DeFi's Total Value Locked (TVL) Grows 25%, AI Development Momentum Continues to Strengthen.

Written by: DappRadar

Translated by: Felix, PANews

May 2025 marks a turning point for the Dapp (decentralized application) industry. With rising user activity, a strong return of DeFi, and the consolidation of AI's position in Web3, the ecosystem shows signs of stability and maturity. From market recovery to infrastructure upgrades and shifts in user preferences, May highlights how Dapps are continuously evolving in terms of long-term utility, rather than just reflecting hype cycles.

Key Points:

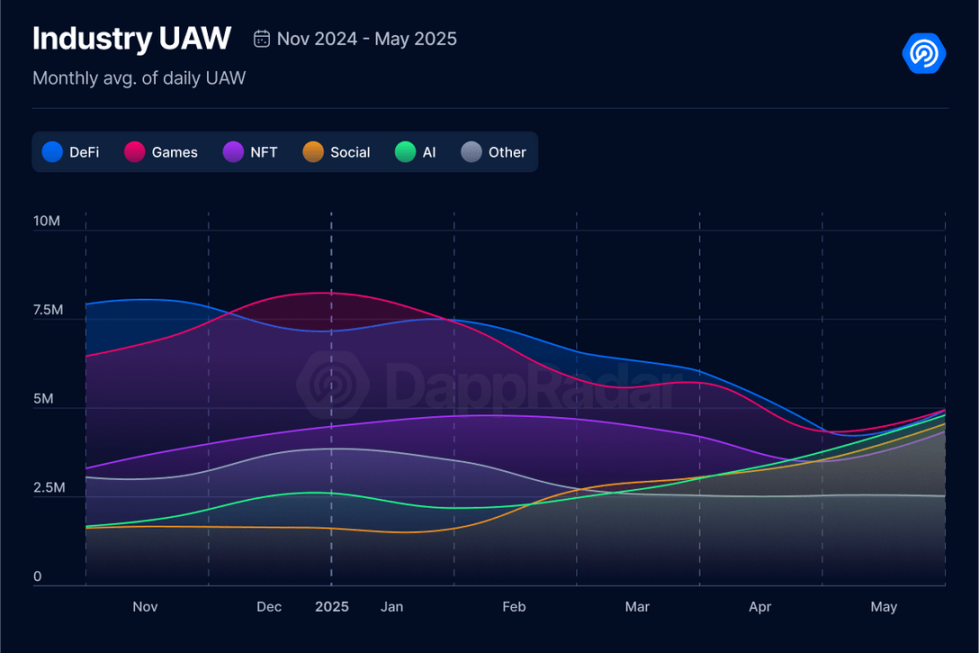

In May, the number of daily active unique wallets (dUAW) reached 25 million, an increase of 8%, indicating a healthy development trend across the ecosystem.

DeFi's total value locked (TVL) grew by 25%, reaching $200 billion, thanks to a 40% rise in Ethereum's price and Hyperliquid's $244 billion in trading volume.

