原文作者:Two Prime

原文编译:Tim,PANews

围绕比特币四年一次的牛熊周期已有大量讨论。这种成倍上涨、轰然崩盘、而后攀至新高的模式贯穿了比特币大部分历史。但必须指出的是,有充分理由表明这个四年周期规律可能已经走向终结。

需要首先提出一个疑问:为何会出现四年周期?

可以归结为三方面因素:

减半效应

每当区块数量增加210000个(约四年时间),比特币挖矿奖励便减半。该机制通过制造供应短缺,通常能在随后数年引起价格上涨。

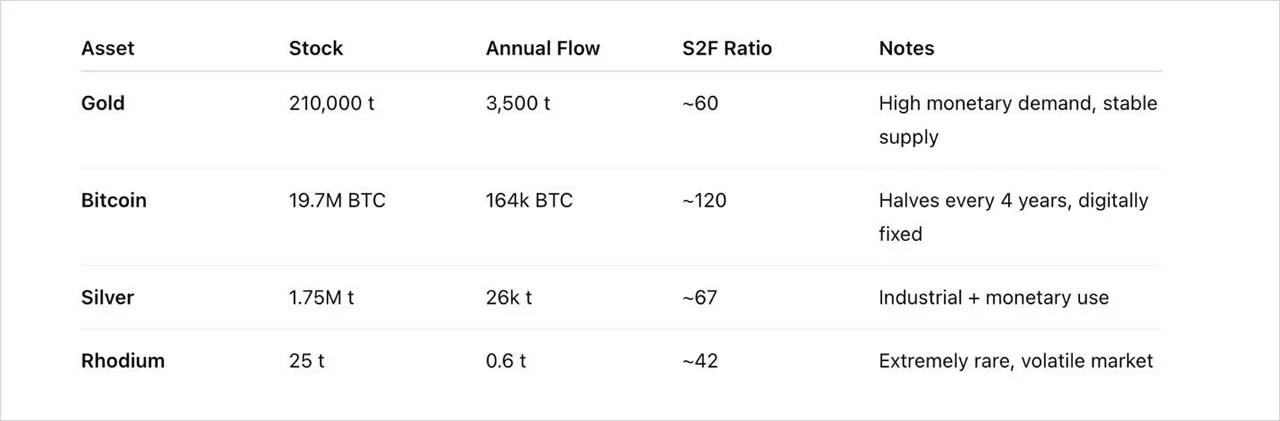

资产稀缺性常以库存/流量比(S2F)衡量,即现有总供应量与年度新增供应量之比。以稀缺资产黄金为例,其S2F比率为60(会因新金矿发现而小幅波动)。当前比特币S2F比率约为120,意味着其年度新增供应量仅为黄金的一半左右。此后每次减半,这一数字还将增加。

全球流动性周期

比特币与全球M2流动性的关联性,已由我们及多方机构多次阐释。值得注意的是,许多人认为流动性也同样遵循四年左右的周期性规律。尽管其精准度不及比特币减半那种节拍器那样高,但这种关联性确实存在。倘若该理论成立,比特币与其保持同步的现象便具备合理逻辑。

心理学角度

每当一波疯涨的牛市出现,就会催生新一轮的普及浪潮。人们的行为模式印证着甘地的论断:先是忽视你,接着嘲笑你,而后对抗你,最终你将获胜。如此循环往复,大约每四年人们就会更进一步接纳比特币的价值,赋予其更强的合理性。人们总会陷入过度兴奋,随之而来的崩盘让整个周期再次循环。

现在要问的是,这些因素仍在主导比特币的价格吗?

1.减半效应

每次减半后,新增比特币数量占总供应量的比例递减趋势愈发微弱。当年新增供应量占总供应量25%时,降至12.5%确实影响巨大;而如今从约0.8%降至0.4%,其实际影响力已不可同日而语。

2. 全球流动性周期

全球流动性对比特币价格而言依然是一个相关因素,尽管这种影响正在发生转变。比特币从散户主导转向机构主导,交易行为已经改变。机构正在做长期积累,短中期的价格下跌不会将他们震出市场。因此,虽然全球流动性仍会对比特币价格产生影响,但其对M2流动性的敏感度将继续减弱。此外,场外机构购买比特币的行为也降低了价格波动,而这正是比特币真正的信心所在。失控的财务支出将被比特币吸纳,并继续迈向光明未来。

3. 心理学角度

比特币获得越广泛的采用,其在人们心理层面的稳定性就越强。散户抛售行为的影响力将减弱,同时市场主导权转向机构买家,也会降低散户对价格造成的波动性。

综合来看,比特币仍是世界上潜力最大的资产之一,其增长模式正经历转型,从周期性增长转向(对数尺度上的)线性增长。全球流动性已成为当前市场的主导力量,与多数资产自上而下(从机构流向散户)的传播路径不同,比特币自下而上地实现了从群众基础到主流机构的渗透。正因如此,我们见证了市场在成熟过程中趋于稳定,其进化模式正日趋规范有序。(图片来源 DeathCab)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。