If you attack the king, you'd better not miss.

Written by: jin, Crypto KOL

Translated by: Felix, PANews

If you ignore this struggle, others will set the rules to control your money. Most people may not realize that the largest on-chain power struggle in recent years is currently unfolding.

"The Ambassadors" by Hans Holbein (1533)

In Hans Holbein's masterpiece "The Ambassadors" from 1533, two powerful figures stand confidently, surrounded by the cutting-edge technology of their time.

On the left is the nobleman with hereditary power and global influence: the king.

On the right is the bishop representing institutions and structures: a formally dressed official.

Between them is a table of an alchemist: adorned with a globe, a sundial, and scientific instruments, symbolizing their attempts to master the mechanics of complex innovations.

But Holbein hides a warning. Beneath their feet lies a distorted, enormous human skull, visible only from a specific angle. The skull foreshadows a rupture: beneath the calm faces, a high-stakes conflict is waiting to disrupt the order.

Today, a similar drama is playing out in the world of digital currencies.

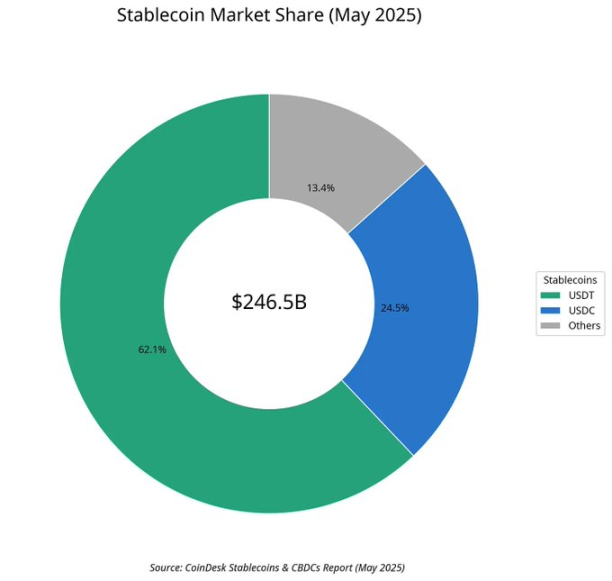

The battle for full-chain stablecoins is a contest among three forces: the reigning king with a vast global empire (Tether's USDT); the institutional power that touts structure and compliance (Circle's USDC); and the disruptive alchemist… the very technology and concept of "full-chain," which both breaks and threatens the balance between the two. This is the story of this conflict, a war for control over the digital dollar, where everything seems precarious.