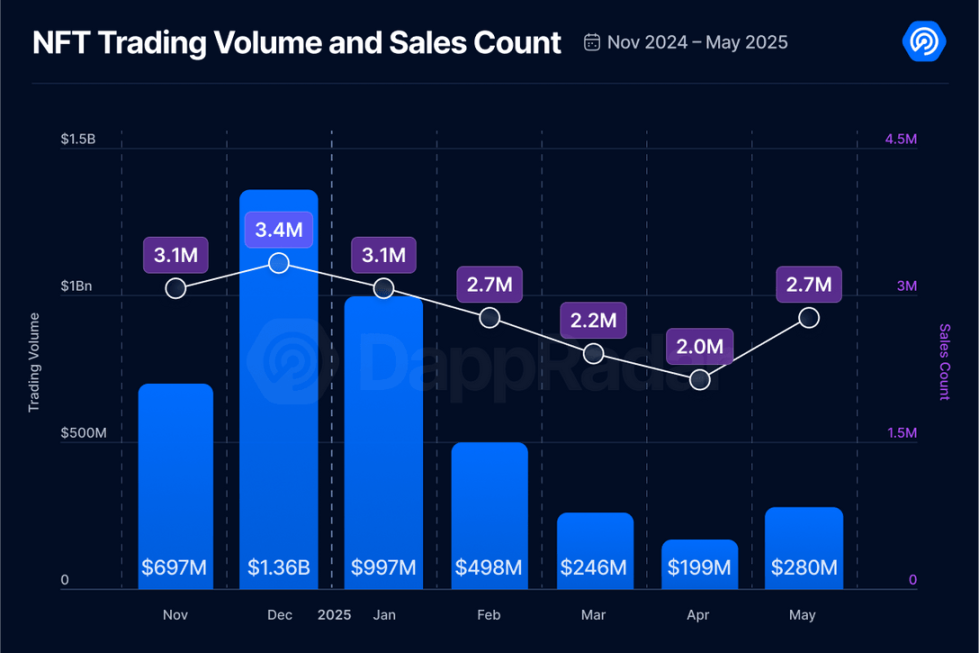

NFT trading volume increased by 40%, reaching $280 million, with the number of transactions growing by 35%, primarily driven by Ethereum, Abstract, and Telegram-related domains.

Daily active user wallets (dUAW) for AI dapps reached 4.8 million, a 23% increase, matching the user engagement levels of DeFi and gaming sectors.

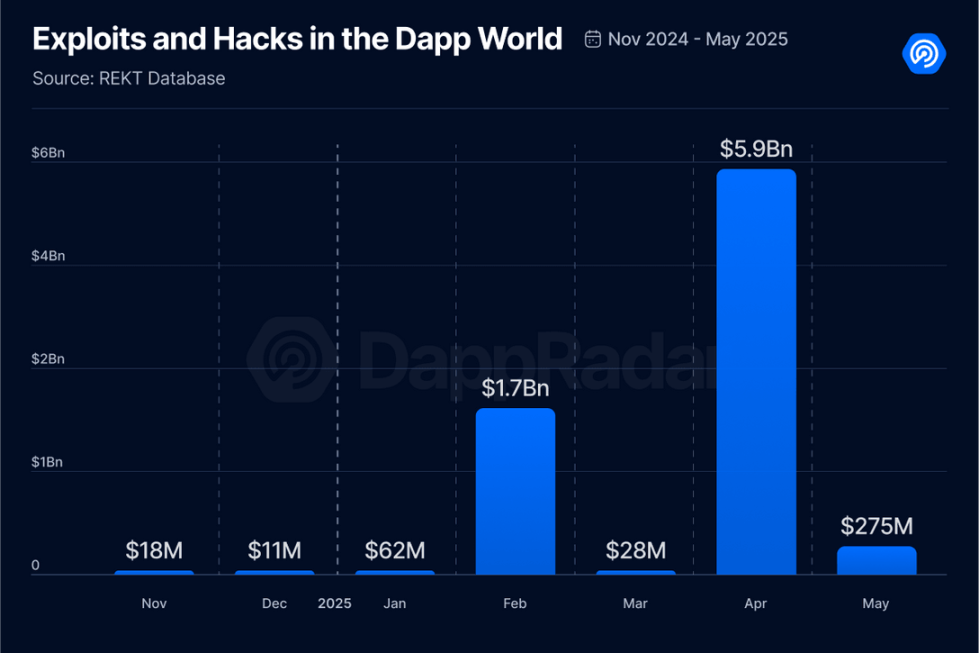

Losses due to Web3 vulnerabilities amounted to $275 million—making it the third highest loss month in a year, surpassing the total from November to March.

1. 25 Million dUAW Marks Healthy Growth of Dapps

In May, dapps clearly showed optimistic signs of recovery, with dUAW growing by 8% to reach 25 million. This growth aligns with overall market sentiment and benefits from the resurgence of DeFi and NFT activities, which will be explored in the following sections.

