During the bull market, many people saw their investments multiply overnight due to a particular project, but many others lost everything when the project team absconded with the funds. On June 11, the price of Aura (AURA) skyrocketed from $0.001 to a peak of $0.008, with an increase of 800% within a few hours and trading volume surging over 115,000% compared to the previous day. David, a well-known cryptocurrency scam analyst on platform X, warned that this surge could be an organized scam—this crime pattern, known as "Rug Pull," is sweeping through the cryptocurrency world in an industrialized manner.

Average profit per Rug Pull project is about $1.65 million

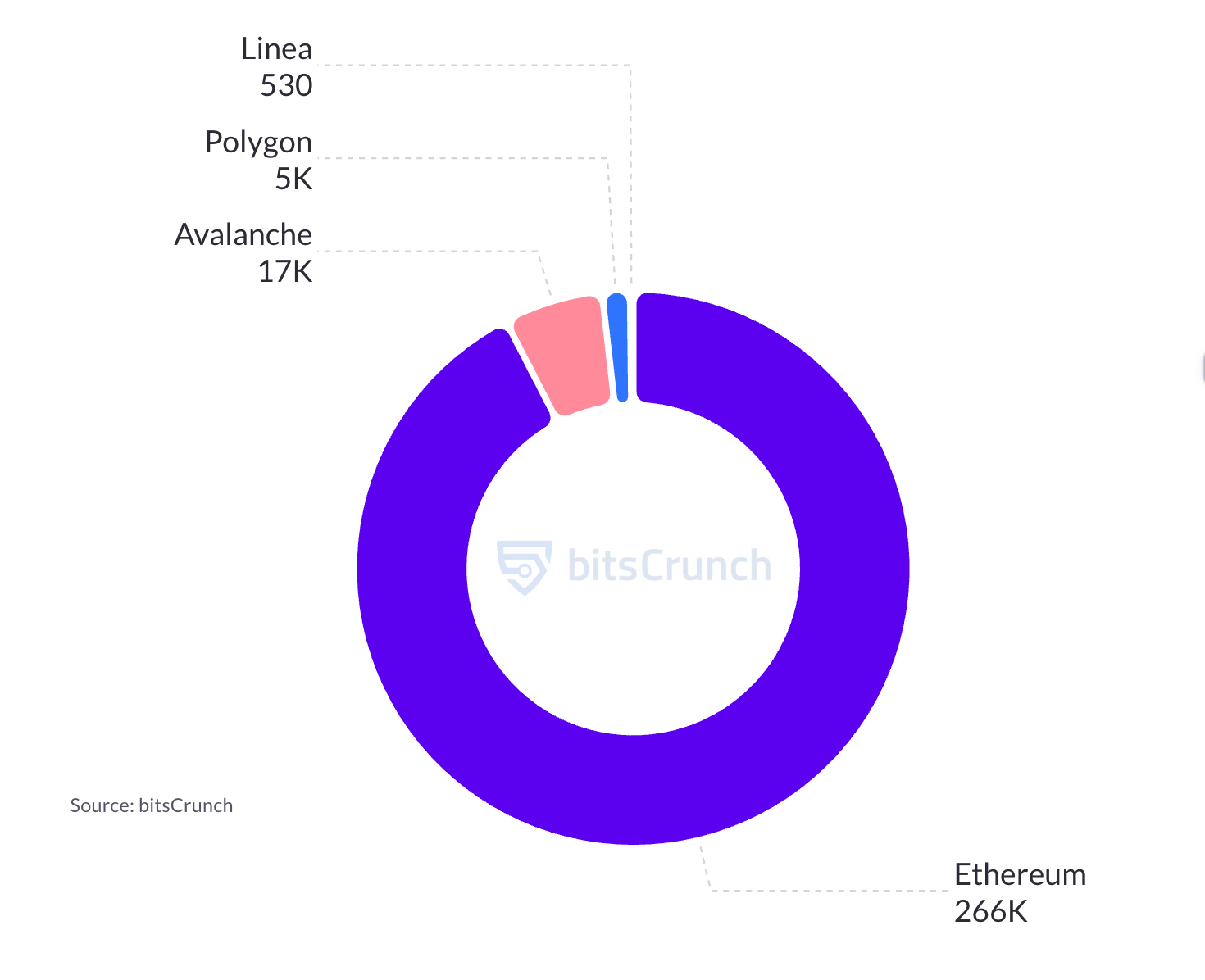

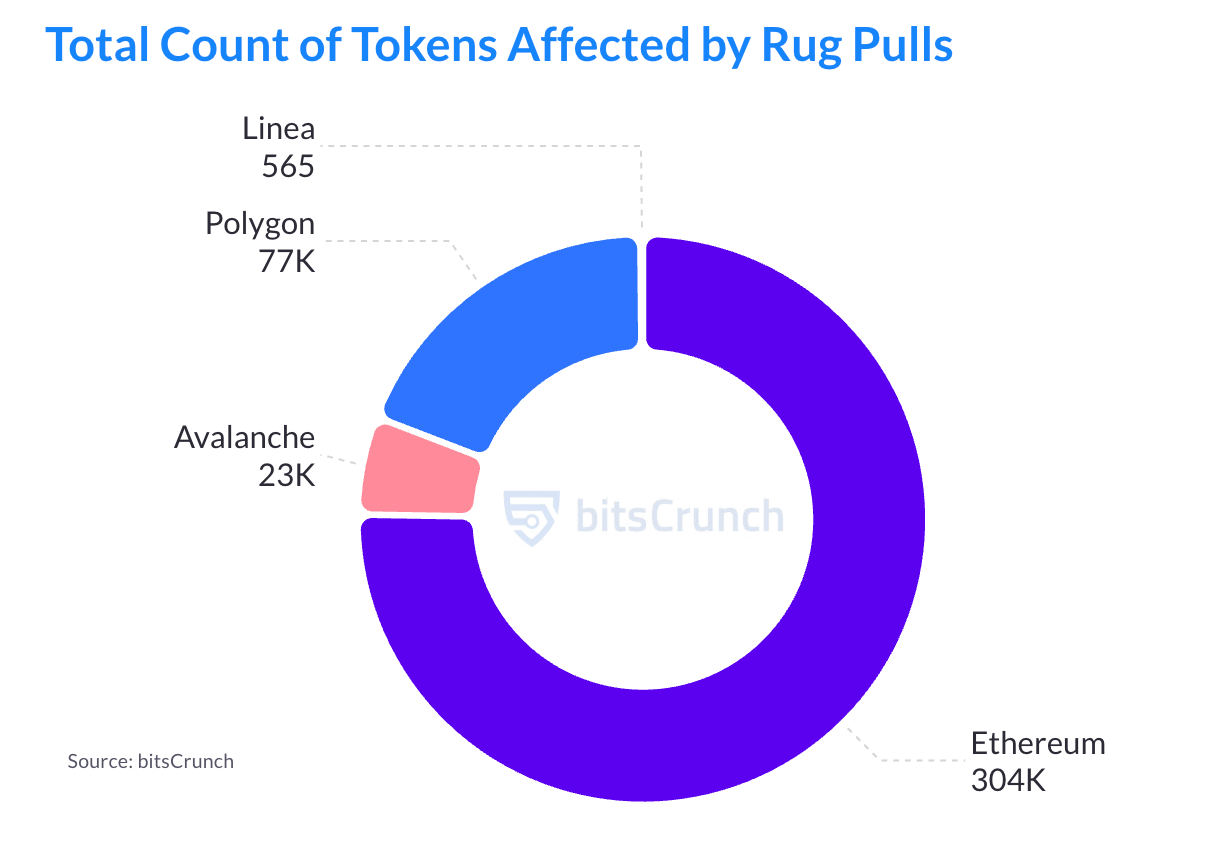

Through on-chain evidence collection of contracts on four major public chains, bitsCrunch data shows that up to 304,000 tokens have experienced varying degrees of Rug Pull, equivalent to hundreds of "trap tokens" being set up on the network every day. Supporting this massive scam is an astonishingly large fraud gang—266,000 independent deployer addresses are active on Ethereum, specifically engaged in the creation and promotion of fraudulent tokens.