The Full-Chain War: Competing for the One True Dollar

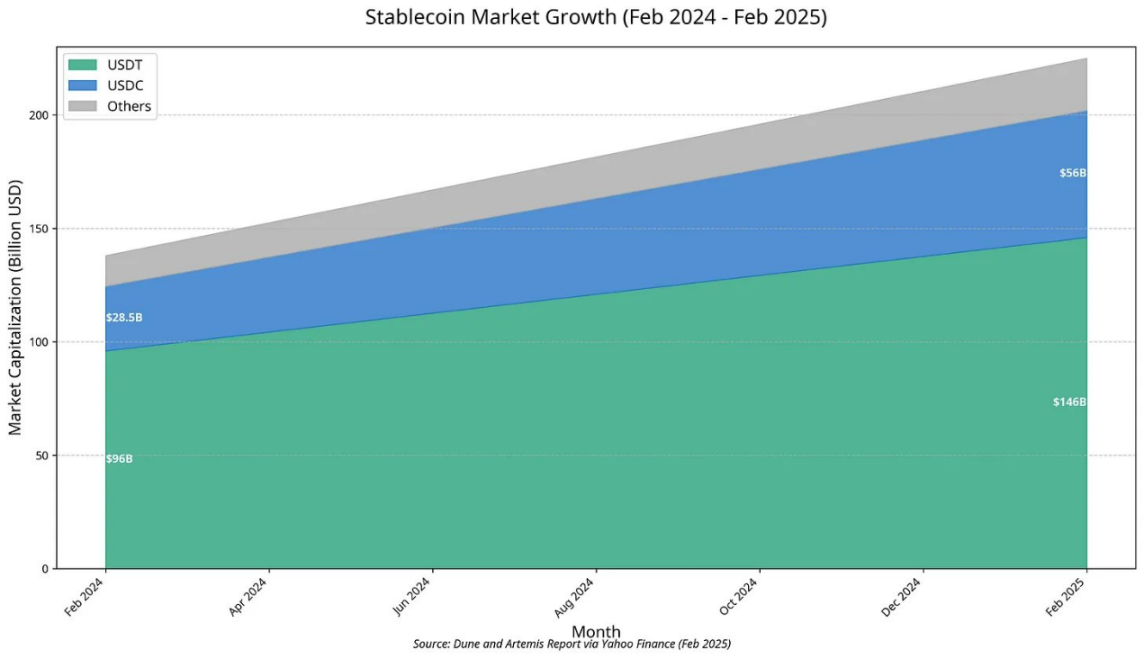

In 2024, an invisible financial empire processes transaction volumes exceeding Visa. At its core is Tether's USDT, a kingdom worth approximately $144 billion, yet it has a fatal weakness.

As Niccolò Machiavelli once said: "If troubles are detected early, they can be easily resolved; if one waits until troubles manifest, any remedy comes too late, for then it is beyond cure… Politics is the same."

Machiavelli may not have known about stablecoins, but he understood power. Data on payment flows indicate that even deeply entrenched dominance can be shaken.

Each chain acts like a customs checkpoint; dollars flow between chains as if goods are manually loaded before container shipping.

This fragmentation is a weakness, and in the crypto world, weakness means competition. A gradient descent war based on incentive mechanisms; a battle for control over the digital dollar itself.

The prize is: to become the only real, universal, cross-chain dollar.

