On Tuesday (June 17), during the Asian market's midday session, the US dollar index rebounded to 98.18, while gold failed to regain overnight safe-haven buying at 3392. Bitcoin's upward momentum corrected, settling around 10,700 USD. The Middle East conflict has entered its fifth day, with Iran signaling hopes to ease the situation. However, US President Trump left the G7 summit early and called for an immediate evacuation of Tehran.

At the beginning of the week, Iran's foreign minister stated that if Israel stops its aggression, Iran will create conditions for restoring diplomatic talks, indicating Iran's willingness to de-escalate the situation. According to The Wall Street Journal (WSJ), Iran hinted at its readiness to end hostilities and resume negotiations regarding its nuclear program. Trump confirmed that Iran had sent signals through intermediaries expressing a desire to ease the conflict.

Source: WSJ

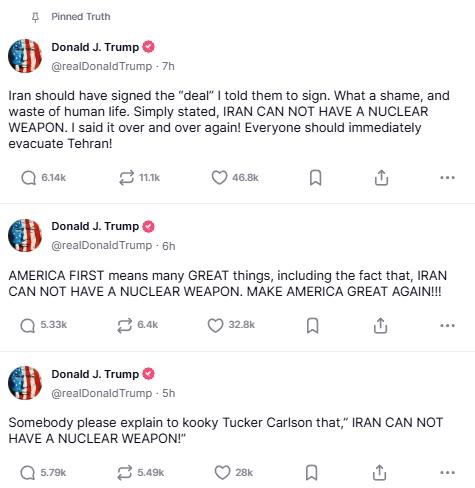

However, tensions in the Middle East continue to escalate, with Trump suddenly leaving the G7 summit early and issuing an "emergency evacuation" warning for Tehran via social media. According to Fox News, Trump returned to the White House from Canada on Monday local time and ordered the National Security Council to prepare for an emergency meeting in the Situation Room.

Prior to this, Trump made a rare statement on his self-created social platform Truth Social: "Everyone should evacuate Tehran immediately!"

Source: Truth Social

US White House Press Secretary Karoline Leavitt later confirmed that Trump arrived in Canada on Sunday to attend the annual G7 summit but decided to leave early due to the escalation of the Israel-Iran conflict. CBS News quoted her saying, "Although the meeting has achieved several outcomes, given the situation in the Middle East, the President will depart after dinner with the heads of state."

"I must return home early, the reasons are obvious," Trump told reporters as he left.

Despite the high geopolitical risks in the Middle East, which are favorable for gold and traditional precious metal assets, market analysts believe that the overall performance of the virtual asset market remains resilient. On June 13, following news of military conflict between Israel and Iran, Bitcoin briefly fell below the 100,000 USD mark but quickly rebounded. Industry insiders believe that current cryptocurrency prices are more influenced by global liquidity and institutional participation levels; while short-term geopolitical conflicts may cause volatility, the market's interpretation of long-term trends remains rational.

FXStreet analyst Lallalit Srijandorn stated that the daily chart shows bearish sentiment dominating the US dollar index, as the index is below the key 100-day exponential moving average (EMA). Additionally, the 14-day relative strength index (RSI) supports the downward momentum of the dollar, currently positioned around 38.25 below the midpoint, providing support for bears in the short term.

The initial support level for the dollar index appears at the lower Bollinger Band of 97.80. Further down, another key downside filter to watch is the low of 97.61 from June 12. The next challenge level is the low of 96.55 from February 25, 2022.

On the optimistic side, the first upside resistance level for the dollar index is at the high of 99.38 from June 10. Any subsequent buying that breaks above this level could pave the way for the 100.00-100.15 area, representing a psychological barrier and the upper boundary of the Bollinger Band. A decisive break above this level could lead to a rebound towards the 100-day moving average of 101.70.

Source: FXStreet

FXStreet analyst Dhwani Mehta noted that from a technical perspective on gold prices, the 14-day RSI has turned higher above the midpoint, currently close to 57.50, indicating that the bullish bias for gold remains intact.

To continue rising, it is crucial to overcome the static resistance level of 3440 USD.

The next upside target is at the two-month high of 3453 USD; breaking this target could challenge the historical high of 3500 USD.

If the previous correction resumes, sellers may challenge the previous strong resistance level (currently a support level at 3377 USD), which is the 23.6% Fibonacci retracement level of the record rebound in April.

