Original Title: Circle IPO is the Antithesis of Crypto Ethos

Original Author: Jeff Dorman, Chief Investment Officer of Arca

Original Translation: Yuliya, PANews

Editor's Note: As the issuer of the USDC stablecoin, Circle's IPO should have been an important milestone for the crypto industry on its path to mainstream finance. However, the issuance process has sparked widespread controversy within the crypto community. In this article, Arca's Chief Investment Officer Jeff Dorman offers a firsthand perspective, strongly criticizing Circle's preference for traditional financial institutions in the IPO allocation while neglecting crypto-native participants. He explores why the core concept of "alignment of interests," a fundamental principle in the crypto industry, is often violated within the traditional IPO framework. Below is the original article, translated by PANews.

Circle, the company behind the USDC stablecoin, completed its initial public offering (IPO) last week, pricing shares at $31 each (above the initial expected range of $24 to $26). The closing price on the first day was $84, and by the end of the week, the stock price had exceeded $107. It is not an exaggeration to say that the investment banks severely mispriced this IPO. Similarly, it is not an exaggeration to say that Wall Street's enthusiasm for investing in crypto assets, especially stablecoins, is soaring.

Reasons to be Bullish on CRCL:

This is currently the first and only publicly listed investment vehicle focused on the growth of stablecoins, an investment opportunity that investors have been waiting for seven years (including Arca).

The stablecoin market is expected to grow to over $1 trillion in managed assets, which alone constitutes a compelling investment story.

USDC currently has $60 billion in assets under management, with an annual growth rate of 91%.

Reasons to be Bearish on CRCL:

This is a business model that is entirely dependent on interest rates, with all revenue coming from interest income;

Circle relies on Coinbase as its issuance agent, and Coinbase takes about half of the interest income;

Circle also relies on BlackRock, which has partnerships with many banks that are trying to enter the stablecoin market and compete with Circle and Tether;

The company has seen almost no revenue or profit growth over the past three and a half years (although EBITDA has grown by 60% year-over-year);

