Many high-win-rate P generals take off by chasing addresses!

The current cryptocurrency trading narrative is split into two extremes: on one side, BTC remains strong, and on the other, the MEME wave sweeps across. On high-performance public chains like Solana, Base, and BSC, thousands of MEME coins are constantly emerging, and more and more on-chain players are entering the battlefield, all wanting to evolve from P rookies to P marshals, seizing the next "golden dog."

How many P rookies are actually making money in the MEME battlefield? To conclude: only about 10% to 20%. The rest mostly die in liquidity traps. Over 80% of MEME coins have a lifespan of less than 24 hours—what you think is "the first wave" is actually just lifting the sedan for P rookies who entered earlier. After researching those P marshals who can break out of the golden dog market, we found they share several key characteristics: they are tied to KOLs, maintain heat with traffic; they are spontaneous projects with clear rhythms, the first round attracts attention, the second round washes out short-term players, and the third round raises prices for selling; the process is highly tool-oriented, with chain scanning and bot deployment in one go; they fight in groups, have clear goals, and precise divisions of labor, completely like professional traders.

So, the question arises: is there a better way to participate? Yes, if you can't beat them, join them. Tracking these P marshal-level addresses is one of the best ways to enter the game. Their on-chain address behavior is the best MEME compass. In MEME Manual Issue 01, we will first discuss how to track valuable addresses and establish your own address intelligence system. In the following issues, we will delve deeper into more professional strategies, such as identifying and following smart money, chain scanning and sitting techniques, discrepancies between internal and external markets, cross-validation of uncertain information, and how to control expectations and fund allocation, etc. Stay tuned, and let's avoid pitfalls together and practice advancing our skills.