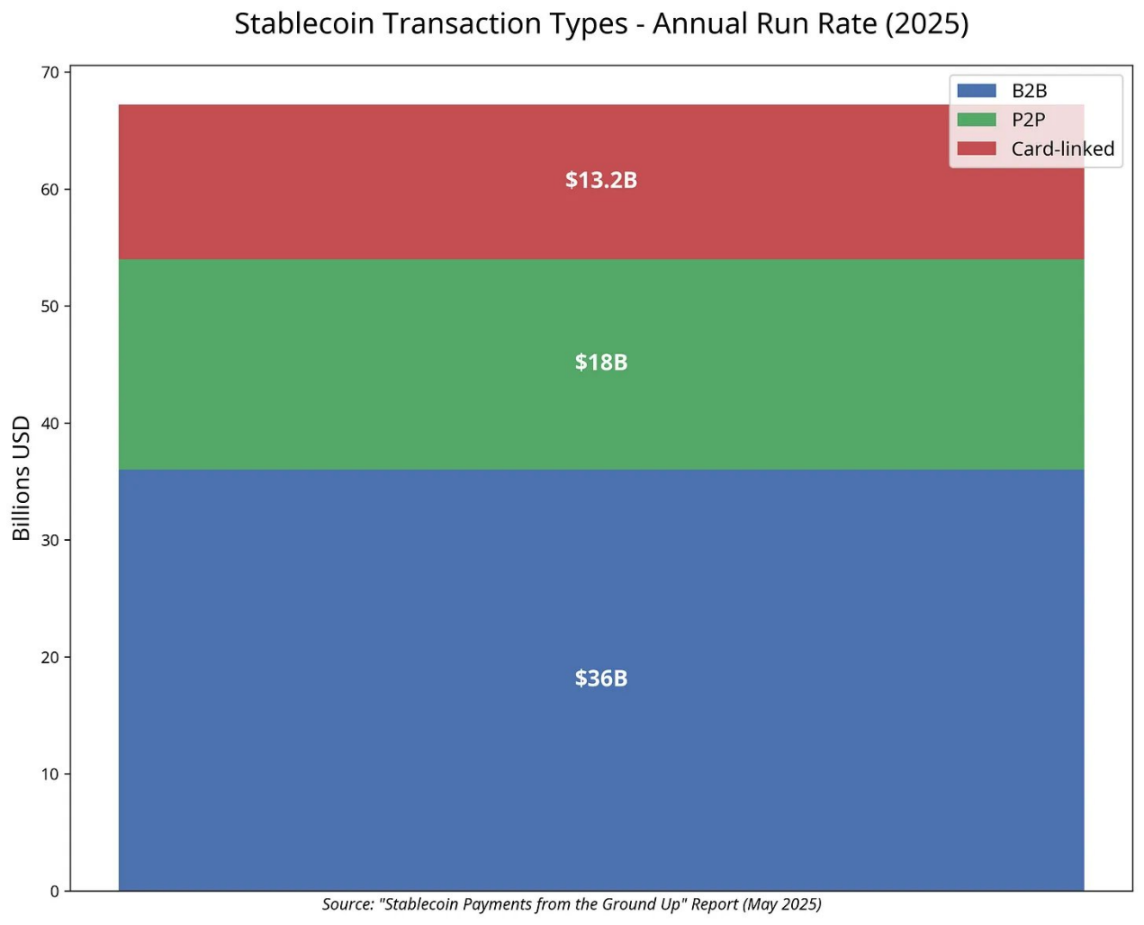

The groundbreaking new report "Stablecoin Payments from the Ground Up," co-released by Artemis, Castle Island Ventures, and Dragonfly, provides real and reliable data. The report, co-authored by industry veterans including Nic Carter, analyzes $94.2 billion in real-world payment flows across 31 companies, stating that stablecoins have evolved from speculative trading tools into a global high-volume settlement network.

This is a story about how the king of stablecoins launches a unified imperial war using battlefield intelligence: a new weapon called USD₮₀ (USDT0).

USDT is the reserve, USDT0 is the channel.

Contestants: A King, A Suit, and An Alchemist

The battle for full-chain stablecoins is a story of strategic games, each influenced by the philosophy of power and fully revealed through data.