Data source: bitsCrunch.com

These "developers" use low-threshold token issuance tools and a large user base to precisely lay their bait. Although the average profit from a single scam project on Ethereum is about $1.65 million, the vast base makes the total income reach an astronomical figure of $502 billion.

Data source: bitsCrunch.com

The Rug Pull incidents on Polygon and Linea are recorded at 530 and 399 cases, respectively. Notably, there is a total attack profit of $10,140 on Polygon. With 7,680 tokens experiencing Rug Pull, there are 4,640 active fraudulent deployers behind them. Although the emerging Linea chain has relatively smaller data volume, it has already recorded 4 contracts that have completely drained liquidity (hard Rug Pull part). According to bitsCrunch data, over 7.05 million investors have become direct victims of Rug Pull scams. This means that the wealth of millions of individuals and families has vanished in the traps of Rug Pull.

Types and Time Cycles of Rug Pull

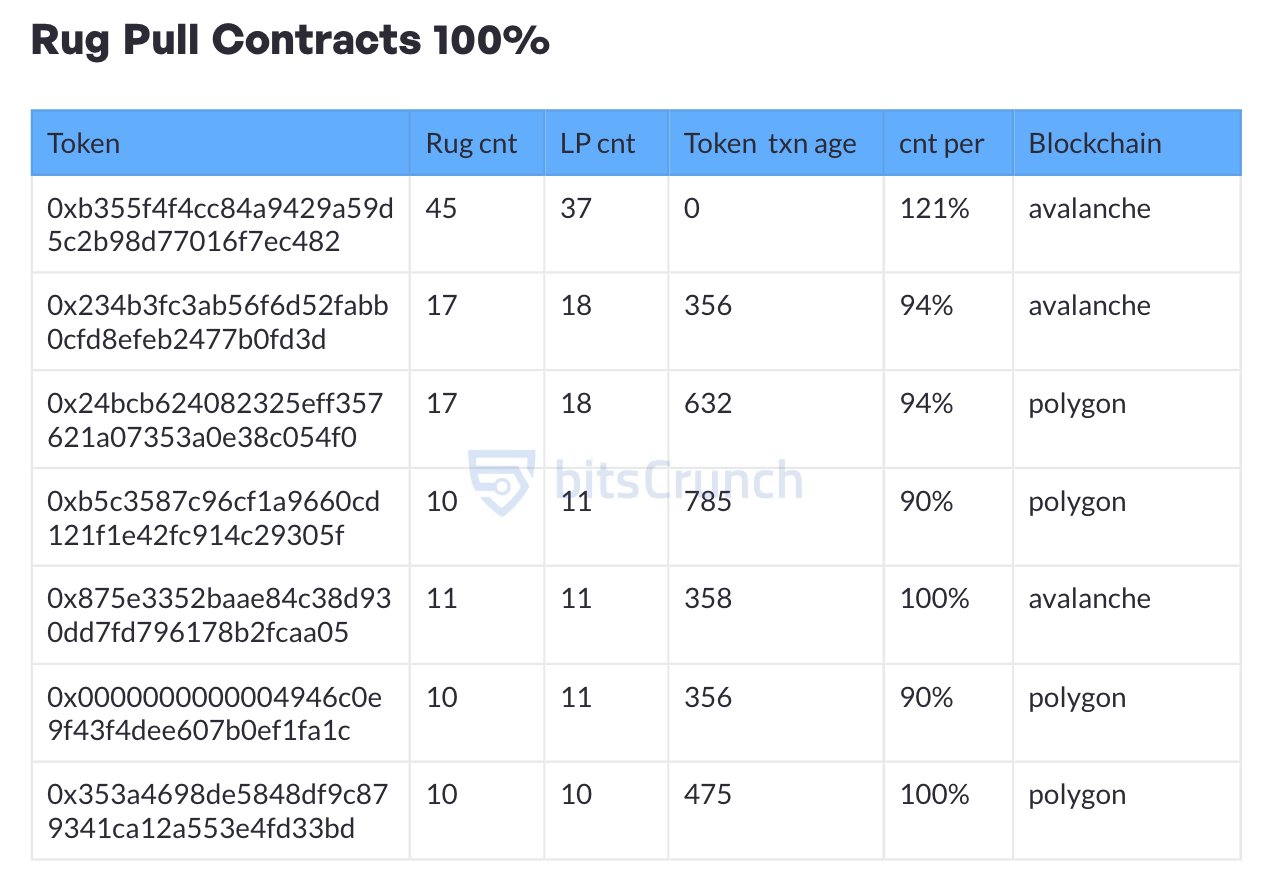

Complete Looting: Hard Rug Pull

A hard Rug Pull is a complete looting, where scammers pre-set malicious code and vulnerabilities to subjectively siphon off the entire liquidity of the project. For example, on Avalanche, the address 0xeeeeeb57642040be42185f49c52f7e9b38f8eeee (17 rugs/9 LPs, ratio 188.89%) and on Polygon, 0x8f006d1e1d9dc6c98996f50a4c810f17a47fbf19 (88 rugs/6 LPs, ratio as high as 1466.67%).

