Israel sent 200 fighter jets to bomb various nuclear facilities in Iran on Thursday evening in an unprecedented pre-emptive attack that killed multiple key Iranian military figures. The bloodbath extended to global markets with all stock indices down on Friday, but interestingly, bitcoin shed almost a full percentage point less than the broader crypto market.

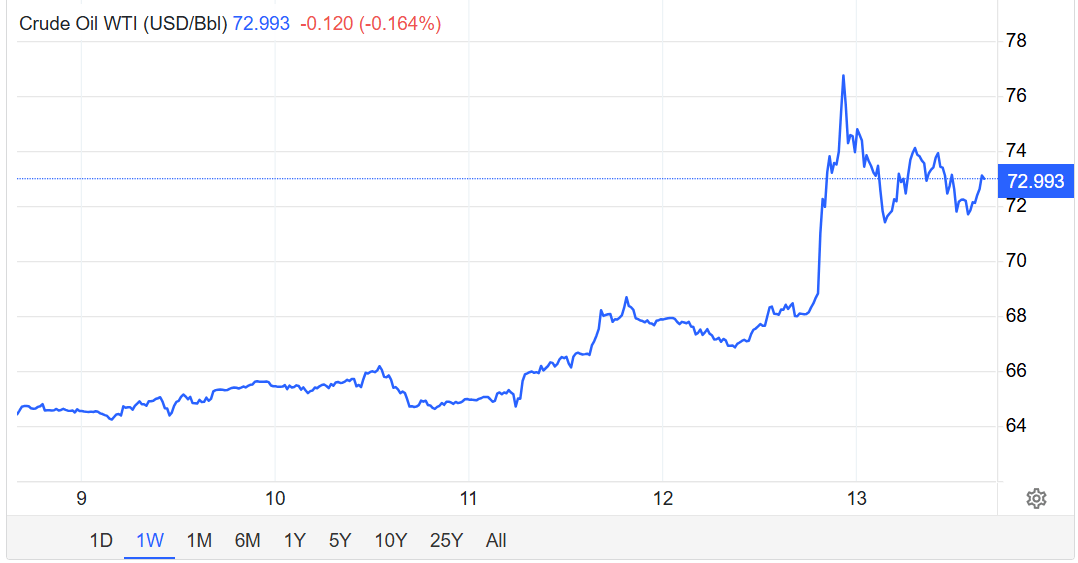

Iran is the seventh largest oil producer in the world and cranks out more than 4 million barrels per day. Yesterday’s attack sent oil prices soaring from roughly $68 per barrel to $75. Markets bled out as expected, with the Dow taking the biggest hit and dropping by more than 550 points.

(Oil price / Trading Economics)

Investors rushed to the old faithful, gold, which at the time of reporting was enjoying an enviable 1.45% appreciation at approximately $3,430 per ounce, just $70 shy of it’s $3,500 all time high price in late April. Digital gold didn’t perform as well as its physical namesake, shedding 2.8% over the past 24 hours, but it did perform better than the overall crypto market which tanked 3.7%, according to Coinmarketcap.

“Eventually people will realize that geopolitical turmoil only strengthens the investment case for a neutral asset that can’t be printed,” said an X user going by the name Stack Hodler. “Until then, treat every dip on geopolitical panic as a gift.”

