Stablecoins are becoming a market consensus.

Written by: Zuo Ye

Stripe's acquisition of Bridge is just the beginning. Huma is using stablecoins to replace the role of bank intermediaries, and Circle has become a new player in the crypto space after Coinbase with USDC, all of which are poor imitations of USDT.

Ethena has emerged later but is ahead, MakerDAO has rebranded to Sky and shifted to yield-bearing stablecoins, and Pendle, Aave, and others are rapidly transitioning to USDC--PT/YT--USDe. The above summarizes the recent stories of on-chain stablecoins.

At least for now, YBS (Yield-Bearing Stablecoin) still belongs to the concept of stablecoins, and it is difficult for everyone to understand the fundamental differences between USDe and USDT. In my view, YBS projects like USDe attract users through yield generation, distributing part of the asset income to users, and after accumulating deposits, continue to earn asset income.

Previously, the issuance of USDT was a process of creating new assets. It is important to know that the reserves of USDT are managed by regulators or project parties, with no relation to users. Users can only passively accept that USDT represents 1 dollar and hope that others also recognize its value.

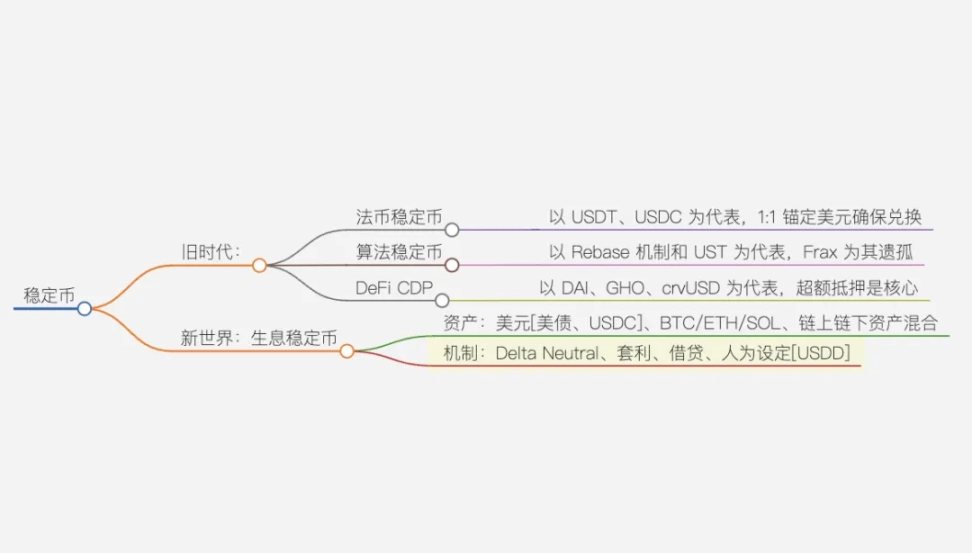

Image caption: Classification of stablecoins

Image source: @zuoyeweb3

YBS follows the logic of on-chain banking's deposit-lending, deconstructing the power of asset issuance. Circle's creation of USDC requires cooperation between government and business and support from exchanges, but YBS has already shown explosive growth.

To reiterate, the history of the crypto industry is a history of innovation in asset issuance models, but this time it is under the name of stability, appearing somewhat milder, unlike the intensity of ERC-20, NFT (ERC-721), and Meme Coin on-chain PVP.

