Although the risk market performed poorly overall today, the writing of this report was relatively easier. Compared to the frequent events yesterday, today's focus is quite concentrated, as the geopolitical conflict has entered a substantive phase. Once war breaks out, oil prices are often the first to react, so I also recommend that those who are not interested in macroeconomics can simply gauge the evolution of the situation through the price fluctuations of West Texas Intermediate (WTI) oil. While it may not be entirely precise, it can save a lot of time spent reading the news.

With the worsening situation in the Middle East, many analysts believe that oil prices are unlikely to fall below $60 this year. Although energy prices are not included in core inflation, they can significantly push up the overall Consumer Price Index (CPI), especially for the United States, which is heavily reliant on a wheel-based economy. Costs in transportation, logistics, commuting, and even the service industry may rise accordingly.

Higher inflation means that the Federal Reserve's monetary policy maneuvering space is further constrained, especially as tariff issues remain unresolved, leading to increasingly pessimistic investor expectations. If the U.S. is forced to become deeply involved in the conflict, it will not only increase fiscal spending pressure but may also prompt the government to increase its debt issuance, further draining liquidity from the risk market.

So, for the sake of our own wallets, let's hope for world peace.

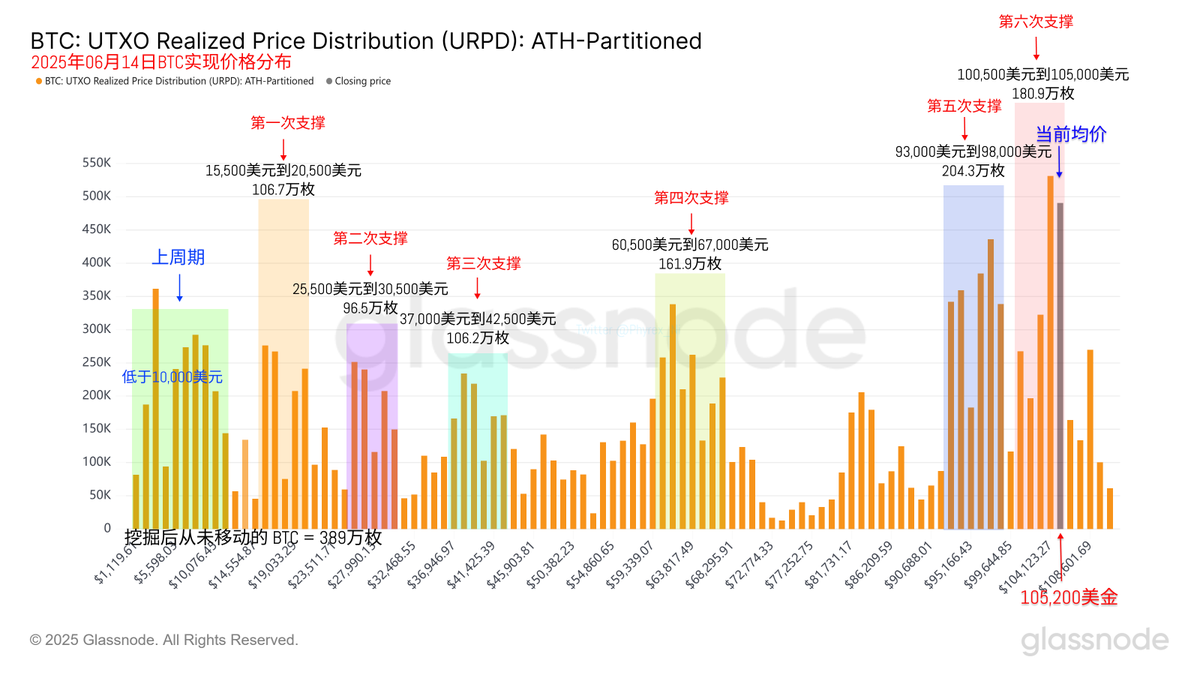

Looking back at Bitcoin's data, the amplification of price fluctuations has increased the turnover rate, especially as investors who bought the dip in the last two days have once again been hit. Some loss-making investors have chosen to exit, while earlier investors remain indifferent. A large amount of data has proven that long-term investors are not very interested in short-term price fluctuations.

Support remains strong between $93,000 and $98,000, with some chips falling back to around $105,000, and accumulation is starting to increase. Although there are not many issues in the short term, if this accumulation continues, the market will be forced to choose a direction again.

Overall, the current market focus is still on geopolitical conflicts, especially with the weekend approaching tomorrow, liquidity will significantly decrease. If there is any positive or negative information during this period, it is very likely to amplify price fluctuations.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。