There is no way to truly understand innovation or envision the future without understanding regulation.

Written by: Sima Cong, AI Channel

This report does not involve valuation analysis or token analysis; it focuses on the clarification of investment logic rather than typical token price trend analysis in token economics.

What to Envision?

Do not be numb or complacent; embrace the trend. We can envision the following:

l A new landscape for the cryptocurrency asset market;

l The integration of traditional finance and cryptocurrency businesses;

l Innovative businesses;

l The benefits brought by regulatory recognition;

l The expansion of use cases, which will extend to broader business models and profit models. For example, an app that can instantly convert any stablecoin into another institution's stablecoin and implement the transaction, which is almost unimaginable in the traditional financial world (provided that the app user completes KYC and AML).

The driving force behind the progress of governments, regions, and businesses worldwide: staying one step ahead.

As for mainland China, it can leverage the offshore RMB stablecoin window supported by Hong Kong to reach the world.

However, it is crucial to note: without understanding regulation, one cannot truly understand innovation or envision the future. Only by understanding the value of regulation can we truly grasp the value of innovation. Regulation not only addresses current issues but also shapes stability for the future norm, and this stability and predictability are among the essential reference standards for investment.

The Underlying Logic in History: Regulatory Recognition and Legitimacy are Necessary Conditions for Industry Growth

Regulation itself is not a stumbling block to innovation but a necessary condition for industry development.

There are countless examples; history tells us that regulation is not a hindrance to innovation but a necessary condition for the industry to transition from marginalization to mainstream acceptance, ultimately leading to industry prosperity and continuous innovation driven by regulation.

Internet Finance (FinTech) — Taking the UK's Fintech Regulatory Sandbox as an Example

After the 2008 financial crisis, the traditional banking system was called into question, and new financial services such as P2P lending, digital payments, cryptocurrencies, and blockchain rapidly emerged. With a regulatory void, many startups grew wildly, leading to frequent risk events (such as the Lending Club scandal and the bankruptcy of Mt. Gox). The UK's Financial Conduct Authority (FCA) launched the "Regulatory Sandbox," allowing startups to test new products or services in a controlled environment. The UK became one of the global Fintech hubs; London became Europe's largest Fintech investment destination; a number of world-class fintech companies such as Revolut, Monzo, and TransferWise (now Wise) emerged; and countries around the world followed suit, forming a global trend of "sandbox regulation."

To this day, Hong Kong's regulatory authorities still use the regulatory sandbox approach for the market entry of stablecoins.

In 2022, the collapse of USDT triggered a credit crisis for stablecoins, leading many to question whether USDT had sufficient dollar reserves. In reality, USDT had flaws; this automatic trading mechanism did not truly understand the logic of finance, especially liquidity crises. In 2023, the Silicon Valley Bank crisis caused a significant drop in USDC, as a large portion of its assets were held in Silicon Valley Bank. These two events made more people realize that stablecoins are not safe and need to be brought under regulation.

A Concrete Scene in Recent Developments

Walmart and Amazon are exploring the issuance of their own stablecoins.

Ø Stablecoins are expected to save merchants billions in fees and provide faster payment processing.

Ø Whether to proceed depends on the regulatory framework for stablecoins currently being discussed in the U.S. Congress under the "Genius Act."

Ø Imagine a stablecoin issued by merchants becoming as ubiquitous as "coupons," which not only reduces costs and speeds up payments but can also serve as a promotional tool for the merchants' main business.

This would transfer a large volume of cash and card transactions outside the traditional financial system, saving them billions in transaction fees.

Walmart, Amazon, and other multinational giants are currently exploring whether to issue their own stablecoins in the U.S.

The Expedia Group and other large enterprises (such as airlines) have also discussed plans to issue stablecoins.

Currently, stablecoins are used to store cash or purchase other cryptocurrency tokens. They should maintain a one-to-one exchange ratio with the dollar or other fiat currencies, backed by cash or cash-like assets (such as U.S. Treasury bonds).

The final decision of these retailers will depend on a bill called the "Genius Act," which will begin to establish a regulatory framework for stablecoins. The bill recently passed another procedural hurdle but still needs to be approved by both the Senate and the House of Representatives.

Stablecoins allow merchants to bypass traditional payment channels, which cost them billions in fees each year, including fees paid when customers shop with credit cards.

Traditional payment settlements can take days, slowing down the speed at which merchants receive sales proceeds. Stablecoins are expected to enable faster settlement processes, which is particularly attractive for merchants with overseas suppliers.

