Key Points:

A giant Ethereum whale earned $31 million through two Ethereum transactions in the past 44 days.

The number of unique Ethereum addresses surged by 70% in the second quarter, with Base network activity leading the way.

Ethereum is about to break its monthly trading range, reaching a 15-week high of $2827 on June 10. If the daily close remains above $2700, it will mark the highest closing level since February 24.

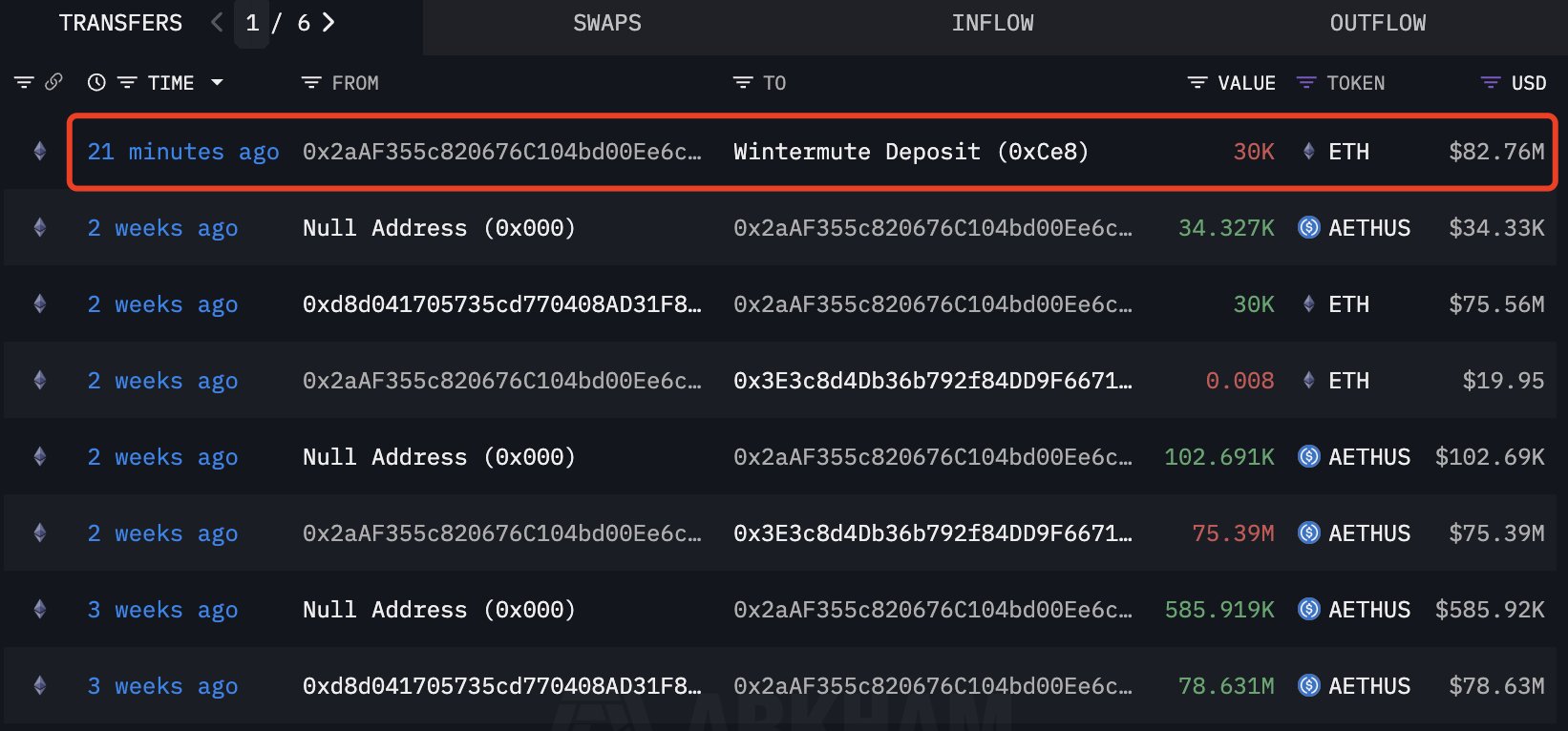

After a month of price range consolidation (between $2300 and $2800), a giant Ethereum whale seized the recent rebound opportunity. According to on-chain data analysis platform Lookonchain, this whale sold 30,000 Ethereum through over-the-counter (OTC) trading on June 10, earning $82.76 million and locking in a profit of $7.3 million. This sale followed the whale's purchase of Ethereum for $75.56 million on May 27.

The same whale previously purchased 30,000 Ethereum at a unit price of $1830 through Wintermute OTC trading on April 27, totaling $54.9 million. By May 22, when the price of Ethereum had risen by 43%, the whale sold at $2621, earning $78.63 million, netting a profit of $23.73 million.

