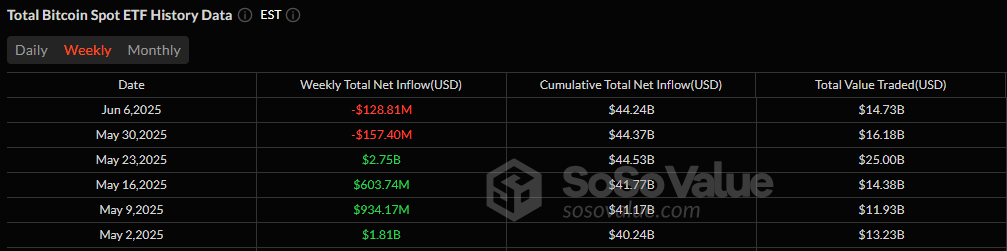

Bitcoin ETFs Log Second Straight Week of Outflows While Ether ETFs Shine With Fourth Successive Week of Inflows

A tale of two crypto markets unfolded this past week. While bitcoin ETFs continued their downward slip with a $128.81 million net outflow, ether ETFs surged ahead, notching their third-highest weekly inflow of 2025 at $281.07 million. The divergence marks the second straight week of bitcoin ETF weakness, starkly contrasting ether’s growing investor appetite.

Source: Sosovalue

Thursday, June 5, delivered the week’s worst session for bitcoin ETFs, with outflows totaling $278.44 million, dragging the overall weekly figure into the red despite two positive days.

Blackrock’s IBIT was the lone bright spot, ending the week with an $81 million net inflow. On the flip side, Fidelity’s FBTC bled $167.72 million, topping the outflow chart, while Grayscale’s GBTC and Ark 21shares’ ARKB shed $40.57 million and $24.54 million, respectively. Vaneck’s HODL and Bitwise’s BITB offered some relief, adding $19.66 million and $12.94 million, but not enough to change the week’s bearish tilt.

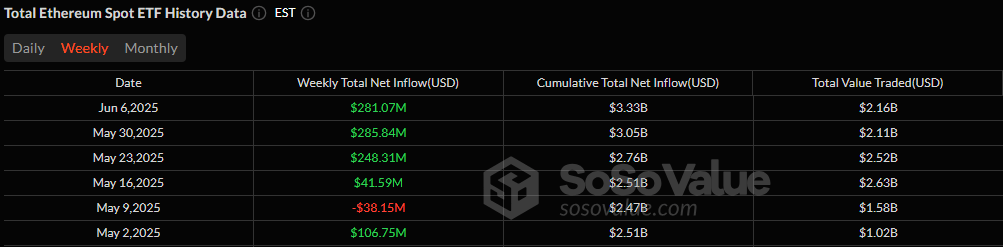

Source: Sosovalue

For ether ETFs, Blackrock’s ETHA stole the show with $249.15 million in weekly net inflows, fueling the asset class’s stellar performance. Grayscale’s Ether Mini Trust and Fidelity’s FETH followed with inflows of $9.37 million and $3.73 million. No ether ETF posted a net outflow, reflecting broad market confidence.

Total net assets stood firm, with bitcoin ETFs closing at $125.58 billion and ether ETFs holding near $9.40 billion. The contrast in flows suggests growing institutional interest in ether over bitcoin for the week.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。