In mid-June, the Bitcoin market was hit by a severe storm due to multiple factors, including geopolitical risks triggered by tensions in the Middle East, uncertainty in U.S. policies, and massive sell-offs by market whales. The price plummeted from a high of around $110,653, experiencing intense selling pressure. This wave of decline caused long positions to evaporate instantly, with on-chain liquidations exceeding $1 billion. Retail investors' panic selling and the chain reaction of leveraged liquidations further depressed the market, plunging it into a state of extreme gloom.

As the clouds of this potential crash had not yet cleared, investor sentiment fell to rock bottom, with discussions of "market collapse" echoing across social media. At this moment, a larger storm seemed to be brewing. An unusually large short position suddenly appeared on the Hyperliquid platform, causing the entire market to tense up.

Here's what happened: An anonymous whale opened a 40x leveraged short position on Hyperliquid, with a position value of up to $115 million, an initial margin of $7.3 million USDC, and subsequently added another $4.97 million. The weighted average opening price was $107,766, and the liquidation price of this position was set in a very sensitive area: $110,826. This means that as long as Bitcoin rises by less than 3%, the entire position will be liquidated.

This is not an ordinary short-term short position; it is a "life-or-death bet on direction." In other words, this is the whale's fate and also a barometer for the market.

Deconstructing Whale Behavior: This is Not a Gamble, It's a Bet on the "Short Line of Defense"

Let's break down the whale's operational rhythm:

- The first position was established on May 21, when the BTC price was around $107,192, directly using 40x leverage with a margin of $7.3 million, leaving almost no room for error, making it a lethal entry;

- On June 12, an additional $4.97 million was added to the short position—this was not a last-minute panic remedy but rather an increase in the established direction, or in other words, it was ammunition for "holding out until the counterattack";

- The average holding cost was raised to $107,766, and the liquidation price was also moved up to $110,826—this price point just happens to land on several key resistance points, like a "short lifeline" drawn by the whale.

From this rhythm, it is clear that this is not an impulsive "all-in" operation, but rather a meticulously calculated programmatic strategy driving the action: the whale knows that its liquidation price is exposed to the market, so it must set up the situation in advance, making it as difficult as possible for others to hit that price.

And this setup, we can also see some clues in the order book.

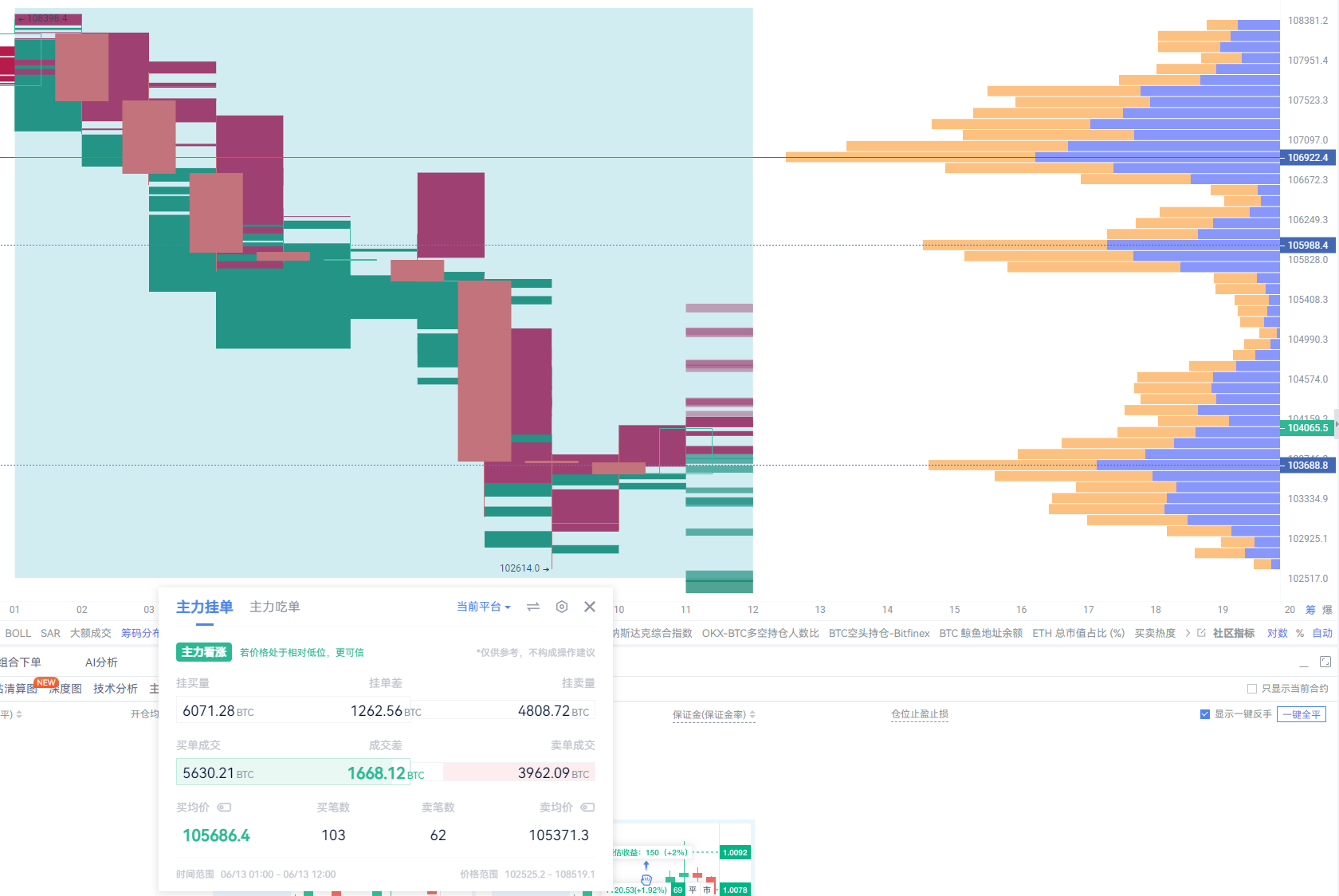

According to AiCoin data, as of June 13 at 11:00, the order book in the $104,132 to $106,106 range showed that selling pressure was 2.4 times that of buying power, forming a clear downward pressure structure.