Three areas stood out this month with sustained and significant growth:

AI DApps grew by 23%, with dUAW reaching 4.8 million

Social DApps grew by 21%, with dUAW reaching 4.3 million

NFT DApps grew by 9%, with dUAW reaching 3.9 million

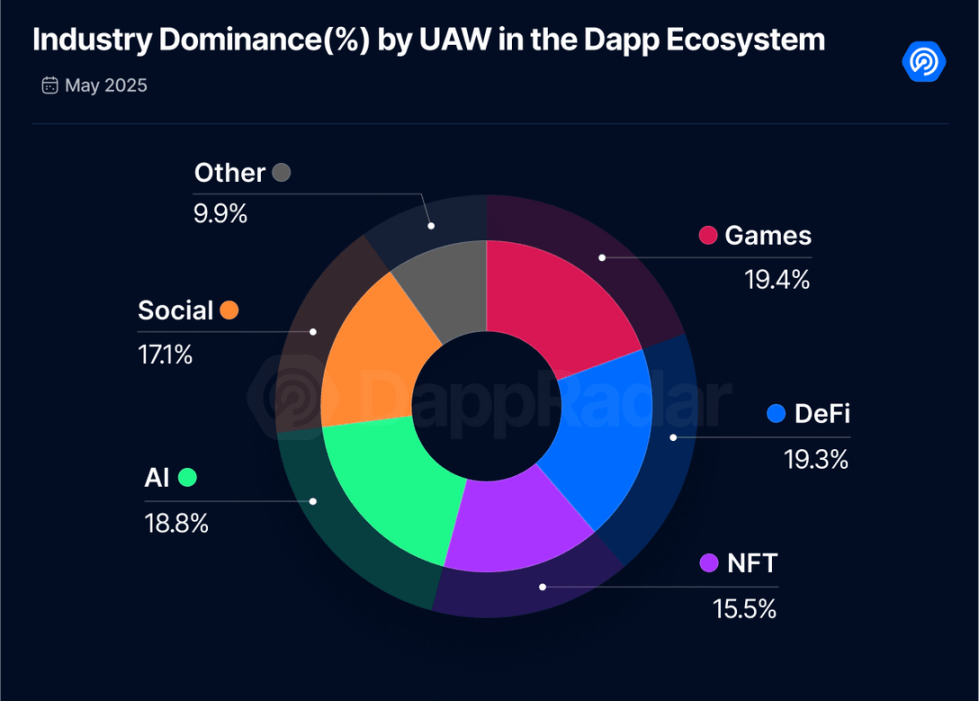

These increases not only indicate a rising appeal across various sectors but also promote a more balanced ecosystem development. We are witnessing AI, DeFi, and gaming DApps gradually taking the lead, with their respective shares in user activity being relatively close.

In addition to the rising user activity in AI, DeFi, and gaming sectors, another emerging trend worth noting is "Information Finance" (InfoFi)—the financialization of data and information in the Web3 space. While AI continues to attract mainstream attention, InfoFi is quietly building a new layer of decentralized stack. This trend enables users, protocols, and AI agents to buy, sell, stake, lend, or borrow data, insights, and models, often leveraging blockchain technology for traceability, transparency, and monetization. Just as SocialFi redefined user engagement, InfoFi is laying the groundwork for data to become an active financial asset.

The diversification of user participation marks an important milestone. A healthy and mature dapp ecosystem means multiple verticals can thrive simultaneously, reflected not only in hype cycles but also in sustained utility, community adoption, and platform evolution.

Although AI has been a mainstream topic across industries, on-chain data now confirms this trend. With AI dapps matching DeFi and gaming in daily active wallets, AI is integrating into the blockchain experience, from productivity tools and agents to social and marketing tools.

May's on-chain activity indicates a stronger and more diverse DApp ecosystem. As user attention becomes more evenly distributed across sectors and emerging technologies like AI further integrate, the landscape of Web3 is evolving towards a more robust and sustainable infrastructure.

