Bitcoin and Ether Funds See Fresh Capital Injections as Crypto ETF Sentiment Stays Bullish

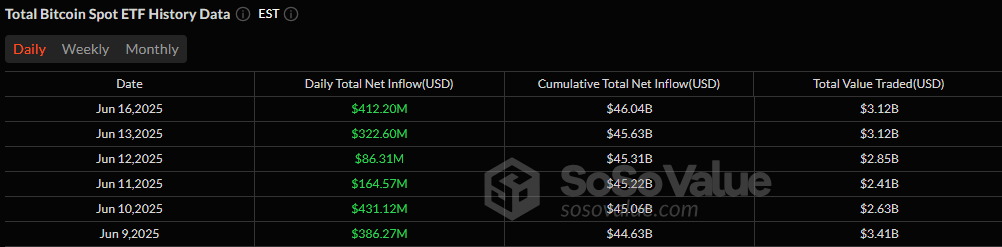

Crypto-focused ETFs started the week on a strong note, as bitcoin exchange-traded funds (ETFs) enjoyed their sixth consecutive day of net inflows, drawing a hefty $412.2 million. The appetite for spot bitcoin products remains undeterred as institutional investors keep piling in.

Leading the day’s charge, Blackrock’s IBIT secured $266.6 million, maintaining its status as the go-to bitcoin ETF for big players. Fidelity’s FBTC followed with $82.96 million, while Bitwise’s BITB added $41.38 million to its books.

Source: Sosovalue

Minor but positive flows were also recorded by Grayscale’s GBTC ($12.84 million), Grayscale’s Bitcoin Mini Trust ($4.81 million), and Ark 21Shares’ ARKB ($3.61 million). Remarkably, no bitcoin ETFs posted outflows for the day, a bullish sign for the sector. Total value traded hit $3.12 billion, pushing total net assets to $132.5 billion.

Meanwhile, ether ETFs shook off Friday’s brief outflow and returned to green territory with a $21.39 million net inflow. Blackrock’s ETHA led with $16.08 million, and Fidelity’s FETH added $5.31 million. No ether ETF recorded an outflow, extending optimism in the sector. Ether ETF trading volume stood at $425.65 million, with total net assets climbing to $10.56 billion.

The consistent inflow momentum signals renewed institutional confidence in crypto ETFs as the market eyes a strong finish to the month.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。