1. The King: USDT / USDT0

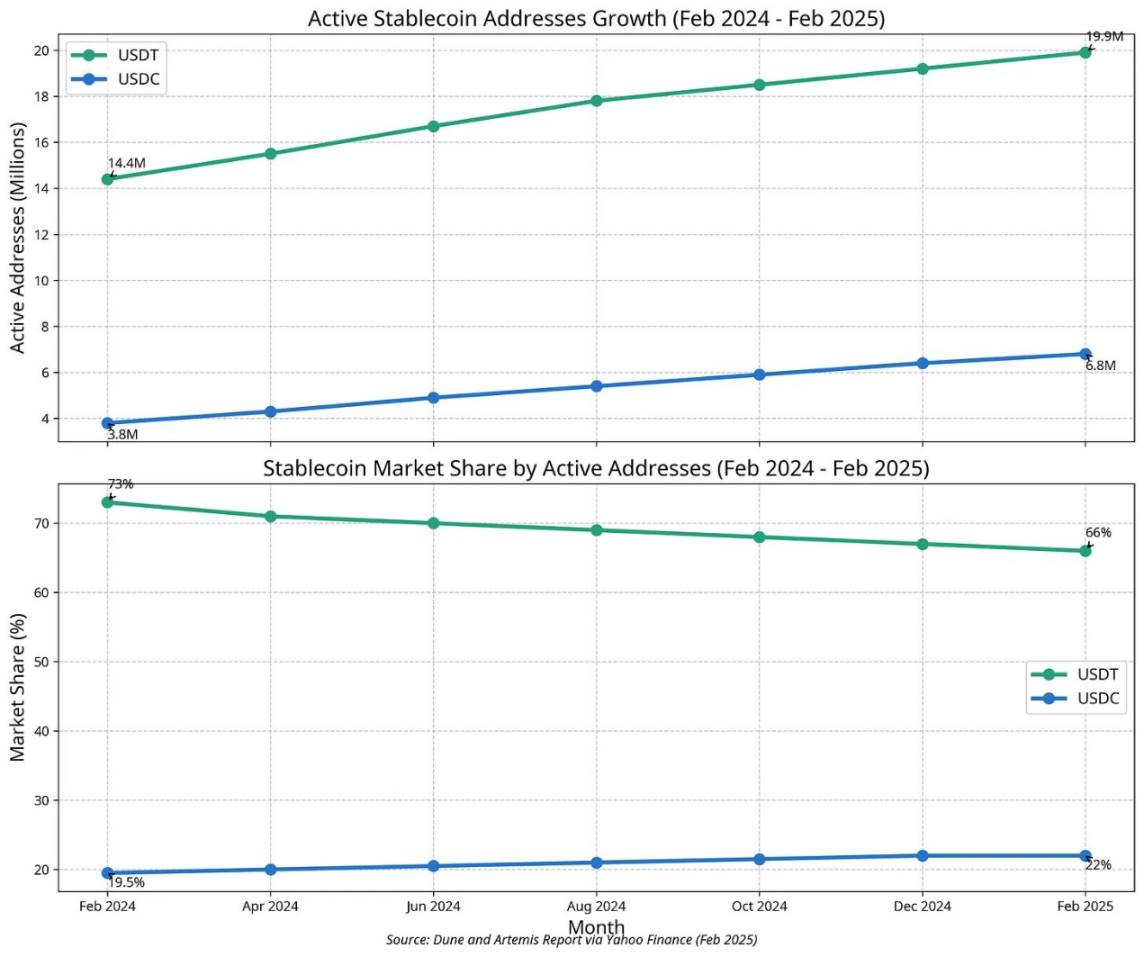

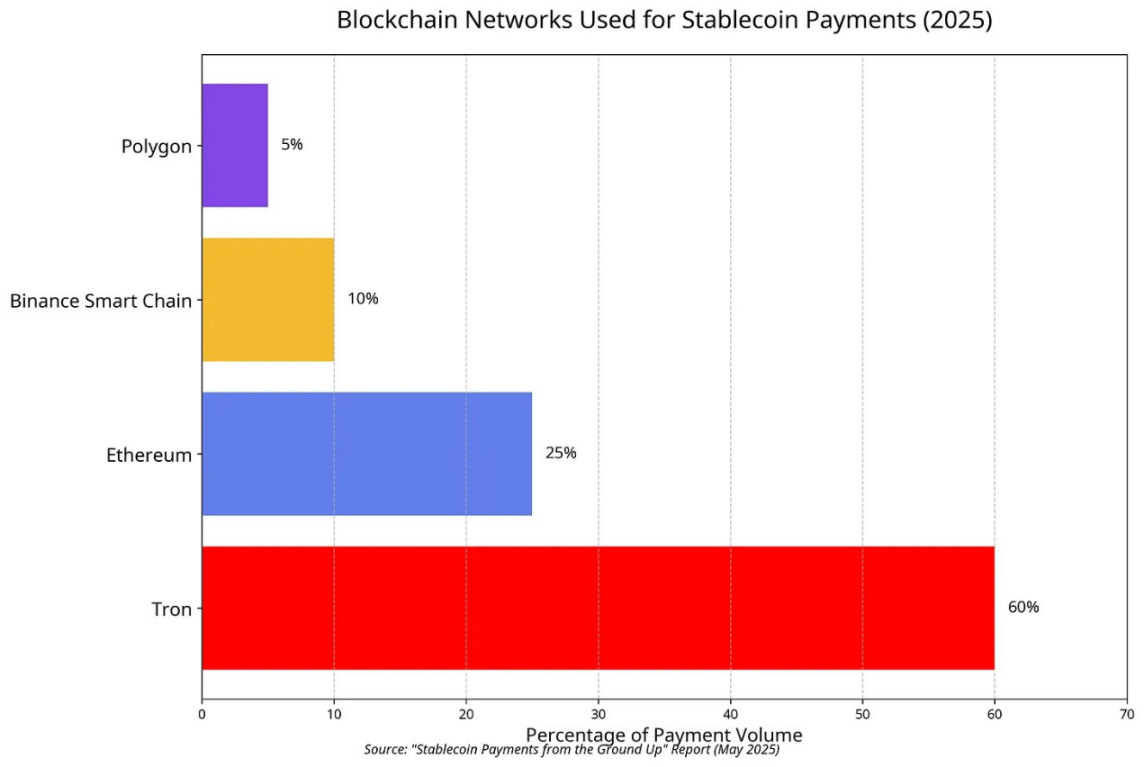

The "Stablecoin Payments" report confirms many people's suspicions: Tether's USDT is the king of the digital dollar and a symbol of the entire royal family. In the vast array of real-world payment samples covered by the report, USDT's market share in transaction volume reaches as high as 90%. These transactions come from streets around the world, not Wall Street. The report reveals that its empire is built on the Tron network, which is considered the most popular payment blockchain and is far ahead.

USDT0 is a full-chain, interchangeable token (OFT) standard built by Everdawn Labs based on LayerZero, designed as a clever integration. It allows traditional USDT to be locked in a vault on Ethereum while minting an equivalent amount of brand new, fully interchangeable USDT0 on the target chain. This is a single, standardized asset that can circulate anywhere. The market demand for this solution has been immediate. In just a few months since its launch in 2024, USDT0 has facilitated over $2 billion in cross-chain transfers.

