The prices of ZKJ and KOGE have plummeted, seemingly pulling the entire cryptocurrency market's sentiment back into a fragile state of "collapse at any moment." Interestingly, Binance immediately modified the calculation method for Alpha points, indicating that this drop is not just a simple case of "unstable liquidity."

Let’s break this down:

- On one hand, there is a systemic sell-off triggered by price drops and drying up on-chain liquidity;

- On the other hand, it involves how platform mechanisms are exploited and how quickly "loopholes" are patched.

It is both a price action and a game of institutional strategy, and it may even be a designed "compliance reward mechanism."

What Happened with the Plunge of ZKJ and KOGE + Adjustment of Point Rules?

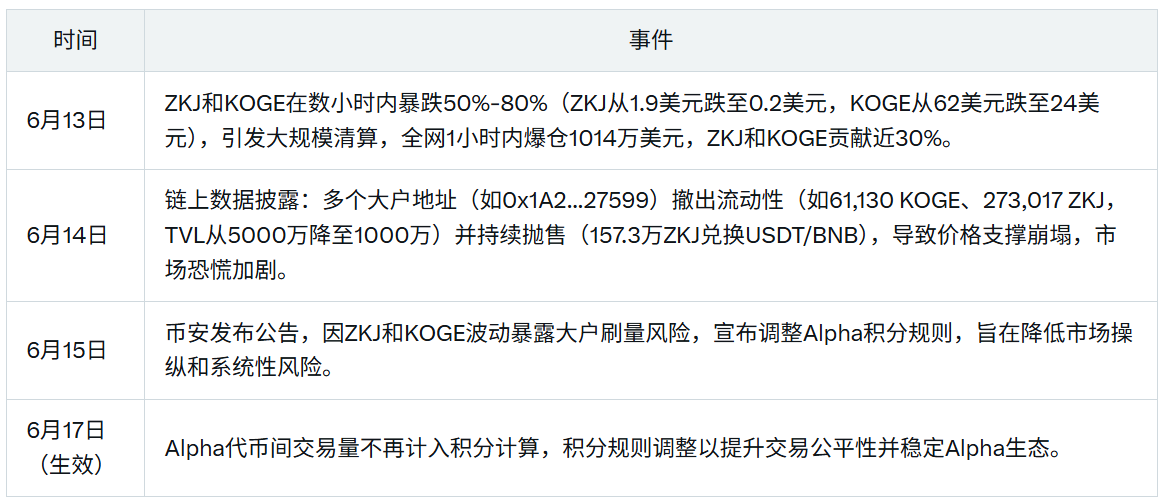

First, let’s quickly outline the key timeline:

The two events seem independent but are highly correlated:

Large on-chain investors withdraw → Price plummets → Chain liquidation → Incentive rules change

The entire process resembles a "closed script," except this time, most traders are the ones being liquidated in the script.

On-chain Withdrawals + Alpha Points, Two Mechanisms Were "Exerted" Simultaneously

ZKJ and KOGE were originally among the more active tokens in the Alpha ecosystem, but their liquidity was mainly concentrated in on-chain LPs (liquidity pools). Once large investors withdraw simultaneously, it effectively dismantles the price protection wall. The original intention of the Alpha points mechanism was to incentivize users to participate in ecosystem building. However, since its scoring logic focuses on "trading volume" rather than "trading quality," traders can quickly accumulate points by repeatedly matching trades within the Alpha ecosystem. The problem is that ZKJ and KOGE were used as one of the main channels for "point farming."

This led to a closed loop: certain traders first withdraw on-chain → driving the price down → simultaneously creating a liquidation cascade → the increased trading volume allows the farming accounts to gain points → racing ahead before the point rules are revised.

In the Alpha ecosystem, the selection of ZKJ and KOGE was not coincidental; it was more like a "point detonator" card designed by mechanism arbitrageurs.

Why Did the Alpha Points Mechanism Become a "Systemic Vulnerability"?

