Adults do not make choices; seize the policy dividend period, both A and H are needed.

Author: Xie Zhaoqing, Tencent News "Underwater"

"Busy" has become the norm for investment bankers in Hong Kong during this period.

"I have several days of business trips to the mainland every week, working on projects and competing for projects," said a sponsor from a leading Chinese investment bank in Hong Kong.

He currently has a total of 8 Hong Kong stock IPO projects, of which 2 have already submitted listing applications, another 2 will submit soon, and the remaining few have also been working on-site for some time. In addition, he has several other projects under negotiation, competing for the final sponsorship contracts, including projects for A-share companies listing in Hong Kong.

"After returning to Hong Kong for a meeting, I stay for about a day before starting another business trip," another investment banker said. "Catching flights or high-speed trains has become a daily routine; the market has heated up, and the work pace feels like it's back to the pre-pandemic years of 2018 and 2019."

The IPO data from the Hong Kong Stock Exchange also confirms the market's enthusiasm. Public data shows that as of June 15, there were 30 companies listed on the Hong Kong Stock Exchange, including A-share companies like Haitian Flavoring and Food Company, Sanhua Intelligent Controls, and two other medical companies currently in the fundraising process. If these four companies are included, the total fundraising amount on the Hong Kong Stock Exchange will reach HKD 100 billion, an increase of more than five times compared to the same period last year. This also marks the Hong Kong Stock Exchange's return to the top position in global IPO fundraising for the first time in six years.

Bian Jing, head of the capital markets at Agricultural Bank of China International, stated that the current wave of Hong Kong stock IPOs represents the best window period since the second half of 2021.

He believes that the targets for this wave of companies listing in Hong Kong are quite good, including industry leaders such as CATL, Heng Rui Medicine, and Haitian Flavoring. Many sovereign funds and long-term funds from overseas that he has interacted with have gradually returned to Hong Kong and become active. At the same time, the regulatory support from both regions for mainland leading companies listing in Hong Kong, including the acceleration of the filing process for listings, has invigorated the Hong Kong capital market.

Accelerated IPOs for Mainland Companies in Hong Kong: HKD 52.2 billion raised in a week, over 200 in the queue

"Overall, the Hong Kong market is indeed very active," said Zhu Zhengqin, head of UBS's global investment banking division in China. In the third week of May this year, her team completed four projects, including CATL, raising over USD 8 billion (approximately HKD 62.7 billion), three of which were projects in the Hong Kong capital market, including the IPO projects of CATL and Heng Rui Medicine, and Bilibili's refinancing in Hong Kong, which raised USD 690 million.

That week also marked a small peak for the Hong Kong IPO market. Public data shows that three mainland companies went public in Hong Kong that week, with CATL raising over HKD 41 billion, Heng Rui Medicine raising HKD 9.89 billion, and another company, Mirxes, raising USD 167 million. The total fundraising amount for the Hong Kong IPO market that week was USD 6.657 billion, equivalent to HKD 52.252 billion.

This means that in the third week of May, the Hong Kong IPO market completed 63% of the total fundraising amount for the entire year of 2024, which is HKD 82.9 billion, in just 7 days.

Zhu Zhengqin believes that compared to the previous two years, the Hong Kong stock market is indeed much more active now. From her observation, after a brief period of heat in the Hong Kong capital market following September last year, it fell back into silence. However, since January this year, the Hong Kong capital market has been on the rise following the boom of DeepSeek, and although it was slightly affected by the Sino-U.S. trade disputes for a week or two, the market quickly rebounded.

The trend of the Hang Seng Index data reflects this as well: the Hang Seng Index rose from 18,800 points on January 13 this year to a nearly two-year high of 24,770 points on March 19, then fell below 20,000 points on April 7, and subsequently climbed back up, closing above 24,000 points again on June 11.

Several investment bankers in Central, including Bian Jing and Zhu Zhengqin, believe that this wave of market enthusiasm will last for some time. Many mainland companies have also noticed this trend, and some have even begun to accelerate their pace of IPOs in Hong Kong.