For years, merchants have been trying to introduce alternative payment methods beyond card payments to escape the card system dominated by Visa and Mastercard, although most efforts have not made significant progress.

According to The Wall Street Journal, large banks have also been considering forming their own stablecoin alliances.

In recent years, merchant industry organizations have been meeting with lawmakers to push for the passage of the "Genius Act." These organizations, led by the "Merchant Payment Alliance," state that the regulatory framework for stablecoins will provide merchants with an alternative payment method that significantly reduces costs and competes with Visa and Mastercard.

From this, we can clearly see a true narrative: a bill called the "Genius Act," which represents the recognition and legitimacy granted by centralized regulation.

What Signal Does This Send?

A clear signal: digital finance will bid farewell to wild growth and enter a mature development stage based on "compliance."

The Logic Behind This

As we can see, the two significant price surges of Bitcoin that broke historical highs were driven by the recognition and legitimacy granted by centralized regulation. One was the approval of the spot Bitcoin ETF, and the other was Trump's election, which continuously promised cryptocurrency-friendly regulatory policies.

The approval of the spot ETF provided a legitimate basis for a continuous flow of liquidity, and Trump's election led to everything we see now, including the "Genius Act" bill, which essentially represents a critical stage where centralized regulation has transitioned from past non-recognition or even suppression to recognition and legitimacy.

The only question is:

In the face of this unstoppable trend, where are the opportunities? What are they?

The Trend is Visible

Ant Group: Submit the application for the Hong Kong stablecoin license as soon as possible.

The Hong Kong "Stablecoin Ordinance" will take effect on August 1. Singapore's Monetary Authority released a stablecoin regulatory framework in August 2023.

On June 12, 2025, Ant Group responded that it is accelerating investment and expanding cooperation in global treasury management, putting its AI, blockchain, and stablecoin innovations into real and reliable large-scale applications.

Ant Group stated, "We welcome the Hong Kong Legislative Council's passage of the Stablecoin Ordinance, which will take effect on August 1. After the relevant channels are opened, we will submit our application as soon as possible, hoping to contribute more to building Hong Kong as an international financial center."

Ant Group has already initiated the application for a Hong Kong stablecoin license and has had multiple rounds of communication with regulators. It is reported that Ant Group has listed Hong Kong as its global headquarters this year and has already completed preliminary trials in the regulatory sandbox in Hong Kong.

Stablecoins, as a bridge connecting traditional finance and tokenized assets, have vast market potential. Their core value lies in the expansion of use cases and the construction of compliance.

The Hong Kong "Stablecoin Ordinance (Draft)" completed its third reading in the Hong Kong Legislative Council on May 21, 2025, was signed by the Chief Executive, published in the Gazette on May 30, and will officially take effect on August 1, 2025. The transition period arrangements are expected to be completed within 2025, with the first batch of licenses issued.

On August 15, 2023, the Monetary Authority of Singapore (MAS) announced the final version of the stablecoin regulatory framework, becoming one of the first jurisdictions globally to incorporate stablecoins into the local regulatory system. MAS allows the issuance of stablecoins pegged to a single currency, which can be the Singapore dollar (SGD) or G10 currencies. G10 currencies include the Australian dollar, Canadian dollar, British pound, euro, Japanese yen, New Zealand dollar, Norwegian krone, Swedish krona, Swiss franc, and U.S. dollar. MAS does not allow the issuance of stablecoins pegged to a basket of currencies or those linked to digital assets and algorithmically issued stablecoins.

On June 10, 2025, less than a week after being elected, South Korean President Lee Jae-myung swiftly fulfilled his campaign promise—allowing local companies to issue stablecoins. According to media reports, the Democratic Party, to which Lee belongs, proposed the "Basic Digital Asset Act," which stipulates that South Korean companies with a capital of over 500 million won (approximately $368,000) can issue stablecoins.

The Wealth Effect is Real

The world's second-largest stablecoin, Circle, listed on the New York Stock Exchange, with a first-day increase of 168.48%.

On June 5, local time, Circle, the issuer of the world's second-largest stablecoin USDC, officially listed on the New York Stock Exchange under the stock code CRCL, with an issuance price of $31 per share. Circle's stock triggered multiple trading halts after opening, with a first-day increase of 168.48%, closing at $83.23, with a total market value of $18.4 billion. The trading volume that day reached 47.1 million shares, approximately $3.941 billion.