- Multi-chain Criminal Activity

Some addresses (such as 0x8031c44b96ec8c9b66ab16c2c164e8deeb361a3f, 0x16eccfdbb4ee1a85a33f3a9b21175cd7ae753db4) have records of hard Rug Pulls on both Polygon and Avalanche, utilizing the characteristics of different chains to commit crimes and evade tracking, causing token prices to plummet to zero, leaving investors with nothing.

Data source: bitsCrunch.com

- High-Frequency Crimes and "Hit and Run"

Many scam addresses exhibit extremely high crime frequency. For instance, the address 0xb355f4f4cc84a9429a59d5c2b98d77016f7ec482 on Avalanche is associated with 45 Rug Pull tokens and 37 drained liquidity pools (LPs). The address 0x24bcb624082325eff357621a07353a0e38c054f0 on Polygon and 0x234b3fc3ab56f6d52fabb0cfd8efeb2477b0fd3d on Avalanche are both linked to 17 Rug tokens and 18 LPs, with a ratio close to 95%, indicating a highly specialized crime pattern. These addresses act like locusts, deploying tokens in bulk, quickly draining them, and then disappearing or changing identities to start anew.

- Token Lifecycle

The lifecycle of many hard Rug Pull tokens (tokentxnage) is extremely short, as brief as 0 days (e.g., 0xb355f4f4…, 0x63dc3ca0…), 1 day (e.g., 0x16eccfd…), or 3 days (e.g., 0x55b1a124…, 0x8a610bf3…). This confirms the scam patterns like "Pi Xiu Pan"—the scam is completed shortly after the token goes live, leaving investors no time to react or exit.