Lin Zilong, head of global capital markets at Ade Financial, noted that most issuers have seen "clear signs of full recovery" in the Hong Kong market and have become more proactive in their mindset.

Unlike before, when most IPO projects required investment bankers to push forward, "now many issuers are more actively promoting," he said. This is because these mainland issuers see signs of market recovery and believe that the feasibility of listing in Hong Kong has increased.

Data from the Hong Kong Stock Exchange shows that in April and May, 37 and 42 companies submitted listing applications, respectively, while in January, February, and March, only 29, 11, and 13 companies submitted applications. This data also indicates that the number of companies listing in Hong Kong is indeed increasing. In just under two weeks since June, as of June 11, 14 companies have already submitted listing applications.

According to the Hong Kong Stock Exchange's official website, as of June 13, 211 companies are waiting to go public, while 30 have already listed.

Generally speaking, the Hong Kong Stock Exchange lists about 100 companies each year, with a peak of 218 companies listed in 2018. This suggests that there may be a "traffic jam" in Hong Kong stock IPOs this year, depending on the speed at which relevant regulatory agencies approve applications.

Adults do not make choices: Seize the policy dividend period, both A and H are needed

"Now, for issuers coming to Hong Kong to list, it's no longer a matter of choice," Zhu Zhengqin stated. A few years ago, mainland companies would consider whether to list domestically, in the U.S., or in Hong Kong as a choice; now they are seriously considering opportunities in Hong Kong.

This is because, including the convenience of subsequent refinancing in Hong Kong and the ease of stock incentive reductions for company executives, the Hong Kong market has become easier for issuers.

Bian Jing noted that one important reason issuers are choosing the Hong Kong market now is that this wave of Hong Kong stock IPOs represents the best window period since the second half of 2021, which is also a window for policy dividends.

Last year, the China Securities Regulatory Commission introduced "five measures for cooperation with Hong Kong," which included clearly "supporting leading mainland enterprises to list in Hong Kong," as well as promoting A-share companies to list in Hong Kong.

Lin Zilong from Ade Financial Group has deeper insights. He and his team began preparing for mainland companies' IPO projects in Hong Kong two years ago, including A-share companies listing in Hong Kong. Previously, under the atmosphere of market uncertainty, when he and his team discussed plans for mainland A-share companies to list in Hong Kong, there was rarely any positive feedback.

An investment banker involved in IPO projects in Hong Kong mentioned that when discussing the plan for A-share companies to list in Hong Kong last year, he was even regarded as a "fraud," because compared to A-shares, Hong Kong stocks had long been criticized for issues like liquidity and valuation.

At the same time, for issuers, listing in Hong Kong requires consideration of predictable timelines and costs. Previously, the timeline for A-share companies to list in Hong Kong was unclear, which was a headache for both issuers and investment banks. Generally, if the process goes smoothly, the timeline for an IPO in Hong Kong, starting from the submission of the listing application, is usually 6-9 months, or 12 months.

All of this began to change after the "926 policy." (Note: On September 26, a meeting of the Political Bureau of the Central Committee was held, emphasizing the need to boost the capital market.) Both the Hong Kong and A-share markets experienced a surge. The most familiar case to the market was that on September 17, A-share company Midea Group successfully listed in Hong Kong, raising over HKD 30 billion, and its market performance was also good, with a two-day increase of nearly 17%.

Lin Zilong stated that from his interactions with mainland A-share issuers, they are more sensitive to policies compared to issuers from other regions. After seeing Midea Group's listing, the signals supporting A-share companies listing in Hong Kong became very clear, leading them to believe that the feasibility of listing in Hong Kong has increased, and the main issue left to discuss is valuation.

Subsequently, the acceleration of the approval process for CATL's listing in Hong Kong further clarified the policy direction for these mainland issuers.

Multiple investment bankers in Central unanimously believe that for a long time to come, the excitement in the Hong Kong stock market will likely focus on A-share companies listing in Hong Kong, as these projects dominate the fundraising market in Hong Kong.

