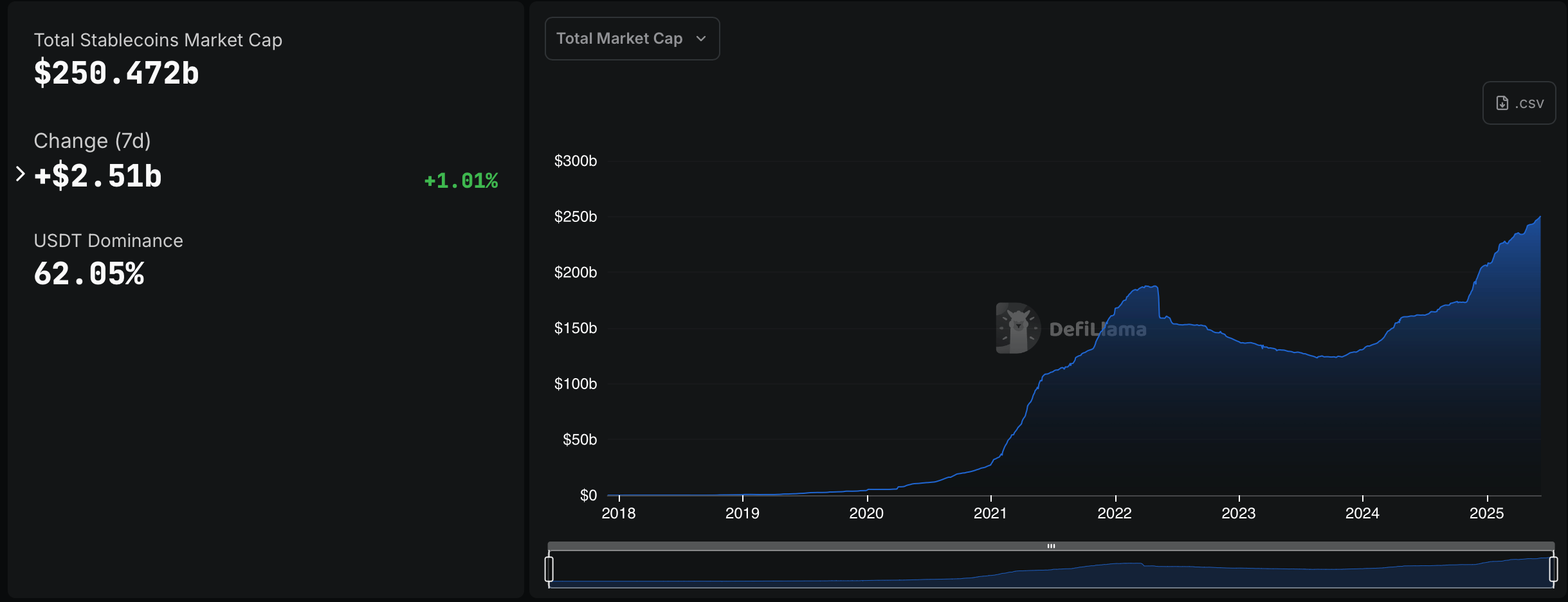

For the first time ever, the stablecoin market has cracked the $250 billion ceiling. Defillama.com data shows the total now sits at $250.472 billion, making up 7.48% of the $3.35 trillion crypto economy. Tether ( USDT) remains the heavyweight, commanding a dominant 62.05% share.

This climb comes as the crypto bull run barrels forward, with bitcoin consistently perched above $100,000 for over a month—a milestone moment. At the same time, demand for USDT and USDC is soaring, while competing tokens backed by Treasuries and yield-focused fiat assets have gained momentum over the last year.

Based on current figures, tether ( USDT) leads the top ten stablecoins by market capitalization, boasting a valuation of $155.408 billion. Circle’s USDC follows at $60.631 billion. Ethena’s USDe takes third with $5.897 billion, reflecting a sharp upward trend. DAI from Sky is in fourth with $4.354 billion, narrowly edging out Sky’s USDS at $4.05 billion.

Blackrock’s BUIDL holds sixth place at $2.892 billion, followed by World Liberty Financial’s USD1 at $2.177 billion. Ethena’s second entry, USDTB, is eighth with $1.455 billion. First Digital’s FDUSD ranks ninth at $1.301 billion, and Paypal’s PYUSD rounds out the top ten after recently topping $1.004 billion.

The rapid capital inflow into stablecoins signals not just confidence, but a shifting preference for onchain liquidity. As tokenized dollars continue gaining credibility, they’re steadily redefining the financial rails of crypto. This trend hints at deeper integration between digital assets and traditional finance (TradFi) markets, suggesting stablecoins may soon play a central role in global financial infrastructure.

With more players entering the stablecoin space and capital piling in, competition among issuers is intensifying. This dynamic could spark a wave of innovation as projects compete on backing transparency, adoption, and yield mechanics. As the sector matures, the next chapter may be shaped less by dominance and more by how well these digital dollars align with evolving user demands.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。