This content is provided by a sponsor.

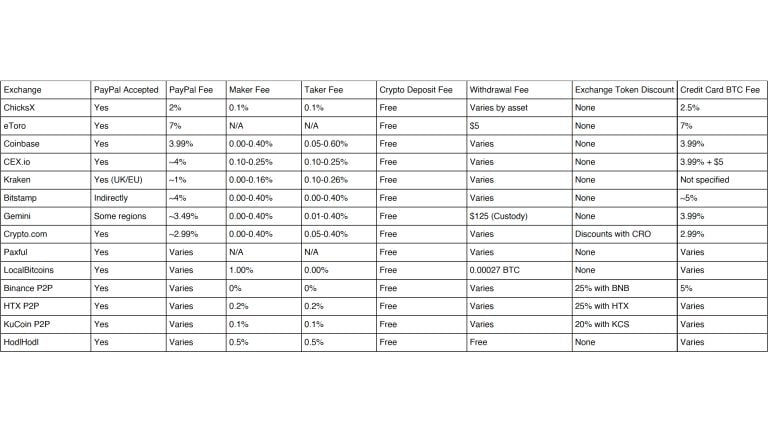

Exchange Fee Comparison Table

Which Exchange Has the Lowest Crypto Fees?

Finding crypto exchanges with lowest fees takes research. After testing dozens of platforms, ChicksX offers the best balance. Their flat 0.1% trading fees beat most competitors while keeping things simple.

P2P exchanges show zero trading fees on paper. But sellers add their profit to prices. You often pay 2-5% above market rates. That’s why transparent fee structures matter more than headline numbers.

Understanding Cryptocurrency Exchange Fees

Every crypto exchange charges different fees. Smart traders know exactly what they pay before trading. Let’s break down the real costs.

Trading Fees: The Main Cost

Trading fees hit your wallet every time you buy or sell. Most exchanges charge two types:

Maker fees apply when you add liquidity with limit orders. These cost less because you help the exchange.

Taker fees apply when you take liquidity with market orders. These cost more because you remove liquidity.

ChicksX keeps both maker fees and taker fees at 0.1%. Compare that to other crypto exchanges where taker fees reach 0.60%.

Deposit Fees: Getting Money In

Most platforms offer free crypto deposits. But fiat deposits tell a different story:

- Bank transfer: Usually free or low cost

- Wire transfer: $10-50 at many exchanges

- Credit cards: 2.5-5% extra

Smart traders use bank transfers to avoid deposit fees. ChicksX makes this easy with multiple payment options.

Withdrawal Fees: Getting Money Out

Withdrawal fees vary wildly between platforms. Some charge flat fees, others use percentages. Network fees add another layer of cost.

Professional traders and high volume traders hate excessive withdrawal fees. They eat into profits fast. ChicksX keeps these reasonable across all digital assets.

Is There a Crypto Exchange with No Fees?

True zero fee trading doesn’t exist long-term. Exchanges need revenue to operate. But some offer promotions or specific pairs without fees.

Decentralized exchanges sometimes show no trading fees. But you pay network fees (gas) instead. During busy times, these exceed regular exchange fees.

Some platforms claim no fees but hide costs in spreads. The price you see isn’t what you pay. Always check the real rate before trading.

Fee Structure Breakdown for Active Traders

Understanding fee structures helps active traders save money. Most exchanges use tiered systems based on trading volumes.

How Trading Volume Affects Your Fees

Higher trading volumes unlock lower fees. But requirements vary:

- Entry level: $0-10,000 monthly

- Mid tier: $10,000-100,000 monthly

- High tier: $100,000+ monthly

Experienced traders plan their trading to hit volume thresholds. But for most people, standard rates apply.

Spot Trading Fees vs Futures Trading

Spot trading fees cover immediate trades. Futures fees apply to leveraged positions. Futures trading often costs less to encourage volume.

ChicksX offers competitive trading fees for both spot and futures. Their simple structure helps traders calculate costs easily.