Multi-chain address tracking is convenient on both computer and mobile

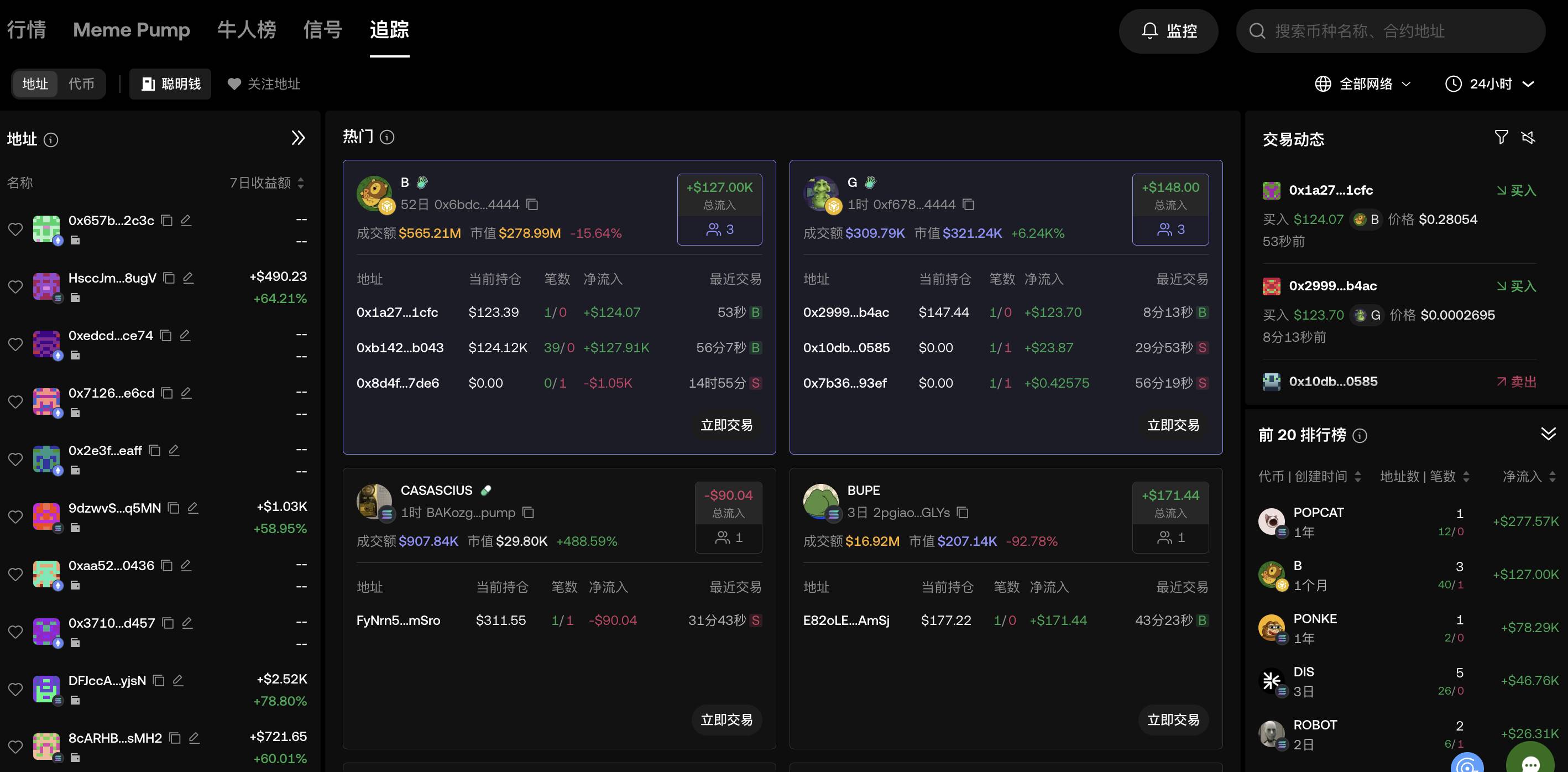

The "Tracking" feature of OKX Wallet is one of the core tools for building and tracking an on-chain address database. One of its biggest advantages is that the mobile and plugin experiences are almost identical, truly achieving a smooth and seamless experience, always online. This is crucial for MEME players because the market never waits for anyone. For demonstration purposes, the following practical operation will use the OKX Wallet Web version as an example, with the path: log in to the OKX Wallet official website → connect wallet → enter the "Market" page → open the "Tracking Panel."

After opening the "Tracking Panel," you will find that this is not just a simple wallet tool, but a one-stop on-chain intelligence station & trading system. The smart money section not only covers hundreds of the most active trading addresses but also supports real-time tracking of addresses across ETH, BSC, Base, Solana, and other chains. All data comes from on-chain original interactions, with delays controlled at the millisecond level, ensuring you can capture the most critical information about whether smart money is lurking, buying, or selling before the market starts.