If the psychological barrier of 3350 USD is breached, the next downside buffer will align with the 21-day simple moving average (SMA) at 3341 USD.

Source: FXStreet

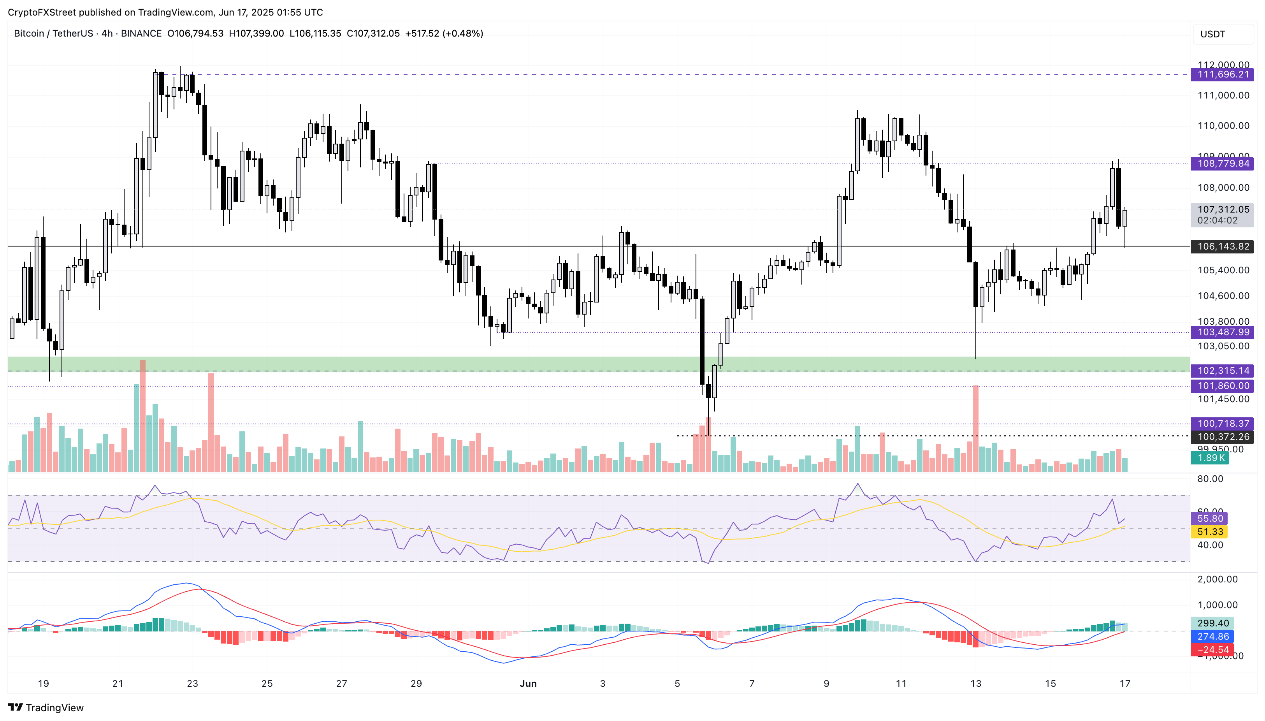

FXStreet analyst Vishal Dixit reported that Bitcoin reached a 24-hour high of 108,952 USD on Monday before dropping to 106,000 USD. It has slightly rebounded during the day, currently maintaining above 107,000 USD, while the long shadow on the 4-hour chart highlights the key support level at 106,143 USD.

Price action indicates that bullish momentum failed to break the resistance level of 108,779 USD, resulting in a bearish engulfing candle with a decline of 1.71%. If the closing price breaks above this key resistance level, it could propel Bitcoin towards the historical high of 111,980 USD.

The RSI has dropped from 55 to near the midpoint, indicating a slight decline in bullish momentum.

Further upward movement, coupled with a decrease in the green histogram, warns that the moving average convergence/divergence (MACD) indicator may show a crossover below its signal line. This suggests a potential bearish reversal for Bitcoin.

If bulls fail to hold the support level of 106,143 USD, a closing below this level could extend the downward trend towards the support level of 103,487 USD from May 31.

Source: FXStreet

Related: Trump urgently summons advisors to the Situation Room, Bitcoin (BTC) responds with a drop

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。