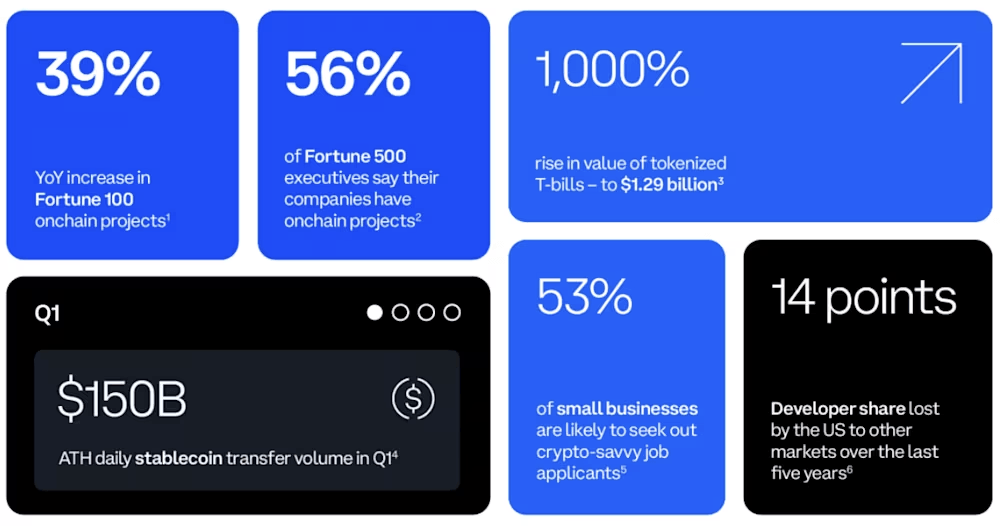

Research released by Coinbase this week reveals that 56% of Fortune 500 executives report their companies are actively working on blockchain-based projects, while the number of crypto, blockchain, or Web3 initiatives among Fortune 100 companies jumped 39% year-over-year in Q1 2024. The report also highlights a growing push for regulatory clarity to retain crypto developers in the U.S., amid ongoing talent migration abroad.

Source: Coinbase State of Crypto report.

This shift is not limited to large corporations. Small businesses are increasingly adopting blockchain tools, with 68% of respondents believing crypto could ease major pain points like transaction fees and processing delays. Meanwhile, half say they’re likely to prioritize crypto-familiar candidates in future tech and finance hires.

Trusted names in traditional finance are also pushing deeper into crypto. U.S.-listed spot bitcoin exchange-traded funds (ETFs) now manage more than $63 billion in assets, and tokenized U.S. Treasury products have grown over 1,000% since early 2023, reaching $1.29 billion. BlackRock’s BUIDL fund recently surpassed Franklin Templeton’s to become the largest of its kind.

Stablecoin integration is expanding as well. Stripe, via Circle, now enables USDC payments across Ethereum, Solana, and Polygon with auto fiat conversion. Paypal has extended fee-free cross-border stablecoin transfers to users in about 160 countries.

Coinbase’s report also stresses the importance of U.S. leadership in blockchain development. Among Fortune 500 executives, 72% said a dollar-backed digital currency is essential to maintaining U.S. competitiveness.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。