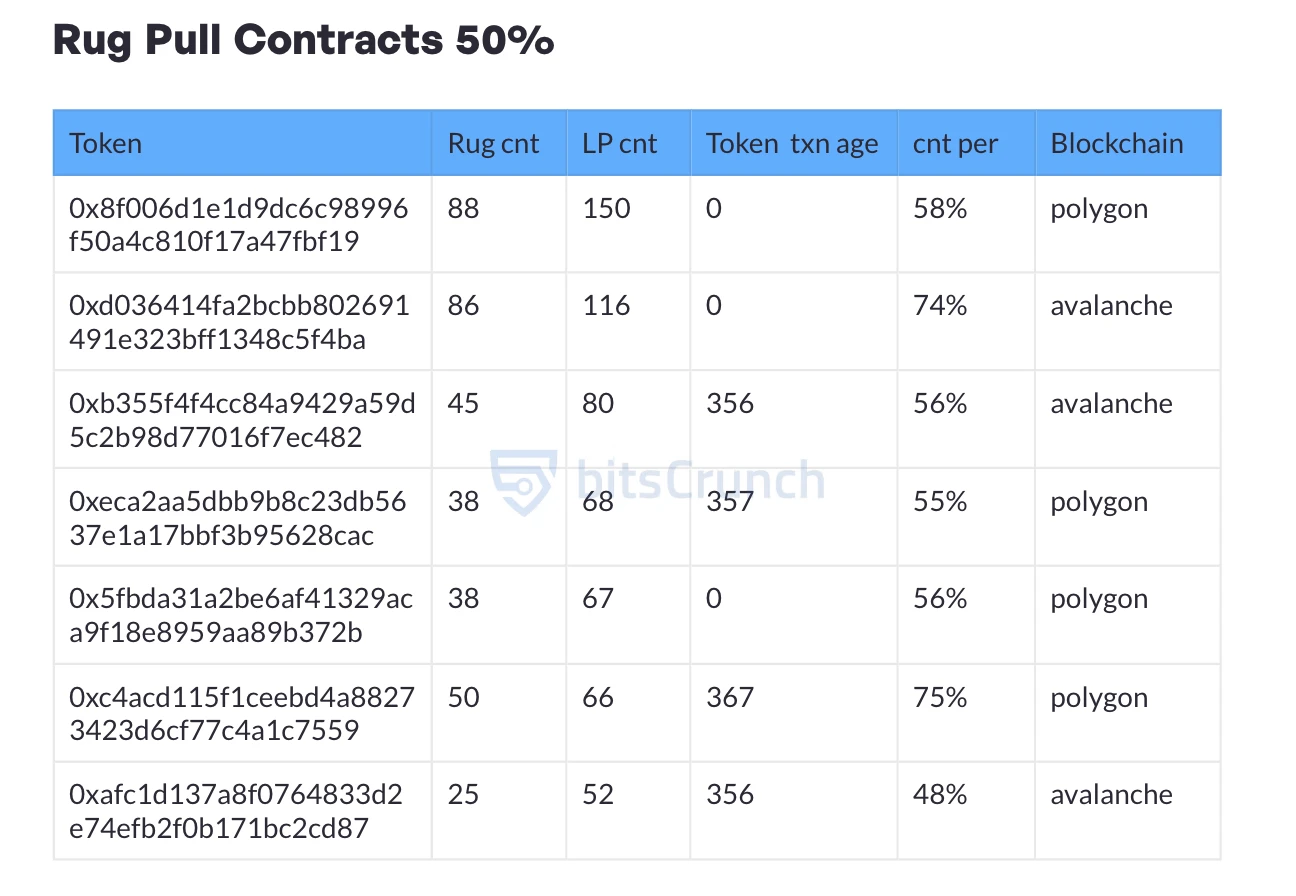

Boiling the Frog: Soft Rug Pull

In contrast to the violence of hard Rug Pulls, soft Rug Pulls (usually referring to withdrawing about 50% of liquidity) are more covert and insidious. They do not cause token prices to plummet instantly but create an illusion of "slow decline" or "temporary adjustments by the project team." Scammers may fabricate various reasons (such as "migrating contracts," "upgrading systems," "responding to market fluctuations"), and some investors may fail to escape in time due to wishful thinking or delayed reactions, ultimately suffering significant losses in the ongoing decline. Although the immediate impact of this model may seem less severe than hard Rug Pulls, its covert nature can affect a broader range and cause more long-term, chronic erosion of market confidence. According to bitsCrunch data, the following image presents some cases of "soft Rug Pull contracts 50%."

