原创 | Odaily星球日报(@OdailyChina)

作者 | 叮当(@XiaMiPP)

2025年,随着特朗普这位“亲加密”总统回归白宫,GENIUS 法案与 CLARITY 法案的相继提出,为数字资产重新划出监管边界。2月,SEC叫停了对Coinbase长达两年的执法调查,给它卸下了沉重的合规包袱。

借此东风,Coinbase 正在重新定义它在加密世界中的战略角色。它不再是那个“只做现货、讲合规”的交易平台,而是试图以美国监管体系为锚点,全面拓展自己的加密版图。从链下的制度布局,到链上的生态延伸,Coinbase正在逐步搭建起一个横跨交易、衍生品、基础设施与支付全图景的金融生态。

它的扩张逻辑不是单一维度的产品堆叠,而是在合规框架内向多个关键方向同时推进:

推出符合 CFTC 监管框架的永续合约,正式挺进高杠杆衍生品主战场;

将 Base 生态资产通过 DEX 无缝接入 Coinbase App,打破传统上币壁垒;

在卢森堡申请 MiCA 加密牌照,并计划扩展至马耳他,意图布局欧盟市场;

正寻求 SEC 批准推出“代币化股票”,连接链上传统证券交易。

这四项举措分别锚定了不同的制度与资产边界,也串联起 Coinbase 想要构建的未来图景:在不触碰监管红线的前提下,搭建一个跨越中心化金融(CeFi)与去中心化金融(DeFi)、链上与链下的新金融生态。

这一战略背后基于一个明确的逻辑:监管框架越明晰,越利于本土合规企业释放优势;而制度型平台的竞争,最终比拼的不是谁更快,而是谁能在监管秩序内搭建出最大的功能空间。

早年的合规试验田,今日的监管受益者

Coinbase诞生于2012年,那是一个比特币刚突破10美元的野蛮生长期。与许多早期项目不同,它选择了一条独特路径:不发币、不搞IC0,主动拥抱监管,以最“非典型”的方式参与这场去中心化实验。2014年,Coinbase成为首批获得美国多州货币服务业务(MSB)牌照的加密平台;2017年牛市后,面对SEC对IC0的清查和CFTC对衍生品的严格监管,它进一步强化合规体系,谨慎筛选上币资产、控制杠杆风险,并引入法律专家完善风控机制。

2021年,Coinbase登陆纳斯达克,成为首家公开上市的加密公司。这不仅是企业自身的里程碑,也标志着传统金融市场对加密资产的首次正面认可。然而,上市后的Coinbase并未大步向前,而是进入了一个在监管夹缝中谨慎求稳的阶段。FTX崩盘后,美国监管全面收紧,Coinbase一度因未注册证券争议而备受压力,但其透明的财务结构、严谨的合规体系和稳健的风控策略,让它成为少数屹立不倒的“幸存者”。

2025 年,美国监管迎来拐点。得益于特朗普政府的加密货币友好立场以及 GENIUS 和 CLARITY 法案,Coinbase 正以全球视野向前推进。除了在国内市场的发力,Coinbase正在编织一个全球合规网络,以巩固其作为值得信赖的加密货币领导者的地位。6月17日,CEO Brian Armstrong 发文表示,将赴伦敦会见英国政策制定者,呼吁“英国应把握制度先发优势”,发出与欧盟、美国外的第三制度支点接触信号。