Which Crypto Has Lowest Transaction Fees?

Different cryptocurrencies charge different network fees:

- Bitcoin: $1-20 per transaction

- Ethereum: $5-50 during congestion

- XRP: Under $0.01

- Stellar: Under $0.01

These network fees exist separately from exchange fees. Smart traders pick coins with low network costs for frequent transfers.

Who Has Cheaper Fees Than Coinbase?

Almost everyone beats Coinbase on fees. Their 0.60% taker fees rank among the highest. Here’s who offers lower trading fees:

- ChicksX: 0.1% flat rate

- Kraken: 0.16% for basic users

- Binance: 0.10% standard rate

- KuCoin: 0.10% base rate

Coinbase works for beginners but costs too much for regular trading. Experienced traders switch to low fee exchanges fast.

Deposit and Withdrawal Methods Compared

Different payment methods mean different costs. Here’s what you pay:

Bank Transfer Options

Bank transfers offer the cheapest way to deposit and withdrawal. Most exchanges charge nothing for ACH transfers. Wire transfers cost more but process faster.

Credit Card Fees

Credit cards work instantly but cost 2.5-5% extra. Only use them for urgent small purchases. Large crypto investments deserve cheaper methods.

Crypto Transfers

Moving crypto between exchanges costs only network fees. Many exchanges cover deposit costs to attract new users. Always check withdrawal fees before choosing a platform.

Additional Fees That Exchanges Charge

Hidden fees hurt more than transparent ones. Watch for these extra costs:

Inactivity Fees

Some platforms charge dormant accounts. These inactivity fees range from $5-50 monthly after 6-12 months without trades.

Conversion Fees

Trading between fiat currency pairs adds cost. Exchanges charge 0.5-2% for currency conversion.

Spread Markup

The difference between buy and sell prices hides real costs. Wide spreads mean higher fees even with “zero commissions.”

How Market Makers Get Better Rates

Market makers provide liquidity and get rewarded with reduced fees or rebates. Some exchanges pay market makers to trade.

Requirements vary but typically include:

- Minimum monthly volume

- Consistent limit orders

- Tight spread maintenance

Regular traders can act like market makers by using limit orders instead of market orders.

Strategies for High Volume Traders

High volume traders use specific tactics to minimize costs:

Exchange Native Tokens

Holding an exchange’s native token unlocks fee discounts:

- Binance: 25% off with BNB

- KuCoin: 20% off with KCS

- Crypto.com: Discounts with CRO

ChicksX keeps fees low without requiring token holdings.

VIP Programs

Many exchanges offer VIP tiers with better rates. Benefits include:

- Lower trading fees

- Reduced withdrawal fees

- Priority customer support

- Higher limits

API Trading

Professional traders use APIs for better rates and faster execution. Some exchanges offer lower fees for API users.

Copy Trading and Social Trading Fees

Copy trading lets beginners follow experienced traders. But it adds costs:

- Performance fees: 10-30% of profits

- Management fees: 1-2% annually

- Regular trading fees still apply

Consider these extra costs before copying others.

Tax Implications of Crypto Exchange Fees

Fees affect your tax bill more than most traders realize. Every fee increases your cost basis and reduces taxable gains.

Track these for taxes:

- All trading fees paid

- Deposit and withdrawal costs

- Network fees for transfers

- Conversion fees

Good exchanges provide yearly statements. ChicksX generates tax-friendly reports automatically.

Comparing Centralized and Decentralized Exchanges

Centralized Exchange Benefits

CEXs like ChicksX offer:

- Predictable fees

- Fast execution

- Fiat support

- Customer support

- User-friendly interfaces

Decentralized Exchange Considerations

DEXs provide:

- No KYC requirements

- Full asset control

- Access to new tokens

- Variable gas fees

- Complex interfaces

Most traders start with CEXs for their simplicity and lower learning curve.