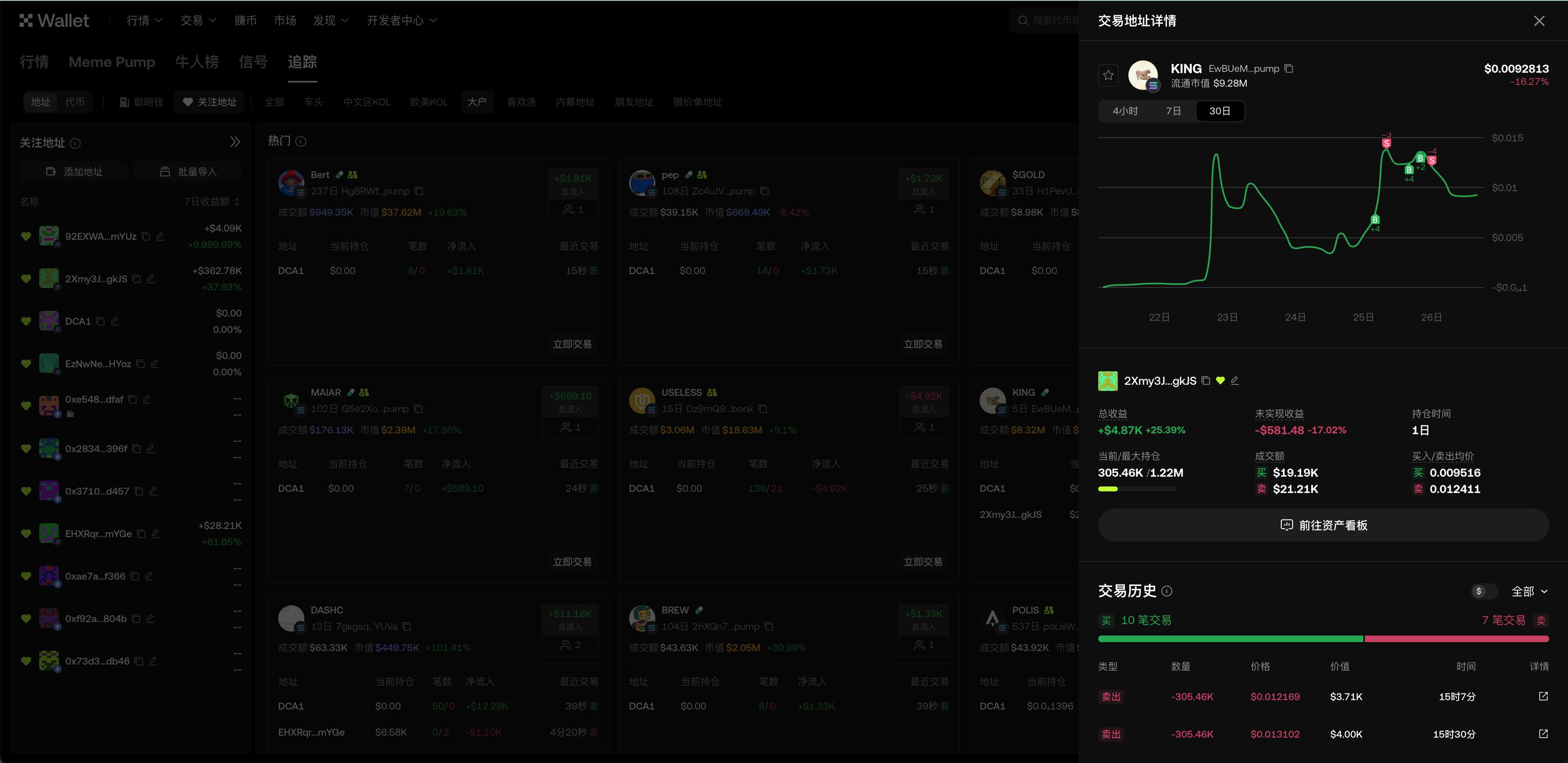

"Tracking Panel" illustration

On the left side are addresses under the Solana ecosystem (the EVM system is still being improved), which can be filtered based on dimensions like profit ranking, recent transaction time, etc., to identify addresses worth monitoring. You can then set up monitoring, establish buy conditions for addresses, and set amounts, so you can receive APP/Web notifications in real-time.

Looking towards the center, the core data of the entire "Tracking Panel" is displayed: it summarizes the token trading information of popular addresses, with recently traded tokens automatically updated on the page in a push format. It also supports one-click navigation to the trading page. During different phases of MEME, users will set different parameters when trading, such as higher slippage and lower buy amounts in the internal market; during higher market cap phases, they will set lower slippage and larger buy amounts; when following smart money, they will set very high slippage and GAS, etc. To facilitate users in different trading scenarios, OKX DEX supports default mode, MEME mode, and preset mode, allowing users to customize slippage, FEE, MEV protection, etc. Additionally, to simplify buying and selling operations, position templates (i.e., the quantity or proportion of buying/selling) are configured, such as 0.5SOL, 1SOL, and 2SOL.

On the right side is the user's exclusive MEME hot dynamic dashboard—at the top is the latest transaction record of the wallets you follow, and at the bottom is the Top 20 popular token ranking compiled based on the behavior of these addresses. You can choose to sort by net inflow, transaction frequency, and other dimensions to accurately find which coins are being accumulated by "professional players."

These capabilities can also be replicated on the App side, with address grouping, real-time synchronization, and message push all intact, truly making the phone a tactical terminal, allowing you to scan the market even when you're out.

How to build your own on-chain address database?