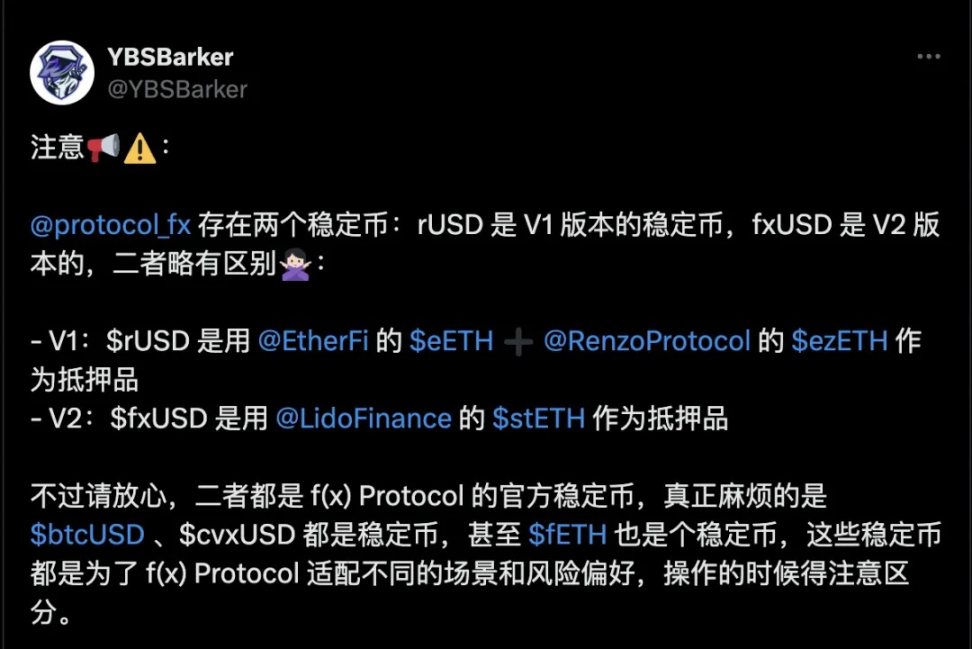

For example, f(x) Protocol has at least five stablecoins, with V1 and V2 having rUSD and fxUSD respectively. In addition, there are $btcUSD, $cvxUSD, and even fETH is referred to as a stablecoin because it maintains price anchoring by capturing part of ETH's volatility, while the remaining volatility is absorbed by xToken.

Image caption: Many stablecoins in f(x) Protocol

Image source: @YBSBarker

Stability arises from volatility, and volatility creates stablecoins.

Sailing from the Old World to the New Continent

Whether it is yield-bearing stablecoins or StableFi, they are new expressions of stablecoins. It is worth briefly sorting out the origins of stablecoins.

Stablecoins originated from Bitcoin, a peer-to-peer electronic cash payment system, but Bitcoin is not stable. This is not a design flaw of Bitcoin; it is essentially an unanchored currency system, and its fair price still fluctuates around value, making it impossible to stabilize in the short term.

The earliest attempt at USDT was within the Bitcoin ecosystem, later shifting to the exchange valuation field. The golden combination of Bitfinex and Tether allowed stablecoins to find their earliest habitat, similar to today's Coinbase and Circle.

Fiat-backed stablecoins were thus born. Their mechanism is not complicated; you just need to trust Tether and have everyone recognize the market trading stability of USDT. The first-mover advantage allowed Tether to create a profit margin higher than BlackRock.

Following closely was the issuance of DAI by MakerDAO. The over-collateralization mechanism (CDP) has long been the only option for on-chain stablecoin issuance. A 1.5x collateralized asset suppresses capital efficiency but provides higher credibility to market participants.

From an on-chain perspective, the history of cryptocurrencies is a story of how to reduce collateralization rates, with financial alchemy working in both directions. Hyperliquid can amplify asset trading leverage, but there is no good way to leverage asset creation.

Image caption: Mainstream stability in 2022

Image source: stablecoins.wtf

Regarding asset creation, UST is a sad chapter; classic algorithmic stablecoins have since faltered. Frax can at most be considered semi-algorithmic or more appropriately termed a hybrid mechanism, already resembling USDC.

Mechanically, yield-bearing stablecoins require both yield mechanisms and stablecoin mechanisms, based on the other three. The CDP mechanism of DeFi giants is also acceptable, and Ethena's delta-neutral mechanism is fine as long as stability can be guaranteed. Of course, USDD is promised to maintain stability by Sun, as long as everyone recognizes it.

The real distinction lies in the yield and profit-sharing mechanisms, depending on the source of yield-bearing assets. The simplest methods are twofold: using on-chain staked assets like stETH or off-chain yield-bearing assets like US Treasuries, and both can be mixed.

Ethena's USDe is somewhat special; it uses stETH for yield while employing a CEX hedging method to maintain price stability and requires compliance through off-chain entities. It also uses USDC as part of its reserves. As mentioned, everything can be mixed, regardless of mechanism or asset.

If Ethena only used ETH assets and hedged on Hyperliquid while completely distributing profits on-chain, it would be the ideal on-chain native yield-bearing stablecoin.

Unfortunately, such projects do not strictly exist.

