaries, perhaps better ones. Intermediaries that are faster, cheaper, more transparent, and more global than traditional banks, but still intermediaries.

Crypto companies planning to build blockchain empires may not shy away from the purity of ideology due to funding needs. Instead, they may focus on raising capital from the public to build the infrastructure that brings the advantages of cryptocurrency to the next billion users.

From the perspective of adoption, this trust-building mechanism seems to be working: traditional paths are accelerating the acceptance of cryptocurrency faster than purely crypto companies.

Ultimately, those cryptocurrency founders who have achieved product-market fit should not fear knocking on Wall Street's door when the time is right. They seem eager for your participation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。