永续合约:在高杠杆战场上的合规突围

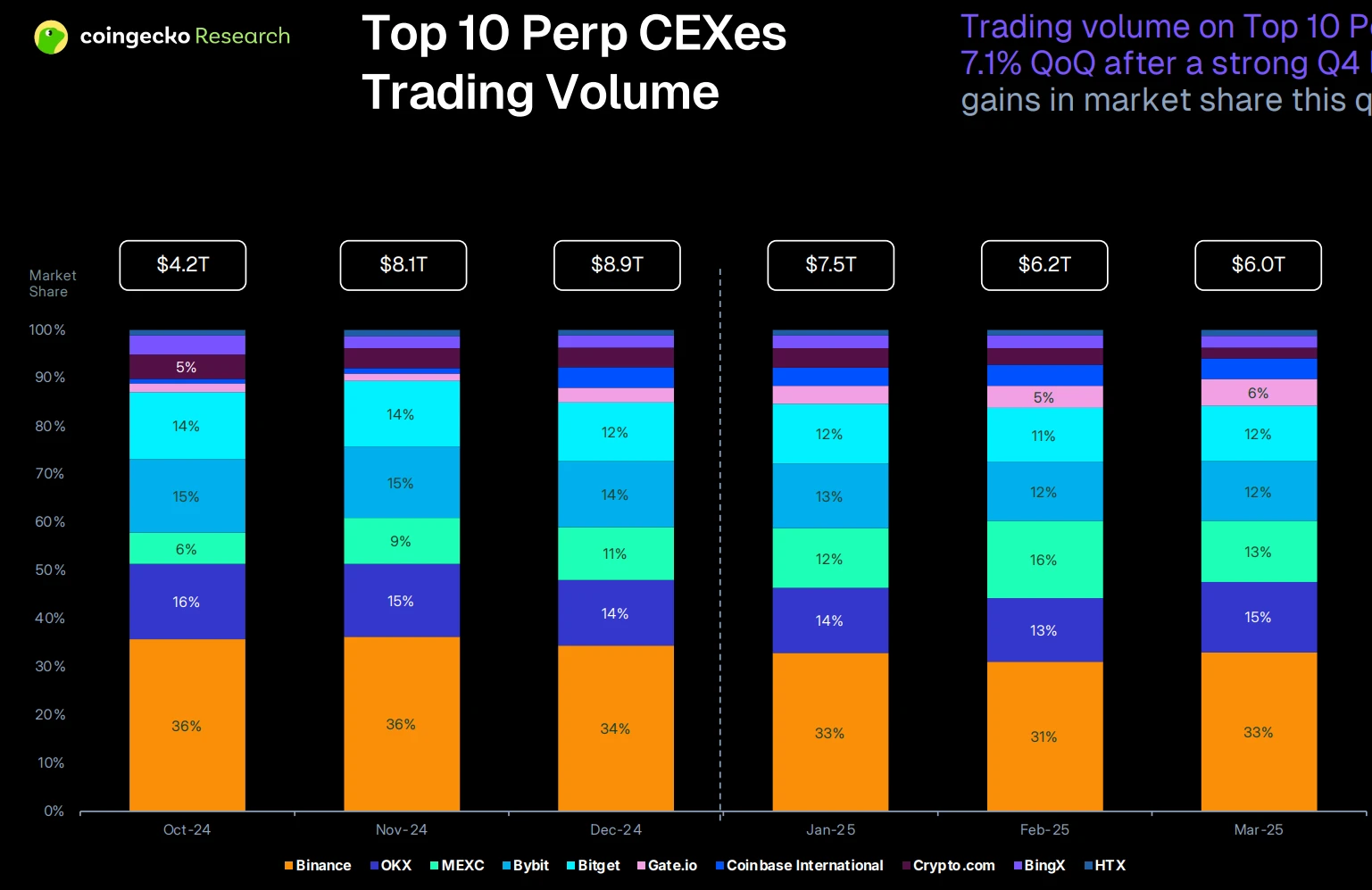

在加密交易领域,永续合约是利润高地,也是监管敏感区。根据 Coingecko 发布的 2025 年 Q1 报告显示,全球前十大交易平台的衍生品交易量累计高达 19.7 万亿美元,是现货市场的三倍。Binance 占据约 32% 市场份额,而 Coinbase 国际站仅占 5%。

但差距的根本并不在技术上,而是战略选择。多年来,Coinbase 始终将合规作为护城河,对高杠杆产品保持克制。这种保守策略让其赢得了 SEC 与 CFTC 的相对信任,也成功完成上市进程,却也错失了一个万亿美元级的市场机会。

如今,这一局面正在改写。近期,Coinbase 宣布获得 CFTC 批准,正式推出合规框架下的永续合约产品,宣布进军高频衍生品赛道。这场“合规+高杠杆”的碰撞,意味着 Coinbase 不再回避利润主战场,而是希望以规则制定者的形象进入竞争核心区。

这不只是“补上短板”的尝试,更是 Coinbase 身份的主动更新。Coinbase 希望在不背离监管初心的前提下,构建一个机构友好、监管认可的衍生品生态,在Binance等平台之外,打造一个“可监管”的全球流动性中心。

Base :从Layer2到战略开放接口

Base 生态是 Coinbase 战略中的一颗新星。2023 年,Coinbase 在 Optimism 的 OP Stack 基础上启动 Base 网络。作为一个不发币的 Layer 2,它试图解决两个问题:第一,帮助开发者用更低门槛的方式部署链上应用;第二,将 Coinbase 的超 1 亿注册用户引导进 Web3,而不是让他们“止步于买入按钮”。

