Original Title: Korea's Leverage wave is coming

Original Author: @impalementd

Original Translation: gpt, BlockBeats

Editor's Note: Currently, South Korea is promoting the legalization of the Korean won-backed stablecoin and leveraged trading, with digital asset taxation set to be implemented soon. Despite strict regulations, there is a strong demand for leveraged trading, and trading volume is expected to increase significantly. High-level government support for crypto is driving the development of a spot leverage system, although derivatives remain restricted. Regulation of Play-to-Earn and Web3 games remains stringent, damaging industry trust, leading major companies to turn overseas. Upbit and Bithumb have become key targets for overseas projects, and the opening of leverage trading will trigger a new round of competition in the market.

The following is the original content (reorganized for better readability):

The wave of leverage in South Korea is about to hit, as the country is at a critical stage of power transition, and the new government is attempting some quite radical experimental ideas regarding cryptocurrency.

The two most likely topics to be implemented are:

- A stablecoin backed by the Korean won

- Legalization of leveraged trading

On June 10, Min, a member of the ruling party, released a draft of the "Digital Asset Basic Law," which includes proposals for the aforementioned stablecoin and leveraged trading.

Once the relevant policies are truly implemented, South Korea will fully advance in the taxation of cryptocurrencies. Upbit and Bithumb have already been promoting themselves as top exchanges to overseas projects, so if leveraged trading is allowed, it could trigger a second wave of trading volume in the South Korean market.

Koreans and leverage are almost synonymous

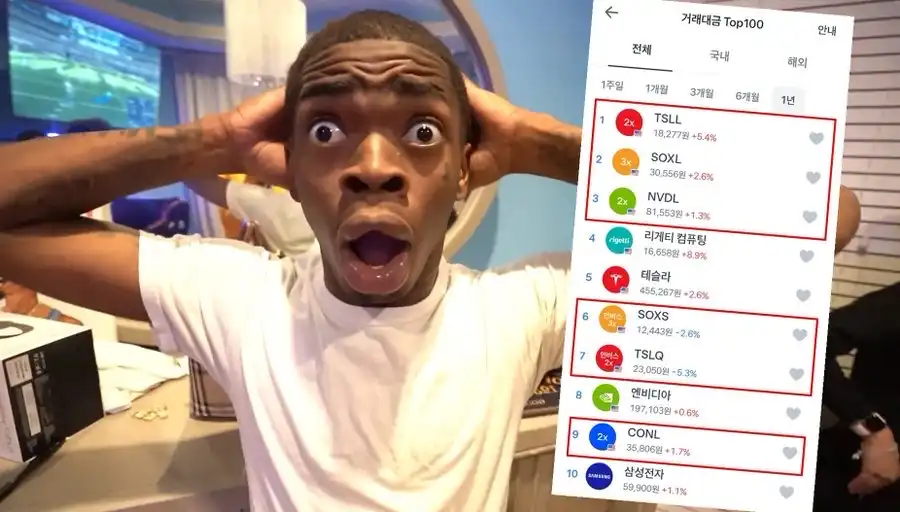

Although this is an old saying, locals do indeed like to refer to themselves as the "leverage nation." Data supports this—among the top ten stocks by trading volume in South Korea, six are leveraged ETFs.

Looking at the holding data—on the list of overseas stocks most favored by Koreans, the sixth is TQQQ (a triple-leveraged NASDAQ ETF). This preference for aggressive betting is not just an internet meme; it has almost become a national characteristic.

Because of this, even on Upbit, Bitcoin trading pairs usually do not make it into the top five, while on Bithumb, they often rank fourth or fifth for years.

Currently, Upbit's 24-hour trading volume is $2 billion, and this is entirely from spot trading. If leveraged trading is allowed, the trading volume could easily triple. After all, the trading volume between the spot and futures markets typically differs by a factor of 3 to 4.

Why is the possibility of opening leverage greater this time?

In the past, there have been several bills attempting to relax regulations or delay cryptocurrency taxation, but the difference this time is that, after the election, the relevant actions are finally "visible."

The ruling Democratic Party has consistently supported taxing digital assets. However, the premise for taxation is the establishment of a regulatory framework, so their strategy is to first promote legislation for "Korean won-denominated stablecoins" and relax restrictions on leveraged trading, thereby laying the groundwork for subsequent taxation.

The current president's new policy chief Kim Yong Bum, who previously operated the think tank Hashed Open Research under the blockchain venture capital firm Hashed, has been actively promoting stablecoin legislation and publicly supporting the relaxation of regulations in the crypto industry.

It may not be perpetual contracts, but the "leverage nation" will be awakened.

No one can be certain whether this bill will ultimately pass, but even if it does, leveraged trading in South Korea will not take the form of perpetual contracts as seen on Binance.

What is written in the draft is actually a spot leverage system based on a "lending model," and it does not involve any derivatives or futures options—such content is completely absent from the draft. In other words, we can only expect leveraged trading supported by collateral.

Although the operation of a spot leverage system is cumbersome and heavily restricted, in South Korea, leveraged products still dominate trading volume in the stock market. This "taste" is likely to carry over to the crypto market. The expected leverage multiples will be between 3 to 10 times.

Once a token is included in the list of those eligible for leverage, its trading volume will soar rapidly, and listing on Upbit will just be the first step.

Combining the leverage system with the Korean won stablecoin will further amplify this effect.

P2E still stuck in a regulatory gray area

Even with these eye-catching reforms and a group of pro-crypto officials joining the government, do not expect the regulation of Play-to-Earn or broader Web3 games to relax in the short term.

Whether under progressive or conservative governments, there has been a crackdown on the "speculative" mechanisms in the gaming industry for years, with the core issue being gambling-like characteristics. Until cryptocurrency taxation is fully implemented, Play-to-Earn projects will continue to be shelved.

The South Korean gaming industry has seen a decline for three consecutive years. The strong backlash against loot box mechanisms has severely damaged player trust, leading major gaming companies to turn to overseas markets. They have little motivation to try P2E domestically. For example, MSU (@MaplestoryU), despite its clear popularity internationally, has never held a Korean-language AMA event.

Overseas projects have already targeted Upbit and Bithumb as their ultimate listing goals. Various teams are flying to South Korea, continuously holding offline gatherings. Everyone knows that to smoothly pass the listing process and gain support, they must earn the recognition of South Korean users.

Project teams are constantly launching various benefits and incentives to attract Korean holders. If leveraged trading opens on Upbit and Bithumb, the competition for the South Korean market will become even more intense.

Once leveraged trading is not limited to Bitcoin but expands to altcoins, we will usher in a golden period for the "Upbit era."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。