2. Popular DApps Ranked by UAW: From Meme Craze to Utility-Driven Growth

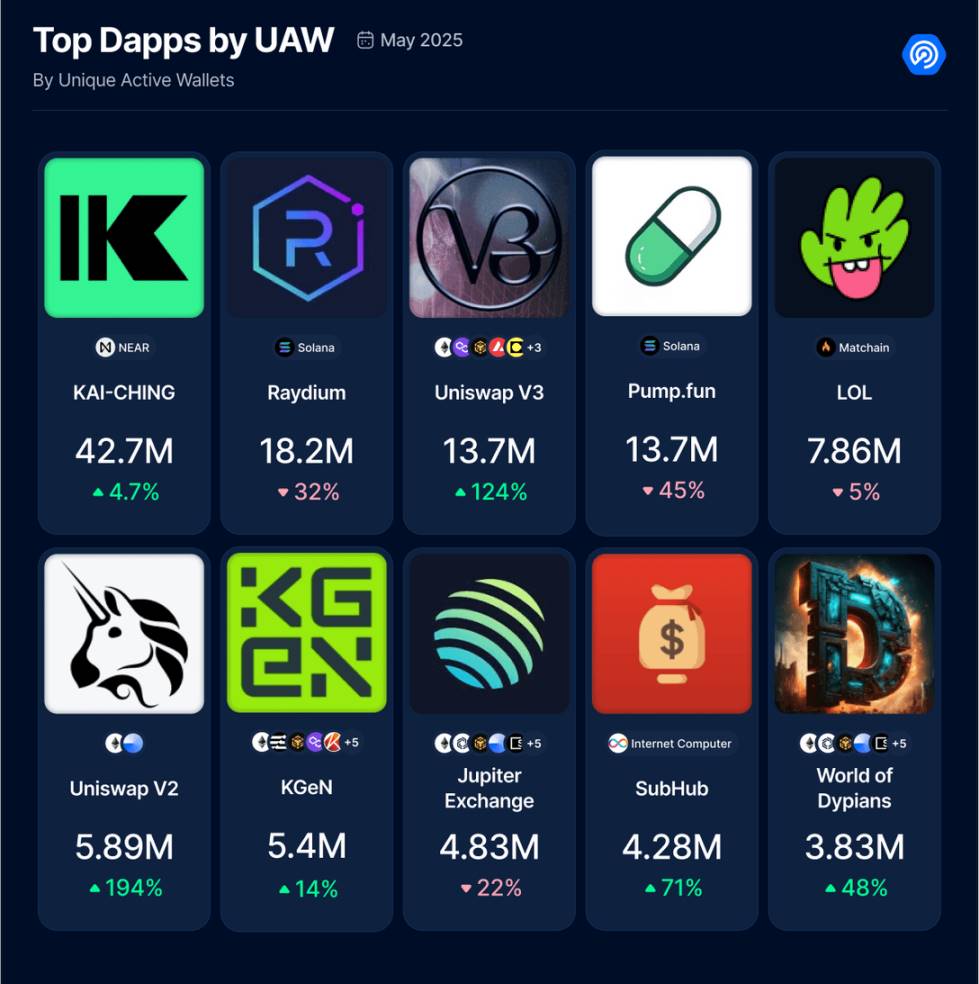

User engagement patterns in May show a gradual shift from speculative hype to a greater focus on utility-driven DApps. While April's meme coin craze, led by platforms like Pump.fun, attracted significant attention, this momentum seems to be cooling. As of May, Pump.fun has declined from its peak activity, indicating that meme coin trading may have reached a saturation point for now.

In contrast, the number of independent active wallets (UAW) for DeFi DApps has significantly increased, particularly on Uniswap V2, which continues to benefit from strong activity on Base. On May 4, Uniswap announced its integration with Soneium, marking a significant advancement. This move not only enriches Uniswap's L2 presence but also opens a new chapter in merging DeFi with entertainment and consumer technology.

In the gaming sector, World of Dypians continues to dominate, consistently ranking high in monthly active users. Its immersive world-building and loyal player community are becoming key factors for long-term player retention, a challenge that this category typically faces.

Meanwhile, in the AI and social sectors, SubHub has gained momentum by combining personalized Web3 communication with AI-enhanced delivery infrastructure. Positioned at the intersection of messaging, wallets, and smart location, SubHub symbolizes how AI dapps are beginning to build loyal user bases rather than merely chasing hype cycles.

The performance of popular DApps in May reflects a broader trend: while speculative hype can quickly drive user surges, long-term retention increasingly relies on utility and platform innovation. Whether based on AI-driven communication, underlying gaming interactions, or L2-based DeFi expansions, today's rising DApps offer not only speculation but also usability and functionality.

