Whether it is institutional endorsement, fundraising speed, or market enthusiasm, Plasma has indeed taken the lead in the innovation of stablecoin infrastructure.

Written by: ChandlerZ, Foresight News

On June 9, the stablecoin project Plasma completed its first round of public fundraising through the newly launched ICO platform Sonar, with a fundraising cap of $500 million, corresponding to a total valuation of $5 billion for the XPL token. The Sonar platform was founded by Cobie, and Plasma is its first project.

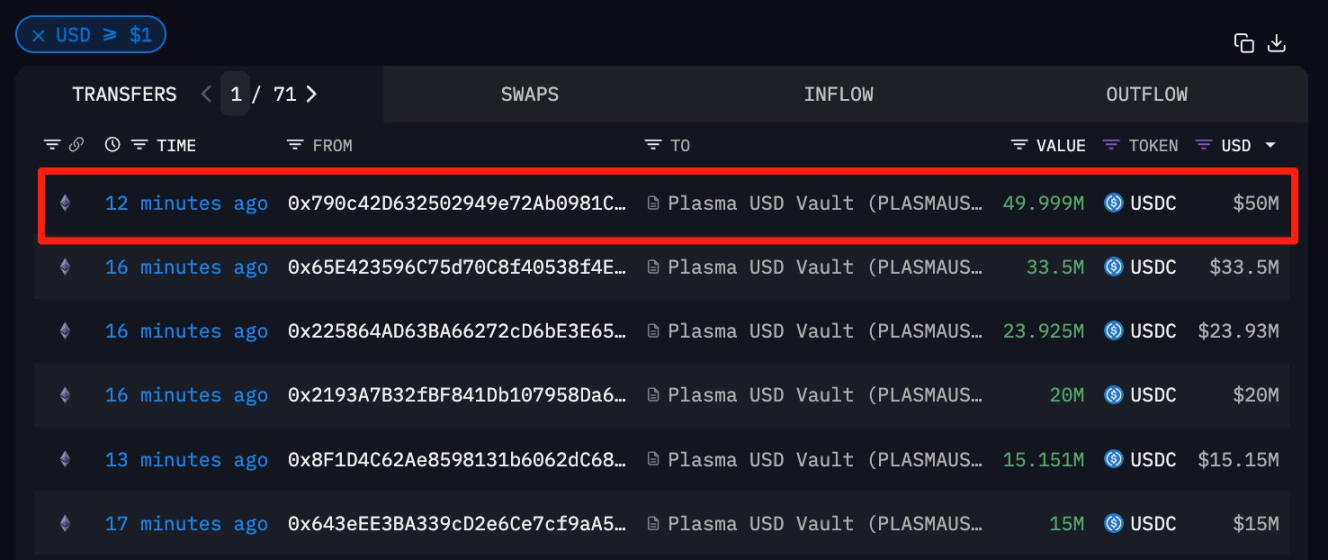

The project completed the subscription of the $500 million quota within minutes of public staking. The official statement claims that over 1,100 wallets participated in this public staking, with a median staking amount of approximately $35,000. According to @ai_9684xtpa's monitoring, a certain whale address starting with 0x790 staked 50 million USDC, accounting for 20% of the total staking share.