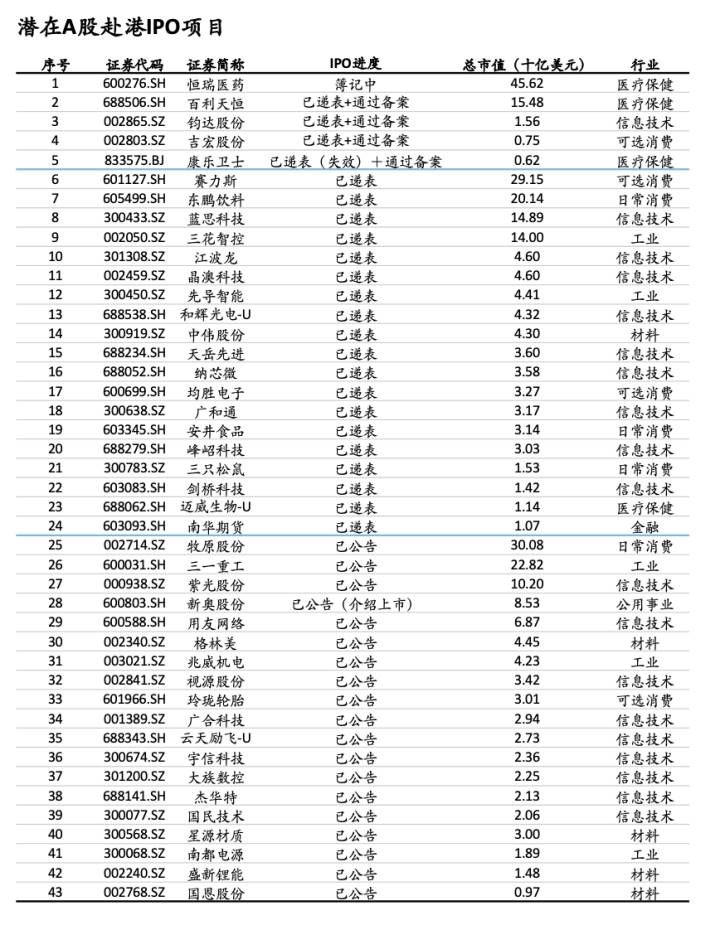

This is not difficult to understand, as most of the A-share companies listing in Hong Kong this time are of good quality, with market values mostly exceeding USD 1 billion, and some even approaching USD 5 billion. As of May 20, the data for A-share companies publicly stating their intention to list in Hong Kong is as follows (image from UBS).

"One must seize this policy window," Lin Zilong believes, reflecting the thoughts of many mainland issuers he has encountered. He believes that the mindset of mainland issuers has begun to change significantly, becoming more proactive about listing. These issuers believe that now is the time to take advantage of the dividend period to list in Hong Kong and raise funds, which can then be used for buybacks or to expand overseas operations.

Bian Jing noted that this wave of mainland companies listing in Hong Kong is also influenced by the current "going global" trend among Chinese enterprises. From what he understands, many mainland companies listing in Hong Kong currently have a strong demand for overseas expansion or global industrial layout.

A head of a small to medium-sized brokerage firm stated that from his observation, the approval process for A-share companies listing in Hong Kong is indeed faster than for new stocks listing in Hong Kong or the U.S. He also mentioned that this may be because the A-share companies going to Hong Kong are relatively leading companies in their respective industries and are already listed in A-shares, making the relevant materials and reviews easier.

Of course, the improving liquidity of Hong Kong stocks is also a point of concern for issuers listing in Hong Kong. Public data shows that in the first five months of 2025, the average daily trading volume on the Hong Kong Stock Exchange was HKD 242.3 billion, a 120% increase compared to HKD 110.2 billion in the same period last year.

Unlike the previous trend of A-share companies listing in Hong Kong, in addition to liquidity, the valuation of Hong Kong stocks has also begun to show some changes. The Hang Seng Index has risen above 24,000 points, and the price difference between A-shares and Hong Kong stocks is gradually narrowing, even leading to a phenomenon of "Hong Kong stocks trading at a premium to A-shares."