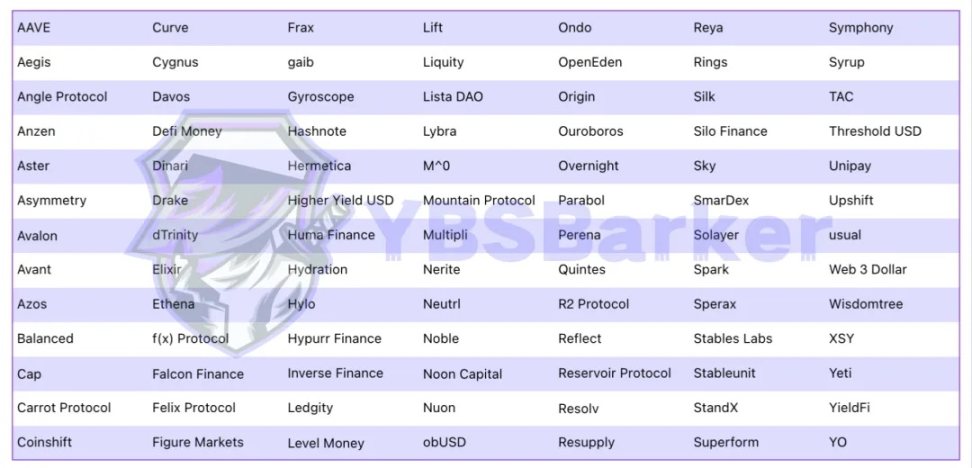

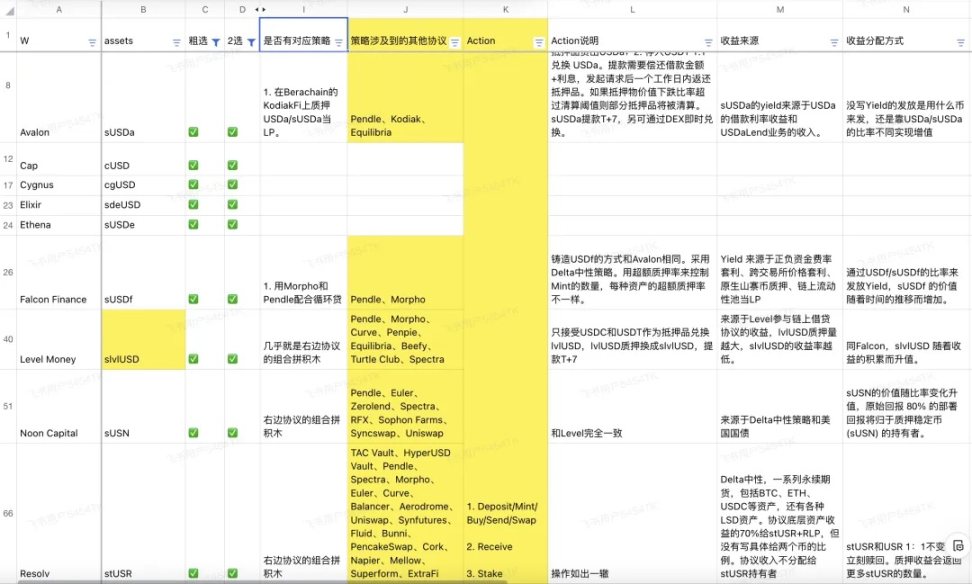

Image caption: List of yield-bearing stablecoin projects

Image source: @YBSBarker

The above is a compilation of 91 projects. If we add USDT, USDT0, USDC, PYUSD, and USDD, reaching a hundred is not difficult.

In fact, according to data from RootData, there are currently 181 projects involving stablecoins, while DefiLlama has recorded 259. However, after excluding non-yield-bearing stablecoin projects, the mainstream options actively available in the market are basically covered here.

Sorting by the first letter of the protocol focuses more on the protocol rather than the stablecoin. Strictly speaking, USDe is not a yield-bearing stablecoin; sUSDe fits the definition. A complete yield-bearing stablecoin protocol token economy should look like this:

Stablecoins and their staked versions, such as USDS and sUSDS

Protocol main tokens and their staked versions, such as ENA and sENA

Additionally, focusing on the protocol will better reflect the distinction between "the protocol is in profit-sharing, and the stablecoin is a profit-sharing certificate." Referring to the historical innovation of asset issuance, any high-potential project in any track will not exceed five, including public chains, DeFi, L2, wallets, inscriptions, runes, and Meme Coins.