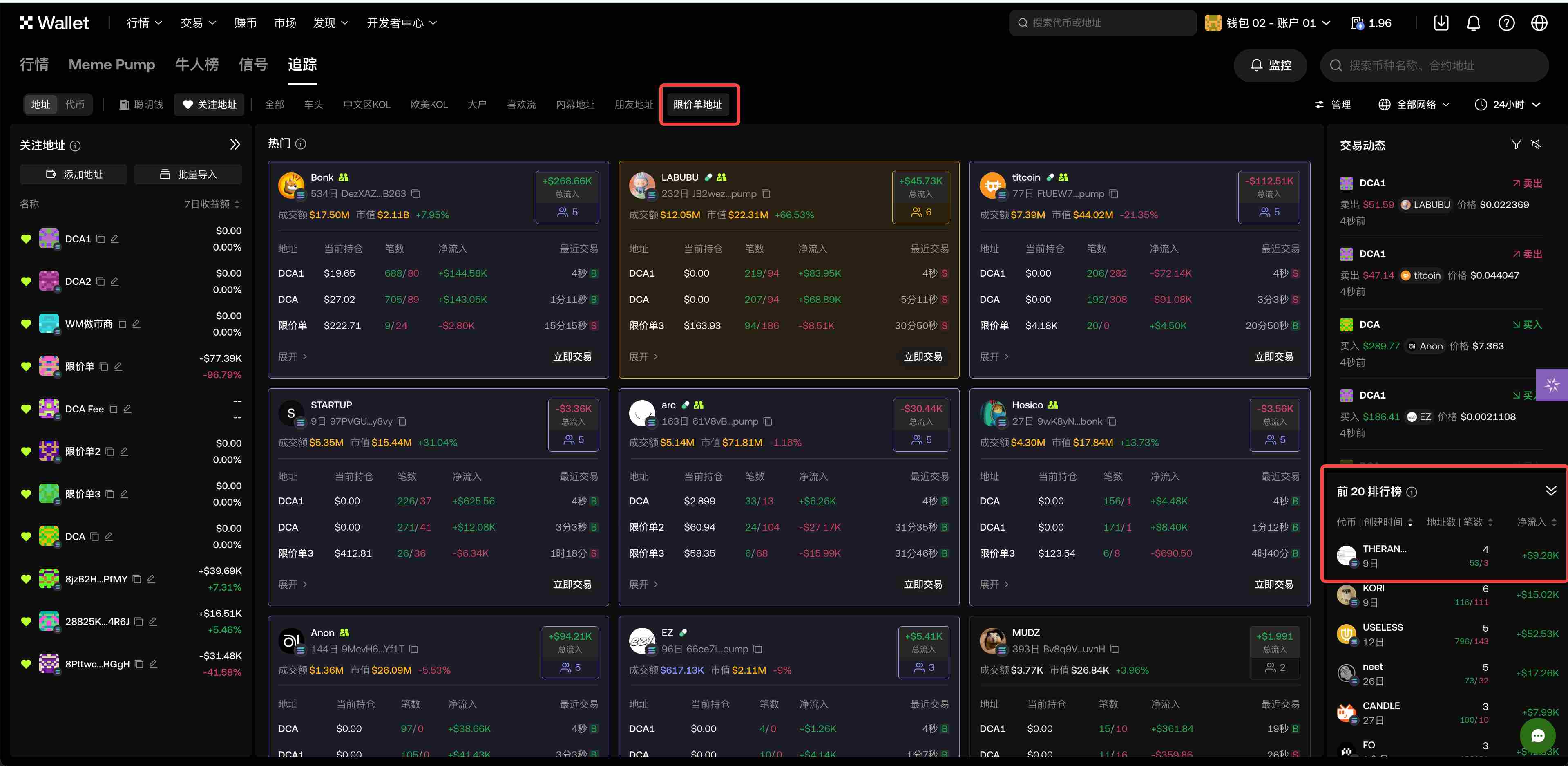

Filtering out high-value addresses is more important than blindly scanning the market. Every day, tens of thousands of new addresses are added on-chain, but only a very small number actually provide profitable signals. For example, have you studied which DEV addresses have a higher probability of returning coins? Which KOL/snipers' addresses always "team up"? These require you to categorize on-chain addresses into a reasonable "labeling system" to establish your own intelligence network. When analyzing tokens, you can add addresses to your watchlist with one click from any place, such as transaction history, profitable addresses, holding addresses, etc. Additionally, you can discover quality addresses on the leaderboard. If you have already built your address database, you can also use the "bulk import" feature, and the system will automatically recognize them.

The "Tracking Panel" supports users to follow up to 600 addresses, providing a visual design. For most practical users, this limit is sufficient; the key is: how you manage, annotate, and group them, and how you set labels! It is recommended that novice users start grouping from a few basic dimensions, as follows:

• Internal market, secondary market

• Long-term holding, preference for swing trading

• Chinese KOLs, Western KOLs

• DEV addresses, large holder/whale addresses, wash trading addresses

• High win-rate addresses, high yield addresses

• Front-run addresses, "pouring in" addresses, etc.

