On June 18, the U.S. Senate officially passed the "GENIUS Act," marking the first time the U.S. government has recognized the compliance legitimacy of crypto assets in legislative form, breaking the policy vacuum caused by the previous ambiguity in regulatory authority between the SEC and CFTC.

Against this backdrop of regulatory positivity, JPMorgan and Coinbase announced significant progress on the same day, focusing on on-chain banking services and tokenized securities, demonstrating the deep integration of traditional finance and the crypto ecosystem.

JPMorgan's Deposits Can Now Be Placed on Base

JPMorgan, one of the earliest and most proactive traditional financial institutions to engage with blockchain, announced the launch of a pilot project called JPMD (JPMorgan Deposit Token). JPMD is an on-chain token representing customer dollar bank deposits, based on a fractional reserve mechanism, and will be deployed on the public chain Base supported by Coinbase.

Naveen Mallela, co-head of JPMorgan's blockchain division Kinexys, stated that the bank will complete its first JPMD transfer in the coming days, moving funds from its digital wallet to the Coinbase platform, paving the way for institutional clients to use the token for on-chain transactions.

The pilot is expected to last several months, marking JPMorgan's further exploration of efficient and secure institutional-grade trading tools through on-chain deposit tokens. The day before, the bank had already applied for the "JPMD" trademark, covering areas including digital asset payments, transfers, and trading services, indicating its intention for long-term application of this tool.

JPMorgan's choice to pilot the issuance of JPMD on Base not only reflects its recognition of Base's security and trading efficiency but also suggests that future institutional clients may directly conduct on-chain fund settlements through Base and the Coinbase ecosystem, injecting a core source of liquidity into the "CeDeFi bridge" created by Coinbase.

Why "Deposit Tokens"?

Although the launch of JPMD has sparked market speculation about its potential entry into the stablecoin market, Naveen Mallela, an executive at JPMorgan's blockchain division Kinexys, stated in an interview with Bloomberg that deposit tokens are a superior alternative for institutional users compared to stablecoins, as they are based on a fractional reserve mechanism and are more scalable.

He pointed out that deposit tokens represent actual dollar deposits in customer bank accounts, operating within the traditional banking system, whereas stablecoins are merely digital representations of fiat currency backed by cash and cash equivalents, with their legal status and operational logic being more detached from the traditional financial system.

At the same time as the JPMD pilot launch, three core executives from JPMorgan have engaged in closed-door discussions with the SEC's crypto special working group, discussing how capital market tools can migrate to public chains, the potential impact of such transformations on market structure, and how institutions should assess the risk control and return models brought by on-chain finance.

According to the meeting minutes released by the SEC, the discussions covered various cutting-edge topics, including digital repurchase agreements, digital debt instruments, and on-chain financing. JPMorgan also clearly stated that it is actively evaluating whether it can form a structural competitive advantage in asset tokenization and on-chain settlement efficiency.

Besides "Dogecoin," You Can Also Buy Stocks on Base

In response to JPMorgan's exploration of on-chain banking systems, Coinbase is also evolving from a trading platform to an on-chain asset infrastructure provider. The company's Chief Legal Officer, Paul Grewal, revealed that Coinbase is applying for a no-action letter from the U.S. SEC to launch tokenized stock trading services for U.S. customers, provided it receives an exemption or permission. If granted, it would mean that SEC staff would not take enforcement action against Coinbase for launching tokenized stock services.

If Coinbase successfully obtains approval for its tokenized stock business, it will achieve an integrated asset flow loop for "stablecoin purchase → on-chain settlement → stock trading → rebate consumption" on the same platform for the first time. This not only challenges the trading entry positions of brokerages like Robinhood and Charles Schwab but may also force these platforms to consider introducing stablecoin payments and on-chain settlement logic, pushing the entire securities industry into the era of on-chain assets.

Tokenized stocks promise faster settlement speeds, longer trading time windows, and lower operational costs. However, U.S. investors currently cannot access such products. Coinbase's new plan indicates that it aims not only to be the "Nasdaq of crypto assets" but also to become the on-chain entry point for traditional securities trading.

In fact, Coinbase's exploration of tokenized stocks is not its first attempt. As early as the S1 filing stage before the company's IPO in 2021, it had planned to tokenize its own stock, COIN, but the plan was shelved due to lack of SEC approval.