Coincidentally, yield-bearing stablecoins are a very complex intersection, with DeFi, RWA, and stablecoins pulling each other. Projects like Aave's GHO (ERC-20) and sGHO (ERC-4626), as well as Curve's crvUSD and scrvUSD, only serve to strengthen their own protocols and will not fully counter USDe or USDS's market share.

So the real question is, outside of USDS and USDe, how much market space is left for emerging yield-bearing stablecoin protocols.

After a rough selection of the 91 protocols, the subjective criteria are as follows:

Older DeFi protocols that do not focus on YBS business, such as Aave, where the core remains lending;

Inactive, the most subjective criteria:

• Not yet launched on the mainnet, will continue to be updated

• Following the trend of fast-track projects, following the stablecoin moves of DeFi giants in 2022, following Ethena's delta hedging in 2023, and the current trends

• And those that have been acquired or have already ceased operations

- No financing or backup; perhaps they are struggling to persist, but stablecoin projects need reserves. Lack of financing indicates a lack of recognition in the primary market, making it difficult to win through technology or community contributions of large TVL.

It must be noted that projects like WLFI's USD1, issued by the Trump family, resemble USDT more and are not closely related to yield-bearing stablecoins, thus not included in the discussion.

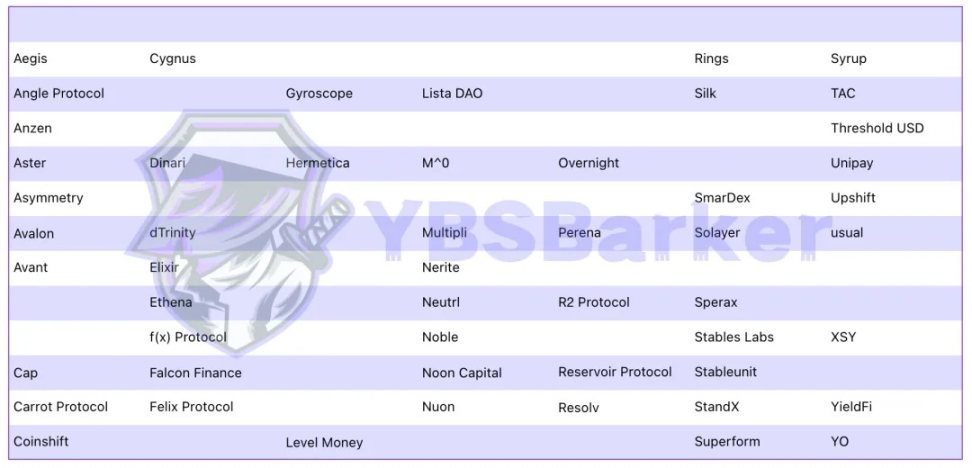

Image caption: Projects after rough selection

Image source: @YBSBarker

The above 52 projects are the contestants vying for the remaining positions in the yield-bearing stablecoin track. For example, we directly exclude Polkadot's Hydration; surely no one is still expecting Polkadot to revive.

For instance, Figure Markets' YLDS is the opposite of on-chain yield-bearing stablecoins, but it has obtained legal registration qualifications, suitable for traditional financial clients with special compliance needs. Detailed exclusion reasons can be found in the Feishu document.

After rough selection, we examine the details based on three dimensions: fundamentals, yield methods, and APY.

• Fundamentals: Official website, Twitter, CA

• Yield methods: Strategies and actions, sources of income, methods of income distribution, rewards

• APY calculation methods

To clarify, strategies and actions refer to the financial strategies corresponding to YBS, while actions are the concrete operational steps. The source of income refers to where the protocol's income comes from, and the income distribution method is generally through staking stablecoins, but specific cases require specific analysis, which will not be elaborated here.

Taking Avalon as an example, its stablecoin is USDa, and its yield-bearing stablecoin is sUSDa, with the details of each dimension as follows:

• Source of income: USDa borrowing interest income + USDa lending business income

• Strategy: Staking USDa/sUSDa in the Berachain ecosystem KodiakFi to form LP

Moreover, Avalon is particularly typical, needing to involve Pendle. In the current YBS ecosystem, the combination of Pendle and Aave is the biggest beneficiary, surpassing the peak period of Curve. Here, I will dig a pit to fill in later.

Of course, this naturally involves assessing and classifying the security and stability of emerging protocols. Sui's Cetus serves as a cautionary tale, with a new pit (today Cetus can claim compensation 😭).