As of March 31, 2025, the value of USDC held by Circle was $59.976 billion. Circle's business model is very clear; the company issues the USDC stablecoin pegged 1:1 to the dollar, investing the $59.976 billion deposited by users in short-term U.S. Treasury bonds and cash to earn risk-free returns. In 2024, it earned approximately $1.6 billion in reserve income, which is interest income, accounting for 99% of Circle's total revenue.

In 2024, the total trading volume of stablecoins reached $27.6 trillion, surpassing the annual transaction total of Visa and Mastercard, which is approximately $25.5 trillion, for the first time. Currently, the total market capitalization of stablecoins worldwide has reached $248 billion, with Circle's USDC accounting for about 25% of the market share, totaling $60 billion, second only to Tether's USDT, which holds about 61% of the market share. In addition to USDC, Circle also issues and manages the euro stablecoin EURC, with a market capitalization of approximately $224 million, and is actively expanding into markets in the Middle East, Africa, and Latin America.

Circle was founded in October 2013 in Boston, USA, initially creating a payment product called Circle Pay. In 2018, Circle co-founded the Centre consortium with Coinbase and launched the stablecoin USDC. In August 2023, the Centre consortium was dissolved, and Circle acquired the remaining shares from Coinbase, becoming the sole issuer and manager of USDC.

The Liquidity in the Imagination Space is Vast

U.S. Treasury Secretary Janet Yellen: The market value of stablecoins pegged to the dollar could reach $2 trillion or more.

Besen, who specialized in foreign exchange trading during his hedge fund career, stated that there have been many instances in history where the dollar's status was questioned, but as new dynamics inject fresh momentum into the dollar, these concerns will ultimately be alleviated.

This administration is committed to maintaining and strengthening the dollar's status as the reserve currency, Besen said during a Senate Appropriations Committee hearing. He emphasized a bill currently being drafted in Congress that would require dollar stablecoins to be backed by high-quality assets such as Treasury bills.

Besen mentioned that it is estimated that the market value of stablecoins could reach $2 trillion in the coming years. Other forecasts are more conservative; for example, Citigroup analysts stated earlier this year that their baseline prediction is that stablecoins could purchase over $1 trillion in U.S. Treasury bonds by 2030.

The Hong Kong Monetary Authority (HKMA) Deputy Chief Executive, Yu Guoheng, stated at the 2025 Caixin Summer Summit held on June 13 that in five years, the proportion of tokenized transactions in financial markets will significantly increase, and regulatory authorities need to proactively build a tokenized clearing platform, with stablecoins being the core clearing unit.

A Return to the Essence of Regulation and Top-Level Design Logic

Without understanding regulation, one cannot truly understand innovation or envision the future.

Currently, global stablecoin regulation is characterized by accelerated standardization and regional differentiation. Major financial jurisdictions such as the United States, Hong Kong, the European Union, and Singapore have intensively launched or implemented regulatory systems for stablecoins over the past two years, marking a new phase in global digital asset regulation. The establishment of these regulatory frameworks not only reshapes the compliance requirements for stablecoin issuance and operation but also directly impacts the landscape of the cryptocurrency market.

Regulatory Logic and Goals: The four regions have different focuses in their regulatory objectives. The U.S. clearly positions stablecoins as "payment tools" through the Genius Act, emphasizing the maintenance of the dollar's leadership in the digital economy, making dollar stablecoins global digital payment tools. Hong Kong focuses on enhancing the competitiveness of its international financial center by regulating the market to attract institutional participation and reserving space for the future issuance of offshore RMB stablecoins. The EU's MiCA framework centers on single market rules to eliminate regulatory differences among member states while emphasizing financial stability and consumer protection. Singapore focuses on value stability assurance, ensuring the reliability and safety of single-currency stablecoins through high standards.

There are significant differences in the definition and classification of stablecoins across regions. Hong Kong adopts the concept of "designated stablecoins," focusing on regulating stablecoins pegged to fiat currencies or officially designated value units. The EU uses a binary classification, distinguishing between Electronic Money Tokens (EMT) and Asset-Referenced Tokens (ART), each subject to different rules. Singapore limits its regulatory scope to single-currency stablecoins, excluding algorithmic stablecoins or multi-currency basket stablecoins. The U.S. Genius Act uniformly defines "payment stablecoins" but explicitly excludes them from the categories of securities and commodities.