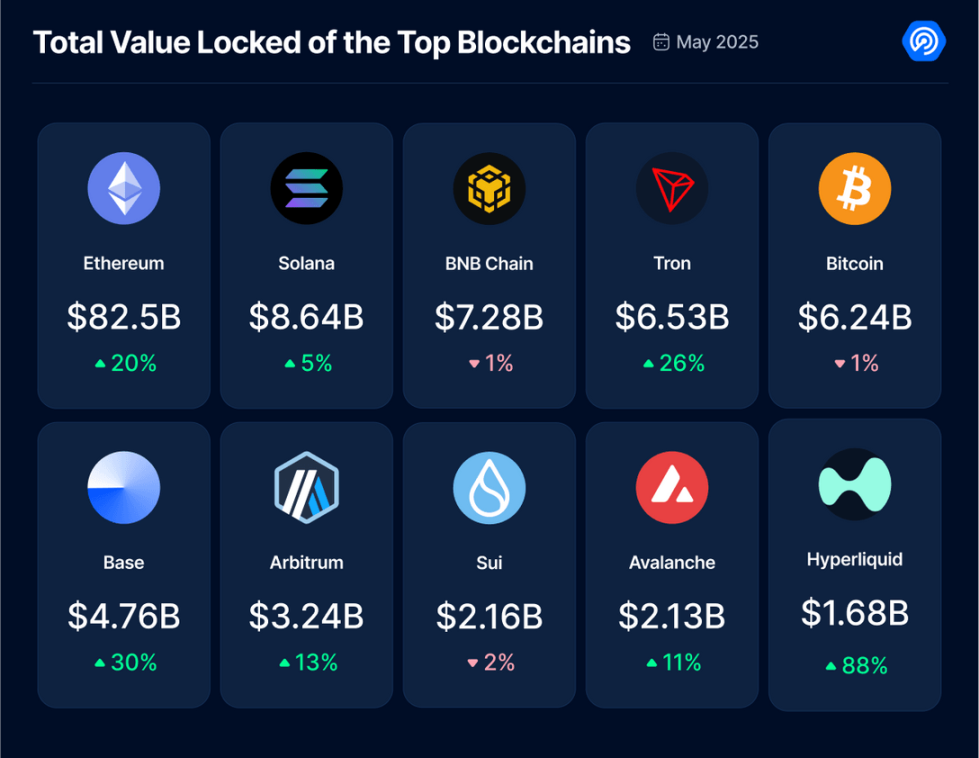

3. DeFi Rises: TVL Climbs 25%

DeFi continued its upward trend in May, with TVL growing by 25%, bringing the total size of the industry to approximately $200 billion. This recovery is closely tied to the overall market rise, particularly as Bitcoin reached an all-time high and Ethereum's price surged by 40%, both significantly enhancing the valuation and liquidity depth of DeFi assets.

TVL across all major DeFi ecosystems has increased, indicating a revival of investor confidence and more active on-chain activity. One project stands out in particular.

This month, the decentralized exchange Hyperliquid performed exceptionally well, with trading volume reaching $244 billion, capturing about 10% of Binance's market share. With this performance, Hyperliquid ranks as follows:

Among the top five in trading volume for centralized and decentralized exchanges

Among the top ten in total locked value across all blockchain networks

This marks a significant shift in how on-chain derivatives protocols compete directly with major centralized finance (CeFi) players, indicating that decentralized perpetual contracts and derivatives are maturing.

In addition to various metrics, several important updates and policy initiatives in May have influenced the development of DeFi:

Ethereum's Pectra Upgrade

This highly anticipated hard fork brought two key improvements:

EIP-7702: Introduces account abstraction, providing regular wallets with smart contract-like functionalities, including batch transactions and gas fee sponsorship.

EIP-7251: Increases the validator reward cap from 32 ETH to 2048 ETH, allowing institutional stakers to earn compounded staking rewards and improving capital efficiency.

XRP Ledger Launches EURØP Stablecoin

Ripple launched EURØP, a stablecoin pegged to the Euro, fully compliant with the EU's Markets in Crypto-Assets Regulation (MiCA). This makes it the first major stablecoin to comply with MiCA regulations, marking a new phase in DeFi compliance and regulation.

U.S. GENIUS Act Advances

The U.S. Senate passed a motion to end debate on the bipartisan GENIUS Act with a vote of 66 in favor and 32 against. This act aims to promote federal regulation of stablecoin issuers. The progress of this act ends a long-standing protracted debate, indicating a growing regulatory momentum in Washington.