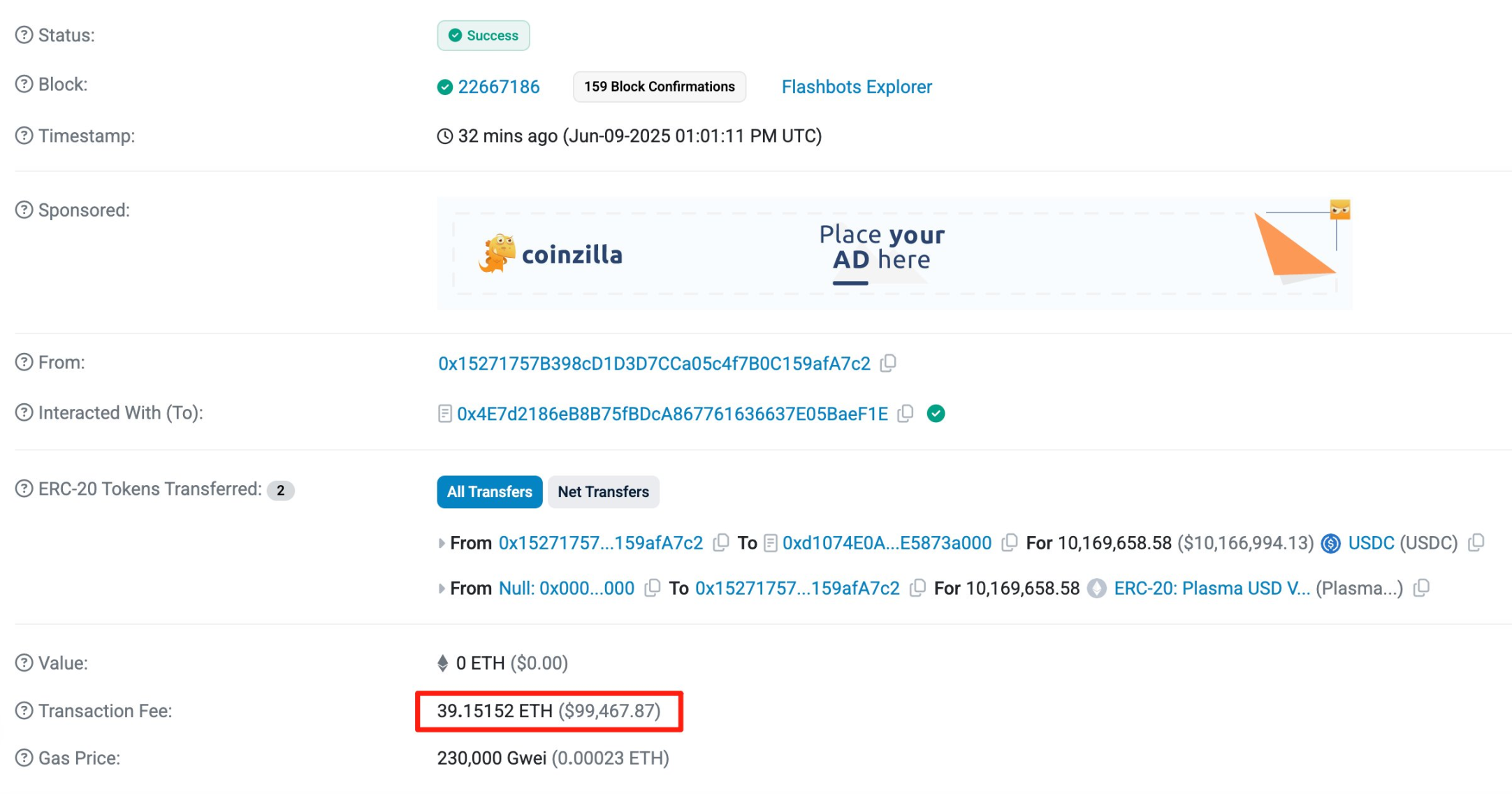

Additionally, a certain address paid 43.04 ETH in gas fees, worth about $110,000, to stake 10.17 million USDC in Plasma, becoming the first staking address. In contrast, the top address deposited 50 million USDC and only paid $7.16 in gas fees. It is worth noting that there was a lively community discussion about this staking, with some users questioning the impact of high-net-worth addresses on share distribution.

Furthermore, Plasma completed its financing by the end of 2024, totaling $24 million. The seed round and Series A financing raised $4 million and $20 million, respectively, led by Framework Ventures, with other participants including Bitfinex, Founders Fund (under Peter Thiel), Tether CEO Paolo Ardoino, well-known crypto KOL Cobie, Bybit, Flow Traders, IMC, Nomura Holdings, and others. Founders Fund recently also invested at a $500 million valuation and signed a token subscription agreement.

What is Plasma? Why has it attracted such a scale of funding in the current market? Will the stablecoin sector welcome a new disruptor?

A Blockchain for Stablecoin Payments and Transfers

Plasma is a blockchain network focused on the efficiency of stablecoin payments and transfers. The project's goal is to reduce the cost of stablecoin transmission on-chain, improve processing capacity, and enhance user experience. According to the official statement, it is not built on Ethereum or other general-purpose public chains, but rather on the Bitcoin network, achieving stronger development scalability through compatibility with the Ethereum EVM.

Plasma targets everyday use cases for stablecoins, such as on-chain payments, settlements, cross-border remittances, and in-app micropayments. Its main positioning is to become the underlying clearing network for stablecoins, rather than a general-purpose smart contract platform.