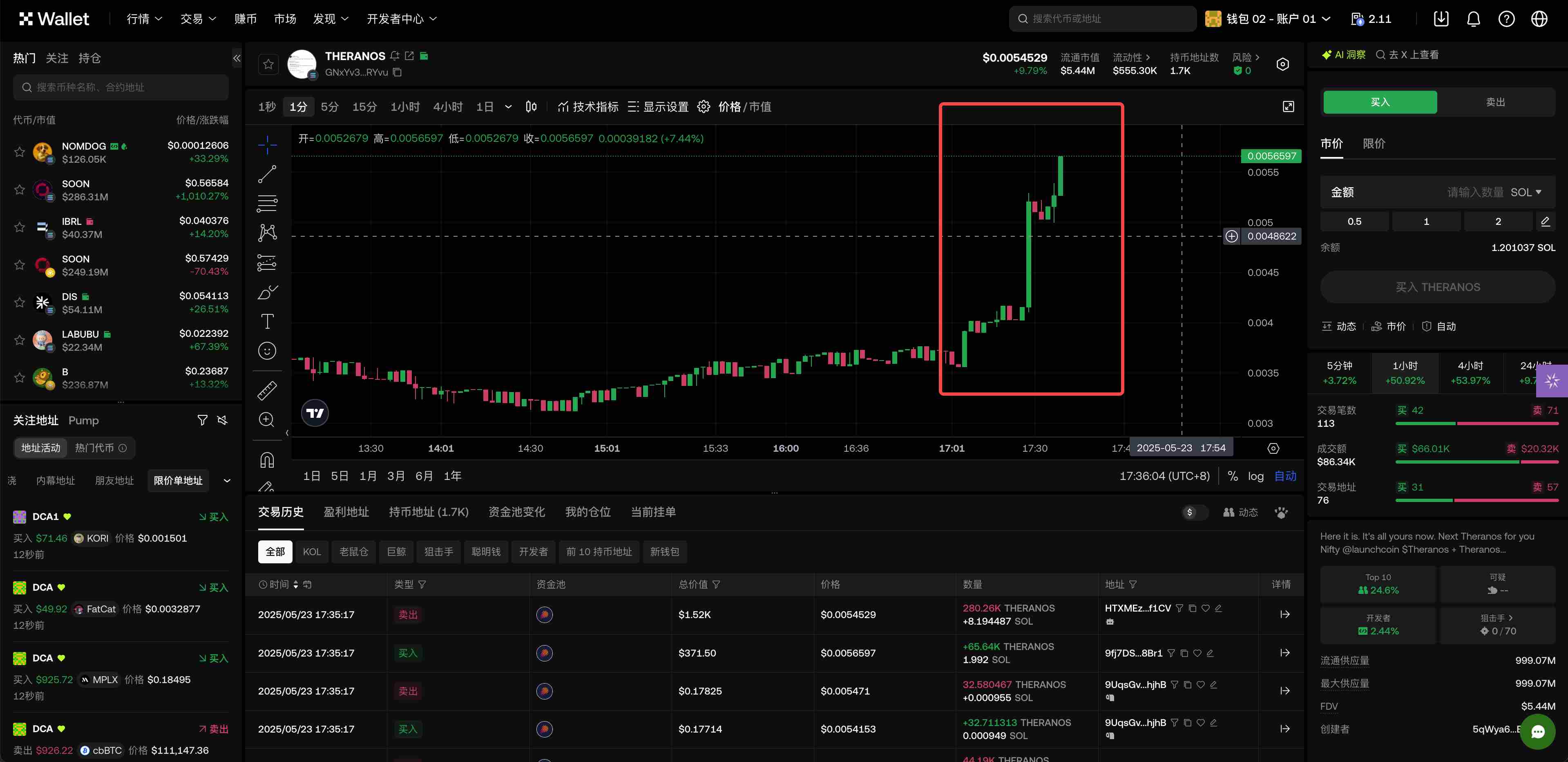

Currently, OKX Wallet's address grouping supports multiple selections; for example, an address can be both an internal market and a KOL. In short, good grouping habits can help you observe and track better, quickly identify their behavior patterns, and read real signals from massive data. For example, recently, a player A used the "Tracking Panel" leaderboard to catch an address on Solana that utilized limit orders to build a position in Theranos. This low-key accumulation method often indicates that a whale might be quietly buying, so player A followed the large holder's layout, bought in, and gained a wave of profits, achieving their own "Aha Moment."