South Korea Considers Approving Cryptocurrency ETFs

The ruling party in South Korea has pledged to approve cryptocurrency spot ETFs and ease banks' restrictions on exchanges, which could significantly enhance the accessibility of cryptocurrencies in Asia's highly active retail market.

With the rebuilding of DeFi's foundation, protocol-level upgrades, regulatory clarity, and market growth, a more mature and resilient future for DeFi is on the horizon. While risks remain, the performance in May 2025 proves that DeFi is continuously evolving in terms of infrastructure and institutional relevance.

4. AI's Development Momentum in Web3 Continues to Strengthen, Public Calls for Decentralized Intelligence

AI continues to dominate globally, with its impact on Web3 becoming increasingly significant. As various industries compete to integrate AI, AI-driven dapps are steadily developing within the decentralized ecosystem. Therefore, this is not just hype but a trend reflecting society's shift towards open, user-controlled technology.

The best-performing AI dapps this month overall remained stable, highlighting the strong durability of early market leaders.

The most notable newcomer on the list is SubHub, a Web3 notification and marketing platform developed by Dmail that utilizes AI-enhanced technology. It aims to optimize the interaction between projects and audiences through personalized messaging via wallet addresses and decentralized identifiers (DIDs). SubHub is positioned at the intersection of AI, communication, and social DApps, reflecting a growing demand for autonomous, targeted, and decentralized promotional methods as users grow weary of traditional centralized marketing models.

SubHub combines smart messaging with wallet-based targeting features, reinforcing the idea of the increasing integration of social and AI DApps, thereby achieving a user-centric experience across multiple layers of Web3 infrastructure.

In addition to DApps, significant progress was made in the AI x blockchain space this month:

ThinkAgents.ai released the open-source "Think Agent Standard," a protocol for deploying autonomous agents in decentralized networks, taking a step towards interoperable on-chain AI.

Tether announced its entry into the AI field, planning to launch a decentralized AI platform that combines peer-to-peer communication with crypto-native integration.

Assisterr (Solana) raised $2.8 million at a valuation of $75 million to support no-code deployment of small language models (SLM)—providing composable AI tools without heavy development costs.

Donut Labs secured $7 million in seed funding to build the first "agent" Web3 browser, combining AI capabilities with crypto wallets and DEX.

Global exchange BingX committed to investing $300 million over three years in its "AI Evolution" roadmap—integrating AI into its trading engine and ecosystem.

However, perhaps most telling is the growing public support for decentralized AI. A poll commissioned by the Digital Currency Group and conducted by Harris Poll (on May 29) revealed:

77% of Americans believe decentralized AI is more beneficial to society than centralized models.

56% prefer AI development through decentralized systems.

These figures highlight a cultural shift that aligns with the transparency, user ownership, and anti-monopoly values of Web3.

5. NFT Grows 40%: A True Recovery or a Short-Term Surge?

In May, signs of recovery emerged in the NFT market, with trading volume climbing to $280 million, a 40% month-over-month increase. Similarly, the number of NFT transactions grew by 35%, reaching 2.7 million. While this growth brings a glimmer of optimism, it is far from a full recovery. A sustainable trend requires several months of continuous growth, but small victories are still victories.

Ethereum's NFT trading volume increased by 30%, reclaiming dominance with a 53% share of the total NFT market. Following closely is Immutable zkEVM with a 13% share, and Abstract with 10%. Notably, Abstract's trading volume surged by 1200%, primarily driven by speculative activities related to mining and anticipated airdrops, indicating that incentive mechanisms continue to influence the NFT market. This is evident from the daily trading volume of the most popular NFT series exceeding 1 million transactions, while the floor price remains around $300.

By sector, the strongest growth was seen in art-based NFTs, with series like Good Vibes Club driving significant trading volume increases. Following closely is the revival of domain NFTs, particularly those related to TON and Telegram, as Telegram-based dapps continue to gain popularity. Their appeal lies in accessibility, gamified experiences, and low entry barriers, suggesting that the combination of messaging platforms and NFTs may become a long-term trend.