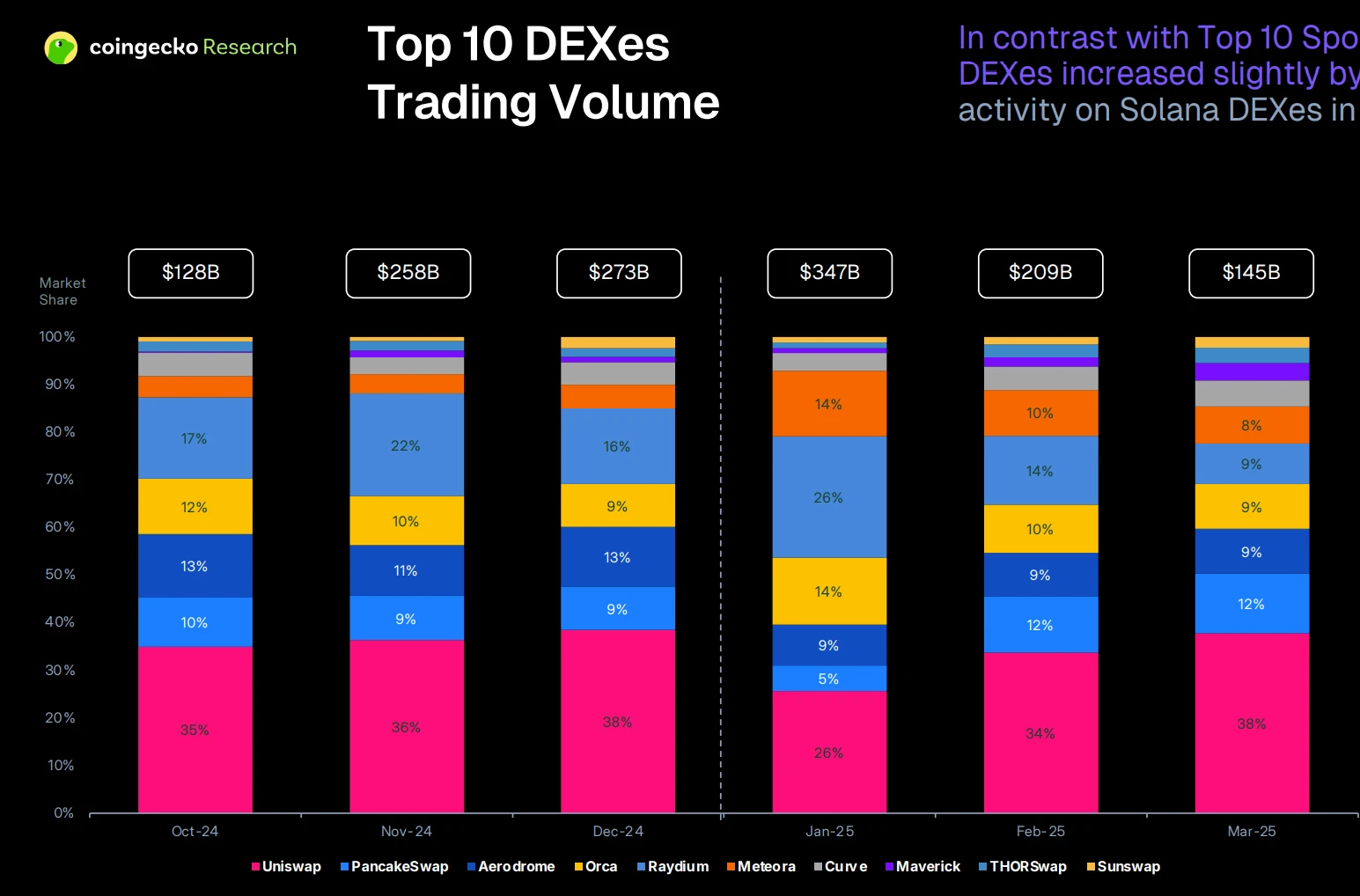

Base的成长是非常迅速的。早期曾靠 Friend.tech、AerodromeFi 等迅速引爆社交与金融赛道热度,也验证了“流量入口 + 链上基础设施”组合的可行性。截至 2025 年 6 月,其总锁仓量(TVL)已达 39.2 亿美元。目前,Base 链上 DEX 交易量跻身前三,市场占比在 13% 至 19% 之间。其中,Aerodrome 作为 Base 原生 DEX,虽起步晚于 Uniswap 和 PancakeSwap,却已占据 9% 至 13% 的市场份额,成为 Base 增长红利的最直接受益者之一。