Address database "monetization" illustration

Furthermore, OKX Wallet is currently one of the few wallet tools that support address tracking and real-time alerts right from the mobile launch. After setting up alerts, as long as you have push notifications enabled in the App, you can receive immediate notifications when a certain address opens, increases positions, or makes aggressive purchases—this means you don't have to stay glued to your computer; you won't miss opportunities even when you're out for a meal.

Is it an opportunity or a reverse "scam"? Practical experience sharing

A good address database is your operational map and early warning radar for on-chain trading. Here’s a scenario shared by a seasoned MEME player B using the "Tracking" feature of OKX Wallet. Deep player B collected DCA (Dollar-Cost Averaging) addresses from Jupiter through the "bulk import" feature of OKX Wallet and created a group. By analyzing the net inflow leaderboard, they could see which tokens on-chain were receiving funds, thus seizing good opportunities. To briefly explain, behind the Jupiter DCA addresses could be a professional team with high safety requirements and large capital, as they would consistently invest in a certain coin, profiting from long-term increases.

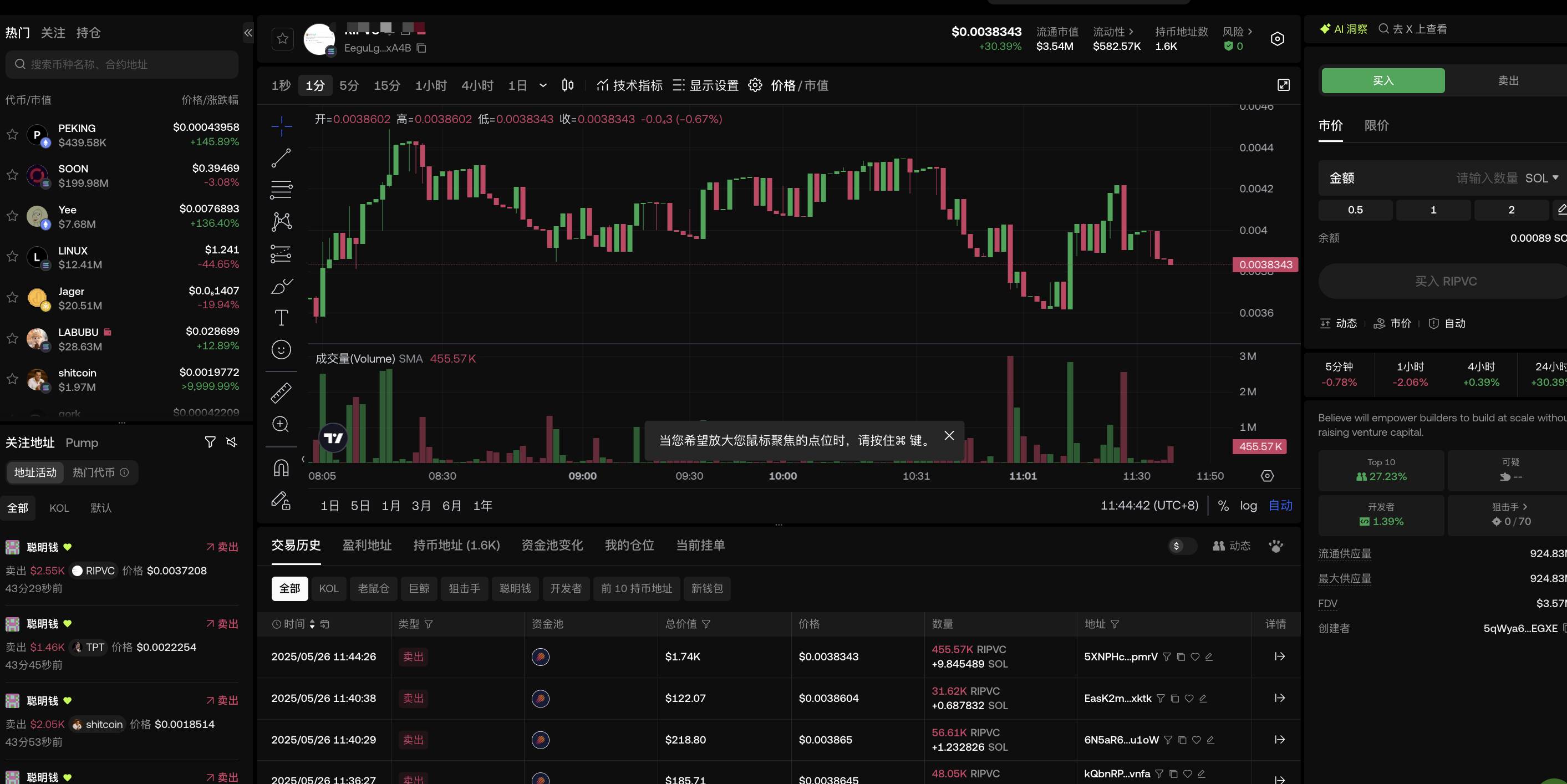

In addition to the above "clever" methods, everyone can also conduct their own research and analysis based on the detailed on-chain data provided by OKX Wallet's "Tracking," including address detail pages and token detail pages. For example, you can analyze the returns, win rates, token preferences, and trading history of an address through the "address detail page," allowing you to label that address and verify it over time to decide whether to include it in your address database.

Address detail page illustration

Additionally, you can analyze the risks and profit opportunities of a token through the "token detail page." You can cross-verify through different data dimensions:

For example,

• If trading volume increases, AI dynamics are frequent, and KOLs, whales, and smart money are synchronously buying a certain token, this usually indicates that the project has sufficient liquidity, possibly backed by a certain level of voice or promotional plans, and has potential for going viral;

• If the creation time is short, the market cap is low, and a large number of new wallet addresses are concentrated in buying at the same time, it indicates that the project may be doing a cold start or is being quietly prepped for speculative sentiment, which can serve as an early signal for tracking;

• If a developer address has recently deployed multiple token contracts but the previous projects ended quickly with a rapid rise and fall, that address may be a harvesting type of whale, and it’s best to avoid it;