Security Features of Low Fee Exchanges

Low fees mean nothing if exchanges lack security. Quality platforms invest in:

Asset Protection

- Cold storage for user funds

- Insurance coverage

- Regular security audits

- Proof of reserves

Account Security

- Two-factor authentication

- Email confirmations

- IP whitelisting

- Anti-phishing codes

ChicksX balances low fees with strong security measures.

Regulatory Compliance and Fee Transparency

Legitimate exchanges follow regulations and display fees clearly. Look for:

- Clear fee schedules

- No hidden charges

- Proper licensing

- Transparent ownership

Avoid platforms that hide fee information or lack regulatory compliance.

Best Practices for Minimizing Trading Costs

Smart traders follow these rules to pay less:

Use Limit Orders

Limit orders qualify for maker fees. They cost less than market orders on every exchange.

Plan Your Trades

Batch small trades together. One larger trade costs less than multiple small ones.

Choose the Right Pairs

Some trading pairs have promotional rates. Native tokens often trade cheaper against stablecoins.

Time Your Withdrawals

Withdraw during low network congestion. Fees drop significantly during quiet periods.

Advanced Trading Features and Fees

Advanced traders need specific features:

Margin Trading

Borrowing to trade costs extra through interest charges. Rates vary from 0.02-0.2% daily.

Futures Contracts

Futures fees differ from spot fees. Funding rates add another cost layer for holding positions.

Options Trading

Not all exchanges offer options. Those that do charge premium fees for the complexity.

Mobile Trading and Fee Considerations

Mobile apps sometimes charge different fees. Check if your exchange maintains consistent pricing across platforms.

Good mobile experiences include:

- Full fee transparency

- Easy deposit and withdrawal

- Complete trading features

- Real-time fee calculations

Global Crypto Traders and Regional Differences

Fees vary by region due to regulations and payment methods. European traders often get better bank transfer options. Asian traders see more P2P choices.

Global crypto traders should pick exchanges supporting their region with competitive local payment methods.

Future of Crypto Exchange Fees

Competition drives fees lower over time. New exchanges must offer competitive trading fees to attract users. Established platforms reduce fees to retain customers.

Trends to watch:

- More zero-fee promotions

- Subscription models

- Dynamic pricing

- Automated fee optimization

Choosing Your Exchange: Final Considerations

After analyzing all options, ChicksX emerges as the optimal choice for most traders. They combine:

- Low 0.1% flat fees

- Simple fee structure

- Strong security

- Multiple payment options

- Good customer support

Other exchanges work for specific needs. Day traders might prefer platforms with maker rebates. Beginners might start with simpler interfaces despite higher fees.

Common Fee Mistakes to Avoid

New traders make these expensive errors:

Ignoring Total Costs

Trading fees represent one part. Add deposit fees, withdrawal fees, and spreads for true costs.

Chasing Promotions

Zero-fee promotions end. Base decisions on standard rates, not temporary offers.

Overlooking Network Fees

Moving crypto costs money regardless of exchange fees. Factor these into your trading costs.

Using Wrong Payment Methods

Credit cards seem convenient but cost too much. Bank transfers save significant money over time.

The True Cost of Trading Crypto

Understanding all fees helps traders profit. Small differences compound over hundreds of trades. A 0.1% saving on $100,000 volume equals $100 saved.

Professional traders obsess over fees because they understand this math. New traders should develop the same mindset early.

Key Takeaways for Low-Fee Trading

Smart crypto trading means minimizing costs at every step:

- Choose exchanges with transparent, low fees

- Use limit orders for better rates

- Avoid expensive payment methods

- Track all fees for taxes

- Consider total costs, not just trading fees

ChicksX delivers on all these points. Their straightforward approach helps traders keep more profits.

Whether you’re investing long-term or trading daily, fees matter. Pick the right exchange, understand the fee structure, and trade smarter. Your wallet will thank you.

_________________________________________________________________________

Bitcoin.com accepts no responsibility or liability, and is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the article.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。