Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

On June 10, under the leadership of new President Lee Jae-myung, South Korea's ruling Democratic Party officially proposed the draft of the "Basic Law on Digital Assets", which aims to allow qualified domestic companies to issue stablecoins.

The bill clearly states that companies with a registered capital of no less than 500 million won (approximately $368,000) and full reserves can legally apply to issue stablecoins pegged to the Korean won. This move marks South Korea as potentially the first major economy in Asia to officially allow the issuance of non-bank stablecoins, laying the groundwork for its "institutional repositioning" on the global crypto map. Meanwhile, the market reacted quickly: KakaoPay's stock price surged by 18%, marking the largest single-day increase since early 2024; local leading exchanges like Upbit and Bithumb are also widely seen as potential beneficiaries.

However, from a broader policy and industry perspective, is South Korea taking steps to create the next "crypto-friendly country model"?

What has South Korea done in crypto so far?

Legalization of Stablecoins: From Institutional Void to Regulatory Leadership

Currently, the global stablecoin market is still dominated by dollar-pegged products, especially USDT and USDC.

According to data from the Bank of Korea, in the first quarter of 2025, the trading volume of dollar stablecoins on South Korea's five major exchanges (such as Upbit and Bithumb) reached 57 trillion won, with dollar stablecoins accounting for over 80%.

For a long time, this structure has satisfied the demand for trading liquidity on one hand, while also raising systemic concerns regarding monetary sovereignty, security compliance, and foreign exchange outflows on the other.

Therefore, the introduction of the "Basic Law on Digital Assets" is seen as the "starting gun" for Lee Jae-myung to fulfill his campaign promises.

Its core intention is not to provide short-term support for project parties, but to reduce dependence on dollar stablecoins like USDT/USDC through a domestic stablecoin system, achieving a return of financial sovereignty.

This is not only a regulatory adjustment but also a strategy for digital sovereignty of the local currency.

ETF, Pension Funds, and Regulation: Forming an Institutional Moat

In Lee Jae-myung's policy vision, stablecoins are not isolated tools but part of a financial combination that advances alongside ETFs, pension funds, and a national regulatory system:

Promote the establishment of BTC/ETH spot ETFs;

Allow the $884 billion national pension fund to allocate crypto assets;

Establish a "Digital Asset Regulatory Bureau."

These measures collectively point to a core logic: integrating crypto assets into the national financial governance system and completing the transformation of "asset formalization." In his view, "legitimacy + security + sustainability" is the foundation for crypto assets to enter the national financial system.

Shift in Regulatory Attitude: Central Bank Cautiously Accepts, Payment Division Emerges

Although Bank of Korea Governor Lee Chang-yong has publicly expressed concerns, stating that "the issuance of stablecoins by non-bank institutions may impact monetary policy control," his latest statements indicate a softening of this stance—“The Bank of Korea will cooperate with relevant institutions to develop a unified regulatory framework and prevent it from being used to evade foreign exchange controls.”

Notably, the Bank of Korea has participated in the BIS-led Agorá project (a CBDC and tokenized bank deposit experimental program), indicating a structural shift in its strategic understanding of new financial infrastructure.

It is foreseeable that the institutional division of "stablecoin issuance belongs to the FSC, monetary control belongs to the central bank" is taking shape. I believe this regulatory collaboration model may serve as a reference for other countries.

Another concern is that the "kimchi premium" may hide inflated liquidity and systemic risks. Additionally, under the backdrop of overlapping regulatory powers, stablecoins still need to overcome multiple hurdles such as "central bank coordination," "foreign exchange review," and "anti-money laundering controls" from proposal to implementation.

Why might South Korea stand out?