• If you see sniper addresses appearing seconds after the first round of liquidity is added to a new coin, and these addresses have also been active in other popular MEMEs, it often indicates that there is an operating team behind the project, which is worth closely monitoring or participating in;

• If a certain token continues to rise, with wash trading addresses accumulating large positions in advance, and the top 10 addresses hold more than 50%, followed by significant social media promotion or a price surge, the project is likely to be highly controlled, with price fluctuations entirely dictated by a few individuals, posing far greater risks than opportunities, etc.

In summary, if you want to evolve from a P rookie to a true P marshal, the key lies in establishing your own on-chain SOP. For example, pay attention to the real-time pop-up alerts of the OKX Wallet "Tracking" feature while monitoring the market; use the net inflow/net outflow leaderboard, combined with multi-dimensional signals such as holding structure and market cap changes, to make timely judgments and selections on popular coins. Enhance your on-chain aesthetics, engage in research actively, and rely less on others—DYOR is the way to advance.

In the future, with the launch of the OKX Wallet on-chain following feature, those P marshals who have already established their address databases and mastered the rhythm of play will have the opportunity to further amplify their win rates and execute high-quality operations. With tools in hand, value shines in your grasp.

Disclaimer

This article is for reference only. It is not intended to provide (i) investment advice or recommendations, (ii) offers, solicitations, or inducements to buy, sell, or hold digital assets, or (iii) financial, accounting, legal, or tax advice. Digital assets (including stablecoins and NFTs) are subject to market fluctuations, involve high risks, and may depreciate. For questions regarding whether trading or holding digital assets is suitable for you, please consult your legal/tax/investment professionals. OKX Wallet is merely a self-custody wallet software service that allows you to discover and interact with third-party platforms; OKX Wallet cannot control the services of such third-party platforms and assumes no responsibility for them. Not all products are available in all regions. You are responsible for understanding and complying with applicable local laws and regulations. OKX Wallet and its related services are not provided by OKX Exchange and are governed by the terms of service of the OKX Web3 ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。