Technical Architecture and Operating Mechanism

Plasma's technical architecture revolves around three core objectives: speed, security, and usability.

- Consensus Mechanism: PlasmaBFT

The project employs its self-developed BFT-like consensus mechanism, PlasmaBFT. According to data provided by the team, the network can support over 2,000 transactions per second under a single-chain structure. In terms of execution, Plasma combines the Ethereum account model and the Bitcoin UTXO model, supporting Bitcoin payment gas, thus achieving a more flexible settlement experience.

- State Anchoring to the Bitcoin Mainnet

Plasma periodically submits the root hash of the on-chain state to the Bitcoin main chain, achieving audit capability and security expansion through an anchoring mechanism. This design circumvents the need to upgrade Bitcoin itself, balancing Bitcoin's stability with the flexibility of the expansion layer.

- EVM Compatibility

Plasma supports the Ethereum Virtual Machine, allowing developers to deploy smart contracts using the Solidity language, compatible with Ethereum development toolchains including MetaMask and Hardhat. This enables existing projects in the Ethereum ecosystem to quickly migrate to Plasma.

- Dual-Channel Transaction Mechanism

The network's transaction design includes free channels and priority channels. Free channels are suitable for users with low time-sensitivity, where transactions do not require gas payment; priority channels allow users to pay XPL tokens to increase confirmation speed, with the system ensuring network stability through queue scheduling and rate-limiting mechanisms.

Token Issuance and Market Response

Plasma's native token XPL officially launched its public offering on June 9, 2025. This token sale was conducted through the new platform Sonar, founded by Cobie, with Plasma being its first project.

The total supply of XPL is 10 billion tokens, with 10% released in this round of public offering, amounting to 1 billion tokens, priced at $0.05 each, corresponding to a fundraising target of $50 million and an overall project valuation of $500 million. Users need to deposit USDT, USDC, or USDS into the Plasma Vault on Ethereum to obtain a time-weighted subscription quota. The total staking amount in this round is $500 million, with on-chain data platforms like Arkham tracking approximately $345 million in USDC staked, $146 million in USDT, and the remainder in USDS and DAI.

U.S. users participating in the token subscription will face a 12-month lock-up period, while most participants from other regions will have a lock-up period of 40 days. Users from the UK and certain restricted jurisdictions are excluded from participation.

Financing Background and Ecological Cooperation

Plasma completed its seed round and Series A financing from late 2024 to early 2025, raising a total of $24 million. In May 2025, Founders Fund again participated in the financing through equity and token subscription agreements, investing at the same $500 million valuation. Previously, Bitfinex had also invested $3.5 million in the project to promote the use of USDT on Bitcoin. Paul Faecks, the project leader of Plasma, stated that the financing will mainly be used to expand the team, build regional infrastructure, promote compliance pathways, and expand ecological cooperation.

Plasma has a clear application positioning, aiming to build blockchain infrastructure for stablecoin payments. Its key scenarios include zero-fee on-chain USDT transfers, payment network integration and merchant settlement systems, settlement APIs for financial institutions, and the deployment of stablecoin DeFi protocols with cross-chain interoperability. The project team revealed that they have communicated integration plans with protocols such as Ethena, Aave, Morpho, Curve, and Maker. Meanwhile, Bitfinex and Bybit are also expected to launch Plasma-related features after the mainnet release.

The team also stated that they are collaborating with institutional partners in certain regions to build a "quasi-compliance" node operation model, with plans to gradually open the validator mechanism in the future. Currently, the on-chain environment remains a restricted test network, with plans to open a public test network by the end of summer.

A New Candidate for the Stablecoin Network?

The timing of Plasma's launch is quite delicate. On one hand, stablecoins are gradually becoming the main asset for on-chain settlements; on the other hand, the transaction fees and confirmation times of mainstream public chains still struggle to match high-frequency payment scenarios. Against this backdrop, Plasma's proposed "dedicated chain solution" and capital structure have attracted significant attention.

Whether it is institutional endorsement, fundraising speed, or market enthusiasm, Plasma has indeed taken the lead in the innovation of stablecoin infrastructure. However, whether it can establish network effects in actual use and escape the label of "overheated valuation" will depend on its stability and developer support after the mainnet launch.

The future stablecoin network may not belong to any single chain, but Plasma has indeed become one of the projects worth observing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。