近期,Coinbase 宣布支持通过 DEX 机制接入 Base 上优质资产,打通“从生态到平台”的路径闭环。用户在Coinbase App上交易的资产,可能来自Base链上的自动化发行与社区定价,而非传统的中心化上币流程。这标志着Coinbase从单纯的资产入口,转型为链上生态的连接器。

Base 的身份也由此发生跃迁:它不再只是一个 Layer 2,而是Coinbase战略中的“生态接口”。它连接开发者、聚合用户、链接产品,同时在链上治理与中心化品牌之间找到平衡。未来,Base有望成为 Web3 生态的枢纽,不仅承载DeFi、NFT等创新场景,还通过与传统金融的对接(如JPMD代币),成为链上资产与现实世界的桥梁。这种开放性与包容性,让Base在Coinbase的版图中扮演了越发核心的角色。

在最新进展中,摩根大通宣布将在 Base 链上试点发行 JPMD 代币(代表美元存款),首笔转账将在数日内完成,仅向机构开放。JPMD 被视为稳定币的合规替代,具备可扩展性,未来或支持计息与存款保险。这不仅印证了Coinbase与传统金融融合的能力,也标志着Base正成为主权资产链上化的重要支点。Coinbase的每一步,都在为区块链与现实世界的深度连接铺平道路。

代币化证券:传统金融的链上镜像

除了拓展加密资产交易,Coinbase 正尝试向更广义的资产范畴扩展。

昨日,Coinbase 首席法务官 Paul Grewal 表示,公司正申请美国证券交易委员会(SEC)批准,推出“代币化股票”交易服务。这意味着传统金融资产如股票将以代币形式在区块链上流通,为传统金融与区块链技术的融合开辟新路径。

若获批,Coinbase 将与 Robinhood、嘉信理财等传统券商展开直接竞争,并可能重塑证券交易的底层逻辑。用户可通过 Coinbase 平台直接交易链上股票,享受区块链技术带来的透明性、高效性和全球可及性。这一举措标志着 Coinbase 的战略转型:从单纯的加密交易平台,进化为核心的链上证券基础设施,成为连接中心化金融(CeFi)与传统金融(TradFi)的关键纽带。

若 SEC 批准该计划,Coinbase 将完善其在传统金融市场的战略布局。这不仅为加密用户提供更多样化的资产选择,还将吸引传统投资者进入区块链生态,促进链上与链下金融体系的深度融合。此举既是 Coinbase 对未来金融图景的前瞻性探索,也是在严格监管环境中推动制度创新的有力体现。

Coinbase One:用户端的加密入口

在面向 C 端用户体验方面,Coinbase 正在通过订阅体系强化其金融服务闭环。Coinbase 现推出全新订阅等级 Coinbase One Basic,月费 4.99 美元或年付 49.99 美元,包含每月 500 美元免手续费交易额度、USDC 年化 4.5% 收益、账户安全保障等功能。

此外,年付用户将于今秋可申请 Coinbase One 信用卡,支持美国运通网络,消费返还最高 4% 比特币。该卡意图拓展加密资产的现实支付场景,进一步打通链下消费路径。Coinbase One 成为 Coinbase 搭建合规、稳定、长期可持续的用户金融入口的重要支点。

结语:制度化扩张的持久战

Coinbase的扩张之旅,早已超越了传统交易所的转型框架,而是一场在制度轨道上重塑金融版图的宏大实践。它既要守住链下监管的信任,又要拥抱链上创新的无限可能;既要为超1亿用户打造简单易用的产品体系,又要与SEC、CFTC、MiCA等监管机构争夺规则制定的话语权。

这不是一场快节奏的“速度赛”,而是一场考验耐力与智慧的持久战。Coinbase的每一步都在回答一个核心命题:如何在监管与创新之间找到平衡,构筑一个既合规又开放的新金融秩序?

未来,Coinbase能否以美国监管体系为根基,完成产品能力与场景边界的全面拓展,仍需时间验证。但它已迈出关键一步:成为CeFi与DeFi之间最具制度信任的桥梁,为区块链技术融入全球金融体系提供了一个可复制的样本。在这个充满变数的时代,Coinbase的探索不仅是企业的自我进化,更是对区块链与现实世界融合路径的深刻思考。

它的故事,仍在书写。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。