In terms of licensing system design, the four regions exhibit different characteristics. Hong Kong implements a unified licensing management system, with the HKMA centralizing approvals, requiring a minimum paid-up capital of HKD 25 million, significantly higher than other regions. The U.S. adopts a dual-track system of federal and state regulation, with federal oversight for large issuers (market capitalization over $10 billion) and state-level regulation for smaller issuers. The EU relies on member state authorization, requiring EMT issuers to be electronic money institutions or credit institutions. Singapore has not implemented a licensing system but has effectively created entry barriers through high standards.

There is a high degree of consensus on core risk control measures among the four regions. Hong Kong, the EU (EMT), and Singapore all require 100% reserve backing and asset segregation. The U.S. requires high-quality liquid asset backing but does not specify a ratio. Regarding redemption rights, Hong Kong requires licensed entities to redeem under "reasonable conditions"; the EU mandates that EMTs must be redeemable at face value for free; Singapore requires redemption within five working days; the U.S. Genius Act requires redemption at face value but does not specify a time limit.

The regulatory frameworks of Hong Kong and the EU have significant extraterritorial effects. Hong Kong's regulation covers offshore issuers pegged to the Hong Kong dollar and stablecoin activities "actively promoted" to the public in Hong Kong. MiCA, as a unified regulation of the EU, applies to the entire single market. The U.S. promotes cross-border cooperation through a reciprocity agreement mechanism. Singapore mainly regulates domestic activities, with limited extraterritorial applicability.

The U.S. stablecoin regulatory framework is undergoing a significant transformation, shifting from a fragmented regulatory approach to unified legislation. After the Trump administration took office, the pace of developing cryptocurrency regulatory policies accelerated significantly, aiming to change the previous situation of overlapping regulatory agencies and unclear regulatory frameworks. In early 2025, the U.S. proposed two key bills at the federal level—the "Stablecoin Transparency and Accountability for a Better Ledger Economy Act" (STABLE Act) and the "Guiding and Establishing a National Innovation for U.S. Stablecoins Act" (GENIUS Act), establishing a new paradigm for U.S. stablecoin regulation.

Regulatory Framework Design: The U.S. adopts a dual-track regulatory model of federal and state oversight. According to the Genius Act, federal oversight is provided by the Office of the Comptroller of the Currency (OCC), the Federal Reserve, and other agencies for "federally qualified non-bank issuers"; state regulatory agencies oversee "state qualified issuers," but they must demonstrate to the Treasury that their regulatory framework is "substantially similar" to the federal framework; otherwise, the issuer must switch to federal regulation. Notably, the act establishes a scale threshold—stablecoin issuers with a market capitalization exceeding $10 billion will be mandatorily included in the federal regulatory framework. This design aligns with the traditional state-level financial regulatory authority in the U.S. while ensuring that large stablecoin systems are subject to unified regulation.

Restrictions on Issuers: The act explicitly states that only licensed payment stablecoin issuers can issue stablecoins pegged to fiat currencies (such as the dollar), and any other entities issuing such stablecoins are committing illegal acts. The act also clarifies the legal attributes of stablecoins, stating that payment stablecoins do not fall under the categories of securities or commodities, thereby avoiding their applicability to other financial regulatory laws. This clarification of legal attributes resolves the long-standing regulatory uncertainty troubling the U.S. stablecoin market, clearing obstacles for compliant issuance.

Any institution engaging in "regulated stablecoin activities" in Hong Kong must apply for a license from the Financial Management Commissioner. License applicants must be registered companies in Hong Kong or recognized institutions with a registered office in Hong Kong and must meet a series of strict conditions:

Financial Requirements: Maintain a minimum paid-up capital of HKD 25 million and hold sufficient high-liquid reserve assets (such as government bonds, bank deposits) to ensure a 1:1 redemption capability for stablecoins.

Reserve Segregation: Customer assets must be properly segregated and not used for other purposes.

Management Capability: Must have a sound corporate governance structure, and the management team must demonstrate expertise in blockchain technology, financial regulation, and risk management.

Technical Security: The distributed ledger technology platform must pass third-party security audits to ensure system security and processing capability.

Redemption Assurance: Must handle redemption requests from stablecoin holders at face value under reasonable conditions without imposing excessively stringent conditions.

Retail Investor Protection: The regulations stipulate that only fiat stablecoins issued by licensed institutions can be sold to retail investors, and only licensed stablecoins are allowed to advertise. This design significantly reduces the risk of retail investors encountering fraud or improper sales, representing a relatively strict investor protection measure in global stablecoin regulation.