Data source: bitsCrunch.com

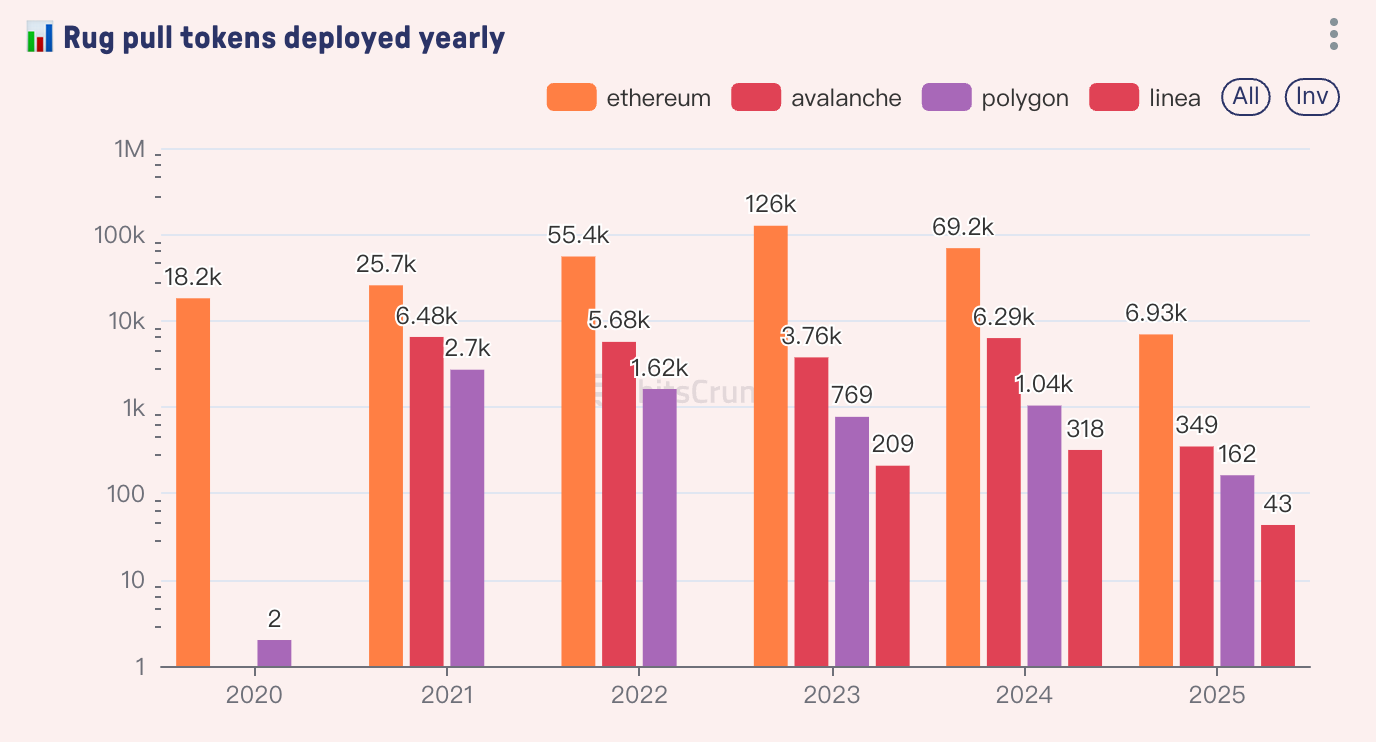

2023 saw the highest number of Rug Pull token deployments

Based on bitsCrunch's on-chain Rug Pull data from 2020 to 2025, it can be observed that the number of fraudulent token deployments on Ethereum reached a historical peak of 125,759 in 2023, accounting for 42.3% of the total over five years. However, the deployment volume plummeted to 69,154 in 2024 (a year-on-year decrease of 45%). Fraudulent activities exhibit significant cyclicality, with an average annual deployment of 48,721 across the four major chains during 2021/2023. The average lifecycle of fraudulent contracts has compressed from 356 days in 2021 to 3.8 days in 2025.

Data source: bitsCrunch.com

The hundreds of thousands of fraudulent tokens and deployers indicate that Rug Pull is no longer a sporadic petty theft but a mature black industrial chain with clear division of labor, tooling, and processes. The cost of fraud is extremely low, while the potential "profits" are enormous. Users need to understand common Rug Pull tactics (high return promises, anonymous teams, lack of audits, suspicious or missing liquidity locks, social media hype, rapid price increases in a short time, etc.). Checking whether contracts are open-source, whether they have been audited by reputable auditing firms, whether the team background is verifiable, and the status of liquidity locks should become essential steps before investing.

Conclusion

The data on Rug Pull is shocking: hundreds of thousands of fraudulent tokens, hundreds of thousands of scam deployers, trillions of dollars in illegal gains, and over seven million victims… This is not merely a collection of individual investment losses but a systematic attack on the foundation of trust that the entire blockchain and cryptocurrency industry relies on. Exposing the dark truth of Rug Pull is not only to warn everyone to be aware of risks but also to inspire the entire industry to form a better regulatory system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。