A mysterious investor has opened a $300 million leveraged position in Bitcoin, sparking widespread speculation about their identity.

According to Hypurrscan blockchain data, this unidentified whale (i.e., a large cryptocurrency holder) established a Bitcoin long position worth over $308 million with 20x leverage at an entry price of $108,100.

The position currently shows over $4 million in unrealized profits but faces liquidation risk if Bitcoin falls below $105,780.

This trade has reignited widespread speculation about James Wynn. The high-profile leveraged trader recently lost nearly $25 million in a liquidation on June 5, as previously reported by Cointelegraph.

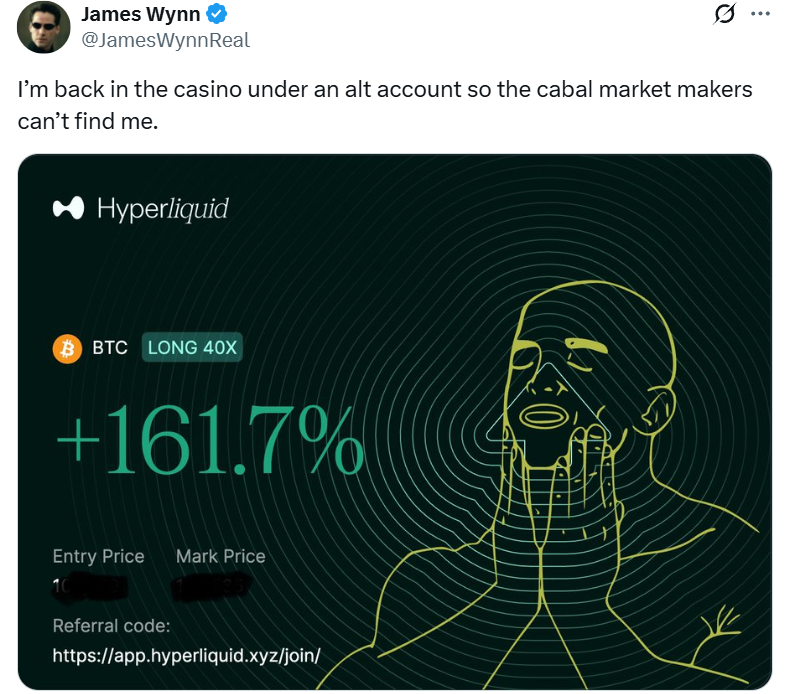

This massive long position was opened just hours after Wynn announced his return to the market with an anonymous account, although he did not specify his wallet address.

Source: James Wynn

"I returned to the 'casino' with a pseudonymous account so that the market-making conspiracy group can't find me," Wynn wrote in a post on the X platform on June 10.

Blockchain data analysis platform Onchain Lens also pointed out that Wynn is likely the mastermind behind this $300 million leveraged long position.

After opening a second $100 million Bitcoin leveraged position, Wynn claimed that his liquidation price was being systematically targeted by major market participants.

"They're coming for me again," Wynn wrote in a post on the X platform on June 2, publicly revealing his previous liquidation price. "Don't let these evil forces liquidate me," he added.

Wynn also stated that his personal accounts on several cryptocurrency exchanges were "closed overnight" without any apparent reason.

While the true identity of this mysterious whale remains unclear, according to an analysis by Nexo editor Stella Zlatareva, this $300 million bet coincides with a "new wave of institutional breakthroughs" in Bitcoin.

"Corporate treasury activity is continuing to expand," she told Cointelegraph, specifically mentioning Strategy's $1 billion stock issuance to fund its Bitcoin purchasing plan, which far exceeds the previously announced $250 million.

Further boosting investor confidence, data from Farside Investors showed that spot Bitcoin exchange-traded funds recorded a net inflow of $386 million on Monday, June 9, rebounding strongly from two consecutive days of sell-offs.

André Dragosch, Head of Research at Bitwise Europe, told Cointelegraph that sustained inflows from ETFs and institutional investors could help Bitcoin break the "fundamental expectation" of $200,000 by the end of 2025.

Related: New analysis predicts that if ETFs are approved, the price of Ripple (XRP) could soar to $25 before plummeting 90%

Original article: “Mysterious Whale Bets $300 Million on Leveraged Long Bitcoin (BTC): Suspected James Wynn-Related Account?”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。