2. The Suit: USDC / CCTP

If USDT is the king of the people, then USDC is the long-awaited challenger, eyeing the throne in the institutional realm. The report confirms that while USDC lags behind, it has firmly secured second place, making its strategic choices increasingly critical. The strength of USDC comes from trust, compliance, and deep ties to traditional finance. Notably, Circle's recent IPO has been very successful.

Circle's Cross-Chain Transfer Protocol (CCTP) directly addresses Tether's weaknesses to tackle the fragmentation issue.

By allowing users to destroy real USDC on one chain and mint an equivalent amount of native USDC on another chain, Circle has created a clean, high-integrity value transfer standard. This strategy has already shown effectiveness in specific markets. The report notes that although USDT dominates globally, USDC has also captured a significant share, with transaction volumes in markets like Argentina and India accounting for nearly half of the total, indicating that its compliance-first strategy resonates with emerging venture-backed fintech companies in these regions. The risks of single-signature and other trade-offs are a topic in themselves.

3. The Alchemist: FRAX

FRAX and other alternatives are "virtually nonexistent" in the payment report's dataset.

This does not indicate failure but clarifies their role. Frax is not currently vying for the title of king in the payment space; it resembles an alchemist in a laboratory, constantly exploring the boundaries of the digital dollar and pressuring the giants to evolve, or risk being eliminated.

FRAX combines algorithmic responses with institutional backing, but the memory of UST still keeps many cautious.

As with most closed financial systems that cannot use violent means (*FreedomTM), this saying is particularly apt: "In a closed financial realm, the money decides the outcome."

Frax USD has now been minted into frxUSD, with its power stemming from the "sacred custodians" appointed by the governance body.

BlackRock's BUIDL, Superstate's USTB, and Janus-Henderson's JTRSY lock verifiable government bonds and cash, minting one token for every dollar locked; after tokens are destroyed, the vault must return that dollar, thus the peg depends on on-chain auditable reserves.

So far, these projects have achieved great success. How does it work?

Yield seekers deposit frxUSD into the sfrxUSD vault, which supports the highest-yielding combinations directed towards short-term government bonds, DeFi arbitrage trading, or AMO market making, thereby raising interest rates while keeping the face value unchanged.

Long-term investors participate in FXB auctions, exchanging existing FRAX for a larger share at maturity, outlining a native on-chain yield curve unaffected by external credit risks. On Fraxtal, every transaction is clearly visible, and the renamed FRAX token fuels gas, controlling the entire laboratory through veFRAX locking.

All of this occurs on the Fraxtal L2 chain, where the commodity token FRAX (formerly FXS) serves as gas fees and provides an anchor for broader ecosystem governance through the veFRAX locking mechanism.

Even so, every anchored asset will incur its "Soros."

Who will play the role of Soros? Anyone with substantial funds and on-chain leverage. Platforms like Jump Crypto, Wintermute, or similar institutions fit this model.

They can borrow large amounts of frxUSD or traditional FRAX, sell them below the pegged price, then short them layer by layer, subsequently redeeming through custodial vaults that still hold reserves.

Profits come from the difference between the tokens purchased at a discount in the market and the full dollar released upon redemption. If the oracle lags or bridging is congested, the price difference will widen. Accumulating veFRAX during calm market periods may accelerate system pressure.

This may be somewhat oversimplified, but naysayers might say it’s like building a highly convex bond market on a fragile curve.

Time will tell, as experiments like this often yield incredible long-term positive impacts.

After all, this is cryptocurrency… before people truly use it, money is just an empty shell. What transforms hollow code into everyday currency?

The Story of Two Dollars: The Unification of Street Dollars and Corporate Dollars

The true significance of USDT0 lies in its ability to connect two vastly different worlds: the world of street dollars and the world of corporate dollars. Nathan's proposed "Value Realization Layer" framework can better understand this division, as he categorizes stablecoin users into two types: "those who need stablecoins and those who do not."

Street Dollars are the lifeline of USDT.

Ana, a free-spirited designer from Bolivia, uses it to combat an annual inflation rate exceeding 100%. David, a small business owner in Lagos, uses it to pay Chinese suppliers, bypassing the central bank's strict foreign exchange controls.

For them, USDT is a practical tool. As Nathan explains, for users in these emerging markets, "the permissionless nature of stablecoins is a transformative unlock." It provides them with a means to use stable currency that was previously unimaginable. This is the economic model of Tron, as the "Stablecoin Payments" report shows that over 52 million addresses hold USDT balances of less than $1,000.