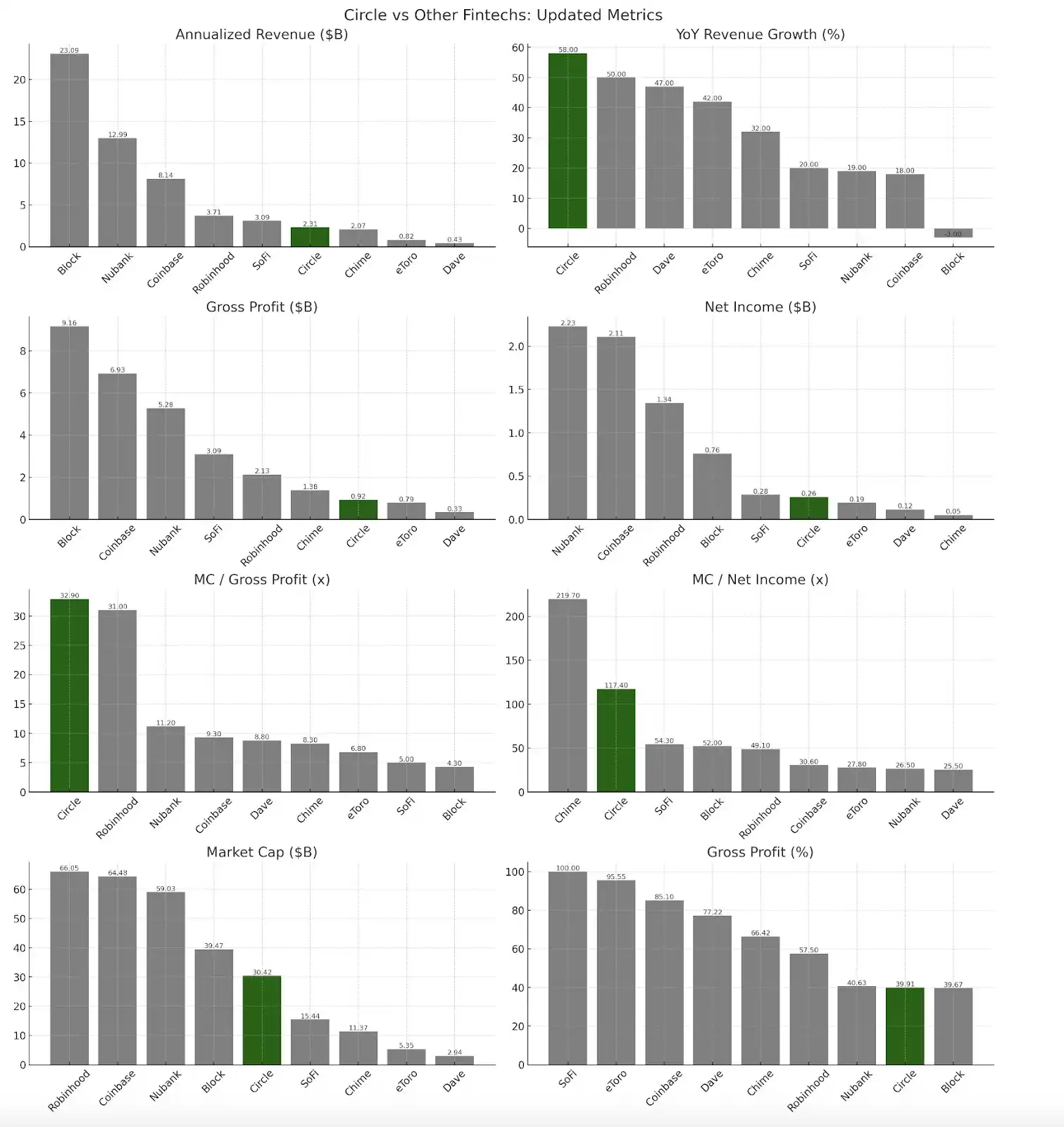

The current stock price of $107 is overvalued, with valuation metrics as follows:

About 30 times gross profit;

About 110 times earnings;

Adjusted EBITDA about 59 times (based on annualized Q1 2025).

About the Open Letter I Wrote to Circle CEO Jeremy Allaire

Many of you may have seen a tweet I posted, along with subsequent news reports about the open letter I wrote to Circle CEO Jeremy Allaire. The language in that tweet was somewhat intense, and I have since deleted it, as it did not represent Arca's official position. However, I want to make it clear that I still stand by the core points I expressed.

In my view, Circle's choice to allocate shares to traditional financial institutions (TradFi) rather than crypto-native funds during the IPO allocation process is a significant mistake. They should be held accountable for the implications of this decision.

We have communicated with several crypto funds and companies, including many early users and promoters of USDC (including Arca itself), and some of them have closer relationships with the IPO underwriters JPM and Citibank than Arca does. We received clear feedback from these leading industry institutions—they either received very little allocation or none at all, further confirming that Circle favored traditional Wall Street financial institutions while neglecting crypto-native supporters.

To date, I have not found any crypto-native institution that received fair treatment in this IPO allocation. This situation is utterly absurd and demonstrates Circle's extremely shortsighted behavior.

Why Am I Angry? Not Out of Emotion, but Out of Principle

Those who know me, or have worked with Arca in an investment capacity, know that I am not an emotional investor. On the contrary, whether in favorable or adverse market conditions, I remain rational and focused on investment logic rather than personal emotions. However, when it comes to "correctly" advancing the crypto industry and adhering to principles of integrity, I am highly passionate and emotionally invested.

Since its founding in 2018, Arca has been at the forefront of the crypto industry, advocating for and fighting for this sector. We have spent considerable time initiating and winning advocacy actions against poorly managed crypto companies that harm investors or clients. Many believed that token holders had no rights—we overturned this misconception, risking our reputation in the process, but we believed it was worth it.

We have consistently exposed what we believe to be industry fraud and misconduct, even if it means having some very uncomfortable conversations with friends or partners. This has also been worthwhile. We have publicly criticized the traditional financial sector's misunderstandings and misclassifications of the crypto industry—such as lumping all tokens together and ignoring the significant differences between them.

We have also pointed out that some companies in the industry deliberately distort narratives for personal gain, harming their peers who are developing alongside them. Additionally, we have always openly acknowledged our own mistakes and committed to continue doing so. We tirelessly educate the world about the pros and cons of crypto technology, aiming to enable investors and users to make informed decisions based on facts rather than being misled by the media or other unreliable entities.

Ultimately, we support all forms of development in the crypto industry. Regardless of whether we are misunderstood, we believe we have a responsibility to use our voice to expose fraud, identify bad actors, and point out poor decisions—aiming to make the entire industry stronger and healthier in the long run. And this time, we are issuing a "citizen's arrest" to Jeremy Allaire and Circle—your actions have strayed from the original intent of crypto.

I Am Not an Idealist; I Just Believe in "Customer First"

I am not a naive idealist. I genuinely believe that when you make your customers wealthy, your company will naturally succeed. Look at Binance, Hyperliquid, and even projects like Axie Infinity; even when facing difficulties now, their founders, employees, customers, and investors maintain a high level of satisfaction. Why? Just one word: "alignment."

This is not a new concept. As early as 2018, before Arca even had a website, I wrote about the lack of alignment in the stock market. In 2020, I criticized Airbnb and DoorDash for not allowing their customers to share in the financial benefits during their IPOs. I also wrote about Coinbase's attempt to go public through a direct listing, which was a commendable effort, although it also had risks—such as the lack of investment bank support to educate investors.

For the past eight years, I have emphasized that tokens are the greatest mechanism for capital formation and user growth in history because they can immediately align the interests of all stakeholders, turning customers into core users and brand evangelists. However, Circle completely and deliberately ignored its customers in this IPO.

Arca's Longstanding Relationship with Circle—Why This IPO Allocation is a Slap in the Face?

I cannot speak for all other funds (although many institutions have stood with Arca in expressing anger over the unfairness of this IPO allocation), but I can clearly speak on behalf of Arca.