Taking CATL as an example, it listed at HKD 263 per share on May 20, which was about a 7% discount compared to A-shares, but after opening that day, it surged over 12%, reaching a peak increase of over 18%, and closed at HKD 306.20 per share, slightly at a premium compared to A-shares (HKD 263.00 per share) on that day. This phenomenon is relatively rare among A+H shares. In fact, CATL's subsequent market performance has consistently shown a slight premium over A-shares.

Such occurrences are not common among the more than 100 companies that have listed simultaneously as A+H shares. Previously, when A-share companies listed in Hong Kong, H-share prices generally traded at a discount to A-shares. Public data shows that only a few companies, such as BYD and China Merchants Bank, have previously experienced premiums.

Some fund managers in Central believe that in addition to the scarcity of targets, the issuance structure of CATL in the Hong Kong market, which has a relatively small base of circulating shares, is also a factor affecting the upward movement of its stock price. (Note: The circulating shares of CATL in A-shares and Hong Kong stocks are 3.9 billion shares and 156 million shares, respectively).

Wang Shuguang, a member of the management committee of China International Capital Corporation, stated that good Chinese companies listed in Hong Kong tend to have a certain premium on A-share trading prices, reflecting that these companies have gained recognition from international funds, which may feedback to the A-share market, drawing more investors' attention to these undervalued A-share companies.

A head of a medium-sized brokerage firm believes that before the approval for domestic A-share listings is lifted, in the foreseeable future, there are actually no more choices for Chinese assets to list other than the Hong Kong market. This is due to geopolitical factors, making issuers more cautious about listing in the U.S. or Europe.

If the choice is not made well, one might miss the best listing opportunity, with the cross-border e-commerce leader Shein being the best example.

Shein once planned to go public in the U.S., the U.K., and even Singapore, but recently it has decided to submit a listing application in Hong Kong. Over the years of making choices, Shein's valuation has been halved, dropping from a peak of USD 100 billion to a rumored valuation of less than USD 30 billion today.

CATL set a "bad" precedent: Investment banks are getting involved even if they don't make money

Regarding how long the trend of A-share companies listing in Hong Kong will last, Wang Shuguang also stated that A-share companies going public in Hong Kong is a trend that may continue for a long time.

Public data shows that nearly 50 A-share companies have clearly stated their intention to list in Hong Kong this year. As of June 13, there are 5 A-share companies that have already listed in Hong Kong, including CATL, Heng Rui Medicine, and Jihong Co., as well as two others, Haitian Flavoring and Sanhua Intelligent, that are currently in the fundraising process.

Zhu Zhengqin believes that the pool of A-share listed companies is large enough, and even the A-share companies that have confirmed their intention to list in Hong Kong can continue for a long time.

She also mentioned that this wave of Hong Kong IPO enthusiasm is not entirely driven by A-share companies going south to list. She cited companies like Mao Geping, which listed at the end of last year, and Mixue Ice City and Blukoo, which went public earlier this year, all of which received a strong market response, but these were not A-share companies going to Hong Kong; they were new IPO projects.

Bian Jing also believes that this wave of enthusiasm may last for some time. There are currently enough companies submitting listing applications in Hong Kong. At Agricultural Bank of China International, he and his team have sponsored 9 projects that have submitted applications this year, with more than 10 projects about to be submitted and another 10+ projects in negotiation.

At the same time, Bian Jing believes that many foreign long-term funds and sovereign funds have gradually returned to Hong Kong.

From his observations, many foreign sovereign funds' names have appeared on the cornerstone subscription lists for IPOs in the past few months, and in fact, many other foreign sovereign funds have also been placing orders from the institutional subscription portion of IPOs—this part does not need to be disclosed, and the outside world knows little about it. "These IPOs can provide substantial returns for the funds, so they will continue to stay in the Hong Kong market."

Tencent News "Underwater" has learned that the sovereign funds returning this time include, but are not limited to, Singapore sovereign funds like Temasek and GIC, Canadian sovereign funds, Malaysian sovereign funds, as well as sovereign funds from Middle Eastern countries like Abu Dhabi, Kuwait, and Saudi Arabia. They have all participated in Hong Kong IPO orders in the past few months. They all want to seize the opportunity and do not want to miss this round of "China fever."