This investor achieved an astonishing profit of $31 million in just 44 days.

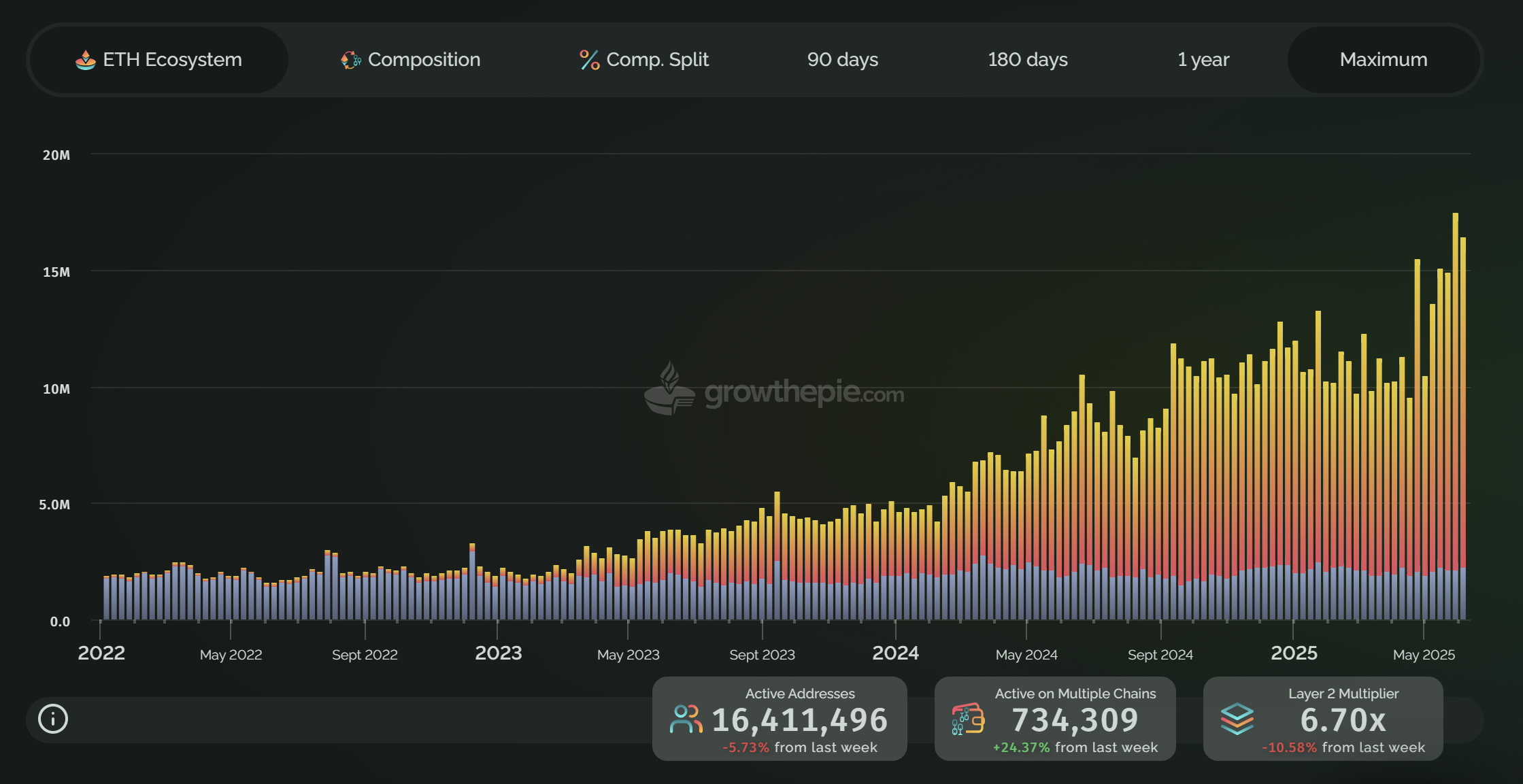

The number of unique addresses on the Ethereum network reached a historic high of 17.4 million earlier this month. According to data from growthepie, the number of Ethereum addresses interacting with one or more blockchains has increased by 70.5% since the beginning of the second quarter. The number of active Ethereum addresses remains high, recorded at 16.4 million on June 10.

The Base network has shown the most significant growth in this surge, accounting for 72.81% of the total increase of 11.29 million addresses this week, while the Ethereum mainnet recorded 2.23 million addresses, making up 14.8%.

Cointelegraph reports that Ethereum continues to dominate the decentralized finance (DeFi) space, holding approximately $66 billion in total locked value (TVL), accounting for 61%.

However, there are still concerns about its sustainability, as the network has only generated $4.33 million in transaction fees over the past 30 days. Recent network updates favoring low-cost data packets (blobs) in layer two scaling solutions have reduced staking rewards, and Ethereum's supply reduction largely depends on network fees.