This order book structure resembles a "line formation":

- The whale placed a large number of short orders above, creating a selling pressure atmosphere and suppressing market expectations;

- At the same time, it also placed a small number of buy orders, disguising them as support levels or signals to lure buyers, creating a price anchoring effect.

If establishing a position is the whale's bet, then the order book is its way of "showing its chips." This move is not just for profit; it is more about sending a message to the market: I am short here, do you dare to liquidate me? Of course, no matter how perfectly the short line of defense is drawn, it must face one ultimate question: will the market respond? The answer to this question is often found in technical patterns—because price patterns are always a reflection of traders' psychology.

Technical Analysis: The Liquidation Line is Not Just a Risk Line, But Also a Lure Line

At $110,826, on the surface, it is the liquidation point for the whale's $115 million short position, but in reality, it has almost become the magnetic pole for the entire market—targeted by bulls and the last line of defense for bears.

- From the candlestick structure, this position is stuck above the double top resistance level and is close to the 78.6% Fibonacci retracement level, forming a typical "structural resistance zone." Over the past two weeks, BTC has attempted to break through this level multiple times without success, indicating that a large number of stop-loss and open positions have accumulated in this range. Because of this, it possesses a strong "explosive attribute": once broken, it will trigger a chain reaction of short covering and FOMO buying.

- RSI: Although the RSI has not yet entered the overbought zone, it is showing a bullish arrangement. Once the price starts to reverse and the RSI breaks through the key threshold, it may trigger the entry of trend traders and momentum buyers. For bulls, this is the ideal sniping logic: 'Use liquidation as fuel, and ignite upward momentum with the liquidation point.'

- AiCoin's main order data shows that the current buy order volume is significantly higher than the sell order volume. Additionally, from the distribution of chips, buying power structurally dominates, indicating a strong willingness to support at the market bottom.

Therefore, this is not just a risk line for a particular whale, but a strategic high ground that the entire market "sees." Bulls know: breaking through here is not just about pushing the price up, but also about the passive buying triggered by the liquidation of $115 million, the panic exit of short sellers, and the entry of trend traders. The combined effect of these three could accelerate the market.

Behind the Liquidation Battle: This is Not an Ordinary Order Book, But a Carefully Arranged Battlefield

On a technical price level, the $110,826 liquidation line has become a magnetic pole for the tug-of-war between bulls and bears; but if we look one layer deeper, we find that this battle is not just happening between candlesticks and order books, but also on the battlefield constructed by trading platform mechanisms.

Why did the whale choose to open such an extreme position on Hyperliquid? The answer lies in the platform's rules.

Hyperliquid, as a decentralized perpetual contract platform that has emerged strongly in the past year, is changing the way the game is played with its "rules":

- Higher Leverage: BTC supports up to 40x leverage, far exceeding Binance's 20x, meaning that a 3% price fluctuation could liquidate the whale's position. This means that a "short position of $100 million" could become an ignition point with just a $3,000 fluctuation.

- On-chain Liquidation + Off-chain Matching: This improves efficiency but may also amplify liquidation slippage. On March 12, a whale caused a $4 million loss to the HLP treasury by withdrawing funds to push up the liquidation price, which is a side effect of this mechanism.

- No ADL Mechanism + Transparent Liquidation: There is no automatic reduction of positions; liquidation is entirely executed by the system. The whale can set up orders near the liquidation line, using hypurrscan.io for precise operations. However, the lack of take-profit/stop-loss order books significantly amplifies slippage risk.

- HLP Treasury Endorsement but Not Unlimited Support: The current treasury balance is $351 million, but facing a potentially liquidated $115 million position, extreme market conditions could put pressure on liquidity and raise concerns about price stability.

In short, this is a "constructible" battle scene: the whale uses platform mechanisms to shape the structure of chips and risk exposure, while traders need to find safe boundaries and opportunity windows within these game rules.

Conclusion

In the short term, the tactical value of the liquidation line has surpassed that of a single position. The $110,826 mark is not just a risk line for the $115 million short position, but also a critical point for market sentiment: the current price is less than 3% away, the funding rate is biased towards the long side (Hyperliquid's June 13 BTC perpetual is +0.015%), and the dynamics of large orders reveal signs of a sell wall collapsing. Once liquidation is triggered, it could create a combination of forced buying, panic short exits, and trend entries, opening a short-term acceleration window for BTC. In the long term, this event reflects a new logic of risk and strategy in the era of DEX. This short position has already become a "totem" for Bitcoin's short-term market.

If the market chooses to hesitate, the main sell wall remains solid, RSI continues to consolidate, and MACD does not break the dead cross, the whale may remain in a fishing position, even using a rebound to push back to $105,000; but if the bulls unite and break through the liquidation price, triggering liquidations, and technical indicators (such as MACD golden cross, OBV volume increase) cooperate simultaneously, then the chain reaction brought by liquidation will become the "fuel pack" for the short-term market, with target ranges possibly pointing above $112,000.

This is a tug-of-war centered around a liquidation line, and it is also a microcosm of the new game mechanisms in the high-leverage era.

We do not necessarily have to place bets, but we must see clearly—every time a whale is liquidated, the market is re-labeling: where exactly is the limit.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。