Transition Period Arrangements: To ensure a smooth market transition, the regulations set up a flexible mechanism: within the first three months of effectiveness, institutions already engaged in regulated activities in Hong Kong can continue to operate; if they submit a license application within the first six months and it is accepted, the transition period can be extended to six months; the HKMA can also approve temporary licenses. Currently, five institutions, including JD Coin Chain, Yuan Coin Technology, and Standard Chartered Bank, have entered the HKMA's "sandbox" program and can continue to operate during the transition period.

MiCA divides stablecoins into two categories for differentiated regulation:

Electronic Money Tokens (EMT): Pegged to a single fiat currency (such as the euro) and used as payment tools. Issuers must issue at face value 1:1 and are prohibited from paying interest. Holders can redeem at face value for free at any time.

Asset-Referenced Tokens (ART): Pegged to multiple assets (such as currencies, commodities, cryptocurrencies, etc.) and regarded as investment tools. Issuers must ensure the segregation of reserve assets, but the redemption time and value assurance are weaker than EMT.

EMT must be 100% backed by fiat cash or cash equivalents; ART must be supported by diversified assets but must meet minimum liquidity requirements. All reserve assets must be strictly segregated and not mixed with the issuer's own assets.

The Monetary Authority of Singapore (MAS) established the stablecoin regulatory framework on August 15, 2023:

Asset Segregation: Reserve assets must be effectively separated from the issuer's own assets and managed by independent custodians.

Redemption Rights: Holders have the right to redeem stablecoins at face value within five working days.

Audit Transparency: Reserve assets must be published monthly and verified by independent auditors to ensure transparency.

Regulation is Essentially a Form of Dividend

The rising compliance thresholds and market centralization are trends that cannot be ignored. Strict regulatory requirements are raising industry entry barriers, pushing the market structure towards institutionalization and centralization. The HKD 25 million minimum paid-up capital requirement in Hong Kong, the EU's authorized institution threshold, and the U.S. federal licensing system all pose challenges for small startups. Traditional financial institutions and large tech companies are accelerating their entry into the stablecoin market, leveraging their capital and compliance advantages.

This is forming a new market landscape dominated by licensed institutions.

The space for cross-border payments and currency internationalization has opened up. The improvement of the regulatory framework has cleared obstacles for the application of stablecoins in cross-border payments. Stablecoins can achieve real-time settlement, significantly shortening transaction cycles while reducing fees to 1/10 to 1/100 of traditional banking systems. In emerging markets, stablecoins are gradually replacing local fiat currencies for daily payments and salary disbursements. Notably, stablecoins are becoming a new tool for currency internationalization. Hong Kong is actively promoting the development of stablecoins, which may facilitate the exploration of offshore RMB stablecoins, enhancing competitiveness by leveraging the vast market in mainland China.

The tokenization of real-world assets (RWA) is expected to develop rapidly in this context. Compliant stablecoins are seen as the key "engine" and "cornerstone" of the real-world asset tokenization ecosystem. In the tokenization process of traditional assets such as trusts, real estate, and commodities, stablecoins provide value anchoring and transaction medium functions, which effectively promote the expansion of RWA scale.

Currently, the U.S. Bitcoin futures market is primarily dominated by three major platforms: CME Group, Bakkt, and Cboe Digital, while Deribit occupies nearly 85%–90% of the global Bitcoin and Ethereum options market. Additionally, there are numerous cryptocurrency derivative products in the U.S., such as Bitcoin futures ETFs.

The derivatives market is becoming increasingly important in the virtual asset space. Virtual asset derivatives will not only become ideal trading tools for highly volatile virtual assets but will also accelerate the integration of virtual assets into the modern financial system. Currently, derivatives occupy an increasingly significant position in the virtual asset field, accounting for over 70% of the trading in the entire cryptocurrency market, which means that most cryptocurrency transactions are completed through futures contracts, perpetual contracts, or other derivatives. Centralized platform futures contract trading dominates the virtual asset derivatives market, but decentralized derivatives platforms cover a wider variety of derivative types, indicating that the development of virtual asset derivatives is an inevitable trend and an indispensable part of future virtual asset development. Virtual asset derivatives will not only provide professional investors with more risk hedging and yield enhancement tools but will also expand overall market liquidity, offering different types of investors more risk-return combination choices. At the same time, this will enrich the types of structured products linked to virtual asset derivatives, opening up greater opportunities for virtual assets in the wealth management market. Hong Kong's clear intention to introduce virtual asset derivatives will bring greater opportunities to its virtual asset market, helping it quickly align with the modern financial system, while the further diversification of the virtual asset product system will significantly enhance the attractiveness of virtual assets.