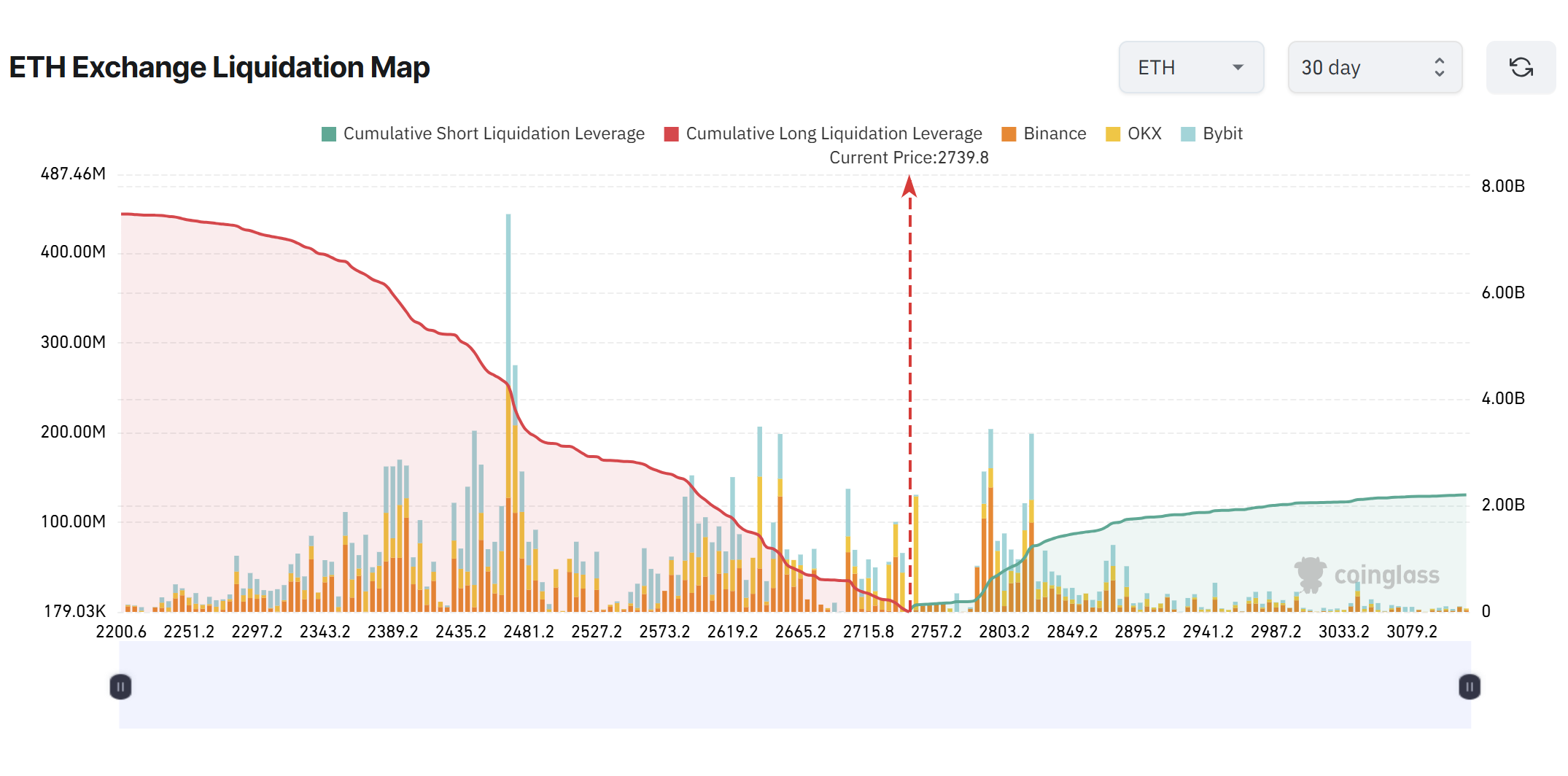

Ethereum futures open interest (OI) has first surpassed the $40 billion mark, indicating that market leverage is at a high level. This record open interest suggests potential for significant volatility.

Despite the risks, market liquidity dynamics remain relatively balanced. According to CoinGlass data, $2 billion in long positions will face liquidation if the price drops to $2600, while $1.8 billion in short positions will be at risk of liquidation if the price breaks above $2900. This balanced state makes it difficult to predict the next move of market makers, who may chase liquidity in either direction.

Related: Ethereum (ETH) price breaks above $2800, but options traders are opening short positions: Will this short position misjudge?

This article does not contain any investment advice or recommendations. Any investment and trading activities involve risks, and readers should conduct their own research before making decisions.

Original article: “Ethereum Price Hits 15-Week High: Will $1.8 Billion in Short Liquidations Push ETH Above $3000?”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。