Several developments in May are expected to reshape the NFT landscape:

Apple Cancels 30% NFT Tax on iOS

Under legal pressure, Apple made a landmark move by canceling the 30% fee on NFT transactions within iOS apps, reducing barriers for NFT marketplaces integrated into iOS applications and opening the door for broader adoption of NFTs on mobile.

OpenSea Launches OS 2.0 Version

OpenSea launched OS2, a fully revamped multi-chain marketplace that expands its offerings from NFTs to fungible tokens and meme coins, supporting 19 blockchains and integrating minting, swapping, and trading into a unified experience.

FIFA Migrates NFT Platform to EVM

FIFA announced it will migrate its NFT platform from Algorand to a custom Ethereum-compatible chain, known as the FIFA Blockchain, enhancing the scalability and wallet compatibility of fan collectibles, supporting operations through MetaMask and other EVM tools.

Tokenization of Physical Assets Gains Popularity

Courtyard, a platform for tokenizing physical assets, has become one of the largest NFT collectible platforms by trading volume, exceeding $55 million, indicating a growing demand for RWA-based NFTs.

While enthusiasm for the NFT space is gradually recovering, much of the trading volume is still influenced by airdrops, mining incentives, and speculative behavior. If this momentum continues in the coming months, it may signal a new phase for NFTs—one that combines utility, accessibility, and real-world applications.

6. This Month's Web3 Losses Reach $275 Million

Despite fewer individual incidents in May compared to April, the losses from hacks and exploits remain concerning. According to the REKT database, just seven incidents resulted in over $275 million in losses, making it the third highest loss month in the past year, surpassing the total from November, December, January, and March.

Although this figure represents a 95% decrease from April's record losses, largely due to the Mantra DAO incident, viewing this as a sign of recovery would be misleading. The severity of single attacks in May highlights the persistent systemic vulnerabilities within the dapp ecosystem.

Notable exploit incidents this month:

Cetus Protocol Exploit: $260 Million

On May 22, the decentralized exchange Cetus Protocol on the Sui network suffered a massive attack, resulting in a loss of $260 million. The token prices on the platform plummeted, with some tokens losing over 90% of their value, prompting the team to suspend smart contract operations to control losses and investigate.

Cork Protocol Exploit: Approximately $12 Million

On May 28, the Cork Protocol experienced a smart contract vulnerability, leading to the theft of approximately $12 million worth of 3,760 wstETH. This attack exposed a critical flaw in the contract logic, immediately triggering community alarms.

Mobius Token (MBU) Incident: Approximately $2.16 Million

On May 11, a suspicious interaction with an unverified contract on the Binance Smart Chain resulted in a loss of $2.16 million. While this incident appears to be a typical exploit, various signs suggest it may have been a "rug pull," further blurring the lines between technical vulnerabilities and malicious actions.

Data from May clearly indicates that, despite improvements in tools and awareness, the Web3 space remains highly vulnerable. Ongoing attacks worth millions of dollars highlight the urgent need for stricter audit standards, real-time risk monitoring, and better education for developers and users.

7. Conclusion

May was a pivotal month for the dapp ecosystem, marking a comprehensive recovery and the maturation of industry dynamics. The number of daily active wallets reached 25 million, with rising user engagement driven by growth in key verticals such as DeFi, NFTs, AI, and social applications.

The shift from hype-driven activity to utility-focused participation is becoming increasingly clear. While meme coins may have cooled, decentralized financial protocols like Hyperliquid and AI dapps like SubHub are becoming increasingly important, indicating that users are leaning towards platforms that offer functionality, innovation, and real value.

The 25% growth in DeFi TVL reflects a recovery of market confidence, aided by infrastructure upgrades and policy advancements. Meanwhile, NFT trading volume surged by 40%, with Ethereum regaining dominance and RWA gaining attention. The momentum of AI development continues to strengthen, not only in public sentiment (with 77% of Americans favoring decentralized AI) but also in usage, matching the user activity levels of gaming and DeFi.

In short, the DApp industry is transitioning from a turbulent experimental phase to a more solid development stage. With the diversification of user activity and the practical application of technologies like AI, the ecosystem is entering a new phase—one defined not only by trends but also by infrastructure, balance, and long-term resilience.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。