The Hong Kong Securities and Futures Commission has issued 10 virtual asset trading platform licenses to mainstream platforms such as OSL and HashKey.

From the perspective of currency as a payment medium, stablecoins are a form of digital infrastructure. The U.S. has taken the lead in establishing stablecoin standards, linking traditional fiat currencies with crypto assets, thereby seizing the dominant position in the infrastructure of cryptocurrency trading. If global trade and settlement activities further expand to include stablecoins, it will reconstruct the traditional cross-border payment and trade payment ecosystem, significantly reducing cross-border payment and transaction costs.

Stablecoins may reshape the global financial ecosystem. Stablecoins pegged to the dollar and U.S. short-term Treasury bills signify that crypto assets will become mainstream monetary assets in the U.S. Stablecoins will also pose new challenges to global central bank digital currencies and financial regulation. The "Stablecoin Act" currently appears to be primarily a U.S. official effort to enhance the credibility of crypto assets, with the basis of the linkage mechanism being U.S. sovereign currency and the highest liquidity asset, U.S. short-term Treasury bills, thus granting U.S. crypto assets the backing of U.S. sovereign credit. Notably, former President Trump and his family have independently issued cryptocurrencies, and key members of the Trump administration, such as the Treasury Secretary and Commerce Secretary, are supporters and beneficiaries of crypto assets.

Let’s first look at the blockchain itself: the starting point of everything

Ø Investment infrastructure will always be the first wave of dividends, but it is necessary to analyze and discern the valuation judgments brought about by speculation and sentiment in token economics.

Ø The next round of upgrades to crypto financial infrastructure will shift from "decentralized experimentation" to "compliance reconstruction." Stablecoins are the fuse, the chain is the pipeline, identity is the valve, and financial institutions are the catalysts.

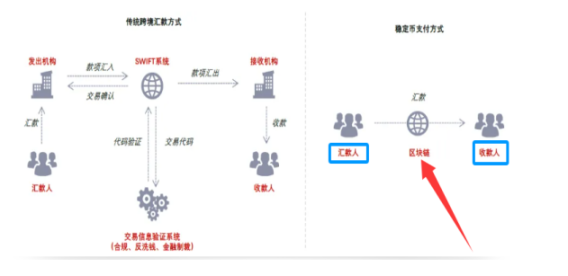

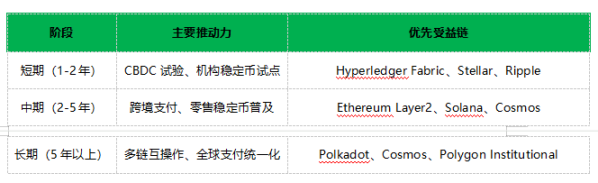

Under the implementation of KYC/AML for remitters and recipients, the essence of blockchain technology will truly play a role in the era of stablecoins. At the same time, blockchain (public chains, private chains, consortium chains) will become the key infrastructure, and the speed of construction must synchronize with the implementation and substantial adoption of the Stablecoin Act.

Ø Base and Polygon are the most likely to become the standard compliant settlement layers under U.S. regulations, while Ethereum will continue to be the high-end auditing stablecoin platform (such as USDC).

Ø Quorum and Hyperledger Fabric are most likely to become the "interbank back-end systems" for global financial compliant stablecoins, used for cross-border clearing and value settlement.

Ø Who will become the "infrastructure of the new financial internet"?

Consider the following dimensions:

Ø Compliance and Licensing: Under the KYC/AML and Stablecoin Act framework, only projects that can meet regulatory requirements will be widely adopted. This may mean having good cooperation with traditional financial institutions or being projects already tested in regulatory sandboxes.

Ø Technical Maturity and Scalability: Large-scale trading of stablecoins requires high-performance, low-latency, and high-throughput blockchain networks.

Ø Security and Stability: As financial infrastructure, security is paramount.

Ø Interoperability: The interoperability between different stablecoins and different blockchains will be key to improving efficiency and reducing costs.

Ø Ecosystem and Adoption: Having an active developer community, a rich array of DApps, and cooperation or adoption by existing financial institutions are important indicators.

