Artificial intelligence (AI) may wipe out 50% of all entry-level white-collar jobs within five years according to Dario Amodei, CEO of AI firm Anthropic. Similarly, Matt Cole CEO of Strive Asset Management says half the companies in the S&P 500 today may vanish in the wake of AI disruption, unless they hedge with bitcoin.

We’ve seen this movie before. Roughly 50% of the firms that made up the S&P 500 in 1990 had dropped from the index by 2020 after being upended by fast-rising Internet companies, according to Cole.

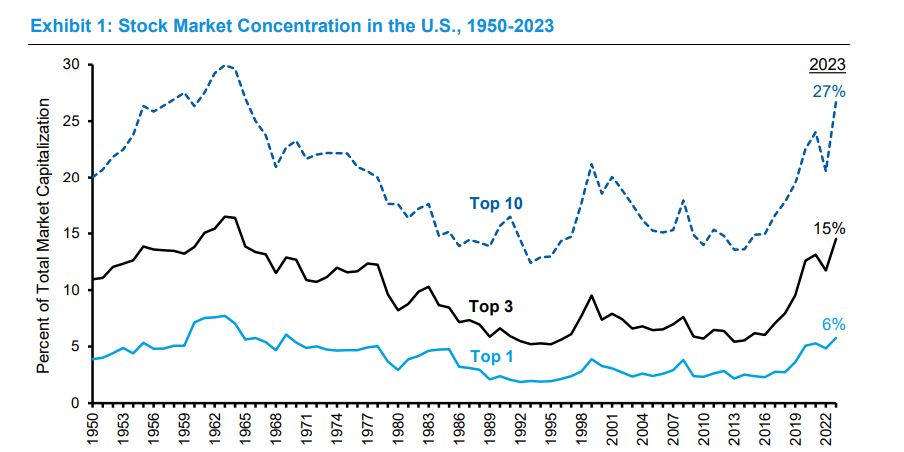

(The number of companies in the S&P 500 fell after the dot com boom leading to fewer and larger firms like Google and Apple dominating the index’s overall market capitalization / Morgan Stanley)

“We obviously had the rise of all these tech stars,” Cole explained in an interview with Bitcoin.com “What’s often not talked about is that from a period of 1990 to 2020, over half the companies in the S&P 500 fell out of the S&P 500; they got replaced.”

Cole says now is the time for shrewd executives to hedge against what will likely be the most significant disruption of our generation, and what better way to do that than by using an asset that is already disrupting finance – bitcoin.

“Our pitch to these companies is, ‘look towards the future,’” Cole said. “AI is an opportunity and a risk to your business, but if your business has a large risk, by putting bitcoin on your balance sheet, you actually hedge against that risk.”

Strive Asset Management was co-founded by former presidential candidate and biotech entrepreneur Vivek Ramaswamy and his high school buddy and beverage executive Anson Frericks. The firm carved out a niche in the asset management space by emphasizing a non-apologetic investment strategy rather than adopting popular socio-political trends such as diversity, equity, inclusion (DEI), and environmental, social, and governance (ESG) frameworks employed by other asset managers like Blackrock. The firm currently has about $2 billion in assets under management and has launched thirteen exchange-traded funds (ETFs), according to its website.

(Strive co-founders Anson Frericks (left) and Vivek Ramaswamy (right) / strive.com)

Cole, an investment veteran who managed a $70 billion fixed-income portfolio for the California Public Employees’ Retirement System (Calpers), assumed the CEO role at Strive in 2023 after Ramaswamy stepped down to focus on his political ambitions.

And now Cole, who bought his first bitcoin (BTC) in 2016, is not only going to load up the firm’s balance sheet with the cryptocurrency, but he’s also implementing an alpha-generating strategy to amplify the returns from Strive’s BTC holdings.

“Most of the companies, or all the companies, are actually focused on the beta side,” Cole explained. “We’re going to do the same things, but we’re also going to do alpha strategies.”

Beta investing is more passive, while an alpha strategy is more active. Alpha strategies can generate higher returns but they usually involve more risk. Cole addressed the risk concerns by emphasizing his portfolio management experience and Strive’s unique expertise in the biotech space.

“We have a management team that’s from the biotech industry,” Cole said. “One of our board members also comes from the hedge fund biotech space. So we just have this unique kind of Venn diagram of Bitcoiners and biotech hedge fund experts.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。