Though these companies have vanished due to collapses and bankruptcies, their wallets—such as those tied to FTX—remain under the stewardship of court-appointed bankruptcy estates. These wallets continue to retain substantial sums onchain, quietly preserving significant value amid the wreckage. Terraform Labs imploded in May 2022 when its algorithmic stablecoin UST broke from its peg, erasing roughly $45 billion and pulling down firms like Three Arrows Capital and Celsius in its wake.

FTX followed in November 2022, unleashing a broader shockwave after disclosures revealed customer funds were misappropriated and leveraged to support its own token. Yet as of June 14, data from Arkham Intelligence shows Terraform Labs still holds $2.45 million onchain. Most of that value resides in two tokens: $1.26 million in convex finance token (CVX) and $1.09 million in governance OHM (GOHM).

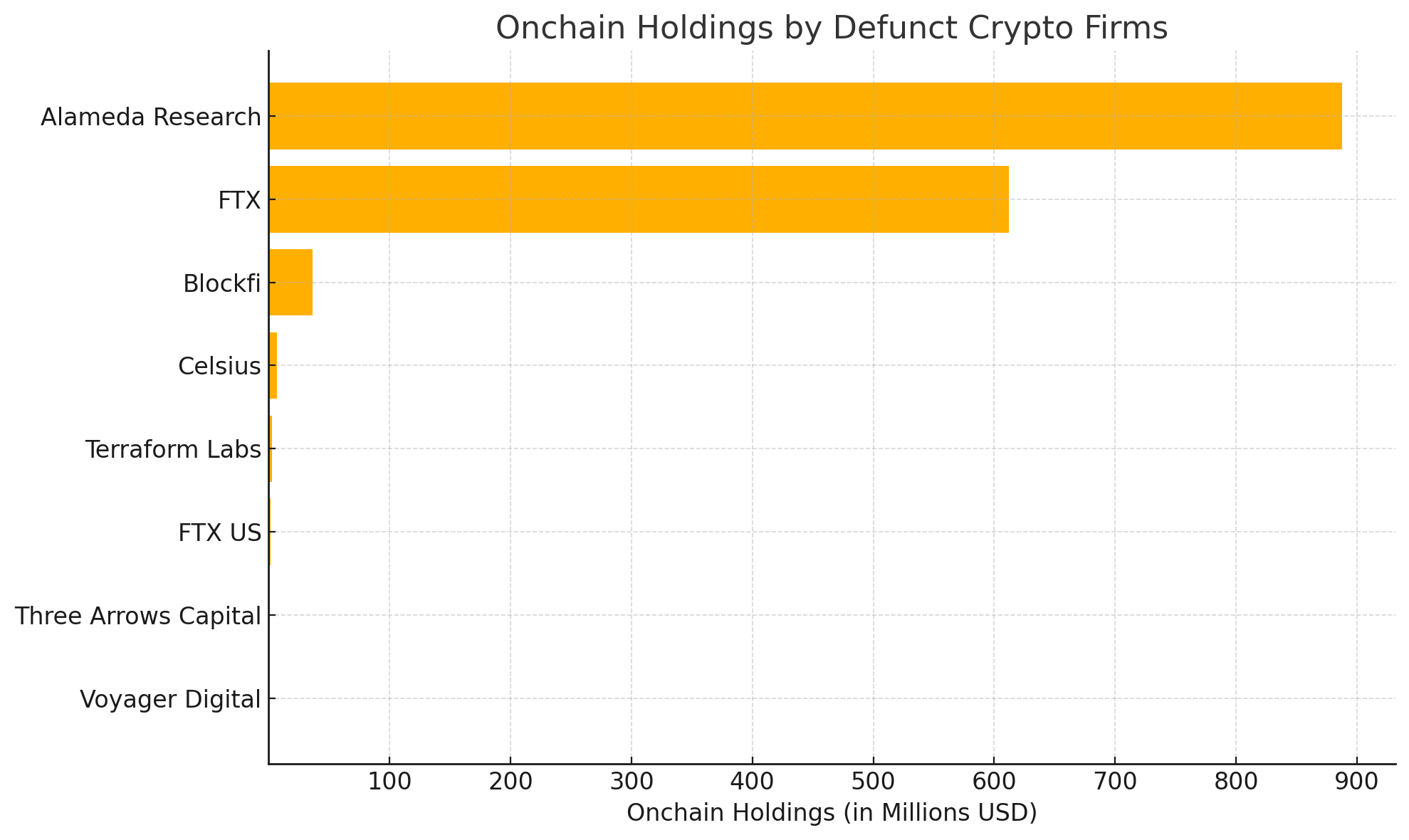

Then there’s FTX. According to Arkham, the bankrupt exchange controls wallets holding $611.93 million in digital assets. Roughly $266 million stems from its 9.777 billion OXY tokens. Another $232 million is tied to FTT, the platform’s native token—which, curiously, still trades at $0.90 per coin. As of press time, FTX wallets contain 257.87 million FTT. The firm also retains about $52 million in MAPS and $16.31 million in FIDA.

FTX US, the American arm of the now-defunct exchange, still controls $1,640,348 in onchain assets, with the lion’s share coming from 5.938 million tron ( TRX). Blockfi, the crypto lender that filed for bankruptcy in November 2022 following its exposure to FTX, maintains $36.37 million in digital holdings. Most of that sum is concentrated in ethereum ( ETH), with the firm sitting on 12,223 ETH valued at $30.84 million.

Celsius Network, which halted withdrawals and entered bankruptcy in July 2022 amid liquidity woes and risky bets, currently holds $6.89 million. Its largest asset is $6.1 million in SAVAX, along with a smaller $576,000 in ETH. Wallets tied to Voyager Digital—which also filed for bankruptcy in July 2022—retain a relatively minor $41,600, indicating minimal onchain exposure.

Meanwhile, Alameda Research, the quantitative trading arm of FTX, still holds a formidable $887.46 million in digital assets. Of that, roughly $735 million is in solana ( SOL), with the firm’s wallets securing 5.099 million SOL. Alameda’s reserves also include $52 million in ETH and 205.006 BTC, worth $21.61 million. In contrast, Three Arrows Capital (3AC) holds a mere $46,036—just over $27,000 of which is in tether ( USDT). At the time of writing, these eight defunct entities collectively hold an eye-popping $1.546 billion in onchain assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。