As Paolo Ardoino (CEO of Tether) elaborates, the digital dollar will fill the market void left by fiscal policy ineptitude and corruption. Permissionless truly means permissionless.

Trust gives value; real, sustained adoption is earned.

Enterprise Dollars represent the opportunity for USDT. They are the dollars used in the high-tech financial cloud of Ethereum and its L2s. They are programmable dollars that can be used as loan collateral, generate yields in complex liquidity pools, and serve as tools for high-frequency arbitrage. For Western users, Nathan believes, "programmability is the main catalyst for stablecoin innovation in the West."

Before the advent of USDT0, these two worlds were independent of each other. This created a significant problem, which a16z's Sam Broner also emphasized.

He referred to the challenge of achieving "monetary unity," meaning that all forms of currency should be interchangeable. The Tron USDT locked in the world of street dollars is not the same as the Ethereum USDT in the DeFi dollar world.

USDT0 attempts to solve this problem.

USDT is the reserve, USDT0 is the channel.

Ana can transfer her earned street dollars into a savings protocol on Arbitrum through a simple transaction, earning a 5% yield. David's company can use the same asset to pay suppliers $219,000, a transaction that previously required a $26 remittance fee. USDT0 connects the raw, chaotic energy of street dollars with the powerful, efficient mechanisms of DeFi, truly integrating Tether's dollars.

As shown in the image above, the preferred blockchain for stablecoin payments, Tron, exemplifies this. Tron offers the lowest fees and is widely adopted in emerging markets.

LegacyMesh locks every token on the Tron or TON network. Then, Arbitrum mints a one-to-one USDT0 twin coin that can circulate natively on Ethereum, Berachain, and any LayerZero-connected chain.

In short, this design compresses dozens of bridging versions into a single standardized token, expanding Tether's influence in DeFi and other areas.

Dollars leaving the streets arrive intact at yield farms and credit markets, moving at blockchain speed rather than circumventing through custodians. With Tron, TON, Ethereum, and Arbitrum already connected, the network now encapsulates most USDT in a single circuit, granting it a "Gas-saving passport" to broader realms.

This is a significant addition to Tether's arsenal.

Endgame: The Battle for Stablecoin Channels

The arrival of full-chain technology heralds a new endgame. Tether's USDT0 strategy now showcases a dual approach:

Core Defense: On low-cost chains like Tron, traditional USDT continues to defend its vast empire of street dollar users and leverages its network effects for a planned migration through LegacyMesh.

Offensive Expansion: USDT0 acts as the vanguard aimed at conquering new territories: high-end DeFi, institutional platforms, and next-generation mobile payment applications.

Three battlefields remain open:

Where will the next key battlefield be? Although Tether dominates in transaction volume, Circle has triumphed in the venture-backed startup race. Will the next generation of high-growth payment companies and neobanks choose the compliance of USDC or the tactical flexibility of assets like USDT0? The battle for the next generation of fintech infrastructure is a critical battlefield.

Can CCTP win on user experience? USDT0 realizes its full-chain vision through third-party protocols (LayerZero). Meanwhile, CCTP is a first-party, vertically integrated solution. Can Circle leverage this tight integration to provide developers and institutions with a safer, faster, or simpler user experience? In a world plagued by bridging hacks, a fortress built and controlled by the issuer is a strong selling point.

Will "Enterprise Dollars" choose a different path? The report notes that B2B payments are now the largest and fastest-growing sector, with average transaction sizes exceeding $219,000. These funds are particularly sensitive to counterparty risk and regulatory scrutiny. As this market matures, will businesses and financial institutions naturally lean towards the "Suit" (USDC) rather than the "King" (USDT) and its special forces?

What happens when the West awakens? The report focuses on the emerging market payment sector, where USDT dominates. But what will happen when stablecoin use cases in the U.S. and Europe begin to rise, driven by programmability and yield? This is Circle's home turf. When these markets come online, can Circle convert its strong position among Western developers and institutions into broader network effects?

As Chuk stated in his article "Stripe, Stablecoins, and the Race to Reshape Finance with $100 Billion," the dollar is unbinding from the old world and re-bundling on-chain.

Another noteworthy participant is Plasma. Supported by institutions like Bitfinex and Founders Fund, it is a sidechain that anchors its state on Bitcoin while running a zero-fee environment compatible with EVM, optimized for stablecoin transfers.