Ø Governance Model: Blockchains that can adapt to future regulatory changes and provide stable, reliable governance have an advantage.

Under strong regulation, public chains that can truly become stablecoin infrastructure often need to possess high transparency and decentralization characteristics while also being compatible with regulatory requirements.

In the context of the "implementation and substantial adoption of the Stablecoin Act," projects that prioritize obtaining the dividends of the era will be those that:

Can directly meet the compliance needs of financial institutions and large enterprises.

Can provide high throughput, low-cost, secure, and reliable trading infrastructure.

Can facilitate the seamless flow of stablecoins between different chains.

Is DeFi and RWA the first wave of dividends?

Ø After the implementation of stablecoins, RWA will become the second asset class recognized by regulators as compliant, deeply binding with the real asset financial system, bringing enormous opportunities for asset on-chain + global trading + custody transparency.

Ø It is important to note the stablecoin regulatory rule that "interest cannot be paid to stablecoin holders," which means that stablecoin issuing institutions cannot complete the basic commercial banking operation of "deposit-loan" and must rely on other means to cover operating costs and innovate other business models to achieve profitability, relying on the innovative application of stablecoins within the entire financial system.

As of the end of May 2025, the total market capitalization of mainstream stablecoins is approximately $230 billion, representing a growth of over 40 times compared to the scale at the beginning of 2020, with a rapid growth rate, but still relatively small compared to the scale of mainstream financial systems, only equivalent to 1% of U.S. onshore deposits. However, in terms of trading volume, stablecoins play a significant role as an important payment method and infrastructure within the cryptocurrency system, with the annual trading volume of mainstream stablecoins (USDT and USDC) reaching $28 trillion, surpassing the annual transaction volume of credit card organizations Visa and Mastercard. As stablecoins are incorporated into the financial regulatory framework, decentralized finance is also expected to welcome development opportunities and deepen its integration with the traditional financial system.

Stablecoins serve as a "bridge" between the traditional financial system and the decentralized financial system (DeFi).

According to the World Bank, as of the third quarter of 2024, the global average remittance fee rate is 6.62%, while the United Nations' 2030 Sustainable Development Goals require that this fee be reduced to no more than 3%, with the arrival time needing to be 1-5 working days. The efficiency of the traditional financial system is mainly affected by the need to go through multiple intermediary banks in the SWIFT network. In contrast, the transaction cost of remitting using stablecoins is generally less than 1%, with a time frame of generally within a few minutes. However, it is worth noting that before the introduction of the bill, stablecoin payments had not been included in KYC and anti-money laundering regulations, which posed challenges to cross-border capital account controls in emerging markets. Therefore, although the technical use of stablecoins for cross-border payments is highly efficient, this difference is partly due to regulatory discrepancies, and as regulatory normalization occurs, the compliance costs of stablecoins may also increase.

Theoretically, the requirement for 100% reserve assets limits the ability of stablecoin issuing institutions to engage in credit expansion. The process of converting deposits into stablecoins is essentially a transfer of bank deposits rather than creation, so the issuance of stablecoins theoretically does not affect the supply of U.S. dollars. However, when funds continuously flow out of deposits, it may lead to banks shrinking their balance sheets and a decrease in the money supply. The process of converting other currencies into U.S. dollar stablecoins effectively creates a currency exchange effect, but this manifests as the flow of dollars across borders or accounts, without affecting the total supply of U.S. dollars.

Lending platforms that use cryptocurrencies as collateral effectively perform a similar function to banks in credit creation, increasing the scale of "quasi-money" (i.e., stablecoins) within the decentralized financial system, but not affecting the supply of traditional currency. Since the application scenarios involved in the crypto asset financial system are mainly concentrated in payment and investment areas, lending is primarily based on speculative demand. As of the end of 2024, the scale of crypto asset lending platforms is approximately $37 billion, which is relatively small.

The conversion of deposits into stablecoins may lead to deposit outflows, a phenomenon similar to the impact of money market funds and high-yield bond markets on the banking system. For example, since 2022, in the context of high interest rates in the U.S., deposits flowing into money market funds have reached approximately $2.3 trillion, becoming one of the triggering factors for the Silicon Valley Bank risk event.

As of the first quarter of 2025, issuers of USDT and USDC hold approximately $120 billion in U.S. Treasury reserves. If combined as one "economy," they rank 19th in the list of foreign holders of U.S. Treasury bonds, positioned between South Korea and Germany.