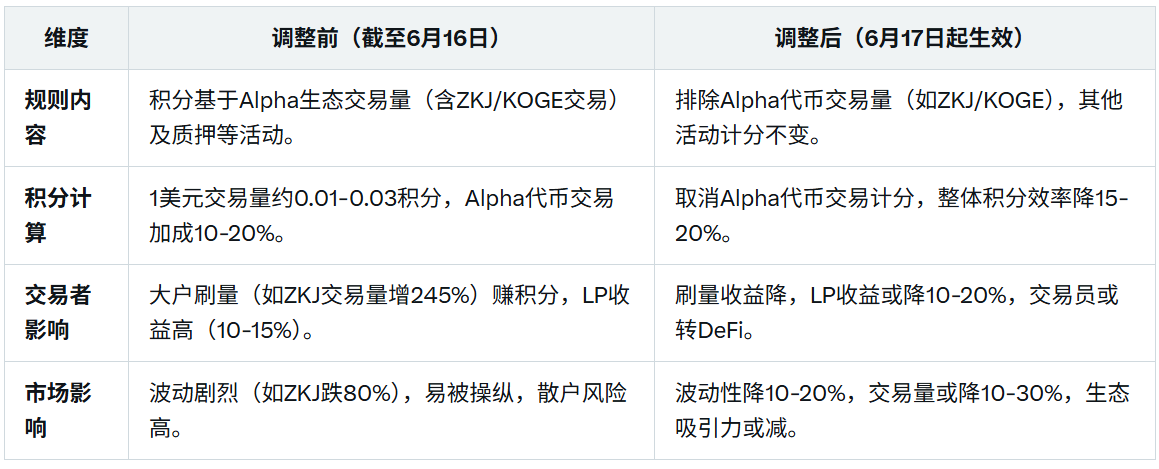

From Binance's perspective, the Alpha points mechanism is not just simple "incentive points"; it is more like a liquidity guiding lever for the platform ecosystem. Under normal circumstances, active trading can bring platform popularity, and points can reward loyal users. However, once this mechanism is overly optimized, point distribution becomes a tool for arbitrage.

The recent modification of the point rules primarily aimed to cut off the "volume farming channel" between Alpha-Alpha. This is akin to shutting down the "intra-pair circulation" model commonly used by farmers. In other words, previously, you could use several Alpha ecosystem tokens to self-match trades and fill up points; now, you must provide real trading pairs and create positive incentives for liquidity providers.

In other words, this adjustment is not just an emergency fix; it is also about punishing "fake trades" while rewarding "real liquidity."

The signal it sends is clear:

The platform is redefining what constitutes "valuable trading behavior."

For strategic traders, this means that strategies relying on "volume farming arbitrage" need to be completely restructured.

Trading Signals: Mining Gold from Chaos

Taking ZKJ as an example, this flash crash is far from just ordinary emotional panic. From the order book structure, technical patterns, to on-chain capital flows, it resembles a premeditated and rhythmic "assassination operation."

Let’s first look at the price movement. The price did not gradually adjust but instead experienced a cliff-like drop—from a high of $1.094 on June 15 to a sudden plunge to $0.253 in the early hours of the 16th, with a single-day drop of over 76%. This is not a crash; it is a precisely calculated strike: penetrating the EMA 20-day moving average, previous platform support, and multiple key stop-loss levels, as if deliberately igniting a liquidation chain, taking out all the longs in one go.

Now, let’s examine the trading volume and technical indicators:

- The large bearish candle that broke below $0.25 saw trading volume surge to 200M, indicating that large funds were actively selling, which aligns closely with the news of "1.573 million ZKJ being sold off";

- RSI dropped rapidly from 37.48 to 2.48, indicating extreme overselling, meaning the selling pressure has been largely released in the short term;

- The MACD fast line first clearly crossed below the slow line, establishing a bearish trend, but the fast line began to flatten out and even cross above the slow line, signaling a decrease in downward momentum.

These are all familiar "rebound models" for technical traders: the first strike breaks support → liquidation triggers a crash → extreme RSI values → exhaustion of trading volume → stabilization and oscillation. The closer to the bottom, the more likely a sharp rebound will occur.

"So how do we mine gold from the chaos?"

- Enter the market in batches around $0.253, targeting a short-term rebound to $0.652 (close to the Fibonacci 0.236 level): after the market experiences an extreme crash, prices often do not immediately start a new trend but enter a state of technical recovery rebound. This rebound usually does not challenge previous highs but rather retraces a portion of the drop in a somewhat regular manner. Fibonacci retracement is calculated based on this "natural recovery rhythm," and 0.236 is the most common first technical rebound level after a crash, especially in the absence of macro-positive factors, relying solely on emotional recovery.

- Set a stop-loss below $0.23, tolerating a 5%-10% retracement risk, and rely on RSI to rebound from extreme values to the 15-20 range to bet on a rebound. Setting up automatic trading and alerts can help efficiently capture the rebound window.

What Should We Focus on After This Plunge?

The events surrounding ZKJ and KOGE have turned a page, but the aftershocks are not over.

On one hand, other tokens with "high point weight + low liquidity" may become the next targets for hunting;

On the other hand, the platform has already begun to reflect on its mechanisms; the old path of "trading equals mining" is no longer viable.

If you are a strategic trader, what you need to think about now is how to construct a healthier arbitrage method using the new rules, such as combining trading depth, liquidity provision behavior, and holding time to earn points, rather than just volume farming!

More importantly, this series of events also reminds us:

In the cryptocurrency market, mechanisms are rules, and rules are the battlefield.

Behind a flash crash, from on-chain capital allocation to trading behavior inducement to platform policy intervention, the three parties intertwine and engage in mutual games. This situation presents both risks and opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。