Most of the IPOs these funds participate in are profitable. According to Ernst & Young, about 70% of Hong Kong stock IPO projects in the past six months were profitable on their first day.

These large overseas funds are particularly interested in undervalued good companies in A-shares listing in Hong Kong. For a long time to come, over 90% of the A-share companies going public in Hong Kong in this wave have a market value of over USD 1 billion. Looking at the companies currently submitting applications, most are led by top investment banks in Hong Kong.

Lin Zilong believes that this wave of A-share companies with a valuation of USD 1 billion going public in Hong Kong may continue until next year, after which more A-share companies with valuations below USD 1 billion may list—this is also where Ade Financial and most mid-sized brokerages are focusing their efforts. Currently, most of the A+H projects in his team are concentrated on companies with valuations under USD 1 billion.

"It looks very lively, but this is actually the excitement of the large investment banks, which has little to do with mid-sized investment banks," sighed a head of a small to medium-sized investment bank. Most of the IPO projects in his hands have not received approval, and small investment banks cannot get involved in large A-share IPO projects. In his view, these large projects have absorbed most of the market funds, making it still very difficult for small projects to issue.

However, the reality is that large investment banks are not as well off as the outside world imagines. Several investment bankers revealed that while there do seem to be more projects now, the profit margins for IPO projects are not as expected, and some are even declining, with some large investment banks also losing money on IPO projects.

"The costs for A-share companies listing in Hong Kong have been driven down significantly." Multiple investment bankers revealed that even with such low costs, investment banks are still fiercely competing for IPO projects because IPO projects serve as a "traffic diversion tool" for investment banks. By establishing connections through IPO projects, these issuers can later engage in refinancing in Hong Kong or other business dealings, which are more valued by the investment banks' parent companies. If they do not actively participate in IPO projects, investment banks may miss out on subsequent fundraising opportunities.

The most extreme case is CATL, which just went public with a fixed underwriting fee of 0.2%. Many investment bankers believe that CATL's listing has actually set a "bad" precedent in the Hong Kong market, leading most A-share companies going public in Hong Kong to use this as a reference for their fees.

Currently, most A-share companies listing in Hong Kong have fixed underwriting fees below 1%, and some foreign investment banks have even offered fixed underwriting fees as low as 0.4%—far below the conventional fixed underwriting fees for IPOs, which range from 3% to 5%. Among the Chinese investment banks in Hong Kong, they are more accustomed to bidding for projects with relatively low fixed underwriting fees.

For investment banks, the difficulty and workload of A-share companies listing in Hong Kong have not decreased, but the underwriting fees have dropped significantly. Many investment bankers involved in IPO projects complain that A+H projects are actually more exhausting than before, but the income has become less. Many Chinese investment banks have seen their revenues and bonuses significantly decrease over the past few years, but investment bankers are also hesitant to jump to foreign banks, which offer much higher salaries.

This is because foreign banks often lay off staff significantly when projects decrease, leaving employees uncertain about their job security—Chinese investment banks, especially those affiliated with banks, tend to be relatively more stable.

Bian Jing stated that in the past few months, as the market has improved and projects have increased, investment banks have also made corresponding adjustments in their fees due to a shortage of manpower. He understands that some IPO project quotes, including sponsorship fees, have increased compared to before.

Previously, due to a lack of IPO projects in a quiet market, some Chinese investment banks had once driven the sponsor signing fee down to around HKD 3 million. The most extreme case was CATL, whose sponsorship fee, including foreign investment banks, was uniformly set at USD 300,000, equivalent to HKD 2.35 million. The sponsors for CATL included multiple investment banks such as JPMorgan, Bank of America, and CITIC Securities International.

At the same time, according to Bian Jing, at least 5 Chinese investment banks in Hong Kong have launched new recruitment plans due to the increase in IPO projects. "As the market improves, everything is slowly climbing in a positive direction, whether it's income or recruitment."

For a long time to come, life for investment banks in Hong Kong will be much better.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。