This design means that USDT locked on Plasma can be transferred at POS speeds while still inheriting Bitcoin's settlement guarantees, providing Tether with a dedicated channel unmatched by Tron and Ethereum.

If USDT0 becomes the universal wrapper for this liquidity, Plasma can handle bulk settlements of Street Dollars and provide assurance as these funds gradually enter the higher-yielding Enterprise Dollar realm, tightly linking the entire system in a way that Circle's CCTP cannot easily replicate.

USDT0 is a key initiative to consolidate Tether's empire and can help extend its influence into new territories through Plasma.

Key Points Where USDT0 Can Surpass Circle's CCTP

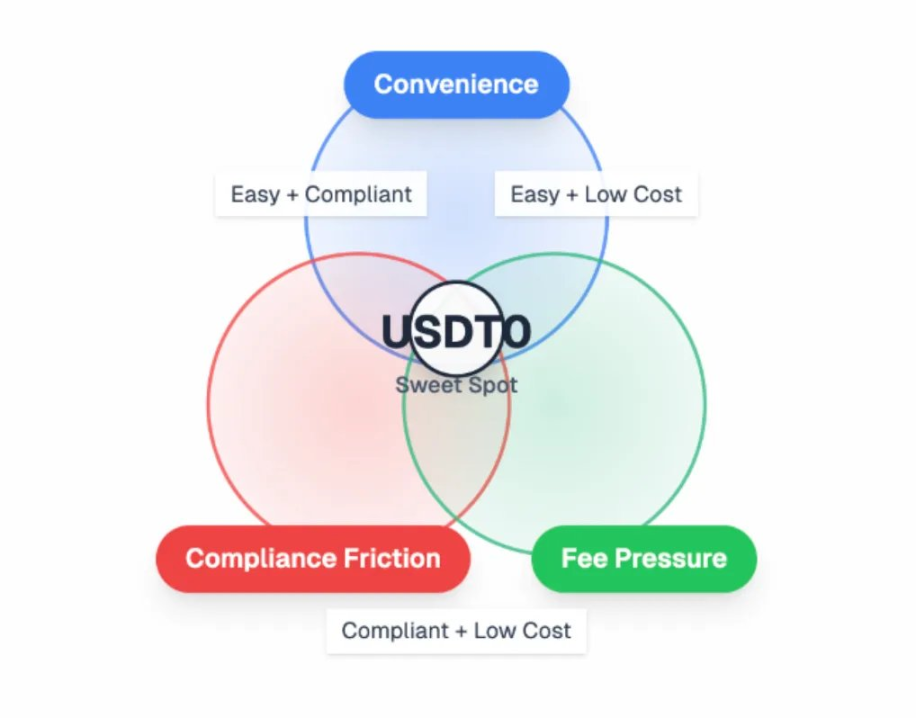

The most apparent breakthrough for USDT0 lies at the intersection of convenience, compliance friction, and fee pressure:

Emerging market wage and remittance channels have relied on Tron's liquidity but are eager to access DeFi yields directly.

Medium-sized B2B settlements: For example, supplier payments ranging from $50,000 to $500,000, which cannot tolerate wire transfer cut-off times and bank limits.

Reluctance to use bridging DeFi protocols, which want a single, low Gas cost dollar across different chains for collateral and liquidity mining.

Mobile fintech applications seeking dollar accounts without banking partners.

By first delving into these four real-world niche markets, USDT0 can solidify its volume advantage before Circle occupies the space.

USDT0's DeFi Strategic Plan

USDT remains the king of the streets, but USDC dominates the dashboard.

To change this balance, Tether must weaken the specific barriers enjoyed by USDC.