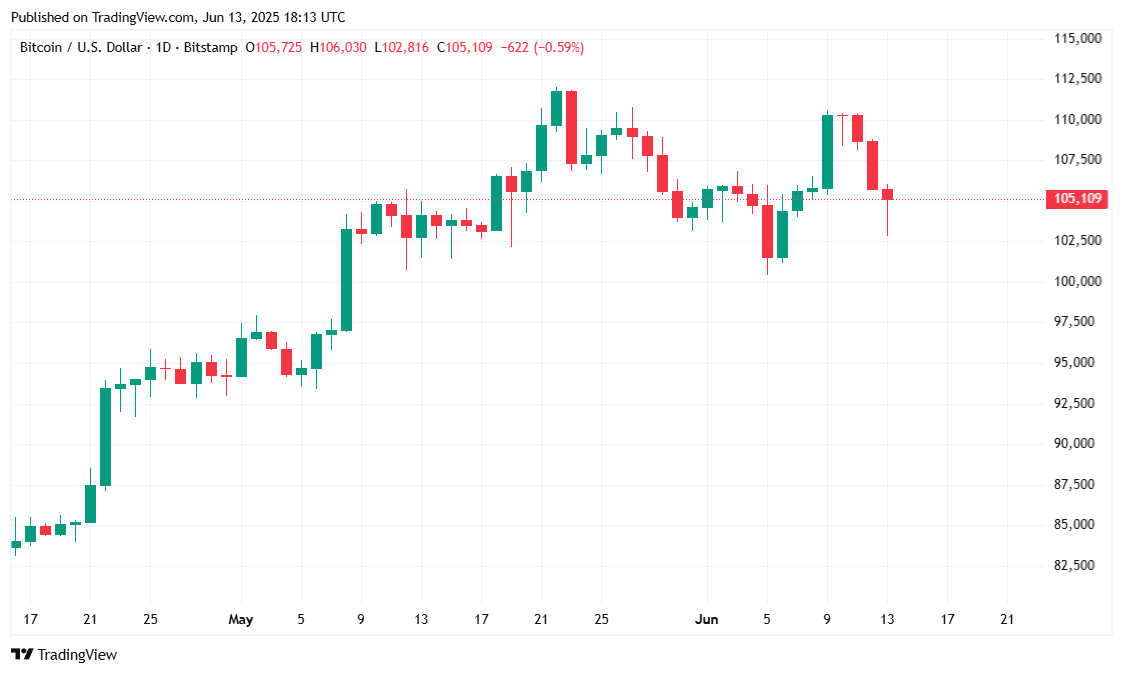

Bitcoin ( BTC) dropped 2.8% over the past 24 hours to trade at $105,079.80 at the time of reporting but still edged out a 0.23% gain over the week. The cryptocurrency traded within a wide range of $102,822.03 to $107,872.21, as increased volatility returned to the market, mostly due to the unfolding Middle East conflict.

( BTC price / Trading View)

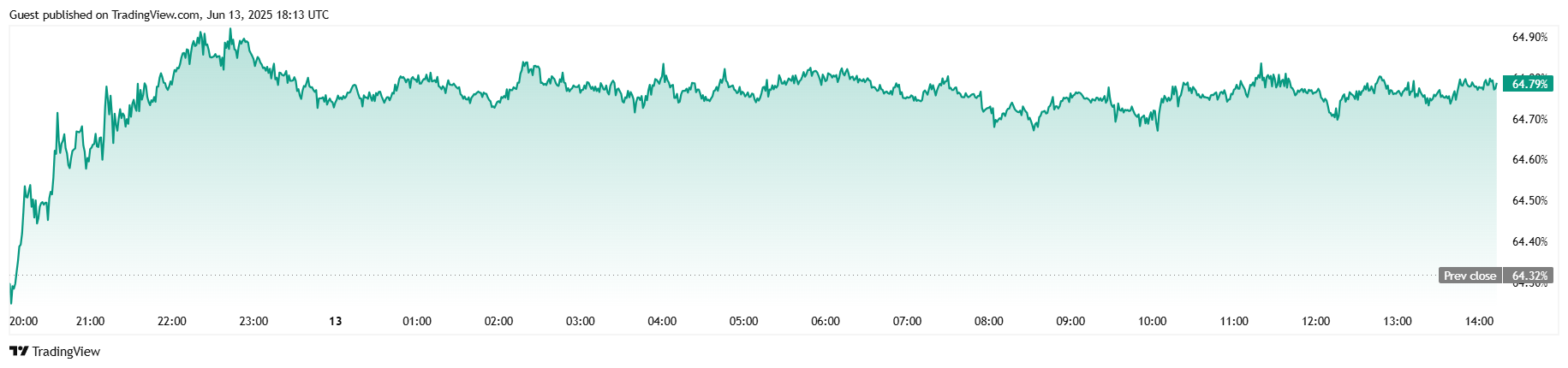

Trading volume surged to $73.20 billion, a 38.22% spike from the previous day as investors reacted to the unexpected price movement late Thursday. Meanwhile, bitcoin’s total market capitalization fell 2.89% to $2.08 trillion. BTC dominance rose by 0.64% to 64.79% as the digital asset held on to its value more firmly than lesser altcoins.

( BTC dominance / Trading View)

In the derivatives market, futures open interest dropped sharply by 5.26% to $69.80 billion, showing a risk-off tone among speculators. Liquidation data from Coinglass revealed that bullish traders were on the losing end, with $1.61 million in long positions wiped out versus just $164,600 in shorts.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。