For nearly a decade, Arca has been a customer and partner of Circle. When USDC had not yet gained market recognition and had almost zero assets under management, we used our platform to support and promote USDC. We defended USDC and the entire stablecoin sector, arguing against those who called the entire industry a "joke."

Our trading and operations teams worked alongside Circle's team, providing practical assistance during product testing, optimization suggestions, and major crises (such as the banking crisis in March 2023 and the USDC depegging incident).

Yet in this IPO, we received only a very low allocation. This outcome is akin to a slap in the face. Crypto companies like Arca have weathered storms and struggled to survive over the past eight years. Many people and companies in this industry support each other and move forward together. When you have the opportunity to allow customers to benefit from an IPO, thereby enhancing their returns and assets under management—these funds will ultimately feed back into the industry—this should have been the obvious right choice.

Why not reward those funds that have been deeply involved and continuously invested in the crypto industry? If these funds receive good returns, they can raise more capital and reinvest in the crypto ecosystem; isn't that a virtuous cycle for the industry? Yet Circle made the completely opposite decision.

Their Actions Are Completely at Odds with the Spirit of Crypto

Circle did not express gratitude to users or achieve long-term win-win outcomes through issuing tokens or creating some form of interest-binding mechanism; instead, they generously allocated IPO shares to mutual funds and hedge funds in traditional finance. These institutions likely haven't even read the prospectus, don't have digital wallets, and certainly won't genuinely use Circle's products. They just want to make a quick buck.

To Those Who Are Angry with Me, I Would Like to Respond:

"You at Arca are like those crypto users who want to get free airdrops, thinking that just because you used the product, you should benefit!"

Answer: This statement is half right and half wrong. Indeed, we agree with the idea mentioned above that "customers should be rewarded." Any customer that directly contributes to business growth, regardless of size, should receive some form of compensation.

DoorDash delivery drivers and customers should have received DASH stock; Airbnb hosts and guests should have received ABNB stock; Amazon Prime members and merchants should also have received AMZN stock… there are countless examples of this. But one difference between IPOs and airdrops is: we are willing to buy shares at the same price as everyone else. Airdrops are typically free giveaways. More importantly, the distribution of airdrops is often based on algorithmic formulas, transparent and automated; whereas IPO allocations are a manual process, and Circle could fully control who gets how much.

"You should blame Citigroup and JPMorgan, not Circle!"

Answer: This statement is completely wrong. I was once an investment banker in the capital markets and worked as a trader, dealing with the syndicate desk for nearly a decade, so I understand how the entire process works. Indeed, investment banks are responsible for creating market demand, pricing, and gathering initial interest from institutional investors. However, the final decision on the allocation list and proportions is made by the issuer (i.e., Circle).

Circle is the client in this transaction; they pay hefty fees to lead underwriters like Citigroup and JPMorgan and have complete final decision-making authority. They have the right to view all orders and can directly control how many shares each party receives. No matter how good your relationship is with the underwriters, it is not as important as your direct relationship with the issuer's executives.

By the way, the scale at which Arca trades traditional assets like stocks, bonds, and preferred shares may be larger than that of most other crypto funds. We even stepped in to help Galaxy (GLXY) during their difficulties in issuing convertible bonds in 2022, tripling the subscription amount to assist them in fundraising (the lead underwriter was Citigroup, who praised Arca at the time).

Even so, large investment banks still do not prioritize small crypto funds during the allocation process. Therefore, the responsibility for this allocation lies with Circle, not the underwriters. Circle chose to ignore the needs of crypto funds, either out of negligence, mismanagement, or more likely, intentionality.

"This IPO was oversubscribed by 25 times—everyone's allocation was compressed!"

Answer: This statement is not entirely accurate. Don't forget, this is Circle's second attempt at an IPO. (The first time they failed and were ultimately forced to withdraw.) This IPO did not go smoothly when it began its roadshow in April of this year for various reasons—the macro market was weak due to trade tariff tensions, and Circle's own lack of profitability and dependence on interest rates and partners raised many questions. The transaction initially struggled until it suddenly became hot close to the pricing deadline. Why? Because the market began to realize that the stock was likely to rise after listing, leading to a frenzy of large orders from investors at the last moment.

The order mechanism for an IPO is a "cat and mouse" game. Many investors intentionally place orders far above what they actually want to secure a larger allocation, betting that they will end up with a satisfactory proportion. Early buyers like Arca, who reported their true subscription demand before the entire order book was established, should have received their fair share based on demand. However, we were completely marginalized in this operational tactic.

The so-called "25 times oversubscription" headline is likely just a "masquerade" of the final data and does not reflect actual fairness.

"Stop complaining—this is just sour grapes!"

Answer: Yes, this is precisely the entire point of this article. Whether Circle's IPO allocation behavior will impact its future and the adoption of USDC remains to be seen. However, we are very much looking forward to the upcoming 13F filings (institutional holding reports disclosed by the U.S. SEC) to see which investors Circle chose to share in their growth dividends.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。