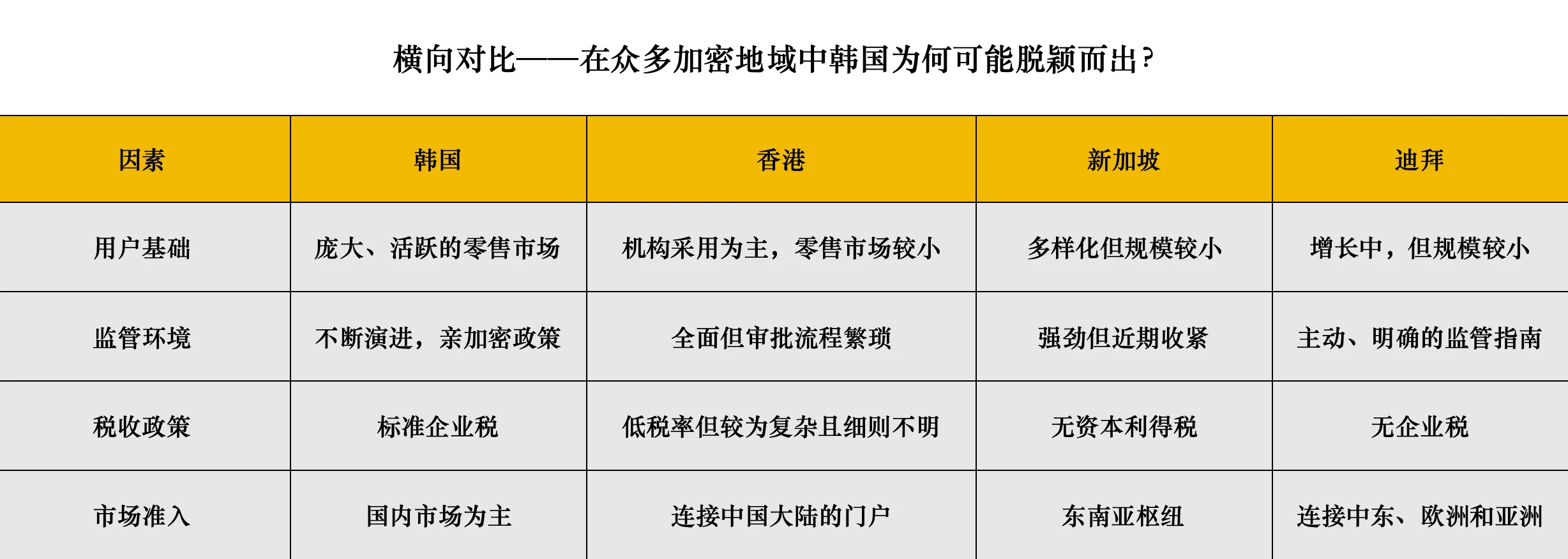

As places like Hong Kong, Singapore, and Dubai compete to become crypto havens, South Korea is exploring another path as a "financial powerhouse":

First, South Korea has a native advantage—a dual drive of user origin and institutional innovation:

A large retail user base provides entrepreneurs with market depth, while the new government's policy support lowers entry barriers and promotes innovation. This dual advantage positions South Korea at the forefront of retail-driven crypto businesses (such as trading platforms and stablecoin projects).

Secondly, with the pro-crypto President Lee Jae-myung in office, the policy dividends may reshape the market landscape:

The legalization of stablecoins is just the beginning. If the ETF approval, pension fund entry, and unified regulatory mechanisms are successfully implemented, South Korea is expected to become "the first economy in Asia to truly integrate crypto into the national financial mainstream." Furthermore, leading exchanges in South Korea (like Upbit and Bithumb) are likely to further solidify their positions under these policy dividends. The implementation of new policies may attract more domestic and foreign companies, pushing South Korea to become a core node in Asia's crypto industry. In contrast, while Hong Kong and Singapore have taken the lead, South Korea's potential in retail markets and policy flexibility is more explosive.

User origin provides a market foundation for entrepreneurs in South Korea, while institutional innovation creates development opportunities through policy support. In the context of fierce competition for crypto status among countries and geopolitical reshaping, South Korea is likely to stand out from the pioneers and become a key player in the global crypto industry.

However, this process will not be smooth—tensions between technological innovation and central bank control, as well as between retail speculation and regulatory responsibility, determine that South Korea's crypto policy still needs to find a new balance between "regulation and market."

The next stop is institutional consensus, not policy frenzy.

Enthusiasm and Worries Coexist

Multiple Parties Anticipate the Institutional Benefits of Stablecoins

South Korea leads the world in digital asset participation, with about 1/3 of the population (18 million people) being crypto investors, and the total trading volume of crypto assets in South Korea once surpassed that of the combined KOSPI/KOSDAQ. According to data from the Financial Intelligence Unit (FIU) of South Korea, 78% of high-net-worth crypto holders are investors over 40 years old, with a noticeable increase in holdings among middle-aged and elderly investors, and their asset allocation tendencies are also changing.

For this group of users, the legalization of stablecoins will bring: lower transaction costs (reducing exchange/transfer steps); higher certainty in local currency transactions (avoiding exchange rate fluctuations); clearer tax and reporting pathways.

For local fintech platforms like KakaoPay and Naver Pay, the issuance of stablecoins means new product expansion paths and the potential for building user stickiness. The market generally expects these tech companies to be among the first to apply for compliance licenses.

Beware of the "Dual Misalignment" of Policy and Asset Bubbles

While the industry warmly welcomes the policy, analysts have also expressed cautious voices.

A report from JPMorgan pointed out that the short-term surge in stock prices of companies like KakaoPay lacks fundamental support, and the institutional benefits brought by Lee Jae-myung's policies have yet to materialize;

Some South Korean economists warn that the legalization of stablecoins should simultaneously introduce multi-dimensional safeguards such as "reserve information disclosure," "cross-border audit mechanisms," and "mandatory KYC interfaces" to avoid becoming a new breeding ground for speculation.

Another lingering concern is that all of this is less than three years since the collapse of Terra's Luna.

Conclusion: Institutional Benefits Are Not Short-Term Gains, But Long-Term Competitiveness

The signal of South Korea's legalization of stablecoins is by no means an isolated measure. It connects to a deep logical transformation of digital assets moving from the margins to regulation, from capital tools to financial infrastructure.

Compared to the past policy vacuum and gray growth, today's South Korea is entering a "national regulatory leadership cycle"—neither a Web3 free utopia nor a high-pressure blocking path, but a localized experiment in institutional compatibility.

In the next three years, the policy driving force of the crypto industry may no longer come from the United States or Hong Kong, but from who can first establish a "dynamic balance between regulation and market" in areas such as domestic stablecoins, ETF systems, and compliant pension mechanisms.

South Korea may be at the forefront of this new journey.

Related Reading

After Singapore's "Guest Removal," is Hong Kong becoming the "East Asian Crypto-Friendly Capital"?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。