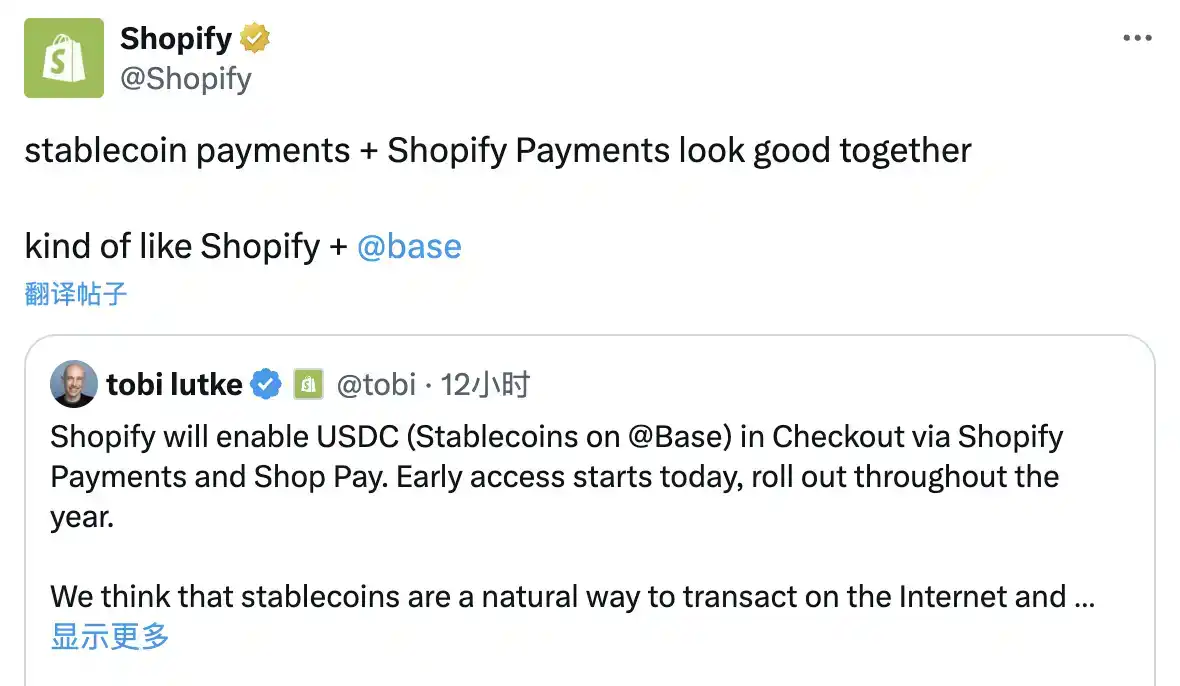

This attempt is the latest move by Coinbase to expand its business beyond crypto assets, aiming to open new revenue sources and promote further institutional adoption. Just last week, Coinbase launched a credit card supported by American Express and partnered with Shopify and Stripe to promote the application of USDC stablecoin payments.

Regulatory uncertainty has long been a major barrier to the widespread adoption of blockchain securities trading. However, with the SEC's plans for the adoption of DeFi and stablecoins, regulation is clearly no longer a concern for Coinbase.

At the same time, competition is intensifying. The news of Coinbase launching tokenized stocks comes shortly after Kraken announced its xStocks project a few weeks ago. The latter has already begun offering on-chain trading services for over 50 stocks and ETFs in European, Latin American, African, and Asian markets. Coinbase needs faster and clearer regulatory pathways to respond to this new round of competition in crypto brokerage.