Stablecoins can primarily accommodate short-term U.S. Treasury bonds with maturities of three months or less, and their capacity to absorb long-term U.S. Treasury bonds is expected to be limited. The interest rates on short-term U.S. Treasury bonds are influenced by central bank monetary policy and depend on factors such as inflation and employment in the real economy. From the perspective of monetary policy, when stablecoin issuers buy U.S. Treasury bonds, they lower short-term interest rates, necessitating the central bank to withdraw money to hedge; in the long run, the attraction of stablecoins to deposits may lead to a trend of financial disintermediation, resulting in a migration of financing from the traditional financial system to the decentralized financial system, which may also weaken the effectiveness of central bank monetary policy.

Key Considerations and Challenges

Ø Legal and Regulatory Framework: This is the core of RWA development. There are significant differences in the definitions and regulations of "security tokens," "digital assets," and "stablecoins" across different countries and regions, making compliance the key to project success.

Ø Asset Valuation and Custody: The valuation of off-chain assets, legal ownership transfer, custody, and auditing of physical assets are indispensable and complex parts of the RWA tokenization process.

Ø Off-chain and On-chain Linkage: How to securely and reliably map the information and legal status of off-chain assets to on-chain tokens requires reliable oracle and legal protocol support.

Ø Liquidity and Market Depth: Even with tokenization, if the market lacks sufficient buyers and sellers, liquidity may still be insufficient. The popularization of compliant stablecoins is expected to alleviate this issue.

Ø Interoperability: Different RWA tokens may be issued on different blockchains, and how to achieve seamless trading and circulation between them will rely heavily on cross-chain technology.

Projects that prioritize obtaining the dividends of the era will be those that:

Ø Have strong traditional financial backgrounds and licenses, or blockchain technology companies that collaborate deeply with such institutions. (e.g., Franklin Templeton, BlackRock, JPMorgan's Onyx, and service providers like Securitize)

Ø Can effectively address complex issues such as legal compliance, asset custody, valuation, and mapping between off-chain and on-chain.

Ø Choose to deploy on regulatory-friendly blockchains with high performance and liquidity potential (whether Layer 2 of public chains or consortium chains).

RWA Ecosystem Overview (Functionally Classified)

1. Real Estate / Trust Asset Tokenization (Most Feasible)

Real estate is one of the RWA categories most amenable to accepting stablecoins as "on-chain dollars," offering stable returns and liquidity. Many traditional real estate investment trusts (REITs) or private real estate funds may choose to tokenize their shares. This not only lowers the investment threshold to attract small investors but also enhances liquidity in the secondary market. Regulatory bodies in places like Hong Kong and Dubai are also actively promoting real estate tokenization projects.

2. Government Bonds / Corporate Bonds and Other Financial Instruments (High Growth Potential)

Stablecoins serve as a natural counterpart for "dollar backing + yield distribution"; government bonds + stablecoins are the most favored combination by regulators. The tokenization of these assets is currently the fastest-growing and largest scale in the RWA field. Compliant stablecoins (such as USDC, or even future bank-issued stablecoins) directly serve as the settlement currency for these tokenized securities.

3. Gold / Commodity RWA (Natural Anchor for Stablecoins)

Gold is inherently tokenizable, and stablecoins themselves can be backed by gold reserves; on-chain gold standards can assist in hedging asset allocation.

Ondo Finance (for example only, not investment advice, nor does it express opinions on token prices)

Is an RWA tokenization platform focused on the tokenization of fixed-income assets (such as U.S. Treasury bonds, ETFs, real estate trusts), providing high-yield opportunities for institutional and retail investors.

Technical Features:

Ø Based on Ethereum Layer 1 and Layer 2 (such as Optimism), with low transaction costs and fast speeds.

Ø Offers structured financial products (such as senior/subordinated tokens) to meet different risk preferences.

Ø Integrates Chainlink oracles to ensure asset price transparency.

Ø Collaborates with SEC-registered brokers to ensure tokenized assets comply with U.S. regulations.

Ø Supports KYC/AML and regular audits to meet the requirements of the GENIUS Act.

Issued to qualified purchasers, requiring strict KYC/qualified investor certification.

Issued to non-U.S. individual and institutional users, supported by short-term U.S. Treasury bonds and bank deposit interest.

Flux Finance is a decentralized lending protocol developed based on the Compound V2 asset pool model. It supports users in using high-quality RWA assets (currently only supporting OUSG) as collateral to borrow stablecoins and lending idle stablecoins to earn interest.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。