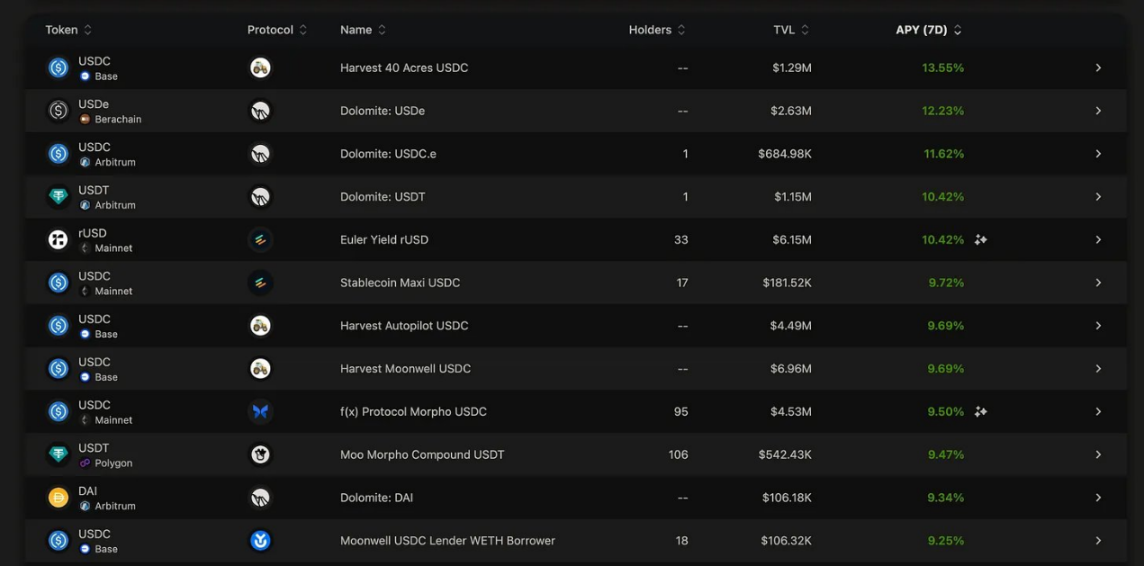

The Vault dashboard heavily relies on USDC: In January 2025, the top ten yield rankings on Vault.fyi were all USDC, with Revert Lend USDC offering an annual interest rate of 14.9% and Gauntlet USDC Core at 14.7%.

This situation changed in June 2025, with 2 out of 10 platforms adopting USDT.

On dashboards like vaults.fyi, this dominance is based on three practical advantages:

Most yield strategies (Maker DSR, Aave, Morpho, Compound, Ethena hedge) accept or return USDC.

Traders perceive USDC as the cleanest on-chain dollar for accounting.

Its bridging is first-party (CCTP), so wrapping rarely dilutes liquidity.

Below is a sequential introduction:

Strategy coverage. Maker, Aave, Morpho, Compound, and Ethena all settle in USDC, so builders default to using it. Tether can counter this by funding pathways such as USDT0 → sUSDe → Ethena or USDT0 → Fraxlend → Curve stables. By wrapping them in ERC-4626 and adding a temporary incentive mechanism of 50-100 basis points. Once Yearn, Beefy, and Enzyme list these vaults, the habit of using USDC will gradually fade.

Perceived compliance. Maker and Morpho are still marking down USDT. Since each USDT0 token is backed by a vault on the Ethereum side and minted natively on each chain, Chainlink's reserve proof price feeding mechanism will allow the risk committee to adjust these markdowns. The borrowing forms clearly show the gap between the two: on June 10, 2025, the fee for borrowing USDT on Aave v3 was about 4.9%, while the fee for borrowing USDC on the same platform was only 0.6%. However, this has not changed the trust in the reserves themselves.

Bridging convenience. Developers prefer Circle's first-party bridging. USDt0 can achieve this convenience by relying on OFT and LegacyMesh: token addresses will appear on every major rollup, so rebalancing vaults between Arbitrum, Optimism, and Base only need to hold one ERC-20 token, without repeated burn and mint cycles.

Pool depth. Curve and Balancer still anchor USDC. USDT can leverage its market maker's book to launch a full-chain tri-pool and return 100-150 basis points of LP fees within a quarter. On Balancer, approximately 30-40 basis points of vlBAL or implicit incentives weekly can also attract similarly deep funds.

Aggregator inertia. Dashboards like vaults.fyi display everything indexed. USDT0 or LayerZero can host the open JSON source of each audited USDT0 vault. Once a strategy passes security review, it will gain the same display space as USDC.

If USDT simultaneously launches these five levers: reference strategies, reserve proof oracles, cross-chain native assets, subsidized deep pools, and public indices; then the annualized yield should lean towards USDT0.

Yield hunters chase numbers, not loyalty; once this spread appears, USDC's dashboard lead may vanish within a quarter, while the "Alchemist's" experiment will gain new liquidity.

The future currency war will unfold on more fronts. The outcome will depend on who holds the past and present, and more importantly, who can create a true dollar by combining street dollars and enterprise dollars, thus occupying the most valuable domains of the future.

Omar Little once said, "If you attack the king, you better not miss."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。