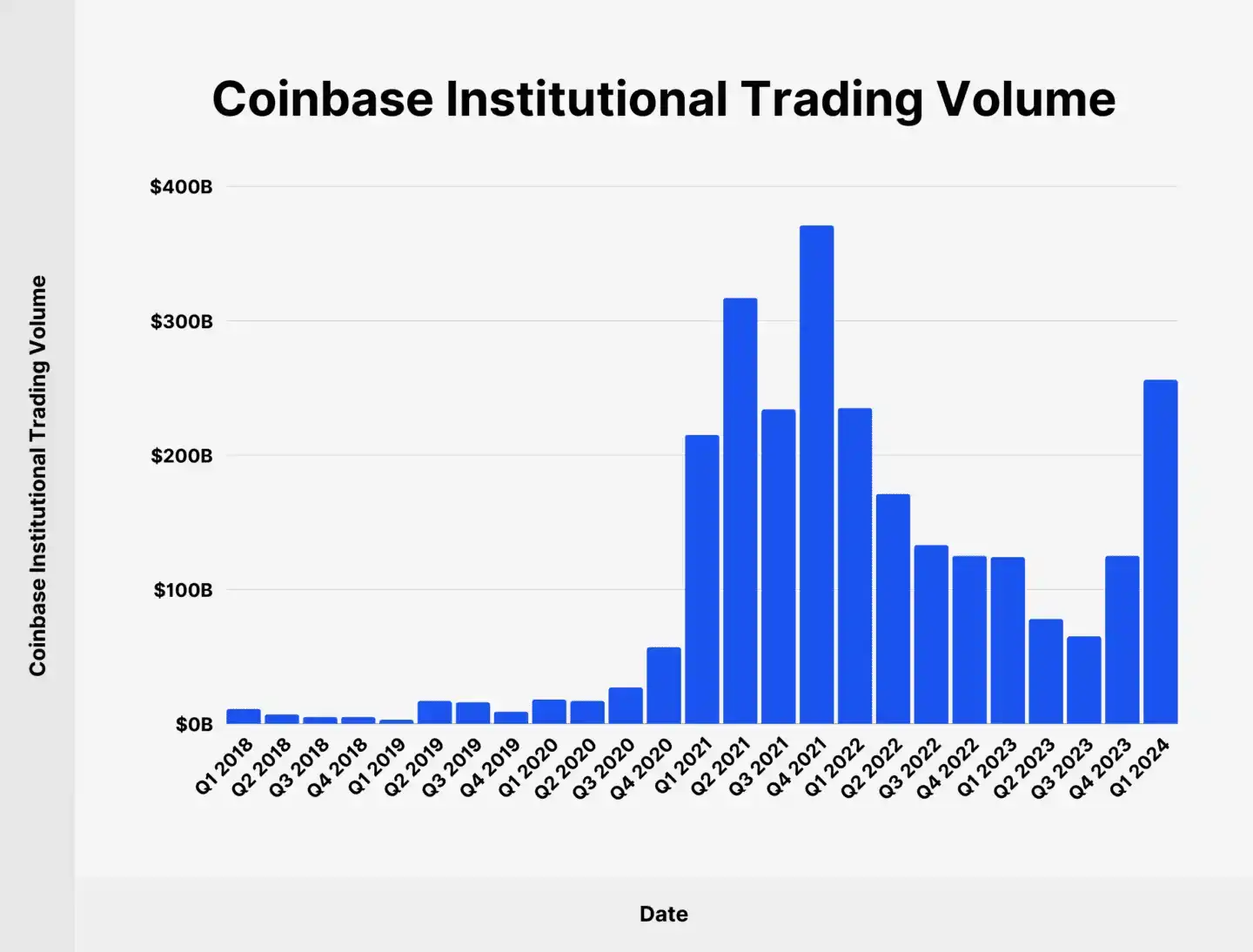

All for Revenue

Statistics show that retail trading accounts for only about 18% of Coinbase's volume, while from 2024 onwards, the trading volume of Coinbase's institutional clients has been steadily increasing (with Q1 2024 trading volume at $256 billion, accounting for 82.05% of total trading volume). As Coinbase integrates DEX on Base, it should be able to introduce significant liquidity for tens of thousands of on-chain tokens on Base. More importantly, many products in the Base ecosystem will have the potential for compliance pathways with the real world through Coinbase.

Related Article: "Coinbase Aims to Be the 'American Binance'"

This month, Coinbase is collaborating with Shopify to support USDC payments on e-commerce checkout pages, entering the cross-border stablecoin payment space. At the same time, it is integrating the DEX on Base into the main Coinbase application, creating a fluid channel between on-chain assets and CeFi users. The most disruptive move is the announcement of launching 24/7 perpetual contract trading features compliant with CFTC regulatory frameworks in the U.S.

All these actions point to a core objective—rebuilding Coinbase's revenue model. As spot trading revenue declines year by year, Coinbase's financial reports indicate that its trading revenue is overly dependent on the crypto market cycle. In this context, derivatives have become a more counter-cyclical source of revenue. By integrating Deribit's liquidity and user base, Coinbase is building a closed loop for derivatives trading aimed at global institutions, and the CFTC endorsement also creates a compliance moat in the U.S. market.

At the same time, Coinbase is leveraging its partnerships with Shopify and Stripe to promote the native use of USDC in e-commerce payment scenarios. Consumers can directly use USDC for payments at Shopify stores, while merchants can choose to settle in stablecoins or local currency. Combined with smart contract custody and API modules on Base, this process requires neither consumers nor merchants to have crypto knowledge, forming a highly scalable "compliant crypto payment engine." Stablecoin trading not only brings on-chain gas fees and settlement fees but also opens up stable income channels for Coinbase targeting small businesses and cross-border e-commerce in long-tail markets.

The collaboration between Coinbase One Card and American Express uses rebates as an incentive, binding users through asset locking and further activating trading behavior on the platform. Although such products still face trade-offs between costs and returns, they reflect Coinbase's strategic vision of gradually integrating "financial services + consumption scenarios."

This multi-pronged approach is not coincidental. In a window of emerging regulatory positivity and gradually improving on-chain settlement infrastructure, Coinbase has chosen to use its platform as a hub to build a multi-dimensional revenue network centered on compliance and characterized by diverse asset flows, from DEX and stablecoin payments to derivatives trading. This logic represents a key turning point for Coinbase's transformation from a crypto exchange to an on-chain financial operating system.

Whether it is JPMorgan's issuance of JPMD based on bank deposits or Coinbase's layout for a tokenized securities platform, both point to the same trend—on-chain finance is entering a period of institutional reconstruction driven by regulation, infrastructure, and mainstream financial institutions.

The passage of the "GENIUS Act," the rising discussion around stablecoins, and the ongoing experiments by major institutions in on-chain market infrastructure mean that crypto finance is no longer a marginal experiment but a realistic choice gradually embedded in the structure of global financial markets, with the boundaries between on-chain and off-chain being progressively dismantled by these pioneers.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。