DeFi Lego to YBS Building Blocks

Successfully reaching the New World does not mean victory; the survival crisis will become more urgent.

There are still too many. We attempt to start with the end in mind, selecting projects to reduce the number, referencing data from YBSBarker and on-chain data from various protocols. We have selected the following 12 protocols based on their underlying assets, core mechanisms, and quantitative data such as TVL.

Image caption: Selected projects

Image source: @YBSBarker

It is important to note that this is merely an analysis of the current market situation and does not equate to these projects winning effortlessly. Beyond the DeFi giants and institutional adoption, these 12 projects primarily compete in the retail market for interest calculation, pricing, and payment scenarios, which are also the most challenging and potentially lucrative tracks.

Perhaps Ethena envies Sky the most, as it is backed by government bond yields and the existing market for DAI, combining yield generation and stablecoins, thus transforming into Ethena's strongest competitor.

Image caption: Parameters of selected projects

Image source: @YBSBarker

In contrast, the remaining 12 contenders can only be said to use yield generation as a customer acquisition strategy.

Similar to the early DeFi Lego blocks, YBS protocols continuously combine with other protocols. Multi-chain, multi-protocol, and multi-pool setups are standard. Each YBS's organizational method and every yield-seeking participant contribute to Pendle's TVL and income.

Do you remember the leverage of asset creation mentioned earlier? In the YBS field, it can be approximated to Pendle, rather than Ethena or other YBS, working hard to create value for Pendle.

These projects still face significant issues. Considering that YBS is in its early stages, this is not unacceptable. However, one point remains: the sustainability of returns across protocols is still questionable. Sky, in order to distribute profits to users, allocated $5 million in earnings to USDS holders, resulting in virtually no profit for the protocol, essentially losing money to gain attention.

Moreover, most YBS protocols will issue a main protocol token, such as ENA, or the recently launched Resolv, which must be supported by the protocol's income and profit-sharing capabilities. If the token price declines, it will negatively impact the yield-bearing stablecoins issued by the protocol.

In other words, as the scale of yield-bearing stablecoins expands, the main protocol token may not necessarily rise, as the protocol's net profit may not be high. Conversely, if the main protocol token price falls, risk-averse sentiment may lead to liquidity withdrawal from yield-bearing stablecoins, entering a death spiral similar to UST.

This teaches us that we must pay attention to the protocol's ongoing profitability. Since YBS projects act as crypto banks for deposit-taking and lending, the safety of the principal is crucial. YBSBarker's Protocol Revenue will continuously monitor the safety of each protocol, while YBSBarker's Yield Sharing Ratio will keep track of the profit-sharing ratios of the protocols.

Now we enter a moment of bold opinions, where objectivity does not exist, only pure subjectivity.

Beyond Sky and Ethena, which new YBS protocols might become the next big opportunity?

I choose Resolv, Avalon, Falcon, Level, and Noon Capital, without any scientific reasoning—just a gut feeling about the projects.

Image caption: Potential leaders

Image source: @YBSBarker

There is a misconception that YBS projects rushing to issue tokens are inferior projects, which is not necessarily true. Many are fishing in troubled waters, but for YBS, protocols need secondary market liquidity for their main tokens. Similar to how Ethena has brought in all major exchanges' affiliated VCs to form a de facto interest alliance, essentially relinquishing the minting rights of USDe.

However, the minting rights of USDe are represented by ENA. Major institutions looking to profit do not need to crash USDe, as that would jeopardize their investments. Stablecoins only have two states: 0 and 1. However, ENA can be gradually sold or staked for yield, which is Ethena's most sophisticated strategy.

Circle aggressively funds Binance and Coinbase, while Ethena adopts a more crypto-centric "bribery mechanism," akin to the Curve War, brilliantly reusing game theory.

Conclusion

Today is just an appetizer. After an overall review of the projects, I hope everyone has a comprehensive understanding of the current YBS market. At least it should not be perceived that creating a YBS is as unattainable as creating a USDT, but neither should it be thought that YBS is merely a new Meme Coin.

The credibility and capital reserves required for YBS are not something Meme projects can achieve. Always remember, YBS is also a form of currency, especially the true YBS that does not rely on government bonds or the US dollar, which is not far from the recognition needed to create BTC/ETH.

Next, I will elaborate on the issuance guidelines for yield-bearing stablecoins from a more segmented perspective. The mechanisms and details that could not be covered in this article will be thoroughly explained.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。